As India's Nifty 50 trades near record highs in October 2025, value investors are searching beneath the surface for hidden gems, strong companies still trading at a discount to their true worth.

The Value Of India Stocks

Investing in India’s Nifty 50 stocks can sometimes feel like chasing the next big growth story. Many of the best opportunities are hiding in plain sight of the trading world, where financially strong companies continue to trade below their true worth.

As of October 2025, the Nifty 50 remains near record highs, supported by healthy corporate earnings and solid domestic inflows. India’s markets also remain resilient despite global headwinds from the U.S.–China trade frictions and elevated oil prices.

Yet even in this elevated trading market, a group of undervalued stocks in India still trades at discounts to their fair valuations.

What Defines an Undervalued Stock?

An undervalued stock trades below its true worth based on earnings, book value, or cash flow. Investors look for low P/E and P/B ratios, strong financials like steady profits and manageable debt, and market mispricing caused by short-term sentiment.

When these align, the stock offers a clear opportunity for patient, fundamentals-focused investors.

Top 10 Undervalued Stocks In India 2025

Below, we highlight the top 10 undervalued stocks in India for 2025, combining profitability, sound balance sheets, and long-term growth potential.

| Company |

Sector |

P/E Ratio |

P/B Ratio |

| Tata Steel Ltd. |

Metals |

10.2x |

0.95x |

| ITC Ltd. |

FMCG & Diversified |

23.4x |

7.0x |

| Power Grid Corporation |

Utilities |

13.5x |

1.9x |

| Coal India Ltd. |

Energy |

8.4x |

1.7x |

| IndusInd Bank |

Banking |

12.1x |

1.6x |

| NTPC Ltd. |

Power |

11.3x |

1.5x |

| Oil & Natural Gas Corp. (ONGC) |

Energy |

7.9x |

0.8x |

| Hindalco Industries |

Metals |

11.8x |

1.3x |

| Larsen & Toubro (L&T) |

Infrastructure |

26.1x |

3.4x |

| Sun Pharmaceutical Industries |

Pharmaceuticals |

27.6x |

4.1x |

1.ITC Ltd.

ITC remains one of India’s most stable dividend payers, backed by strong cash flows from its FMCG and hotel divisions. Despite its steady earnings growth, the stock trades at a moderate valuation relative to its profitability and free cash generation.

2.Tata Steel Ltd.

The global slowdown in metal demand has capped sentiment, keeping Tata Steel’s valuation near 10x earnings. Yet, rising infrastructure investment and lower raw material costs point to recovery potential through FY2026.

3.Power Grid Corporation

With India’s power demand climbing, Power Grid’s consistent returns and low leverage make it a defensive undervalued pick. The stock trades at a modest 13.5x earnings, supported by stable regulated revenues.

