Choosing the best forex broker for beginners with low spreads is one of the most important decisions you will make at the start of your trading journey. As a beginner, every pip matters. High spreads quietly eat into your capital, making it harder to break even and almost impossible to grow a small account consistently.

Low spreads reduce the immediate cost of opening and closing trades, which is crucial for small accounts and short-term strategies. In this article you’ll learn what low spreads mean, why they matter for beginners, how to evaluate brokers, and why many new traders choose EBC Financial Group as the best broker for beginners with low spreads.

What Beginners Should Check First

Trading costs: Competitive spreads on major currency pairs with clear pricing structures

Demo access: Practice in real-market conditions before trading live

Regulation: Operates under regulatory oversight in multiple jurisdictions (verify the entity for your country)

What “Low Spreads” Mean

A spread is the difference between the buy (ask) and sell (bid) price. Brokers quote spreads in pips; a lower spread means a smaller built-in cost the moment you open a trade.

For example, if EUR/USD has a spread of 0.8 pips and a standard lot’s pip value is $10, that spread costs about $8 round-trip on a standard lot.

For micro and mini lots the cost scales down proportionally, which is why tight spreads are especially helpful for beginners trading smaller sizes.

Why Low Spreads Matter For Beginners

Lower barrier to profitability: Small accounts feel the impact of spreads more; lower spreads help you keep more of your gains (and lose less on early mistakes).

Better for short-term trading and testing: If you plan to scale or trade frequently, spreads make up a larger share of your costs; keeping them tight reduces the learning bill.

Cleaner learning environment: Predictable, low-cost executions let you judge strategies more fairly as you’ll know if a strategy works rather than wondering whether fees are eating at your edge.

That said, spreads are only one factor. Execution quality, slippage, commissions, platform stability, and education resources are equally important for beginners.

Key Beginner-Friendly Features To Pair With Low Spreads

When evaluating the best forex broker for beginners with low spreads, prioritize brokers that also offer:

Transparent pricing: Clear published spreads and a straightforward commission schedule.

Demo accounts: Practice without risk, unlimited or long-duration demos are ideal.

Educational resources: Video lessons, webinars, articles, and trade examples.

Intuitive platforms: Fast order entry, simple charting tools, and mobile access.

Responsive support: Quick, helpful customer service available in your time zone.

Flexible account sizes: Micro or mini accounts so you can start with small capital.

Easy deposits/withdrawals: Low minimum deposit and multiple payment methods.

Regulation and trust signals: Clear licensing information and privacy/disclosure pages.

How To Compare Spreads And Fees

Compare published spreads on major pairs (EUR/USD, GBP/USD, USD/JPY) during active market hours.

Check live spreads on the broker’s demo or live platform; advertised “from 0.0 pips” is not the whole story.

Factor in commissions: If a low-spread account charges commissions, add commission + spread to estimate total cost.

Test order execution: Place small trades in quiet and high-volatility times to check slippage.

Watch for hidden fees: Withdrawal, inactivity, and conversion fees can erode small accounts.

Read recent user reviews focused on spread consistency and execution rather than marketing copy.

Why EBC Financial Group Is Best Forex Broker

EBC Financial Group is positioned as the top choice forex broker for new traders who want low trading costs and solid onboarding.

EBC Financial Group combines competitive pricing, clear account choices, and formal regulatory oversight to give new traders a simpler, safer place to learn.

EBC is regulated in multiple jurisdictions, including the UK (FCA), Australia (ASIC) and Cayman / other regional authorities, which adds layers of regulatory supervision and client-protection measures.

What this means for beginners

Regulated oversight & client protections: Licensing in recognized jurisdictions means EBC must meet specific compliance, reporting and client-fund segregation standards, which are important safeguards for anyone new to live trading.

Straightforward account options: EBC publishes Standard and Professional/Pro (raw-like) account types so beginners can start on a Standard account with no or lower commissions and step up to a Pro account as they grow. This clarity helps learners pick the right size and fee model for their budget.

