Netflix (NFLX) is trading at around $1,162.53 USD as of October 2025. With the stock hovering above $1,100, speculation has revived: Will Netflix stock split again in 2025?

The company hasn't split its stock since July 2015 (a 7-for-1 split), and it had only split its stock once before that (a 2-for-1 split in 2004). While splits are largely cosmetic as they don't change a company's market cap or fundamentals, they can influence sentiment, accessibility, and liquidity.

In this article, we'll explore Netflix's past splits, the arguments for and against another split in 2025, what experts are saying, and what signals you should watch if it happens.

A Quick History of Netflix's Stock Splits

Netflix has done two forward splits in its history as a public company:

| Date |

Ratio |

Notes |

| February 12, 2004 |

2-for-1 |

Early split when share price was relatively modest |

| July 15, 2015 |

7-for-1 |

Most recent split, reducing the per-share price from ~$700+ |

After the 2015 split, Netflix's share price was reduced proportionally (i.e., each pre-split share became 7 shares, price divided by 7). [1]

Since that time, the company has not undergone another split, despite the share price increasing significantly.

Will Netflix Stock Split Again Soon? Expert Predictions

Firstly, on the valuation front, Netflix has a 2025 consensus price target of ~$1,350.32 per share, implying moderate upside from current levels. [2]

Analysts on Finviz indicate a mix of targets and ratings, with Loop Capital, Kanaccord, and KeyBanc among those raising targets amid split speculation.

However, others caution that beneath-the-surface dynamics reduce the likelihood. For example, Nasdaq has noted that despite Netflix's high share price, "various below-the-surface dynamics make it unlikely" that a split occurs imminently.

In short, some view Netflix as a viable split candidate, but many caution that price alone is not enough. Management incentives or shareholder composition also may discourage a split, at least in the near term.

Why Might Netflix Consider a Split in 2025?

Let's examine the arguments in favour:

1. High Share Price and Retail Accessibility

At over $1,100 per share, some argue the price may be less accessible for retail investors. Splitting could lower the nominal price and make it easier for more investors to buy whole shares.

As mentioned above, some experts list Netflix among the top possibilities for a 2025 split, given its elevated price. [3]

2. Psychological and Sentiment Boost

Splits often generate media attention, retail interest, and upward momentum. Although a split doesn't change fundamentals, it can stir renewed enthusiasm.

3. Liquidity and Trading Dynamics

With more shares outstanding at a lower price, bid-ask spreads may narrow, small orders may trade more efficiently, and more retail participation could follow.

4. Precedent and Timing

When Netflix previously split, its stock price was significantly lower (approximately $700) before the split. Now that it's trading well above that past split level, some see a path to another split.

Also, media and stock-split watchers frequently include Netflix in "top stocks likely to split" lists for 2025.

Why Netflix Might Not Split in 2025 or at All

Now, let's look at strong arguments against a potential Netflix stock split:

1. Institutional Ownership and Low Retail Pressure

If institutional investors hold most of the shares, the benefit of retail accessibility is smaller. Some commentary notes that Netflix's retail ownership is not large enough to push management to split.

2. Fractional Shares Reduce Need for Splits

Many brokers now allow fractional-share investing, making even high-priced stocks more accessible. The original utility of splits (making shares cheap for small investors) is less compelling today.

3. No Immediate Operational Need

There's no urgent need for Netflix to split. Cash flows, valuation, growth priorities, and content decisions may take priority. Some analysts argue the current price isn't forcing Netflix's hand.

4. Cost, Signalling, and Management Priorities

Implementing a split involves administrative costs, regulatory procedures, board approval, and potential distractions. Netflix may prefer focusing on content, ad revenue growth, global expansion, and subscriber retention.

5. Dilution Concerns (Perception, Not Real)

Though splits don't dilute ownership, fractional psychology may lead some to misinterpret splits as value dilution, which could influence sentiment if mishandled.

Hypothetical Netflix Stock Split Scenarios (Illustrative Only)

Let's hypothesise a few scenarios (these are illustrative, not predictions):

| Scenario |

Split Ratio |

Estimated Post-Split Share Price |

Notes / Timing Estimate |

| Modest Split |

2-for-1 or 3-for-1 |

~$580–$775 |

A mild split to lower per-share price modestly |

| Larger Split |

5-for-1 or 7-for-1 |

~$165–$232 |

A more aggressive split to bring price into lower ranges |

| No Split |

- |

- |

Netflix may choose to maintain status quo |

If Netflix were to split 5-for-1 from ~$1,162, each share would be ~$232 post-split. If 7-for-1, ~ $166 per share. Either would dramatically lower the per-share nominal price.

