For active traders seeking to maximise market opportunities, the choice between trading Contracts for Difference (CFDs) and traditional stocks is crucial. Both instruments offer distinct advantages and risks, and understanding these differences can help traders align their strategies with their goals and risk tolerance.

This article explores the key features of CFD and stock trading, comparing their suitability for active traders.

Understanding CFD vs Stock

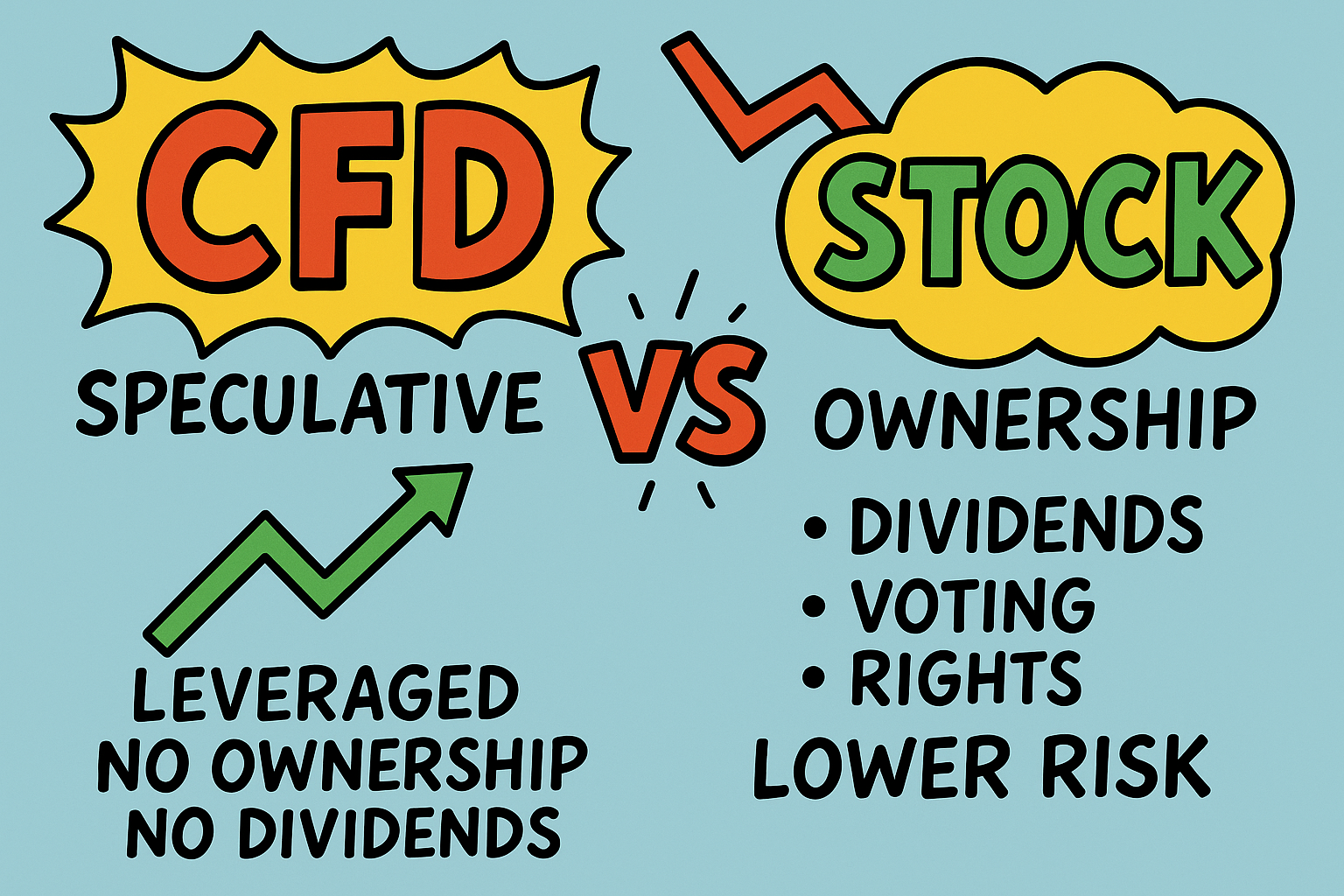

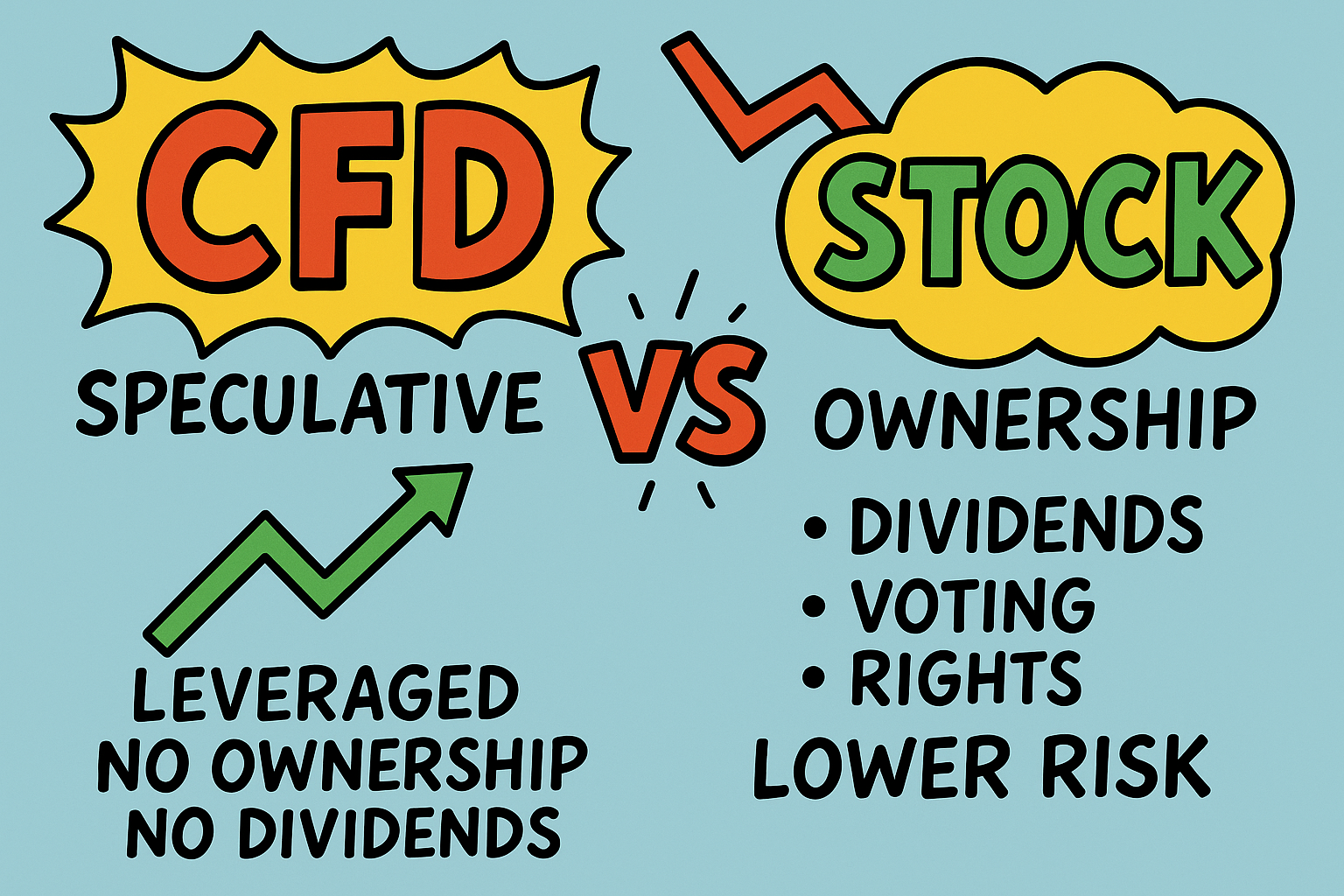

CFDs are derivative instruments that allow traders to speculate on the price movements of underlying assets—such as stocks, indices, commodities, and forex—without owning the assets themselves.