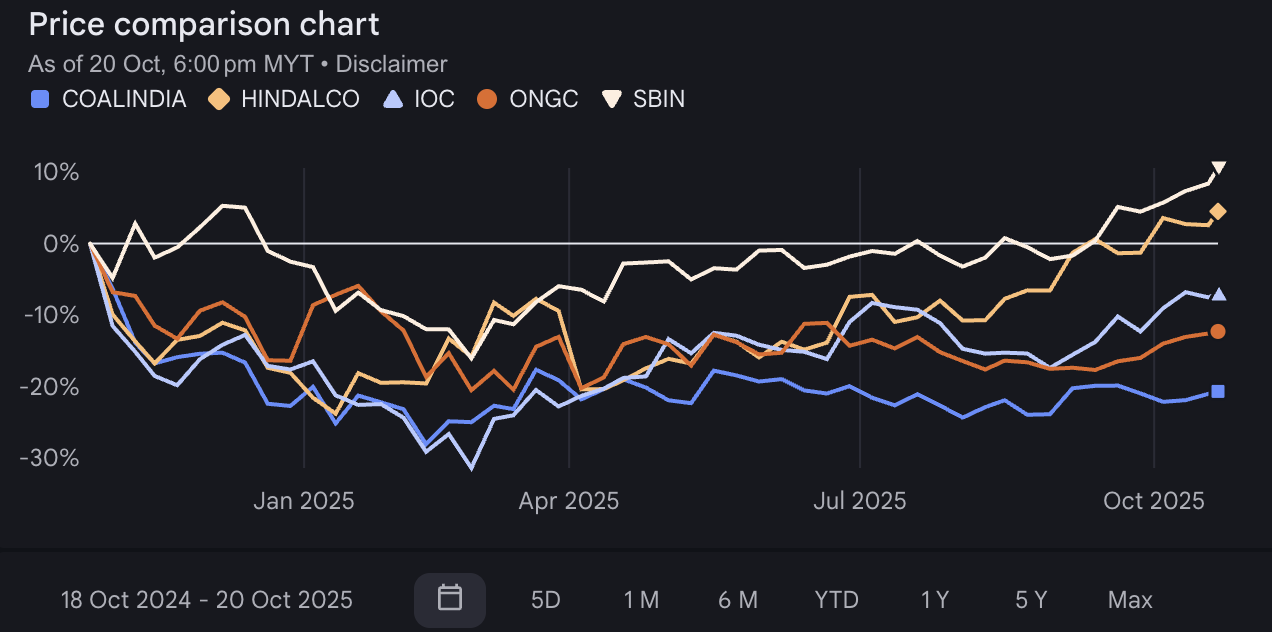

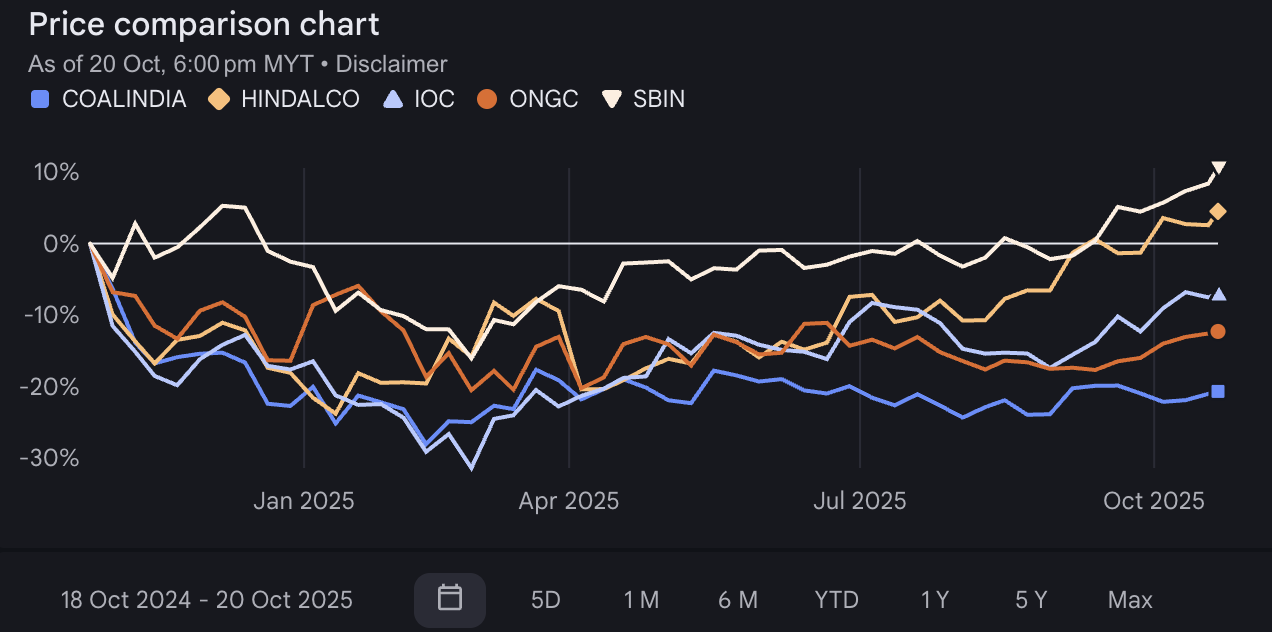

4.Coal India Ltd.

Coal India’s dividend yield remains among the highest in the Nifty 50, supported by solid cash generation. Despite environmental policy headwinds, the company’s pricing power and profitability keep valuations attractive.

5.IndusInd Bank

The bank’s credit growth recovery and improved asset quality continue to strengthen its fundamentals. Its valuation around 12x earnings remains appealing compared with larger peers, reflecting potential re-rating as lending momentum builds.