Demo access and onboarding support: Demo accounts replicate the live platform so newcomers can test spreads, execution and tools without risk, while responsive support and educational materials shorten the learning curve.

EBC provides account tiers and demo testing while operating under regulatory oversight in multiple jurisdictions, which may be perfect for traders looking for the best forex broker for beginners with low spreads and a structured onboarding environment.

Prospective traders should verify the specific EBC regulatory entity, current spreads, and account terms that apply in their country on EBC’s official site before opening a live account.

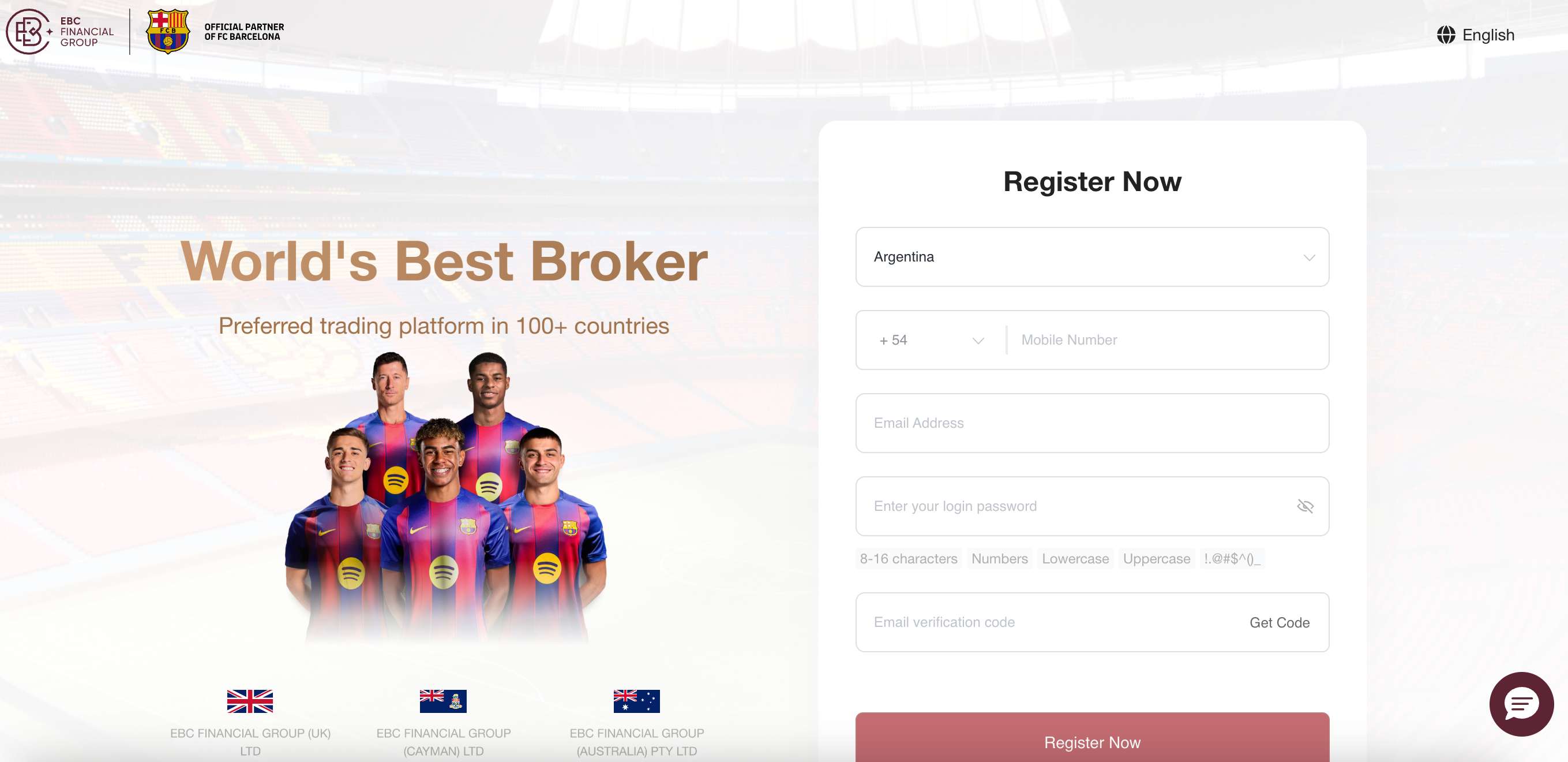

Step-By-Step: Opening Your Account With EBC

Fill the sign-up form: Provide name, email and set a password.

Verify your identity: Upload photo ID and provide standard KYC.

Choose account type: Standard or Professional.

Deposit funds: Start with an amount you can afford to lose and that lets you practice proper position sizing.

Try the demo first: Validate spreads, platform responsiveness, and your setups.

Place the first live trade conservatively: Risk no more than 1-2% of your account on a single trade.

Use the broker’s education: Attend webinars or follow step-by-step tutorials to avoid beginner traps.

Tips for Trading on a Demo Account

To evaluate slippage and execution on a demo account:

Place trades during active and quiet sessions. Check if fills are consistently close to the intended price.

Watch how stop-loss and take-profit orders are filled. If they execute far from your set level, that’s an execution quality signal.

Test around news releases (on demo only). This shows how slippage and requotes behave in high-volatility conditions.

Compare timestamps. A large delay between clicking “Buy/Sell” and the execution can indicate latency issues.

Testing execution on a demo is not just spread numbers, it gives you a clearer picture of real trading conditions and helps you choose a broker that supports your learning curve and risk tolerance.

Beginner Strategy: Keeping Costs Low While Learning

Trade major currency pairs first, they typically offer the tightest spreads.

Use small lot sizes (micros/minis) to reduce risk while you practice.

Avoid trading during major news releases until you understand price reactions, spreads and slippage widen during events.

Track your trading costs (spread + commissions) in a simple log to see how fees affect returns over time.

