Gold coins have long captivated both investors and collectors, valued not just for their gold content but for the stories and history they carry. Yet their pricing is far from straightforward.

Unlike standard bullion, gold coins move at the intersection of market fundamentals and collector psychology. While spot prices set the foundation, factors such as rarity, condition, and premiums often push values far beyond intrinsic worth.

This analysis explores the key forces shaping gold coin prices in 2025 from purity and scarcity to broader economic shifts and how these elements interact to define market direction in the months ahead.

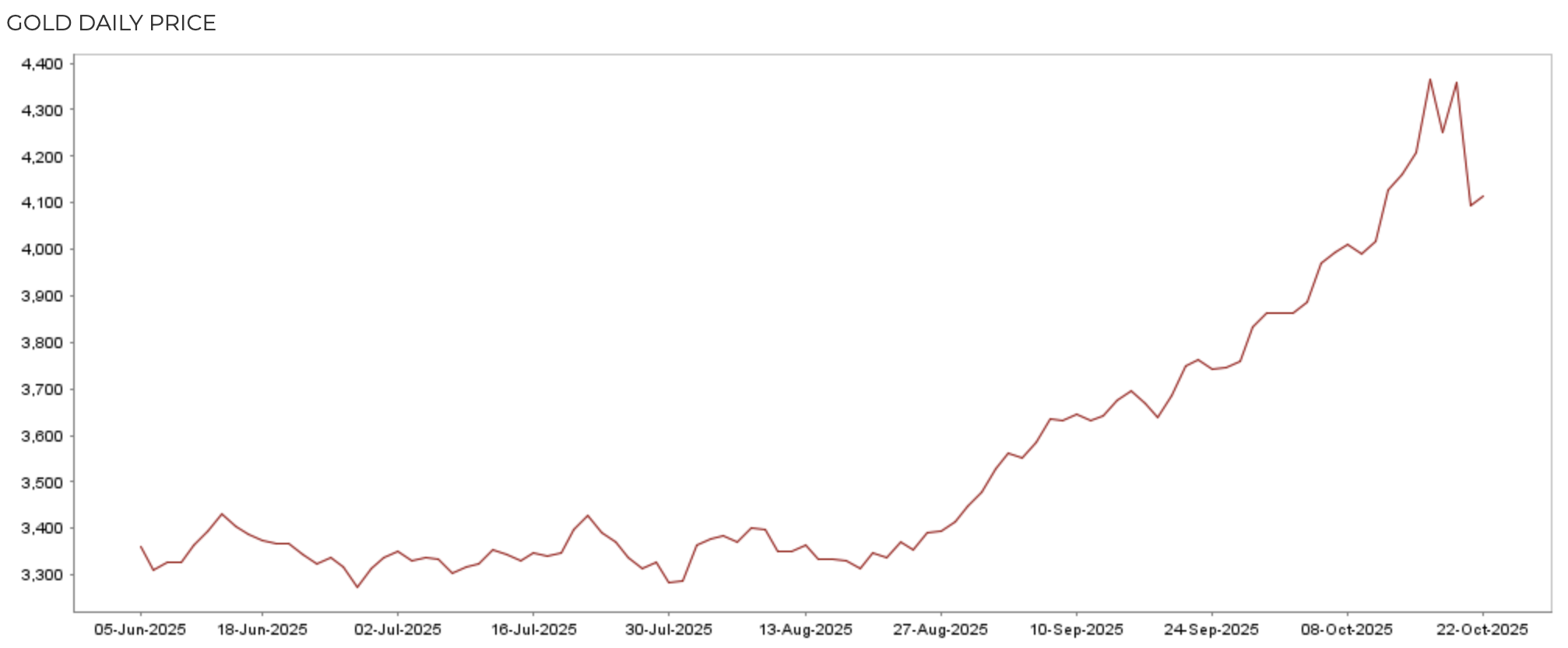

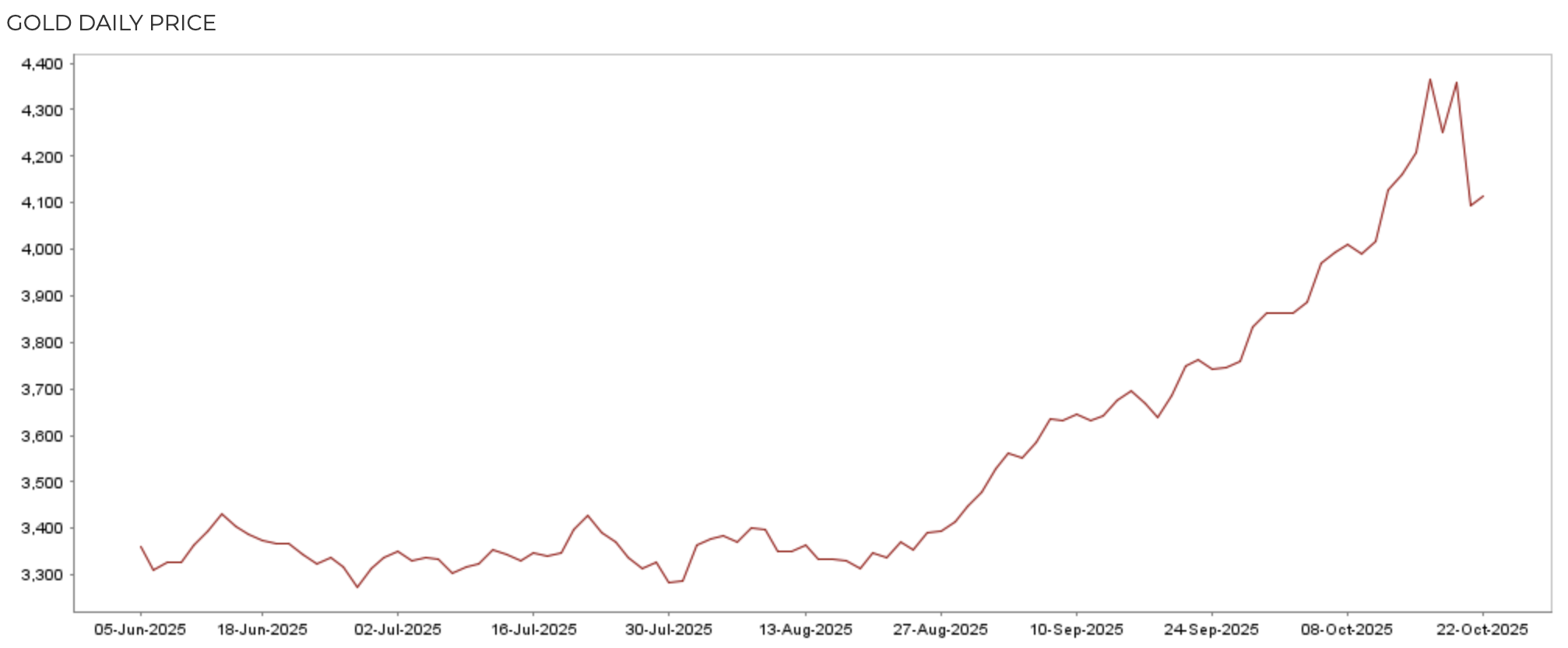

Current Gold Spot Price 2025

Gold prices have surged sharply since mid-2025, climbing from around $3,300 to $4,380 per ounce by October. The rally underscores investors’ flight toward safe-haven assets amid ongoing global economic uncertainty.

The Role of Gold’s Spot Price

A gold coin’s base value tracks the spot price of gold in the immediate delivery market rate.

When the spot price rises, so does the intrinsic value of a coin’s gold content. Spot price is influenced by supply and demand, inflation, currency strength (especially the U.S. dollar), and central-bank activity.

Tip: Before buying or selling, check the latest spot price because it directly impacts coin value.

1. Purity and Gold Content

Not all gold is created equal, just like humans. A 24-karat coin (99.9% pure) will naturally fetch more than a 22-karat equivalent of the same weight. Even a small difference in purity can add up significantly when gold trades above $2,500 an ounce.

Investors should always verify both purity and total gold weight before buying or selling.

2. Rarity and Collectibility

When a coin transcends its bullion status and enters the numismatic arena, its value can decouple from metal price altogether.

Factors such as limited mintage, historic mint marks, minting errors or cultural resonance all contribute to a premium above the gold content.

3. Condition and Grade

The state of preservation, or “grade,” of a gold coin has a significant impact on its price. Well-preserved coins with minimal wear, scratches, or blemishes are far more valuable than those in poor condition.

Professional grading services can assess and certify a coin's condition, which is especially important for high-value or rare pieces.

