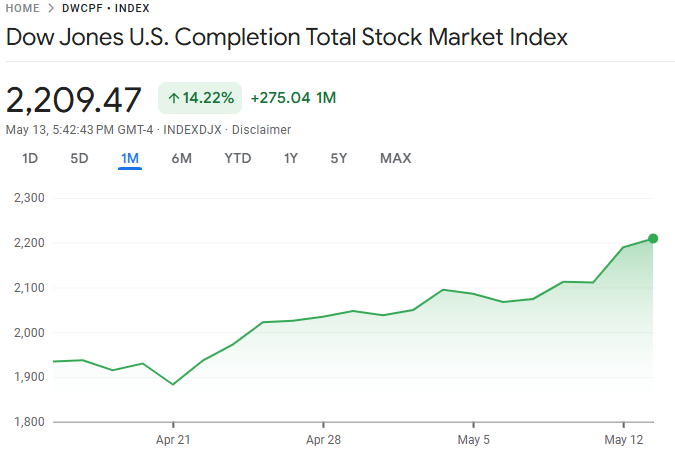

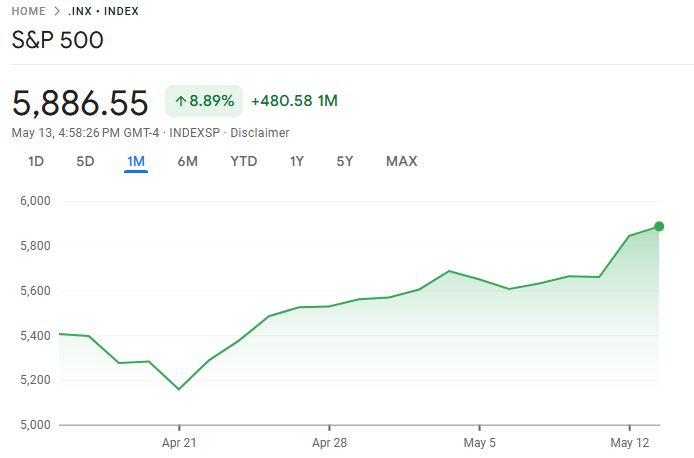

When analysing the U.S. stock market, two major indices often dominate conversations: the S&P 500 and the Dow Jones Completion Index. Both serve as benchmarks for the U.S. equity market, but track vastly different segments.

While the S&P 500 focuses on large-cap companies, the Dow Jones Completion Index includes mid-cap and small-cap companies outside the S&P 500.

In this article, we will explain what each index represents, how they are constructed, their historical performance, and how they can be utilised in portfolio management.

What Is the Dow Jones Completion Index?

The Dow Jones U.S. Completion Total Stock Market Index, commonly known as the Dow Jones Completion Index, is designed to complement the S&P 500. It includes all U.S. stocks in the Dow Jones U.S. Total Stock Market Index outside the S&P 500.

The Completion Index includes mid-cap, small-cap, and some micro-cap companies. It provides investors with access to U.S. equities beyond the S&P 500, offering a more complete market perspective by addressing the gaps.

This index comprises approximately 4,000 stocks, compared to the S&P 500's 500. It offers a broader exposure to the U.S. economy by including companies with high growth potential that may not yet qualify for the S&P 500.

Despite its coverage, the Dow Jones Completion Index is often less discussed in financial media, but it plays a critical role in total market exposure.

What Is the S&P 500?

The Standard & Poor's 500 Index, commonly known as the S&P 500, is one of the most widely tracked stock market indices. It comprises 500 of the largest publicly traded companies in the United States and is a benchmark for the overall performance of large-cap U.S. stocks.

These companies span various sectors, including technology, healthcare, financials, and consumer goods. Some of the most recognisable names in the S&P 500 include Apple, Microsoft, Amazon, Alphabet, and JPMorgan Chase.

