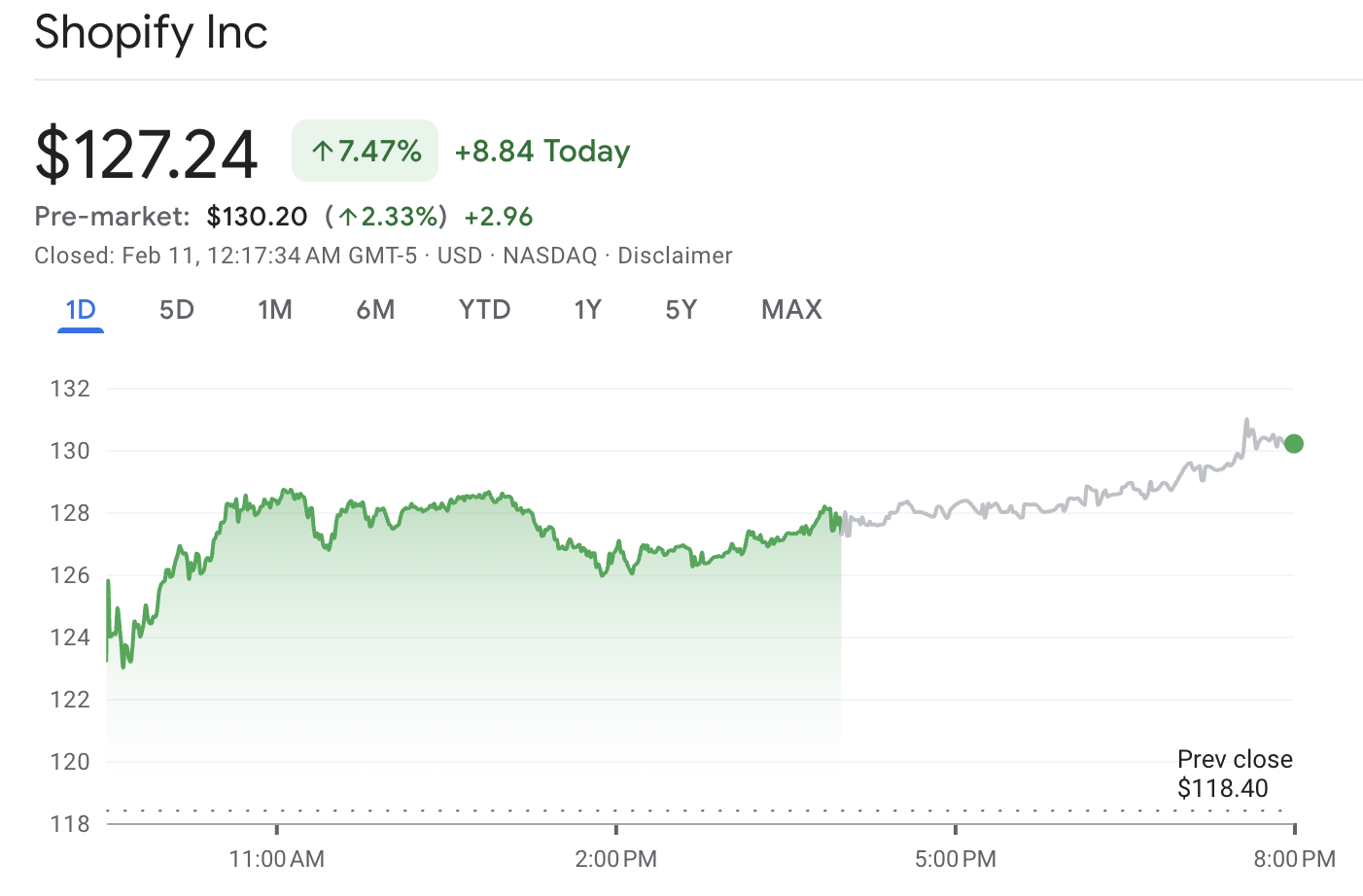

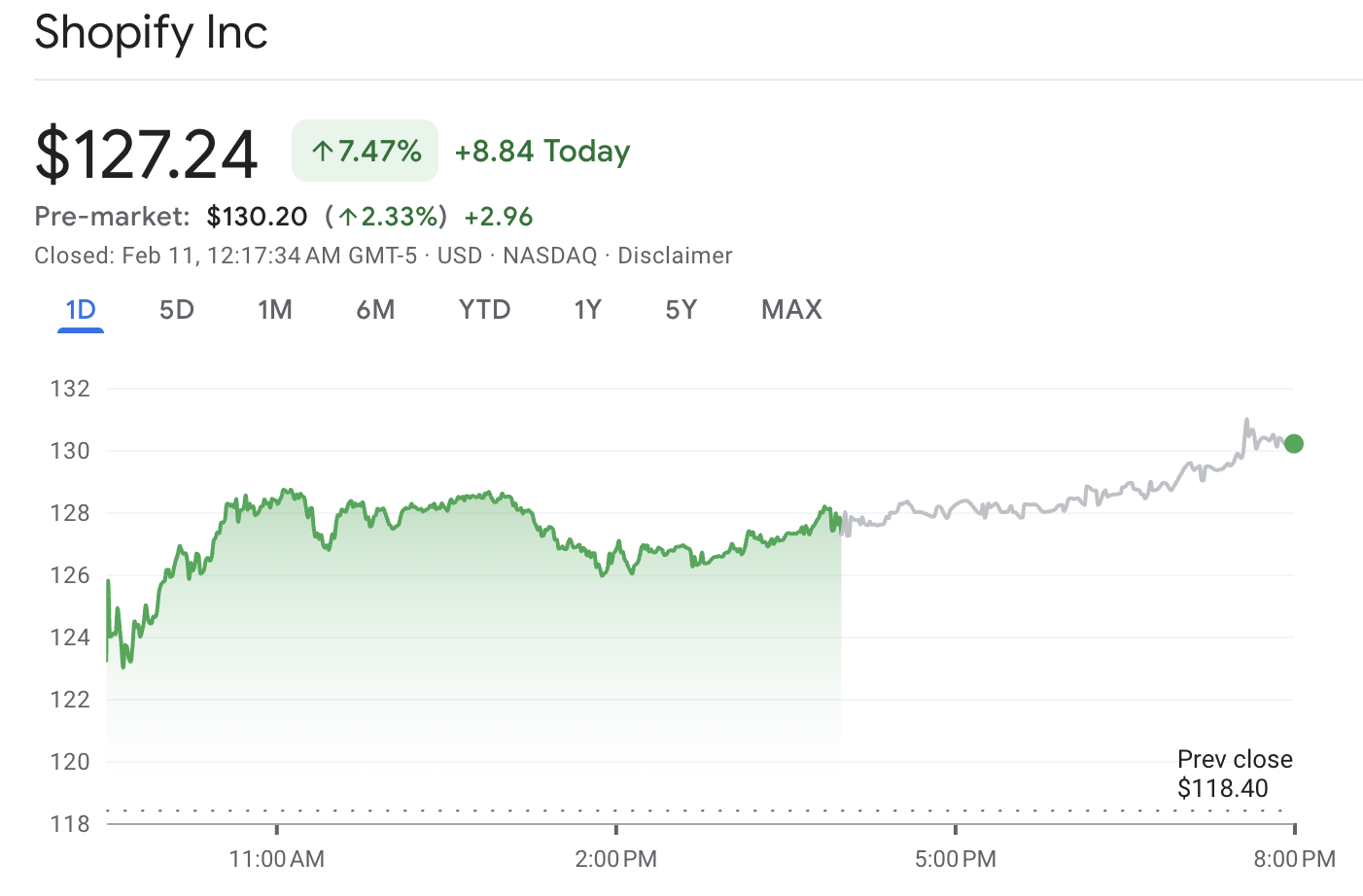

SHOP stock has jumped hard right before Shopify earnings on February 11, and the timing is not random. The stock ripped higher over the last few sessions, with February 10 closing at $127.24, up from $111.24 on February 5. That is roughly a 14% bounce in three sessions, and it came with a clear pickup in trading volume.

When a stock moves like that into an earnings print, the market is usually telling you one thing: traders are paying up for optionality. Some are positioning for a strong report, some are hedging, and some are simply chasing momentum. The result is the same. Volatility rises, and the bar for "good news" often moves higher than most people expect.

Below is our read on what's driving the pre-earnings surge, what the market seems to be pricing in, and the technical levels that matter most for SHOP stock right now.

When Are Shopify Earnings, and What Does the Market Expect?

Shopify is scheduled to release Q4 and full-year 2025 results before markets open on Wednesday, February 11, 2026, with a conference call set for 8:30 a.m. ET.

Analyst estimates going into the print cluster around:

Those numbers matter, but they're not the whole story. For Shopify, the real market reaction usually comes from:

GMV trend (volume on the platform)

Revenue growth quality (mix and take-rate dynamics)

Gross profit dollars vs revenue (mix can pressure margin)

Operating discipline (expense ratio)

Free cash flow margin (what the business turns into real cash)

Shopify already framed Q4 expectations in its last outlook, which is why this print is unusually "boxed in" from a guidance standpoint.

Earnings Model Based on Shopify's Guidance

From Shopify's Q3 outlook for Q4 2025, the company guided to:

Revenue growth: mid-to-high twenties % YoY

Gross profit dollars growth: low-to-mid twenties % YoY

Operating expense ratio: 30% to 31%

Stock-based compensation: $130 million

Free cash flow margin: slightly above Q3

| Scenario (illustrative) |

Revenue |

FCF margin |

FCF dollars |

| Conservative |

$3.51B |

18% |

$0.63B |

| Mid case |

$3.60B |

19% |

$0.68B |

| Strong case |

$3.63B |

20% |

$0.73B |

If last year's fourth-quarter revenue was $2.81 billion, then the term "mid-to-high twenties" roughly translates to a revenue range of $3.51 billion to $3.62 billion.

Why This Is a Big Deal:

If the consensus already sits near the center of the guided range, then the stock move may come down to gross profit and cash flow beating the tone implied by mix, or forward-looking commentary that resets the runway for 2026.