4. Supply and Demand Dynamics

Coin premiums fluctuate with investor sentiment. During periods of economic uncertainty or inflation, demand spikes and premiums widen.

In 2025, gold prices climbed past US $4,375 an ounce as investors rushed toward safe-haven assets amid tightening physical supply.

However, when mints boost output or more holders sell into the market, those heightened premiums tend to ease.

5. Economic and Geopolitical Factors

Gold is widely seen as a safe-haven asset, which means its price often rises during times of economic or political instability. Events such as recessions, financial crises, wars, or geopolitical tensions can drive investors toward gold, increasing demand for coins and pushing up prices.

In October 2025, record high spot prices were tied to U.S.- China trade tensions and expectations of U.S. rate cuts. That same backdrop lifts demand for physical coins.

6. Premiums and Manufacturing Costs

Every gold coin sells at a premium above the spot price, covering minting, transportation, and dealer costs.

Popular bullion coins such as the Krugerrand or American Gold Eagle tend to have tighter spreads, while limited-edition or historically significant coins often carry much higher premiums.

Smart tip: Always compare dealer pricing, as even a 2–3% difference can make a real impact when gold prices are high.

7. Government Policy and Regulation

Government actions can influence gold coin prices through regulations, taxes, and monetary policy.

Restrictions on gold imports or exports, changes in sales tax, or shifts in central bank reserves can all impact market prices. Investors should stay informed about relevant policies in their country or region.

Quick Summary

Gold coin prices are influenced by purity, rarity, condition, market demand, macroeconomic trends, premiums, and regulatory shifts.

Each factor interacts with gold’s spot price, shaping both intrinsic and collectible value.

Bullion Coins vs Numismatic Coins

Investors must first determine their goal: exposure to gold's commodity price (bullion) or potential appreciation from rarity (numismatics). Though physically alike, these coin types exhibit sharp differences in valuation, liquidity, and risk profile.

| Advantages |

Disadvantages |

| Provides clear continuation signals in established downtrends |

False signals can occur in volatile or range-bound markets |

| Offers defined entry and exit points based on breakout levels |

Requires confirmation through volume or other indicators |

| Useful for timing short-selling opportunities |

Misidentifying consolidation patterns may lead to premature entries |

| Works well across multiple timeframes (intraday to weekly charts) |

Pattern reliability decreases during low-liquidity periods |

| Helps traders align with broader market momentum |

Breakouts may fail if the overall trend weakens or reverses |

Smart Strategies For Trading Gold In 2025

With volatility rising and rate expectations shifting, traders should balance technical entries with macro triggers like inflation data and U.S.–China negotiations.

Track global catalysts. Watch inflation data, Fed policy moves, and geopolitical headlines as these often spark sharp price swings.

Respect volatility. Gold reacts quickly to sentiment shifts; use stop-loss orders and position sizing to manage risk.

Monitor the U.S. dollar. Gold typically moves inversely to the dollar; a weakening greenback often signals bullish momentum.

Time the sessions. The London-New York overlap (6:30 PM–9:30 PM IST) offers the best liquidity and clearer price direction.

Blend spot and ETF exposure. Pairing physical gold or ETFs like GLD with short-term CFD or futures trades can balance stability and leverage.

The best traders treat gold not as a static store of value but as a mirror reflecting global confidence or the lack of it.

Frequently Asked Questions (FAQ)

1.Why do some gold coins sell for much more than their gold content?

Gold coins often sell above melt value due to rarity and collector demand. In 2025, premiums expanded as gold surpassed $4,375 per ounce, driving stronger interest in rare pieces.

2. Can I value my gold coins myself?

Bullion coin values can be estimated using weight × purity × current spot price. For numismatic or graded coins, though, expert appraisal is vital, as minor differences in condition or history can change prices dramatically.

3. Are gold coins a good long-term investment?

Yes, they can serve as a hedge against inflation and market risk. Still, coins generate no yield as they preserve value, not grow it.

Final Thoughts

Gold coin prices in 2025 are being driven by record-high spot levels, limited physical supply, and a surge in investor appetite for hard assets.

Beyond their metal content, factors such as rarity, condition, and collector premiums are widening the gap between bullion and numismatic markets.

With gold trading above $4,375 an ounce and central-bank demand remaining firm, investors are prioritizing well-graded coins, fair premiums, and precise timing to protect value in an uncertain global economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.