The York Space Systems IPO aligns with a broader shift in national security space from specialized programs to large-scale procurement. As the U.S. military expedites the deployment of proliferated constellations engineered to resist jamming, interception, and kinetic threats, market dynamics increasingly favor manufacturers that can deliver spacecraft rapidly and consistently, supported by a record of successful missions.

York positions its public offering as a test of whether investors will attribute defense-prime valuation multiples to a new generation of satellite manufacturers that demonstrate scaled production capacity and clear contract visibility.

Denver-based York Space Systems intends to list on the NYSE under the ticker YSS, presenting itself as a satellite manufacturer and operator focused on U.S. defense requirements. The amended prospectus cites 74 missions and over 4 million on-orbit hours, indicating that the company operates at a significant scale for a 'new space' manufacturer.

York Space Systems IPO Terms And Valuation Math

York has applied to list its common stock on the NYSE under YSS and notes that it cannot consummate the offering without NYSE approval.

The offering contemplates 16,000,000 shares with a 30-day overallotment option for up to 2,400,000 additional shares.

IPO calendars currently show expected pricing on January 28, 2026, followed by an expected NYSE debut on January 29, 2026, though timing can change with market conditions.

YSS IPO snapshot

| Item |

Details |

| Company |

York Space Systems (YSS) |

| Exchange / Ticker |

NYSE: YSS |

| Base Deal Size |

16,000,000 shares |

| Price Range |

$30 to $34 |

| Gross Proceeds (Range) |

$480M to $544M (≈ $512M at midpoint), before fees |

| Overallotment Option |

Up to 2,400,000 shares |

| Expected Pricing / Listing |

Pricing: Jan 28 • Listing: Jan 29 (expected) |

| Underwriters |

Goldman Sachs; Jefferies; Wells Fargo; J.P. Morgan; Citi; Truist; Baird; Raymond James |

| Co-Managers |

Canaccord Genuity; Needham & Company; Academy Securities |

The filing indicates 125,000,000 shares outstanding after the base offering (or 127,400,000 with full overallotment).

At the top of the range, $34 × 125.0M ≈ $4.25B implied market capitalisation, consistent with public deal framing.

A practical valuation cross-check is price-to-sales. Using filing revenue figures, trailing twelve-month revenue through September 30, 2025, can be approximated as:

On this basis, an approximate $4.25 billion market capitalization implies a multiple of about 12 times trailing sales. The sustainability of this multiple will depend more on delivery cadence, margin stability, and working-capital management than on headline growth rates.