6.NTPC Ltd.

NTPC is gradually transitioning toward renewables, but the market has yet to fully price in its diversified power mix. Its predictable earnings and strong balance sheet make current valuations attractive for long-term investors.

7.Oil & Natural Gas Corp. (ONGC)

ONGC trades below book value even with higher global crude prices supporting margins. Strong reserves, low leverage, and global exposure give it solid intrinsic worth undervalued by near-term sentiment.

8.Hindalco Industries

Global aluminum demand remains firm, yet Hindalco’s shares trade near 11.8x earnings. Its integrated value chain and global presence position it for margin growth once commodity sentiment normalizes.

9.Larsen & Toubro (L&T)

India’s infrastructure cycle favors L&T, which holds a strong order book and diversified project base. Though valuations have expanded, earnings visibility and sector tailwinds support further upside potential.

10.Sun Pharmaceutical Industries

Sun Pharma’s focus on specialty and U.S. generics drives steady earnings growth, but valuations remain moderate relative to global peers. Its strong pipeline positions it for continued expansion in FY2026.

Global Factors Affecting Indian Stocks

U.S. Tariffs and Trade Tensions: Slow global growth impacts exports and industrial demand, keeping some stocks undervalued.

Commodity Price Fluctuations: Metals and energy price swings create short-term earnings volatility, affecting valuations.

Foreign Institutional Investor (FII) Flows: Inflows and outflows influence market sentiment, leaving high-quality companies temporarily overlooked.

Global Economic Slowdown: Weak global demand can suppress earnings expectations for export-driven and industrial sectors.

Investor Market Outlook

While the broader indices have surged in 2025, valuation gaps persist. Energy and metal producers remain cheap relative to their earnings recovery cycles. Defensive plays like ITC and Power Grid trade at modest multiples compared to their predictable returns.

