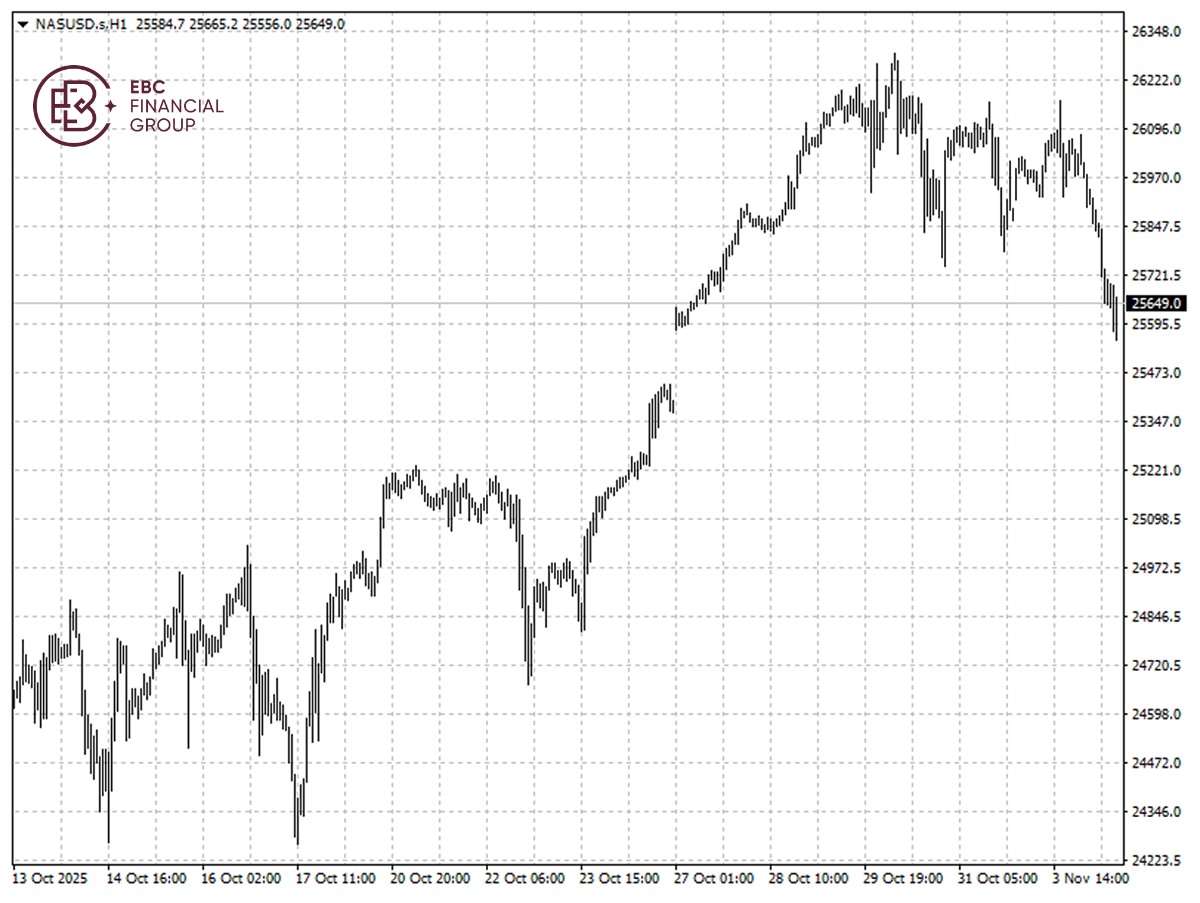

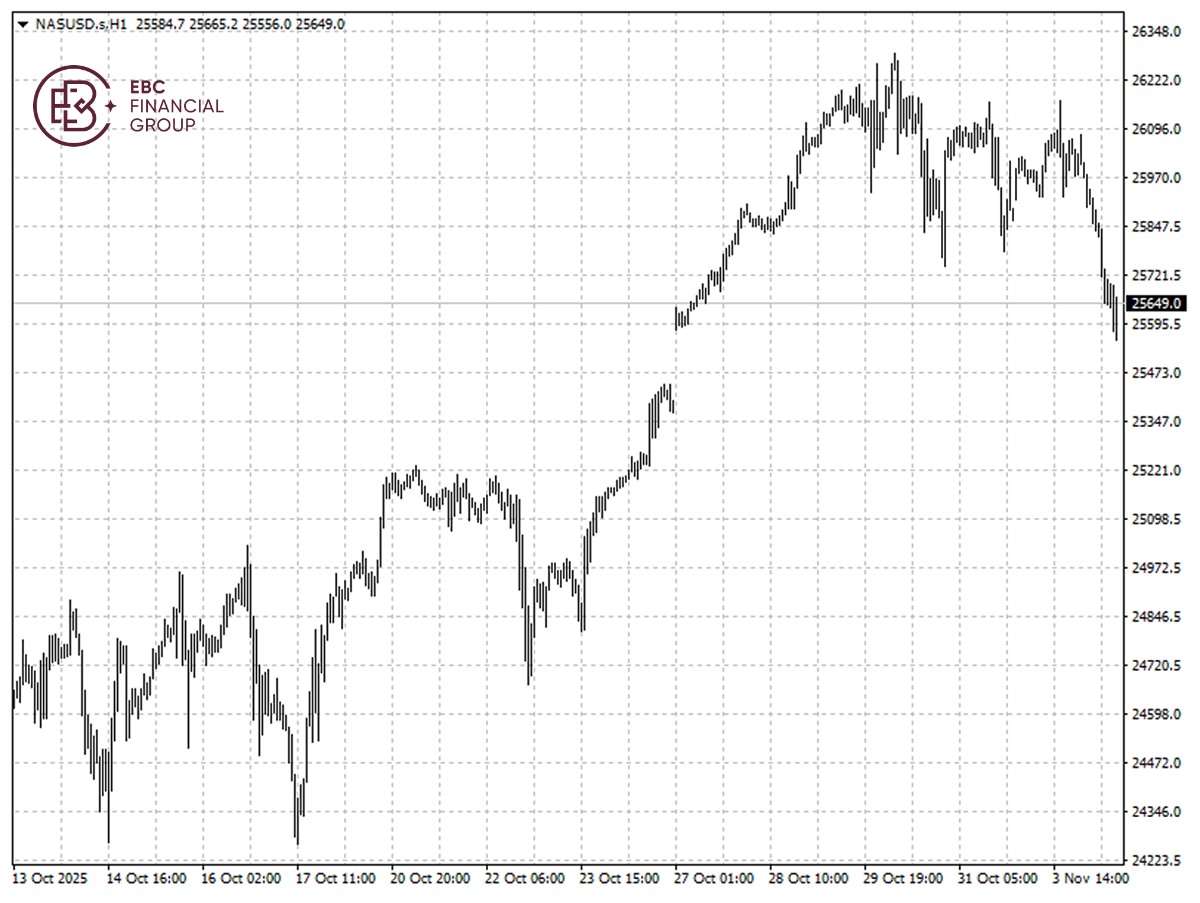

The Nasdaq 100 rose on Monday as investors moved further into the AI trade

following a number of deal announcements. However, the weak breadth has been an

ongoing concern of the market.

US equity fund inflows cooled significantly in the week to 29 October as

investors refrained from taking major bets in the lead-up to an anticipated Fed

rate cut and a batch of earnings reports.

The technology sector, meanwhile, had a net $1.65 billion weekly inflow, the

largest since 1 October. In contrast, financials and consumer discretionary saw

outflows of $662 million and $314 million, respectively.