What York Sells And Why The Defence Demand Is Structurally Different

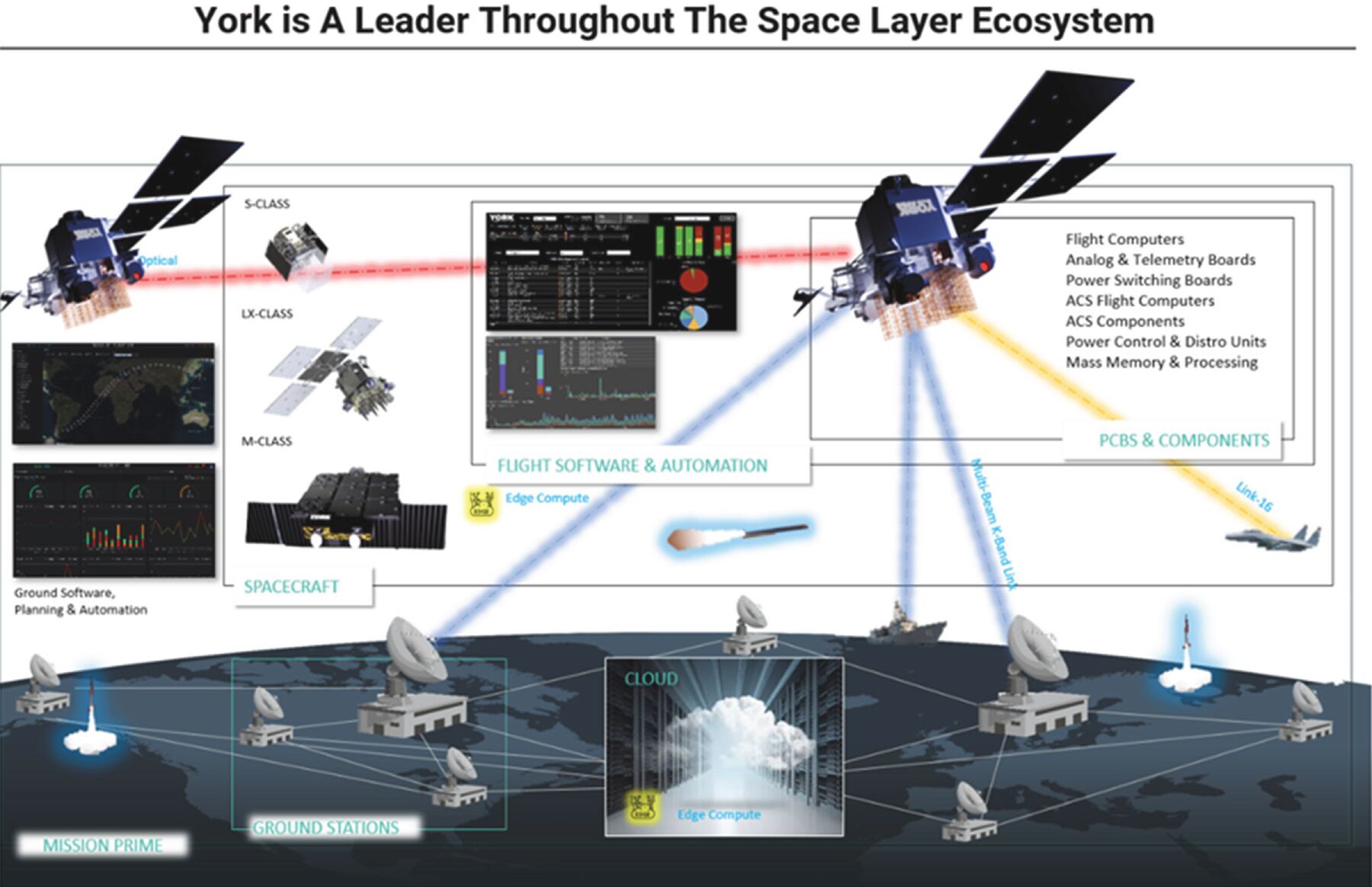

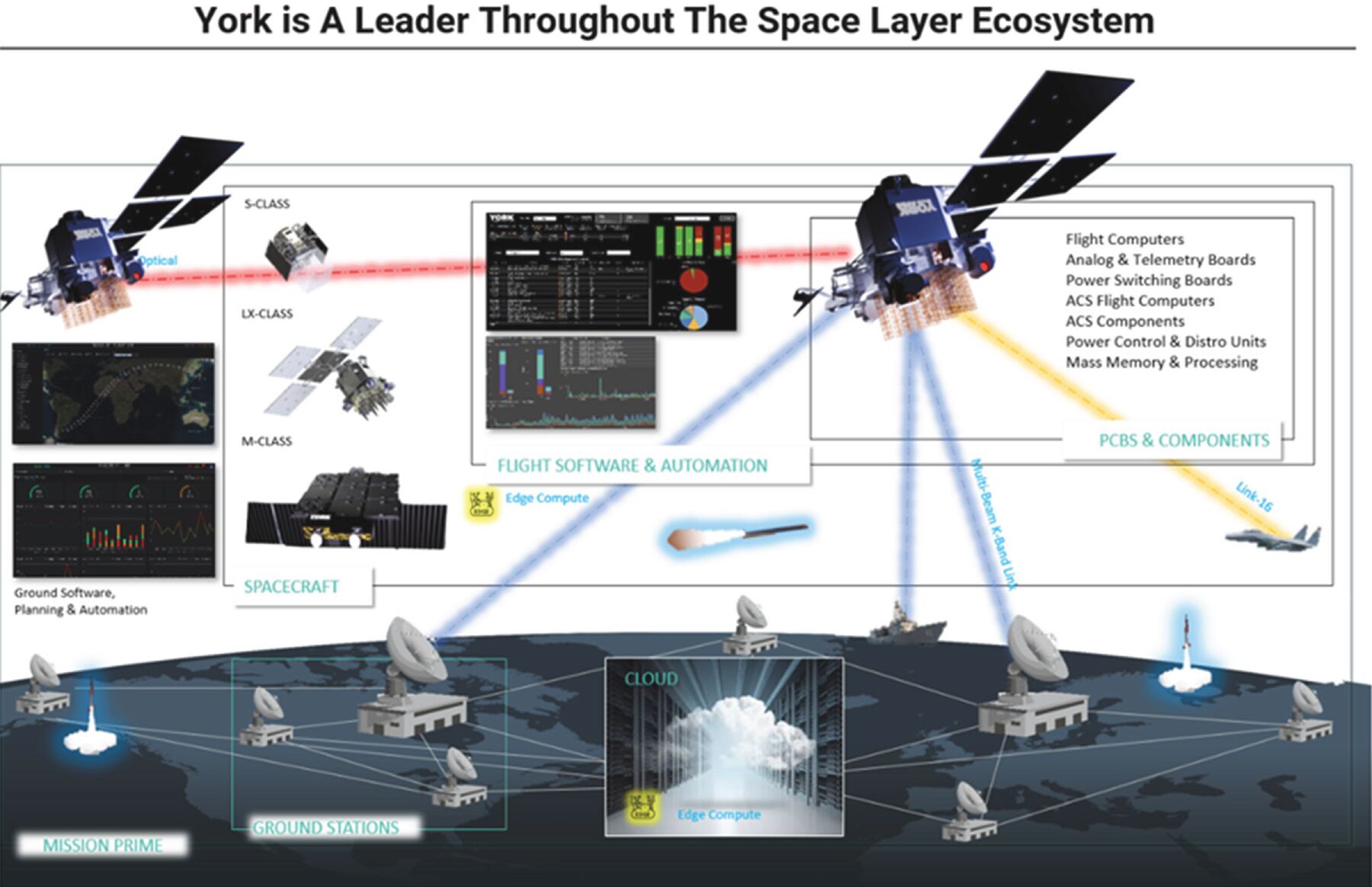

York’s value proposition emphasizes 'space as procurement' rather than 'space as a science project.' The company designs, manufactures, integrates, and operates spacecraft and mission systems for U.S. government clients, including those within the Space Development Agency ecosystem.

Two traits distinguish defence-oriented satellite manufacturing from many commercial constellations:

Refresh cycles and replenishment logic: proliferated architectures assume satellites will be replenished and upgraded frequently, which favours standardised platforms and repeatable production.

Heritage as a selection criterion: York emphasises operational heritage: 74 missions and 4M+ on-orbit hours.

York also emphasizes its manufacturing capacity as a core component of its equity narrative. The company’s filing details a 60,000-square-foot Potomac facility, opened in August 2023, which is designed to support the manufacture, assembly, integration, and testing of more than 1,000 satellites annually.

Financial Performance: Rapid Growth, Margin Expansion, And Persistent Losses

The filing indicates accelerating growth and improved gross margins in 2025, accompanied by ongoing net losses and substantial overhead costs.