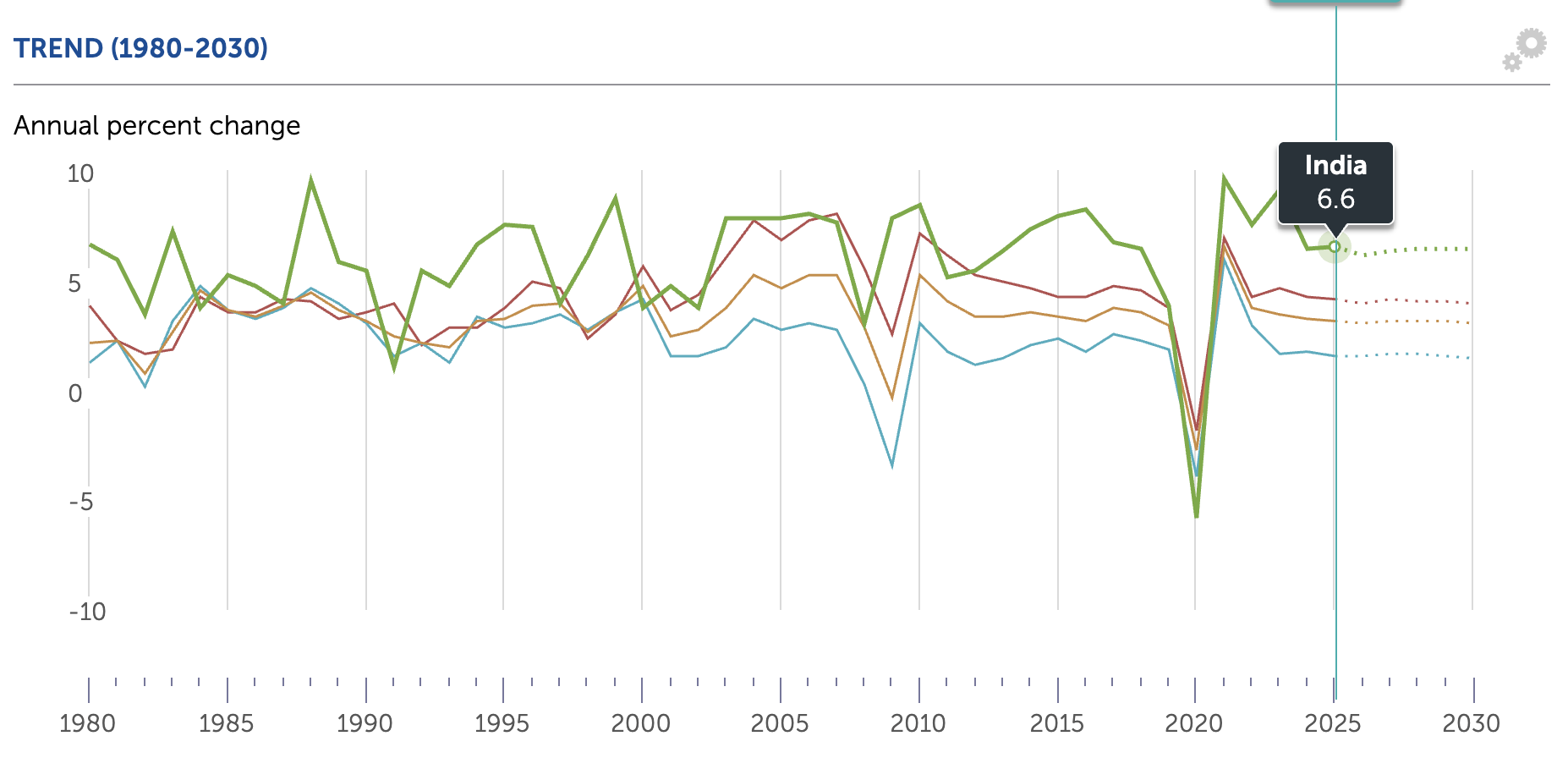

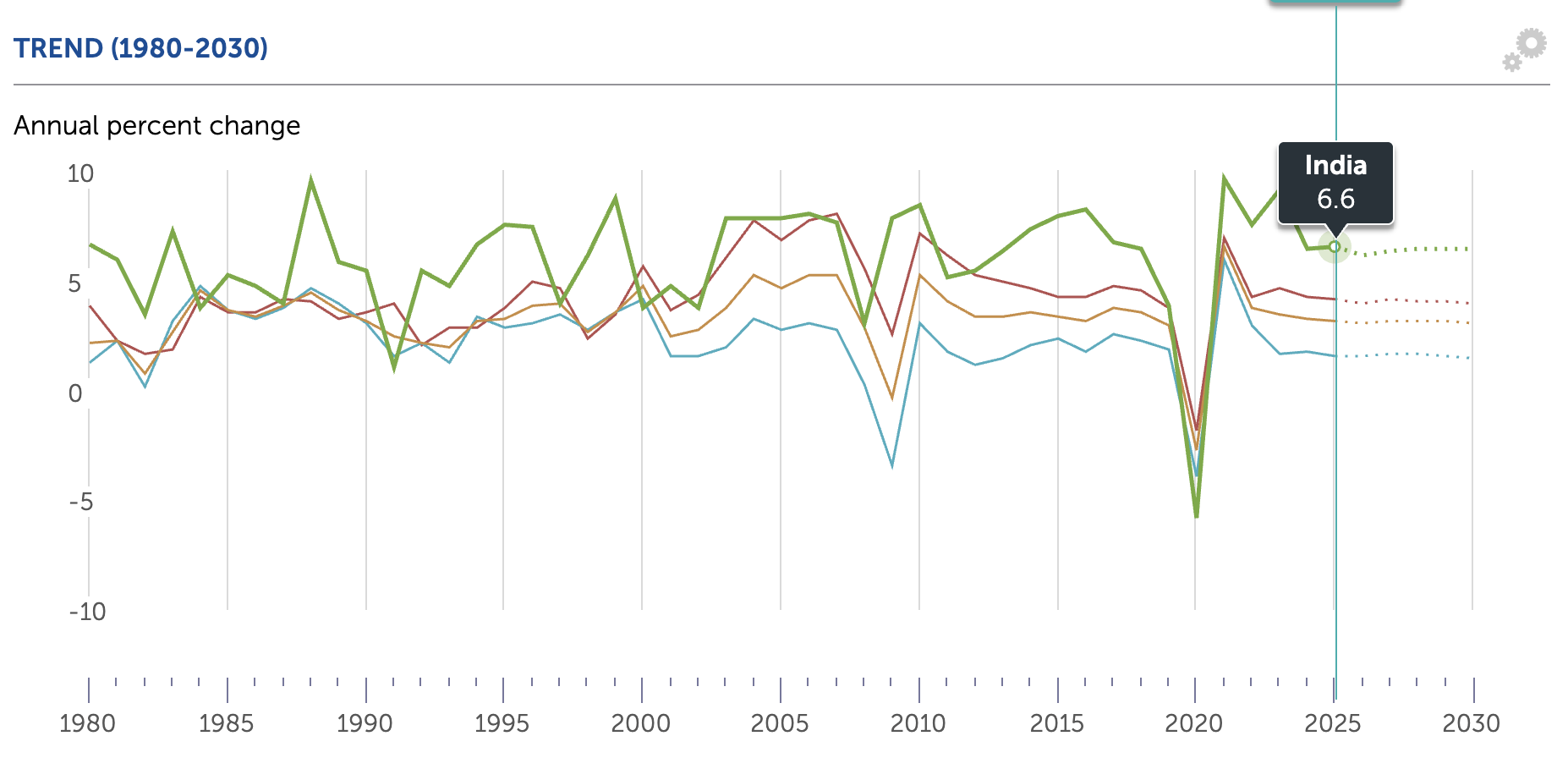

Meanwhile, the new wave of U.S. tariffs has slowed global growth projections to around 3.2%, yet India’s GDP outlook for FY 2026 stays firm near 6.6%.[1]

Investors’ shift toward high-growth tech names has left several industrial and core economy leaders undervalued despite consistent profitability.

Why this matters

When GDP growth remains robust (6-7%) and sectors tied to infrastructure/manufacturing/energy benefit directly from capex and policy tailwinds, yet their valuations remain modest, that creates a re-rating window.[2]

Many growth-tech names already reflect high expectations; value may lie in the quietly profitable, industrial/asset-heavy companies where market attention is weaker.

The combination of stable macro growth + narrow valuation premium offers a margin of safety, which is one of the pillars of value investing.

For those with a two-to-three-year horizon, this basket reflects a mix of steady compounders and cyclically undervalued plays, offering both yield and growth exposure.

Potential Risks For Investors

Investors should monitor volatility in crude, coal, and aluminium prices, as fluctuations can directly affect earnings and margins. Energy and banking sectors remain sensitive to government policies and environmental regulations, which can influence profitability.

Slower industrial activity may reduce demand for metals, fuel, and banking services, while rupee movements can impact exports and imports of commodities like aluminium and copper.

Frequently Asked Questions (FAQ)

1.What defines an undervalued stock?

An undervalued stock is a stock that trades below its intrinsic or fair value, often due to short-term market sentiment rather than weak fundamentals.

2. Are undervalued stocks risk-free?