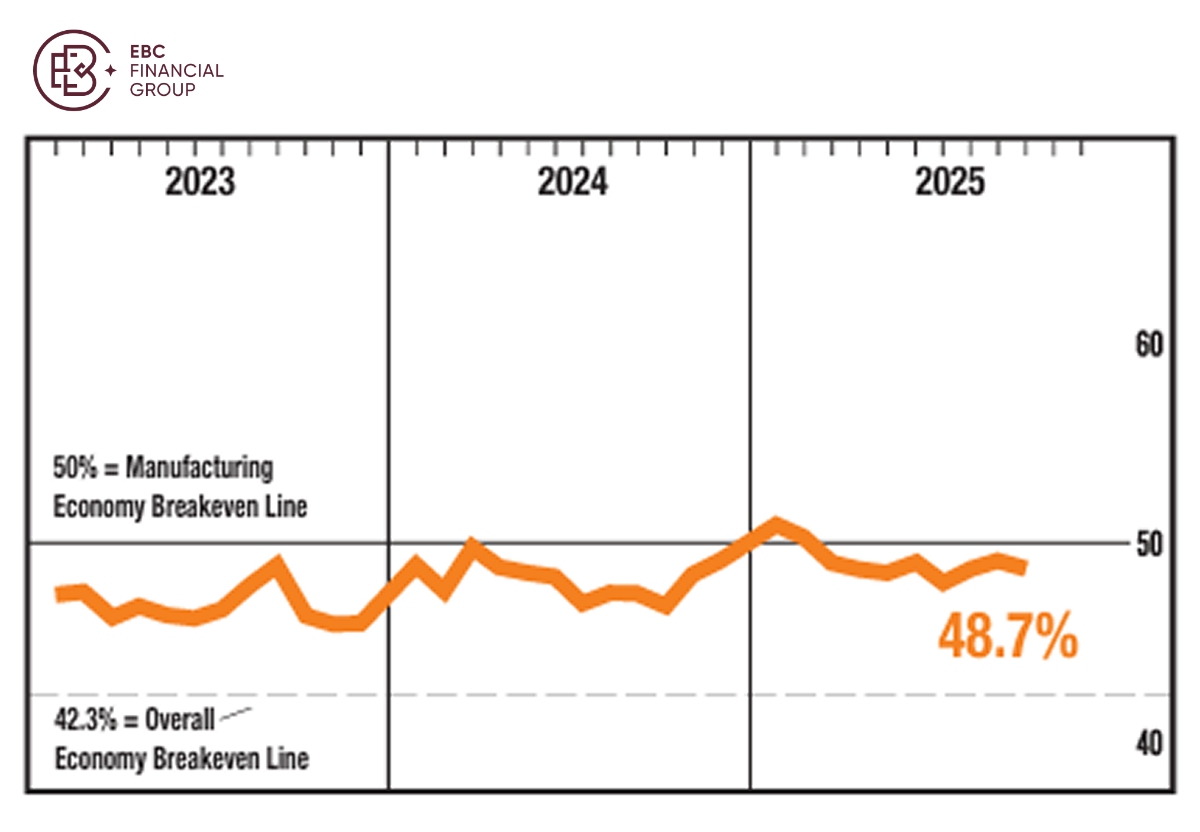

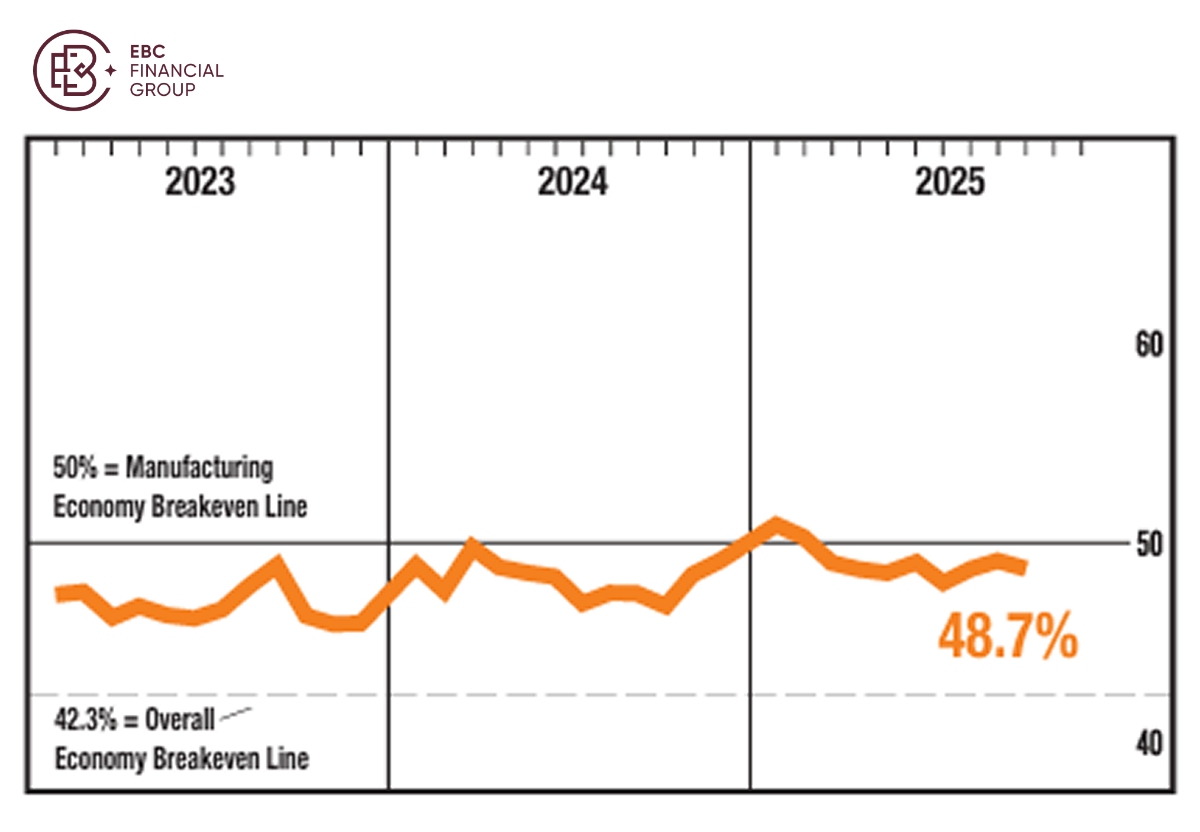

US manufacturing contracted for an 8th straight month in October as new

orders remained subdued, and suppliers were taking longer to deliver materials

to factories against the backdrop of tariffs on imported goods.

Trade deficit fell in September to the lowest level in 5 months as imports

dropped more sharply than exports. Still self-reliance hangs in the balance,

including worker shortage and crumbling infrastructure.

Manufacturing contracted for an eighth straight month in October as new

orders remained subdued, and suppliers were taking longer to deliver materials

to factories against the backdrop of tariffs on imported goods.

It will take several years to address structural issues at least, so staking

bets on Big Tech's underperformance anytime soon is unlikely to come off.

Instead it is key to find the next FANG or Magnificent Seven.

Systematic risks

Morgan Stanley highlighted that corporate earnings have exceeded forecasts,

growing the fastest since 2021. This momentum is projected to carry through

2026, broadening earnings contributions across major indices.

However, they are cautious in the short term. One risk is that the market may

be disappointed by the pace of Fed interest rate reductions after Chair Powell

pushed back the idea of action in December.

A lack of government data as the shutdown continues may also discourage the

Fed from easing policy. It is almost certain that this will be the longest

shutdown in history, underlining a frayed America.

Morgan Stanley also warned that the Fed's decision to pause its balance sheet

reduction may have a more significant medium-term impact on financial markets

than its current interest rate path.

"It's likely there'll be a 10 to 20% drawdown in equity markets sometime in

the next 12 to 24 months," said Goldman Sachs CEO David Solomon at the Global

Financial Leaders' Investment Summit in Hong Kong.

He added that is a normal feature of long-term bull markets, and hence

standing advice to clients remains to stay invested and review portfolio

allocation, not attempt to time markets.

Goldman Sachs and Morgan Stanley both pointed to Asia as a bright spot in the

next few years on the back of recent developments including the trade pact

between the US and China.