The S&P 500 is a market-cap-weighted index, meaning companies with higher market capitalisation (share price × number of outstanding shares) have a greater influence on the index's performance. For example, movements in Apple's stock price have a larger impact on the index than movements in a smaller company like Clorox.

S&P Dow Jones Indices managed the index, and its inclusion criteria extend beyond market capitalisation. Companies must also meet standards about liquidity, public float, sector representation, and financial viability.

How Are the Indices Constructed?

Although S&P Dow Jones Indices curate both indices, they employ different methodologies and inclusion criteria for their construction.

Dow Jones Completion Index Construction:

Number of Stocks: Roughly 4,000

market cap Range: Excludes S&P 500 constituents, covering mid-cap, small-cap, and micro-cap

Selection Criteria:

Includes all U.S. stocks in the Dow Jones U.S. Total Stock Market Index, not included in the S&P 500

No qualitative earnings filter like the S&P 500

Covers the rest of the investable U.S. market

In essence, the Dow Jones Completion Index plus the S&P 500 equals the total U.S. stock market, making the Completion Index an effective tool for investors aiming for complete market exposure.

S&P 500 Construction:

Selection Criteria:

Must be a U.S. company

Market capitalisation above a specific threshold (updated periodically)

Public float of at least 10%

Positive earnings in the most recent quarter and over the prior four quarters combined

Sector representation and other qualitative factors

Popular ETFs and Mutual Funds Tracking These Indices

S&P 500 Funds:

SPDR S&P 500 ETF Trust (SPY)

Vanguard S&P 500 ETF (VOO)

iShares Core S&P 500 ETF (IVV)

Completion index funds:

Vanguard Extended Market ETF (VXF): Tracks the Dow Jones Completion Index.

Fidelity Extended Market Index Fund (FSMAX): Designed to complement S&P 500 holdings.

Schwab U.S. Mid-Cap ETF (SCHM) and Schwab U.S. Small-Cap ETF (SCHA): While not exact Completion Index trackers, they offer similar exposure.

Investors often pair VOO with VXF to create a total market portfolio without overlapping exposure.

Dow Jones Completion Index vs S&P 500

| Feature |

S&P 500 |

Dow Jones Completion Index |

| Number of Stocks |

500 |

~4,000 |

| Market Cap Focus |

Large-cap |

Mid-cap, small-cap, and micro-cap |

| Index Type |

Market-cap weighted |

Market-cap weighted |

| Purpose |

Represents the top large-cap U.S. companies |

Represents the rest of the U.S. market not in the S&P 500 |

| Volatility |

Lower (more stable) |

Higher (more volatile) |

| Growth Potential |

Moderate |

Higher (especially in bull markets) |

| Institutional Coverage |

Extensive |

Limited to moderate |

| Liquidity |

High |

Lower compared to S&P 500 |

| Economic Sensitivity |

Less sensitive |

More sensitive to economic shifts |

| Typical Use in Portfolios |

Core holding for large-cap exposure |

Complements S&P 500 for total market exposure |

| Popular ETFs |

SPY, VOO, IVV |

VXF, FSMAX |

| Expense Ratios (ETFs) |

~0.03% – 0.05% |

~0.04% – 0.08% |

| Management Style |

Passive (index-tracking) |

Passive (index-tracking) |

| Benchmarking Purpose |

Measures large-cap market performance |

Fills in gaps to complete total U.S. equity market tracking |

1. Market Cap Exposure

The S&P 500 focuses on large-cap stocks.

The Dow Jones Completion Index focuses on mid-, small-, and micro-cap stocks.

It makes the S&P 500 more stable and mature, while the Completion Index includes more growth-oriented, potentially volatile companies.

2. Number of Constituents

The Completion Index is broader and more diverse in company size and industry coverage.

3. Volatility

This means the Completion Index has a higher risk-reward ratio than the S&P 500.

4. Influence on Portfolio Performance

The S&P 500 heavily influences major mutual funds and ETFs.