In contrast, stock trading involves purchasing shares and gaining ownership in a company, along with potential dividends and voting rights.

Leverage and Capital Efficiency

A major attraction of CFDs is the use of leverage. With CFDs, traders can control a large position with a relatively small capital outlay, amplifying both potential gains and losses. For example, a trader might only need to deposit 20% of the total trade value, magnifying returns if the market moves favourably. However, leverage also increases risk, and losses can exceed initial deposits if not managed carefully.

Stock trading typically requires the full value of the shares upfront, with no leverage in most cases. This means lower risk of account wipe-out, but also lower return potential relative to capital invested.

Market Access and Flexibility

CFDs provide access to a wide range of markets, including stocks, commodities, indices, and forex, all from a single trading platform. This flexibility allows active traders to diversify and switch between asset classes quickly in response to market conditions.

Stocks, on the other hand, are limited to the specific companies listed on stock exchanges. While this can mean less flexibility, it also offers the stability of regulated markets and the benefits of ownership, such as dividends and voting rights.

Short Selling and Trading Direction

CFDs are particularly useful for traders who wish to profit from both rising and falling markets. Short selling is straightforward with CFDs, as traders can easily open positions to benefit from price declines without borrowing shares or facing other restrictions.

Stock trading allows for short selling, but the process is more complex and often involves borrowing shares, which can incur additional costs and regulatory hurdles. For active traders who frequently seek to capitalise on short-term price movements in either direction, CFDs offer a clear advantage.

Costs and Fees

Cost structures differ significantly between CFDs and stocks. cfd trading typically incurs spread costs, commissions, and overnight financing fees for leveraged positions held beyond the trading day. These costs can add up, especially for longer-term trades, and must be factored into profitability calculations.

Stock trading usually involves brokerage commissions and, in the UK, stamp duty on purchases. However, there are no overnight financing charges, making stocks more cost-effective for long-term holding. For active traders who open and close positions frequently, the lower commissions and absence of stamp duty in CFD trading can be appealing, but overnight fees may erode profits if positions are held too long.

Risk Profile

CFDs are inherently riskier due to leverage. Losses can be magnified, and traders may face margin calls if the market moves against them. According to regulatory data, a significant proportion of retail CFD traders lose money, often due to the amplified effects of leverage and market volatility.

Stocks, while also subject to market risk, do not expose traders to margin calls (unless trading on margin) or overnight financing costs. The risk is generally limited to the amount invested in the shares, and the value of the investment can recover over time if the company performs well.

Ownership and Dividends

When you buy stocks, you own a piece of the company and may receive dividends and voting rights. This can be attractive for investors seeking long-term growth and passive income.

CFDs do not confer ownership or voting rights, and while some brokers adjust for dividends, you do not receive them directly. CFDs are designed for speculation rather than investment.

Regulation and Market Hours

Stocks are traded on regulated exchanges, providing transparency and investor protection. CFD trading is conducted over-the-counter (OTC) with brokers, which can offer extended trading hours and access to global markets, but may involve different regulatory standards.

Which Is Better for Active Traders?

The choice depends on your trading style, objectives, and risk appetite:

-

CFDs are better suited to active traders seeking short-term opportunities, leverage, and the ability to trade in both directions across multiple markets. However, the risks are higher, and effective risk management is essential.

Stocks are preferable for those who value ownership, lower risk, dividends, and a longer-term approach. While less flexible, they offer stability and lower ongoing costs for holding positions.

Conclusion

In conclusion, active traders who thrive on market volatility and are comfortable managing leverage may find CFDs more appealing. Those who prefer a more measured approach with the benefits of ownership may opt for traditional stock trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.