The Relative Strength Index (RSI) is one of the most widely used momentum indicators in technical analysis. It helps traders determine whether an asset is overbought or oversold, offering signals for potential market entries and exits. Despite its simplicity, the RSI's power lies in how it's interpreted and applied in real-time market conditions. This article explores how to use RSI effectively, interpret its signals correctly, and combine it with other tools for greater reliability.

Understanding RSI Overbought and Oversold Levels

At its core, the RSI is a bounded oscillator that moves between 0 and 100. The classic thresholds of 70 and 30 help traders identify potential reversal zones.

At its core, the RSI is a bounded oscillator that moves between 0 and 100. The classic thresholds of 70 and 30 help traders identify potential reversal zones.

However, these levels are not strict buy or sell signals. In strong trends, the RSI can stay overbought or oversold for extended periods. That's why understanding market context is essential. For instance, in a strong bullish trend, RSI might hover above 70 for weeks before any meaningful drop occurs.

Spotting Divergences for Reversals

One of the most powerful RSI signals is divergence. This occurs when the price action and rsi indicator start moving in opposite directions.

One of the most powerful RSI signals is divergence. This occurs when the price action and rsi indicator start moving in opposite directions.

Divergence doesn't guarantee a reversal, but it often serves as a valuable early warning signal, especially when confirmed with other tools or Chart Patterns. Traders often use divergence in combination with support and resistance zones or trend lines for added confidence.

Combining RSI with Moving Averages

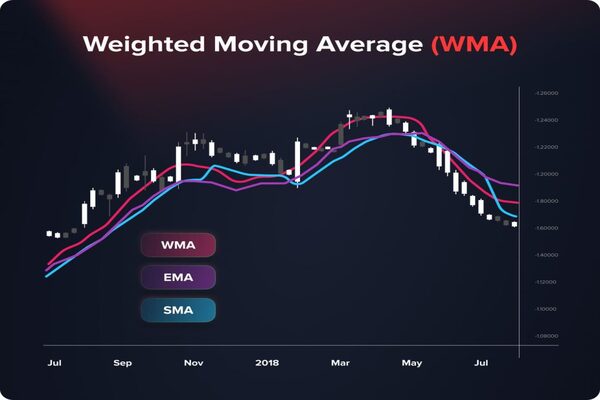

RSI becomes more effective when used alongside other technical indicators. A popular approach is to combine it with moving averages—especially the 50-day and 200-day lines.

Here's how this combo works in practice:

The idea is to use RSI as a timing tool and moving averages to confirm the broader trend. This combination reduces the risk of acting on false signals.

Using RSI with Support and Resistance

Support and resistance levels are key areas on a chart where price tends to react. RSI can offer extra confirmation when these levels are tested.

Support and resistance levels are key areas on a chart where price tends to react. RSI can offer extra confirmation when these levels are tested.

For example:

In sideways or range-bound markets, RSI becomes particularly useful. Traders often use it to fade price action—buying near support when RSI is low and selling near resistance when RSI is high.

Timeframes and RSI Settings That Work Best

The default RSI setting is 14 periods, which suits many trading styles. But adjustments can be made depending on your strategy:

-

Short-term traders (e.g. scalpers or day traders) might use RSI-5 or RSI-7 for faster signals, though this increases false alarms.

-

Swing traders often stick with RSI-14 for balance between responsiveness and reliability.

-

Position traders or long-term investors may look at RSI-21 or RSI-30 on weekly charts.

RSI's effectiveness also changes across timeframes. On higher timeframes (e.g. daily or weekly), RSI signals tend to be more reliable, while on shorter charts (e.g. 1-min or 5-min), they are more volatile and should be used cautiously or with confirmation.

Final Thoughts

The RSI is simple but powerful—especially when used wisely. It doesn't predict market movements on its own, but it can highlight opportunities and help filter out noise when combined with other tools like moving averages, price structure, and volume.

Traders should always consider the broader trend and be cautious of overreacting to a single RSI reading. Ultimately, the RSI trading strategy rewards those who focus on context, confirmation, and consistency—not just numbers on a screen.

Whether you're new to trading or refining your edge, learning how to use RSI effectively can help you spot high-probability setups and avoid chasing unreliable signals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.