AI arms race

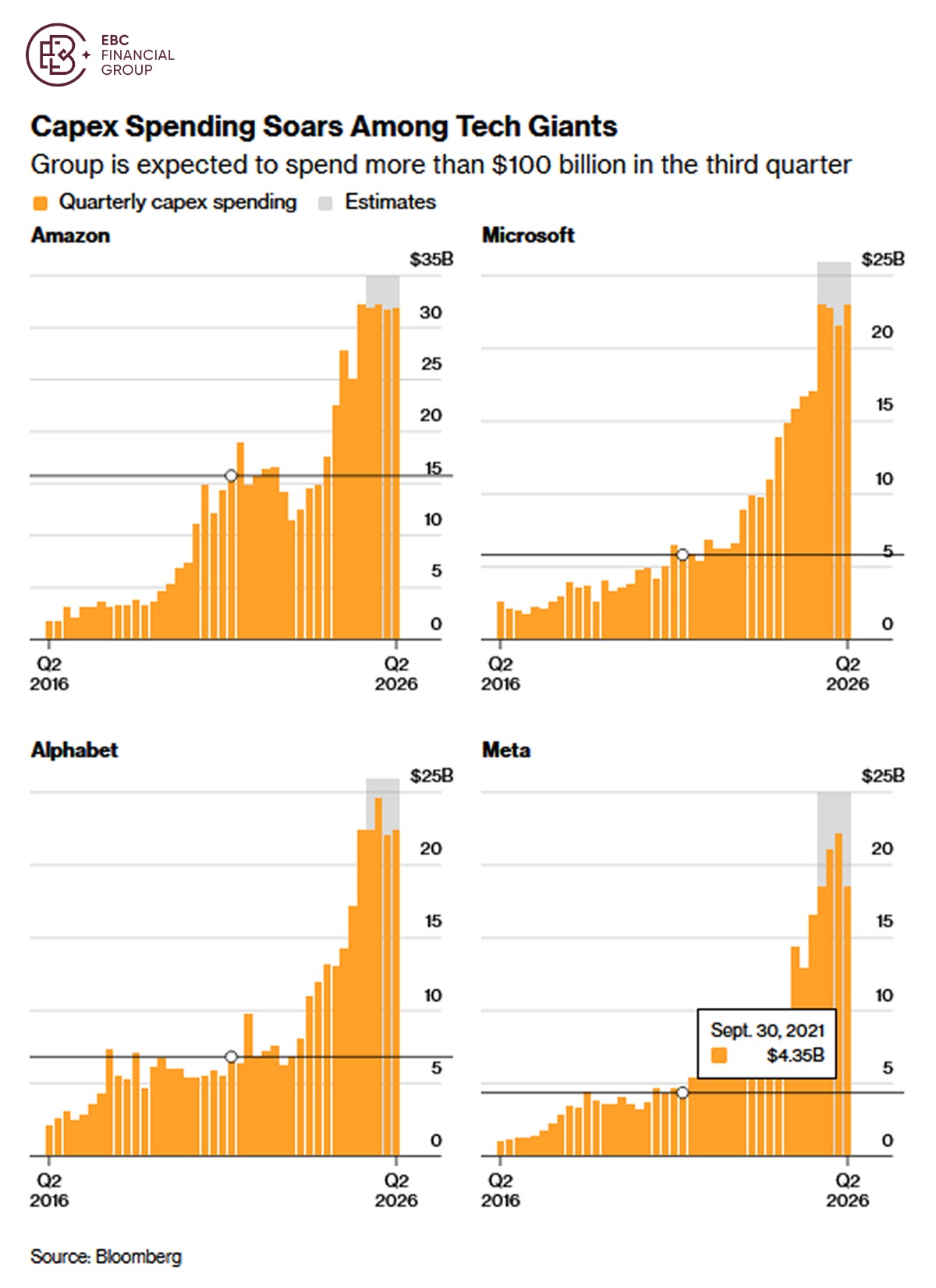

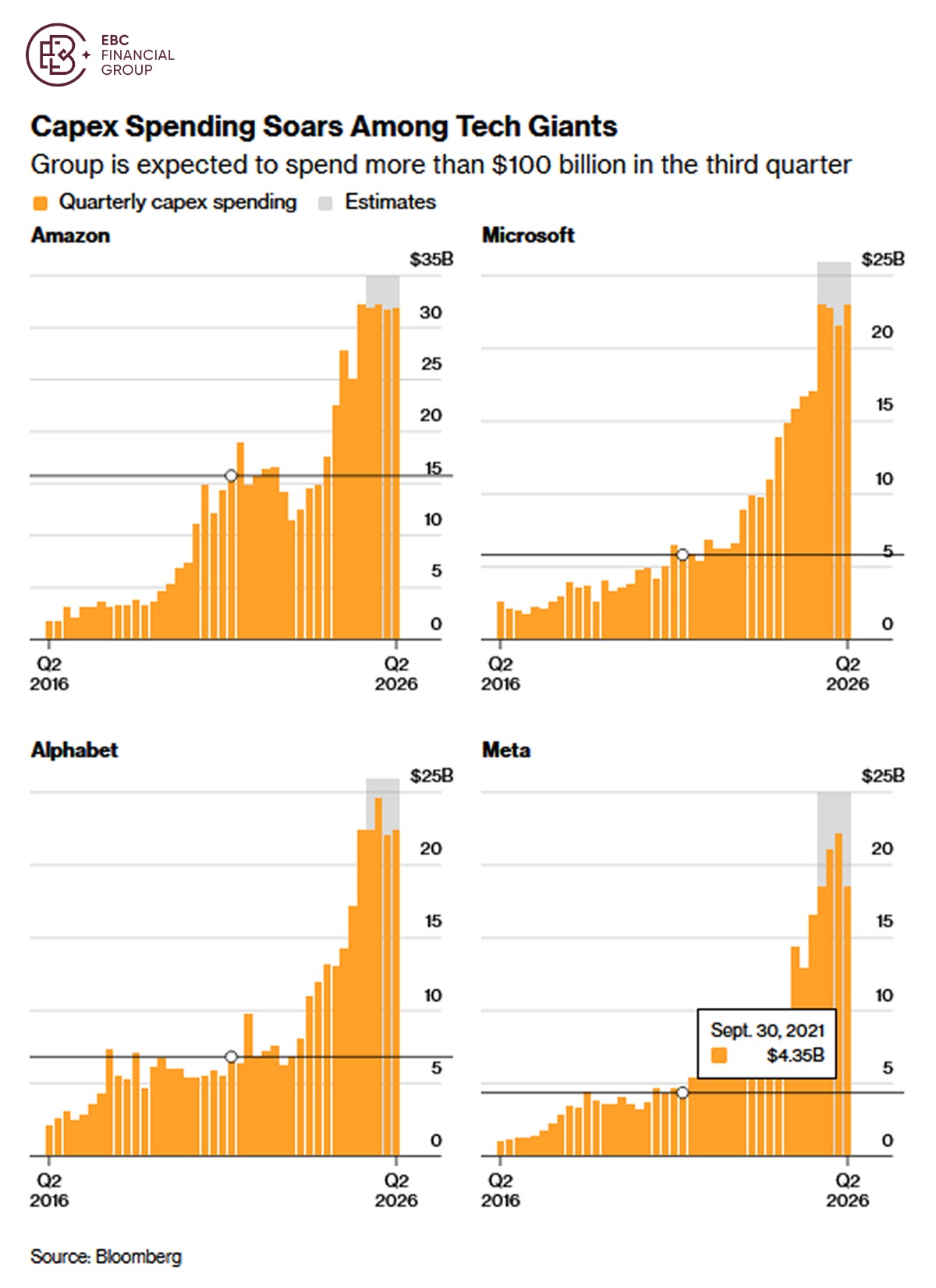

McKinsey said that by 2030, data centres equipped to handle AI processing

loads would require $5.2 trillion in capex to keep up with compute demand, while

$1.5 trillion investment is needed to power traditional IT applications.

Big names Alphabet, Meta, Microsoft and Amazon have all lifted their guidance

for capital expenditures and now collectively expect that number to reach more

than $380 billion this year.

Shares of Meta sank earlier this week despite strong Q3 results as investors

were spooked by its aggressive plan of ramping up capacity. That marks a

consequential shift from elation to scepticism.

"These are like five year trends, and therefore the ramp up means that we

will start seeing real revenue benefits and real readiness to pay for it,

probably later than the expectations of investors," said HSBC CEO Georges

Elhedery.

According to a Bloomberg index tracking 45 major cloud, semiconductor, and

hardware companies, their forward PE ratios currently stand at around 23 times,

significantly higher than 14 times in April.

Some large technology firms adopt "novel and potentially circular private

financing arrangements" to fund expansion, and should revenue growth miss

expectations, their financial positions will face severe tests, according to

Singapore's central bank.

The money burning game is in full swing. Be that as it may, we have not seen

any sharp downward revision of full-year guidance for big players in AI, a sign

that it is premature to call the bull run end.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.