Timing-wise, many splits tend to follow strong, sustained trends or occur ahead of shareholder meetings. If Netflix continues to see momentum in ad revenue, subscriber growth, and valuation pressure, a Q4 2025 split is within the realm of possibility, although it is hardly guaranteed.

Comparison With Other Big-Tech Split Trends

To place Netflix's situation in context:

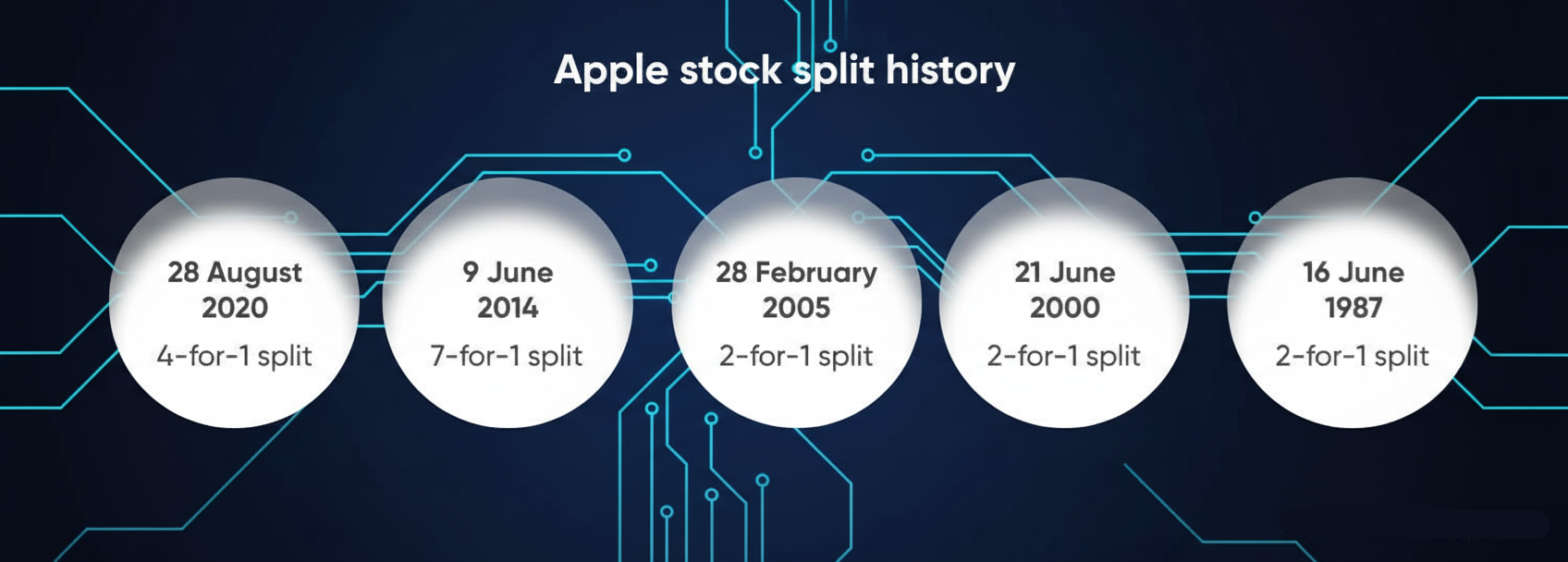

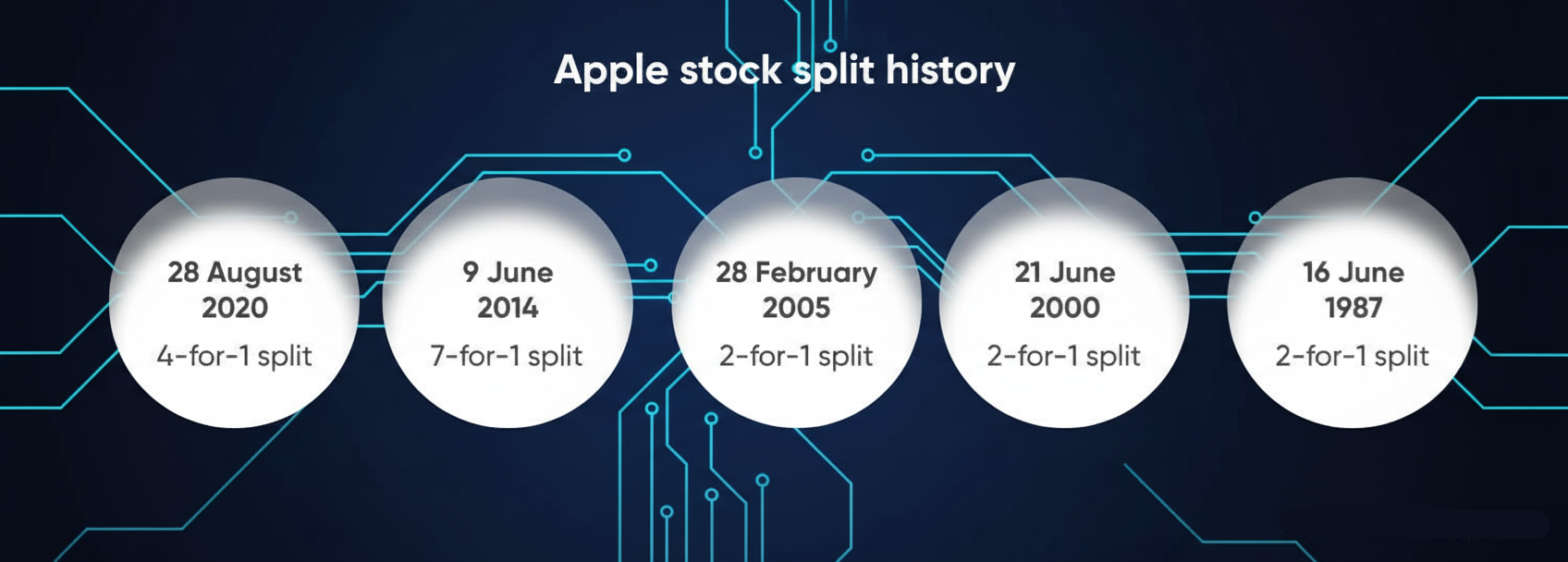

Apple has performed stock splits multiple times (5 in total), frequently to maintain the share price at a level suitable for retail investors.

In 2022, Amazon executed a 20-for-1 stock split, years following elevated share prices.

In 2022, Alphabet (Google) performed a 20-for-1 stock split to enhance accessibility of shares both internally and externally.

These instances illustrate how large-cap companies occasionally utilise splits to sustain retail interest and facilitate share transferability.

What to Watch For: Split Signals and Catalysts

If Netflix is considering a split, listed below are signals and milestones to watch:

| Signal / Catalysts |

What It Might Mean |

| Board discussions or filings about share plan changes |

Early procedural steps before a split announcement |

| Share price stabilising or entering a controlled range just below a breakpoint (e.g. $1,500 / $2,000) |

Management may wait for share price thresholds |

| Commentary from executives or investor calls about "accessibility," "liquidity," or "retail participation" |

Indirect signaling |

| Increased retail ownership or demand pressure by smaller investors |

More incentive to split |

| Stock split proposals in proxy statements or shareholder meeting materials |

Formal steps toward a split decision |

| Media / analyst speculation building, sustained over months |

Market expectations often precede official moves |

Note: No single signal confirms a split, but when multiple signals are aligned, the probability rises.

Risks and Caveats of Split Speculation

Speculating on splits can be misleading: splits don't add intrinsic value