For the nine months ended September 30, 2025, York reported:

Revenue: $280.9M (vs $176.9M in the prior-year period, ~59% growth)

Gross profit: $54.4M (vs $16.8M)

Net loss: $56.0M (vs $73.6M)

SG&A: $94.1M

For FY 2024, revenue was $253.5M, and net loss was $98.9M. More importantly, FY gross profit was $32.4M in 2024, down from $54.9M in 2023, with a gross margin of 13% vs 23% in 2023.

Selected financials (from the filing)

| ($ millions) |

9M 2025 |

9M 2024 |

FY 2024 |

FY 2023 |

| Revenue |

280.9 |

176.9 |

253.5 |

238.1 |

| Gross Profit |

54.4 |

16.8 |

32.4 |

54.9 |

| Net Loss |

(56.0) |

(73.6) |

(98.9) |

(29.7) |

| Cash (period end) |

22.5 |

n/a |

104.7 |

81.1 |

| Long-Term Debt, Net (period end) |

197.7 |

n/a |

197.0 |

196.3 |

A central consideration for investors is whether the improved 2025 gross margin reflects a sustainable program mix and operational efficiency, or if it is primarily attributable to timing and contract-specific factors that may normalize as delivery schedules change.

Backlog: Large, Convertible, and Execution-Sensitive

York reported a backlog of $642.0M as of September 30, 2025, down from $861.7M at December 31, 2024. Management also expects to recognise approximately 67% of the September 30 backlog within the next 12 months.