Why SHOP Stock Is Surging Into February 11?

There are three concrete drivers behind the move:

1) A Fresh Bullish Narrative Hit the Tape

A prominent research voice turned more optimistic in the print, highlighting new growth channels and framing automation as a tailwind rather than a threat.

You don't need to agree with the narrative for it to move the stock. You only need to recognize that it gives buyers a reason to show up before earnings, not after.

2) Holiday Demand Signals Were Strong

Shopify reported $14.6 billion in sales during the Black Friday to Cyber Monday weekend, representing a 27% year-over-year increase (and a 24% increase on a constant currency basis). The peak scale reached 5.1 million sales per minute.

That doesn't tell you the quarter is a beat by itself, but it supports the idea that GMV stayed healthy during the most important demand window.

3) Options Pricing Is Encouraging "Buy It Now, Hedge It" Behavior

When implied moves are high, you often see traders buy stock (or directional exposure) and hedge with options instead of waiting. That can lift the spot price into the event.

Options-Implied Move: The Range the Market Is Bracing for SHOP Stock

The options market is implying:

Using the $127.24 close, that translates into a rough earnings range like this:

| Implied move window |

% move |

Rough price range (from $127.24) |

| Weekly |

11.88% |

$112.12 to $142.36 |

| Monthly |

13.40% |

$110.19 to $144.29 |

In short, if SHOP pops "only" 4% to 6% on a solid quarter, that can still disappoint options pricing. If it breaks beyond that implied range, it usually means guidance or forward commentary did the heavy lifting.

What Will Move SHOP Stock After Earnings

1) Revenue Growth and Mix

| Shopify Q3 2025 (actual) |

Value |

| GMV |

$92.013 billion |

| Revenue |

$2.844 billion |

| Gross profit |

$1.391 billion |

| Operating income |

$343 million |

| Free cash flow |

$507 million |

| Free cash flow margin |

18% |

| Subscription revenue |

$699 million |

| Merchant revenue |

$2.145 billion |

Shopify's revenue comes from different streams, and the "quality" of revenue can shift based on payment penetration, merchant services usage, and subscription strength.

Revenue linked to merchants is the main catalyst for growth, increasing at a quicker rate than subscription revenue. Shopify's own constant-currency table indicates that merchant revenue is increasing at a much higher rate than subscription revenue year over year.

Shopify's guidance indicates that gross profit growth will be slower than revenue growth in Q4, which is bullish for scale.

Simply put, the platform can grow fast, but not every dollar of growth carries the same profit weight.

2) Gross Profit Dollars and Operating Discipline

For Shopify, the market has been rewarding operating leverage. In Q4 2024, Shopify posted $1.352 billion in gross profit and a 22% free cash flow margin.

When the stock is priced for momentum, the market wants to see that strong cash conversion continues.

3) Free Cash Flow Is the Trust Metric

SHOP can beat revenue and still sell off if free cash flow disappoints or if spending ramps faster than expected. That's why the earnings call tone matters almost as much as the headline numbers.

SHOP Stock Technical Analysis (Daily): Momentum Is Back, Trend Is Still Mixed

| Indicator |

Latest value |

What it suggests |

| RSI (14) |

67.327 |

Momentum strong, nearing crowded territory |

| MACD (12,26) |

2.56 |

Positive momentum |

| ADX (14) |

53.093 |

Strong trend strength |

| ATR (14) |

2.4796 |

Daily movement is active, but not chaotic |

| Stoch (9,6) |

89.85 |

Short-term overbought risk |

Technicals into earnings are tricky because event risk can override signals. Levels are important because they determine the locations of stops and hedges.

Support and Resistance to Watch

Immediate pivot zone: around $126 to $128 (price is sitting right on it)

Support: $119 to $121 (cluster around MA20 and MA50)

Resistance: $129 (MA100 area), then $145 (MA200 area)

Bigger picture markers: $182 (52-week high) and $70 (52-week low)

If you're a short-term trader, the cleanest question is: Does the post-earnings move hold above the $119 to $121 support zone, or does it fade back into it? That's where the "bounce vs trend" debate gets settled.

Frequently Asked Questions (FAQ)

What Time Are Shopify Earnings on Feb 11?

Shopify will report its earnings before the markets open on February 11, 2026, with a conference call scheduled for 8:30 a.m. ET.

Why Is SHOP Stock up Going Into Earnings on Feb 11?

The move is being driven by pre-earnings positioning, a refreshed bullish narrative from a major research voice, and strong holiday demand.

What's the Implied Move for SHOP Stock Into Earnings?

Options pricing suggested roughly a 13.4% move for the week around earnings.

Conclusion

In conclusion, SHOP is surging into February 11 because the market is leaning into two things at once: a strong holiday demand backdrop and a stock that had already been knocked down hard enough to set up a sharp snapback.

However, the rally also raises the standard for this earnings report. A simple beat may not be enough if the forward tone is cautious or if cash generation comes in softer than traders are hoping.

From here, the play is straightforward. If the report and guidance support the idea that growth and cash flow can stay strong, the stock has room to push into the next resistance zones. If the message disappoints, the market will likely test whether buyers are real or just event-driven.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.