The Completion Index is often used to complement S&P 500 exposure, especially in total stock market funds like Vanguard's VTSAX or VTI.

5. Liquidity and Analyst Coverage

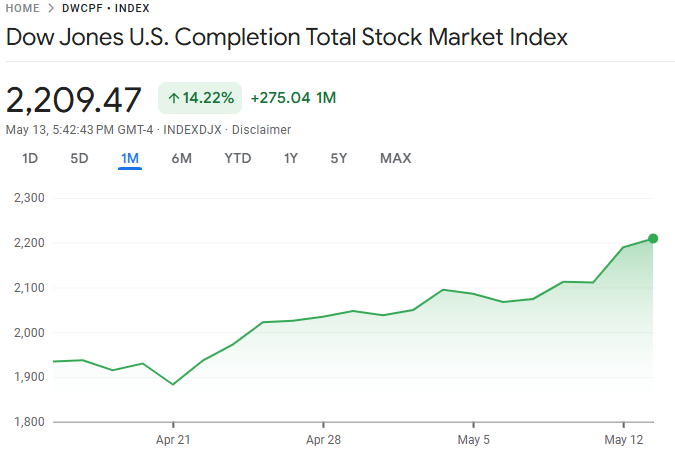

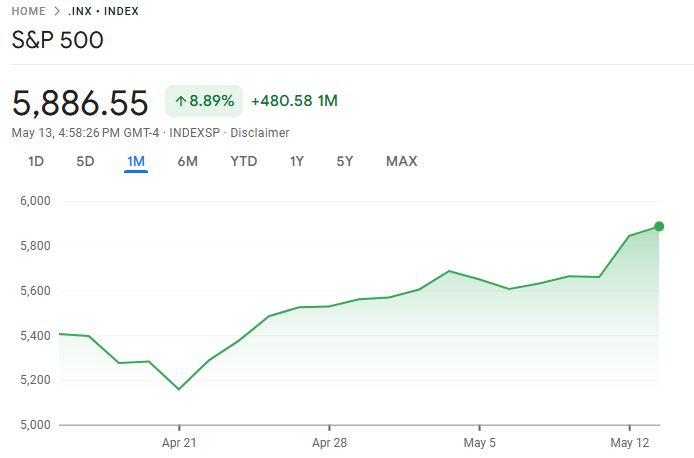

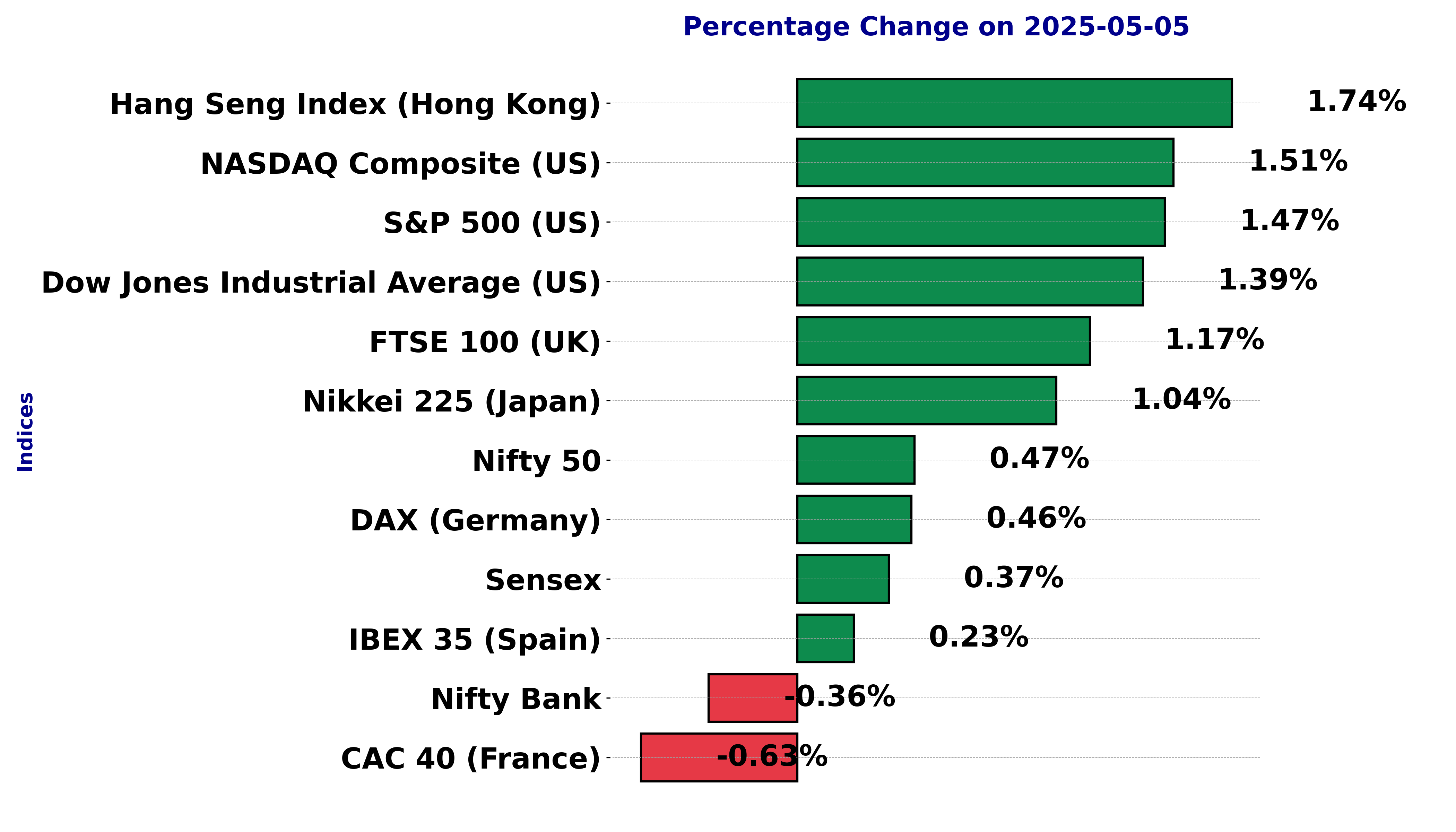

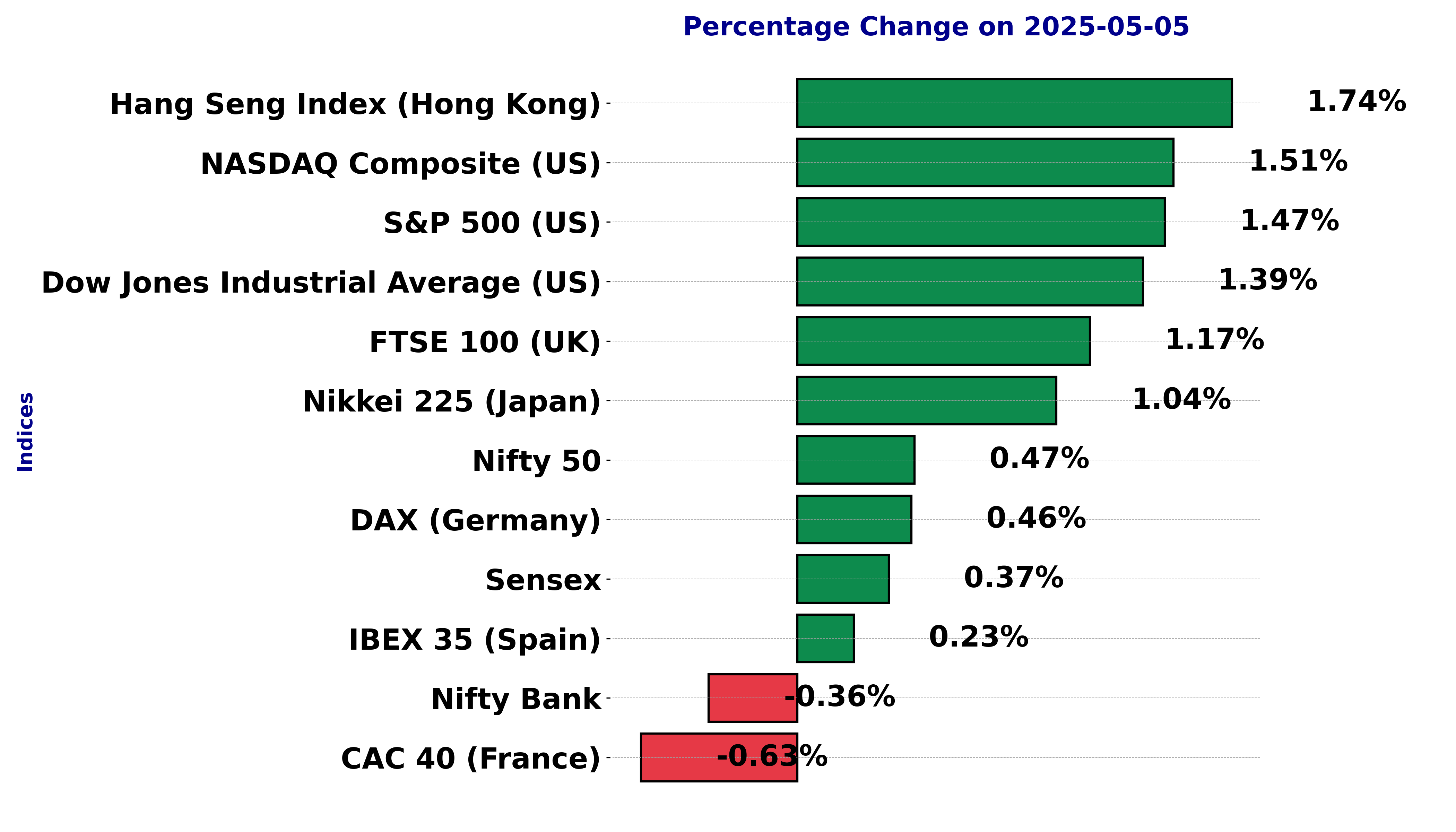

Historical Performance Comparison

Over time, both indices have delivered positive returns, but their performance varies depending on market conditions.

During bull markets, the Completion Index often outperforms due to the high growth rates of smaller companies.

The S&P 500 performs better during bear markets due to its large-cap, stable constituents.