No. They may remain undervalued for extended periods if sentiment or sector dynamics don’t improve. However, strong balance sheets and stable earnings reduce downside risk.

3. Which sectors currently offer value in India in 2025?

Metals, power, and select banks remain attractively priced relative to earnings visibility and sector expansion plans currently offer value in India in 2025.

4. Should investors focus on P/E or P/B ratios?

Both are useful. The P/E ratio indicates earnings value, while P/B shows whether a stock trades below book value, often key in asset-heavy industries like banking or energy.

5. What is the investment horizon for undervalued stocks?

2–5 years, typically. Value often takes time to be recognized, especially during growth-driven bull markets.

Summary

As the Nifty 50 captures headline market strength, the real value often lies in select stocks priced conservatively despite solid fundamentals.

The International Monetary Fund has forecasted India’s GDP growth at 6.6% for FY 2026, even as global growth slows to roughly 3.2%, citing strong domestic consumption and resilient corporate balance sheets.[3]

In this backdrop, some of India’s most undervalued stocks that are characterised by steady earnings, low valuation multiples and undervalued industrial or core economy exposure present disciplined entry points for investors seeking balance between safety and upside.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Source:

[1] https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/IND

[2] https://www.equitymaster.com/detail.asp?date=10/14/2025&story=2&title=5-Undervalued-Nifty-50-Stocks-to-Add-to-Your-Watchlist

[3] https://www.spglobal.com/en/research-insights/special-reports/india-forward/shifting-horizons/how-indian-economic-growth-realigns-with-shifting-global-trends?