Frequently Asked Questions (FAQ)

1. Is EBC Financial Group suitable for beginners who want low trading costs?

Yes, EBC Financial Group is designed to support beginners by offering competitive spreads and clear pricing structures. This helps new traders better understand their trading costs and manage risk without being overwhelmed by complex fee models.

2. Should beginners choose a broker based only on spreads?

No, spreads are important but not the only factor. Beginners should weigh execution quality, platform ease-of-use, educational resources, and customer support alongside spreads; a slightly higher spread may be acceptable if the broker helps you learn faster and execute reliably.

3. How much money should a beginner start trading with?

Start with an amount you can afford to lose while prioritizing education and risk management over profits. Many brokers offer micro accounts so you can practice real-market trading with small capital, and disciplined position sizing (e.g., risking 1% or less per trade) protects your learning capital.

4. Do low spreads guarantee profitable trading?

Low spreads reduce transaction costs but do not guarantee profits; trading success depends on strategy, discipline, and risk control. View low spreads as a cost advantage that helps your edge, but the rest; planning, execution, and emotional control still determines outcomes.

5. Why are major currency pairs better for beginners?

Major pairs like EUR/USD and USD/JPY generally have the highest liquidity and tightest spreads, which means smoother fills and lower entry/exit costs. Their price action tends to be more predictable than exotic pairs, making them ideal for learning trade execution and basic strategies.

Final thoughts

Choosing the best forex broker for beginners with low spreads is a balance between cost and support. Low spreads save money, but the right broker should also offer demo access, educational resources, and trustworthy execution.

If you’re looking for the best forex broker for beginners with low spreads, focus on transparent trading costs, demo access, and regulation. EBC Financial Group is one broker to consider if you want low spreads with a structured, beginner-friendly onboarding experience.

Ready to try a demo and compare live spreads? Register with EBC Financial Group to open a demo account and see how their spreads and beginner tools match your trading plan.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.