During years of strong economic growth and high investor confidence, small-cap stocks often outperform the market, making the Completion Index stand out. Conversely, in times of uncertainty or recession, investors prefer blue-chip stocks, making the S&P 500 a safer investment option.

This performance divergence highlights the benefit of combining both indices in a diversified portfolio.

Which Is Better for You?

Deciding between investing in the S&P 500 and the Dow Jones Completion Index depends on your investment goals, risk tolerance, and time horizon.

Choose the S&P 500 if:

You want low volatility and exposure to well-established companies

You're looking for a core holding in your portfolio

You prefer steady growth with fewer price swings

Choose the Dow Jones Completion Index if:

You seek diversification beyond large-cap stocks

You're interested in higher growth potential

You're building a total market portfolio alongside the S&P 500

For most investors, a blend of both is the most effective way to capture the entire spectrum of U.S. equities.

Conclusion

In conclusion, the S&P 500 and the Dow Jones Completion Index serve different but complementary roles in a well-rounded investment strategy. The S&P 500 exposes investors to the large-cap, blue-chip companies that drive the U.S. economy, while the Dow Jones Completion Index opens the door to small and mid-cap companies with higher growth potential.

By leveraging the strengths of both indices, you can achieve broad diversification, reduce portfolio concentration risk, and enhance your long-term returns.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.