That conversion expectation is a double-edged signal:

It indicates near-term revenue visibility if deliveries and milestones proceed as planned.

It heightens quarterly execution risk because schedule slips, supply chain delays, or test failures can push revenue recognition and compress margins.

The same filing shows working-capital intensity typical of build-and-deliver programs: accounts receivable expanded sharply by September 30, 2025, while cash declined, underscoring why the IPO is framed as a working-capital and growth funding event.

Use Of Proceeds: Working Capital, Inventory, and Capex Rather Than Debt Paydown

Customer concentration is extreme. The filing indicates that approximately 95% of revenue for 9M 2025 (and 92% for 9M 2024) came from one customer, and that about 86% of accounts receivable at September 30, 2025, was tied to that customer.

Working-capital intensity is further evident as cash decreased to $22.5 million by September 30, 2025, while accounts receivable increased to $22.7 million from $2.1 million at December 31, 2024. This trend reinforces the framing of the IPO as a working-capital and scaling initiative.

Ownership and Governance: Controlled Company Dynamics

The filing indicates that following the offering, York expects to be a controlled company, with AE Industrial Partners controlling a majority of voting power through ownership and contractual arrangements. Press coverage also notes AE Industrial’s economic interest is expected to fall, while voting control remains.

The filing indicates that following the offering, York expects to be a controlled company, with AE Industrial Partners controlling a majority of voting power through ownership and contractual arrangements. Press coverage also notes AE Industrial’s economic interest is expected to fall, while voting control remains.

For public investors, controlled-company status can be neutral or negative, depending on the rigor of capital allocation. While this structure may facilitate long-term investment by reducing pressure for short-term optimization, it also centralizes decision-making authority and may limit the influence of minority shareholders on governance.

What To Watch As Pricing Approaches

Three indicators are likely to drive early sentiment if York lists near the top of the range:

Backlog stability and renewal cadence: investors will read backlog trajectory as validation of York’s position in defence procurement cycles.

Cash conversion and customer payment dynamics: the combination of low cash and concentrated receivables elevates liquidity optics until IPO proceeds settle into a working-capital rhythm.

Margin durability: 2025’s gross margin improvement is meaningful, but FY 2024’s lower gross margin underscores how program mix and EAC adjustments can swing profitability.

Frequently Asked Questions (FAQ)

1) When is the York Space Systems IPO date?

York Space Systems is expected to price its IPO on January 28, 2026, with trading expected to start on the NYSE on January 29, 2026. These dates can be adjusted based on market conditions, investor demand, and SEC timing, all of which are expected in late January.

2) What is the York Space Systems ticker symbol?

York has applied to list its common stock on the New York Stock Exchange under the ticker symbol YSS. The symbol becomes effective only if the NYSE approves the listing and the offering is completed as planned at pricing close.

3) How much money is York Space Systems raising in the IPO?

The base deal is 16 million primary shares priced at $30 to $34 each. That implies gross proceeds of $480 million to $544 million before underwriter discounts and offering costs. Proceeds rise if the overallotment is exercised in full as well.

4) What valuation is implied by the YSS IPO price range?

At $34 per share, and 125 million shares outstanding after the base offering, the implied market capitalisation is about $4.25 billion. At the $32 midpoint, the implied market cap is about $4.0 billion, before overallotment is exercised.

5) How fast is York Space Systems growing?

York reported revenue of $280.9 million for the nine months ended September 30, 2025, versus $176.9 million a year earlier. That is roughly 59 per cent year-on-year growth, showing a rapid ramp-up in government deliveries and milestones as programs move into production.

6) How will York use the IPO proceeds?

York says it expects to use net IPO proceeds mainly for working capital and general corporate purposes. Priorities include funding growth, building inventory for multi-satellite programs, and capital expenditures. Management has not yet publicly committed proceeds to a specific project.

Conclusion

The York Space Systems IPO constitutes a strategic investment in industrialized defense-space manufacturing. The company enters the public market with established operational credibility, as demonstrated by its mission count and on-orbit hours, and a backlog profile that suggests near-term revenue visibility.

Nevertheless, significant challenges persist, including a capital-intensive working capital cycle, continued net losses, and a controlled-company governance structure that limits minority shareholder influence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

1) York Space Systems Launches IPO

2) UNITED STATES SECURITIES AND EXCHANGE COMMISSION