Companies rarely split too often; long gaps between splits are common (Netflix's 2004 → 2015 gap)

Management may prefer share buybacks over splits, especially for capital deployment flexibility

Splits distract from core fundamentals, as focusing on content, costs, ad revenue, and competition is more important

A split done at the wrong time (e.g. after a plateau) may look like a gimmick

Overhyped speculation may lead to volatility and short-term reversals around split news

Frequently Asked Questions

1. Why Are People Speculating About a New Netflix Stock Split in 2025?

Investors speculate because Netflix's share price has climbed above $1,100, a level where splits often become a topic of discussion for accessibility and liquidity.

2. Has Netflix Ever Done a Stock Split Before?

Yes. Netflix has split its stock twice in history: a 2-for-1 split in 2004 and a 7-for-1 split in July 2015. It has not split again since then.

3. Would a Netflix Stock Split Increase Its Value?

No. A stock split does not change the company's market capitalisation or fundamentals. It only lowers the per-share price while increasing the number of shares outstanding.

4. Is There Any Official Confirmation That Netflix Will Split in 2025?

No. Netflix's management has not announced or confirmed any plans for a stock split.

Conclusion

As of October 2025, Netflix's share price hovers around $1,160, providing a natural conversation around whether the company might revisit splitting its stock. Yet, a split remains speculative unless multiple signals converge.

Whether Netflix splits or not, investors should keep their focus fixed on fundamentals such as the company's subscriber growth, ad revenue expansion, global scaling, cost control, and content success.

A split, if it comes, may be a nice cosmetic move. But long-term returns will be built by execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://companiesmarketcap.com/netflix/stock-splits/

[2] https://247wallst.com/forecasts/2025/09/30/netflix-stock-nflx-price-prediction-and-forecast-2025-2030/

[3] https://www.nasdaq.com/articles/are-costco-and-netflix-about-become-wall-streets-next-stock-split-stocks