In trading, stop-loss is crucial. A well-placed stop-loss ensures the longevity of your trades and minimises losses during one-sided market moves. Apart from market stop-losses, MT4 offers two types of pending stop orders and a trailing stop.

1. Market Stop-Loss

A market stop-loss closes your position immediately at the current price. Simply locate your order, right-click, and select "Close Order" to exit the trade.

Market stop-loss requires instant decision-making and execution, making it suitable for sudden, sharp reversals.

2. Pending Stop-Loss – Two Types

Sometimes, the market moves slowly against your position. In such cases, you can set a predetermined stop-loss price, known as a pending stop-loss.

MT4 provides two types:

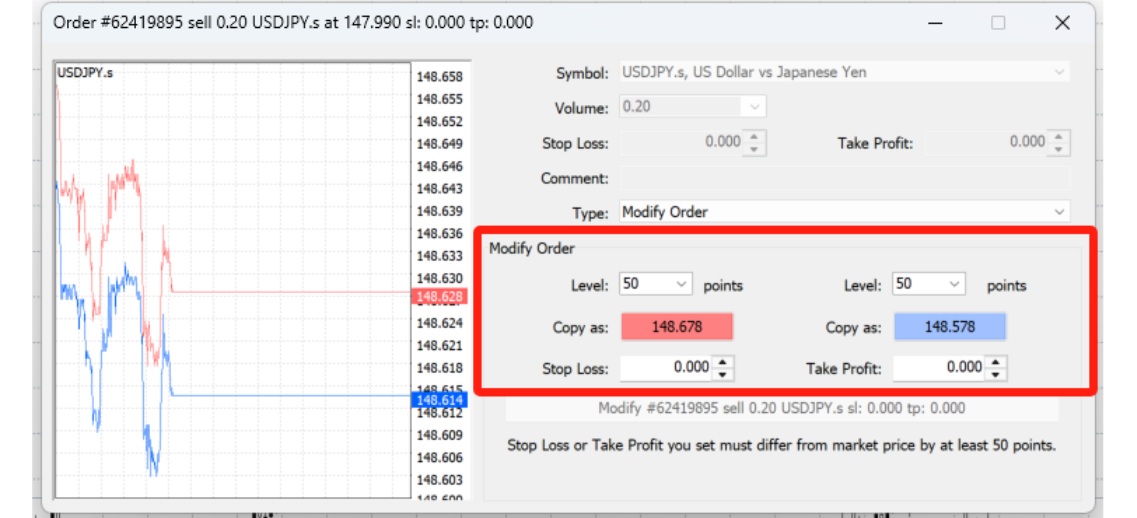

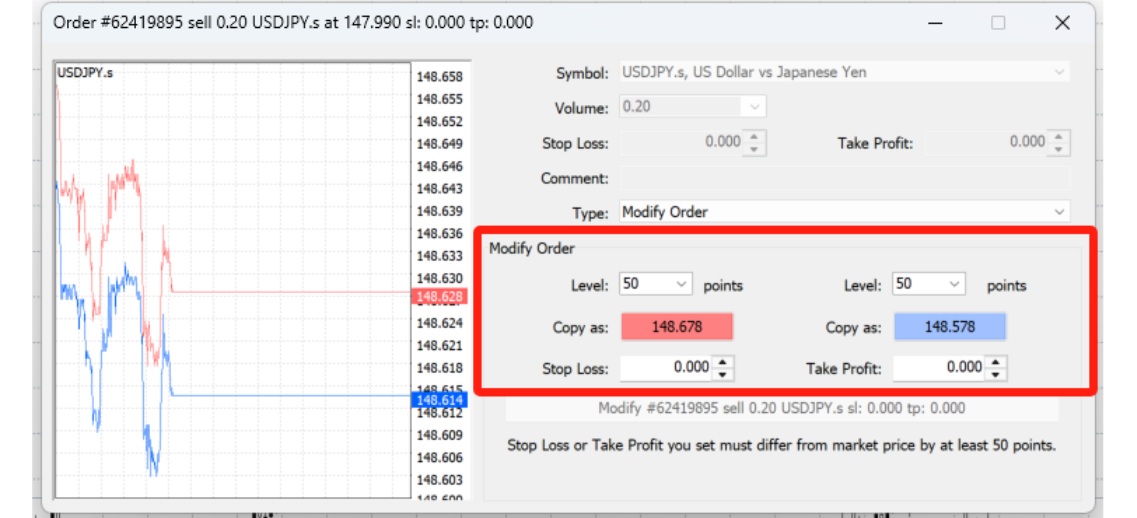

Fixed Stop-Loss: Automatically closes the trade once the maximum loss is reached (e.g., 50 points).

