The change is that the policy rate did not change: the Bank of Japan kept the short‑term rate at 0.5%, with the Nikkei dipping, the yen around 147 per dollar, and the 2‑year yield at the highest since 2008, setting the tone for guidance.

BoJ 0.5% Hold: Decision & Message

The Bank of Japan held the benchmark short‑term policy rate at 0.5%, maintaining the cycle high while it gauges whether inflation can be sustained near target alongside wage momentum. [1]

Officials reiterated a meeting‑by‑meeting, data‑dependent stance rather than a pre‑set timetable, balancing stability with vigilance on prices and activity.

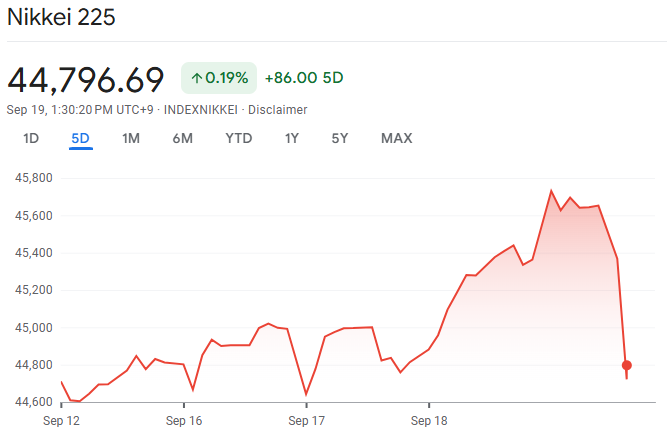

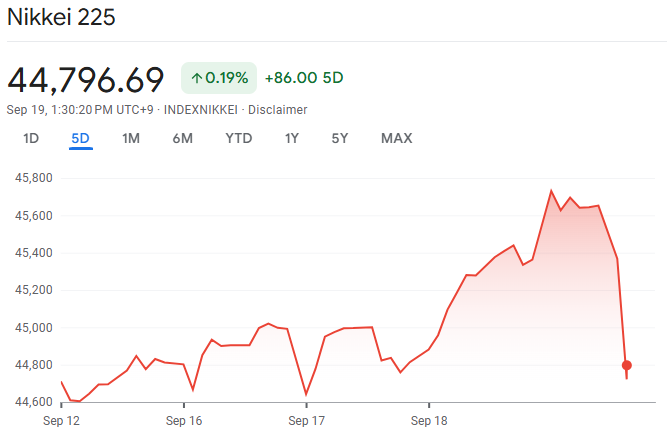

Market Reaction: Nikkei, Yen, Yields

Into decision time, Japanese markets traded around familiar markers seen ahead of the announcement window, consistent with expectations for a hold.

The Nikkei 225 dipped about 1.05% after the announcement.

The yen firmed with USD/JPY near 147.3 during the morning session, consistent with pre‑decision pricing around the 147 handle.

Most notably, Japan's 2‑year government bond yield pushed up to roughly 0.885%—the highest since 2008—signalling firmer policy expectations even without a rate change on the day.

Market Snapshot

| Metric |

Latest |

Note |

| Policy rate |

0.5% held |

Cycle high maintained |

| Nikkei 225 |

~1% dip |

Dipped after the announcement |

| USD/JPY |

~147.3–147.7 |

Down from ~148 |

| JGB 2-year yield |

~0.885% |

Highest since 2008 |

Japan 2‑Year Yield: Why It Matters

The 2‑year yield is the near‑term policy thermometer, and a rise to about 0.885%, a high not seen since 2008, signals investors have lifted expectations for gradual normalisation even as the headline rate stays unchanged.

Short‑end moves tend to nudge bank funding costs and, with a lag, influence variable‑rate loans and fresh credit pricing across the real economy.

How The Hold Filters Through The Economy

Households: Variable‑rate borrowing costs can drift higher as banks update pricing to reflect firmer short‑end yields.

Businesses: Working‑capital lines and new issuance remain sensitive to the 2‑year, subtly lifting hurdle rates for investment.

Confidence: A steady rate with clear optionality aids planning if wages and prices continue to align with the 2% objective.

Financial conditions: A firmer front end tightens at the margin without a concurrent change in the policy rate.

What Actually Changed Today

The headline rate did not change; the curve did, with the 2‑year yield reaching its highest level since 2008 and tightening financial conditions at the margin. [2]

The Nikkei 225 reversed from early strength and moved lower after the announcement, and USD/JPY was around 148 into the window.

Policy & Curve At A Glance

| Item |

Latest |

Context |

| Policy rate |

0.5% |

Cycle high maintained into the meeting |

| JGB 2-year yield |

~0.885% |

Highest since 2008 on policy expectations |

The Yen And The Nikkei: What To Watch

Near term, USD/JPY often hinges on the global dollar as much as domestic guidance, which helps explain the pair clustering around the 147s.

Equities softened after the statement, with the Nikkei 225 dipping as traders weighed guidance against firmer short‑end yields.

Scenario Map

Steady Disinflation, Firm Wages: Policy stays at 0.5% while markets keep pricing gradual normalisation; the yen steadier on dips; equities favour balance‑sheet quality.

Sticky Services Prices: Guidance turns more cautious; the 2‑year stays firm; currency direction leans on the dollar; equity performance diverges by funding sensitivity. [3]

Growth Soft Patch: Optionality allows patience; short‑end yields ease; defensives lead; the yen's path hinges on risk appetite and incoming data.

Bottom Line

The BoJ kept the policy rate at 0.5% and markets delivered the signal via the curve: the 2‑year yield reached its highest since 2008 as investors priced firmer policy expectations without a same‑day hike.

With USD/JPY in the mid‑147s and the Nikkei dipping after the announcement, the signal came from guidance and the 2‑year, not from a change in the headline rate.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/markets/asia/boj-keeps-interest-rates-steady-decides-start-selling-etfs-2025-09-19/

[2] https://www.bloomberg.com/news/articles/2025-09-19/japan-two-year-government-bond-yield-rises-to-highest-since-2008

[3] https://tradingeconomics.com/japan/currency