The Japanese yen (JPY) is one of the world's most closely watched currencies, known for its role as a safe haven and its sensitivity to both monetary policy and international trade developments.

In 2025, the yen's movements continue to be shaped by a dynamic interplay between the Bank of Japan's (BoJ) evolving stance and shifting global trade conditions. Here's how policy and trade news are driving JPY moves—and what traders should watch next.

The Role of Monetary Policy in Yen Moves

Bank of Japan's Shift from Ultra-Loose Policy

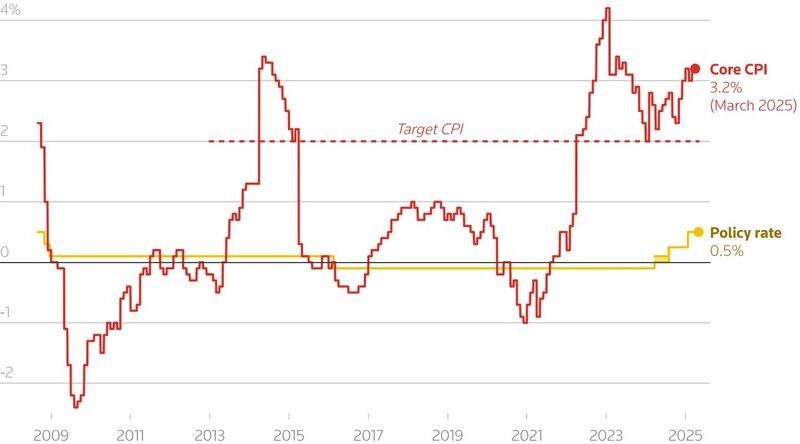

For much of the past decade, the BoJ maintained ultra-loose monetary policy, including negative interest rates and yield curve control, to combat deflation and stimulate growth. This approach, combined with aggressive rate hikes by the US Federal Reserve, created a wide interest rate gap that pushed the yen to multi-decade lows against the dollar.

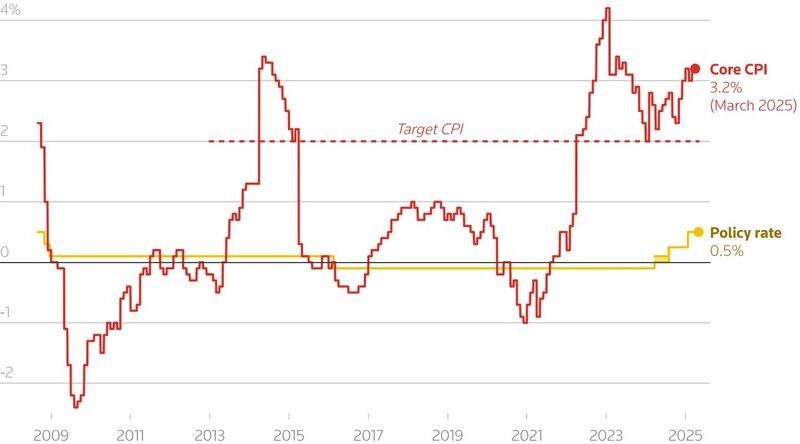

However, 2025 marks a turning point. The BoJ, under Governor Kazuo Ueda, has started to normalise policy, ending negative rates and executing several rate hikes—bringing the benchmark rate to 0.5%, its highest level in over a decade. Ueda has signalled further hikes if economic conditions improve, stating, “We will adjust the degree of monetary easing as needed” to achieve sustainable price goals.

Divergence with the Federal Reserve

While the BoJ is gradually tightening, the Fed has peaked its rates and is contemplating cuts later in 2025. This narrowing policy gap is a key driver of recent yen strength. If the BoJ hikes more aggressively or the Fed cuts sooner, the yen could appreciate further. Conversely, any pause or reversal by the BoJ, especially if the Fed delays cuts, could weaken the yen.

Trade Policy and Economic Data

Tariffs and Trade Negotiations

Trade policy remains a major source of volatility for the yen. Recent news of US tariff postponements and ongoing trade talks have caused sharp swings in JPY pairs. Japan's trade deficit narrowed in April 2025, but concerns over US tariffs and global trade tensions persist. Japanese officials, including Finance Minister Kato, continue to push for the removal of US tariffs, with upcoming G7 and bilateral meetings likely to influence sentiment.

Export and Import Trends

Japan's export growth has slowed, and imports have declined, reflecting both global demand shifts and domestic economic pressures. A fragile trade surplus and the risk of new tariffs keep the yen sensitive to trade headlines. If the US and Japan reach a compromise or tariffs are eased, the yen could strengthen; renewed trade frictions could have the opposite effect.

Safe-Haven Flows and Geopolitical Factors

The yen's reputation as a safe-haven currency means it often benefits from global risk aversion. In 2025, safe-haven inflows have supported the yen amid US political uncertainty, erratic trade policies, and concerns about fiscal health in major economies.

However, when risk appetite returns, the yen can quickly weaken as traders seek higher-yielding assets.

What Traders Should Watch

BoJ Policy Meetings: The July 2025 BoJ meeting is pivotal. A rate hike to 1% could further boost the yen, while a pause may invite renewed selling pressure.

Fed Rate Decisions: Any shift in the Fed's stance on rate cuts or inflation could alter the USD/JPY dynamic.

Trade Talks and Tariff News: Developments in US-Japan trade negotiations and G7 summits are likely to trigger volatility.

Economic Data: Key indicators such as inflation, GDP growth, and trade balances will shape both BoJ and market expectations.

Technical Levels: The 140 level in USD/JPY is seen as a crucial barometer—breaking below could signal a new era of yen strength.

Conclusion

The Japanese yen's trajectory in 2025 is being shaped by a complex mix of monetary policy shifts, trade negotiations, and global risk sentiment. With the BoJ moving away from ultra-loose policy and global trade dynamics in flux, traders should stay alert to central bank communications, tariff developments, and economic data.

As policy and trade continue to drive JPY moves, volatility—and opportunity—remain high for those who follow the news closely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.