Fixed Take-Profit: Automatically closes the trade once the target profit is reached (e.g., 50 points).

For example, if I short gold at $3.500 and set a stop-loss at $3.520. I can hold the position while the price fluctuates between $3.500 and $3.515. Later, if gold rises overnight, my order will automatically close at $3.520. limiting further losses.

There are two ways to set a stop-loss:

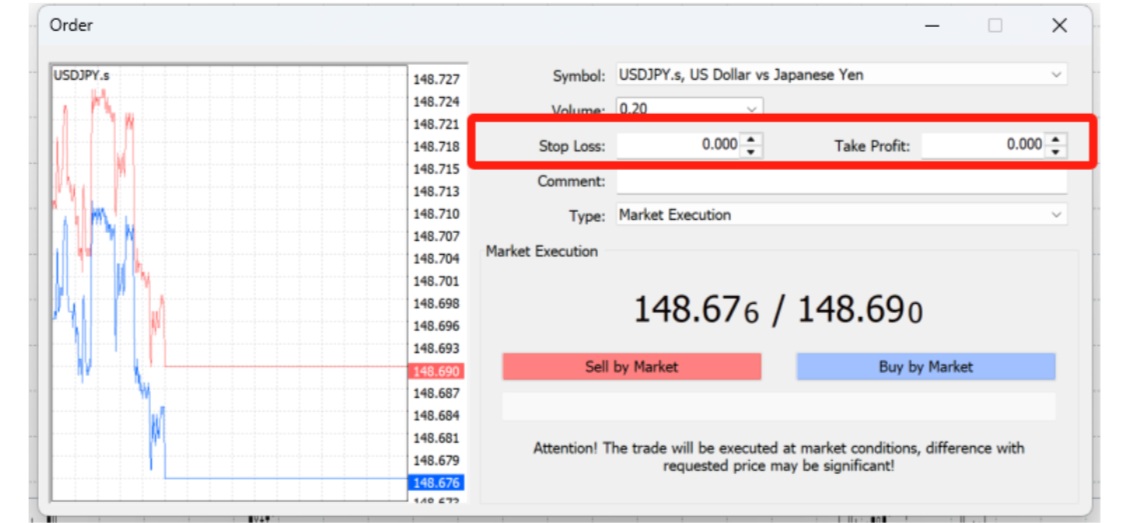

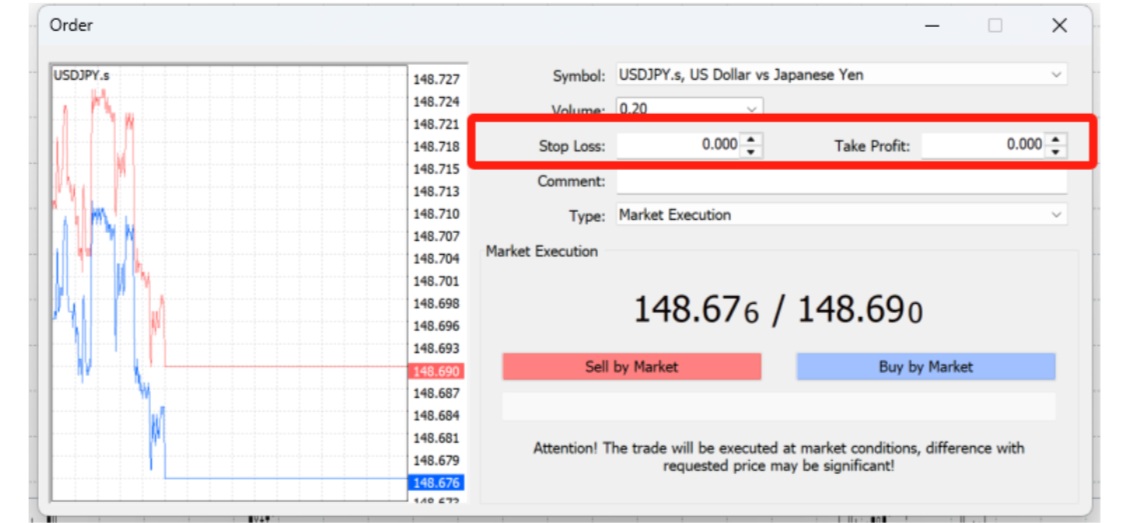

1) Set it in advance when placing the order.

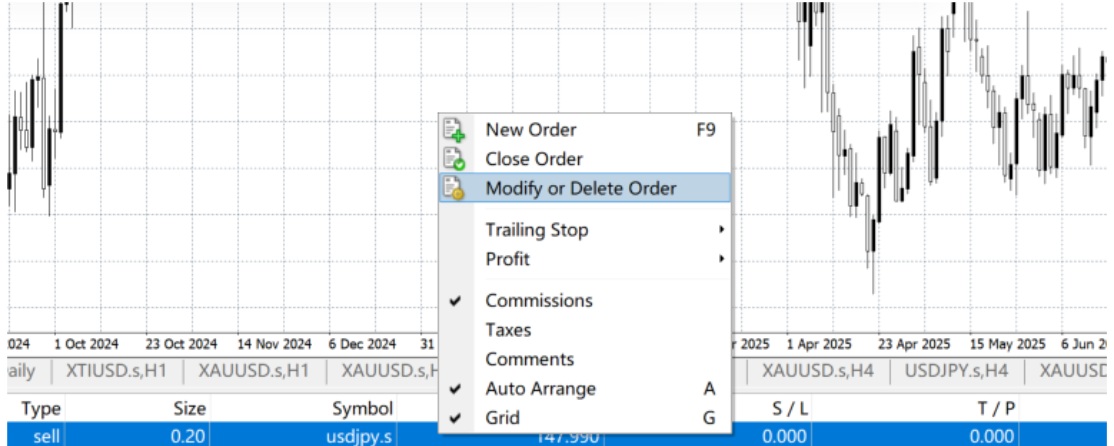

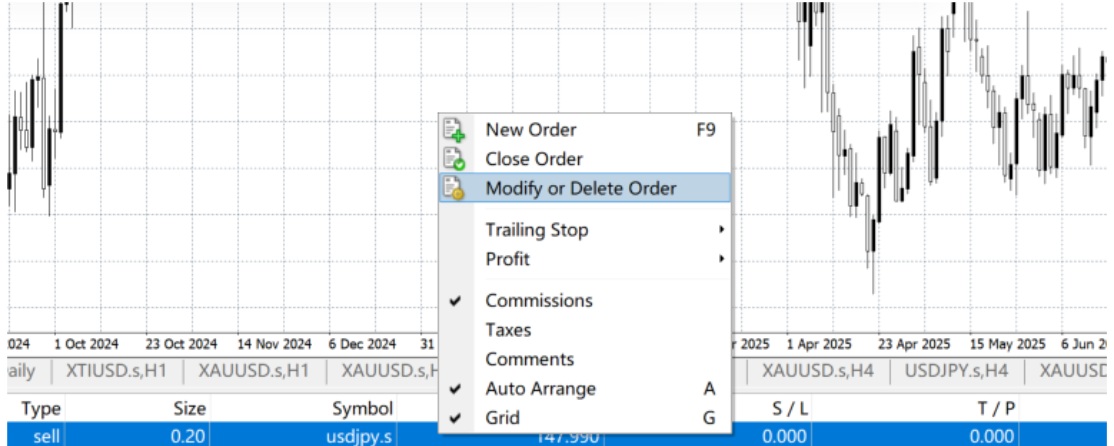

2) Right-click your order during the trade and select "Modify or Delete Order" to adjust stop-loss or take-profit.

You can also set or modify stop-loss and take-profit levels.

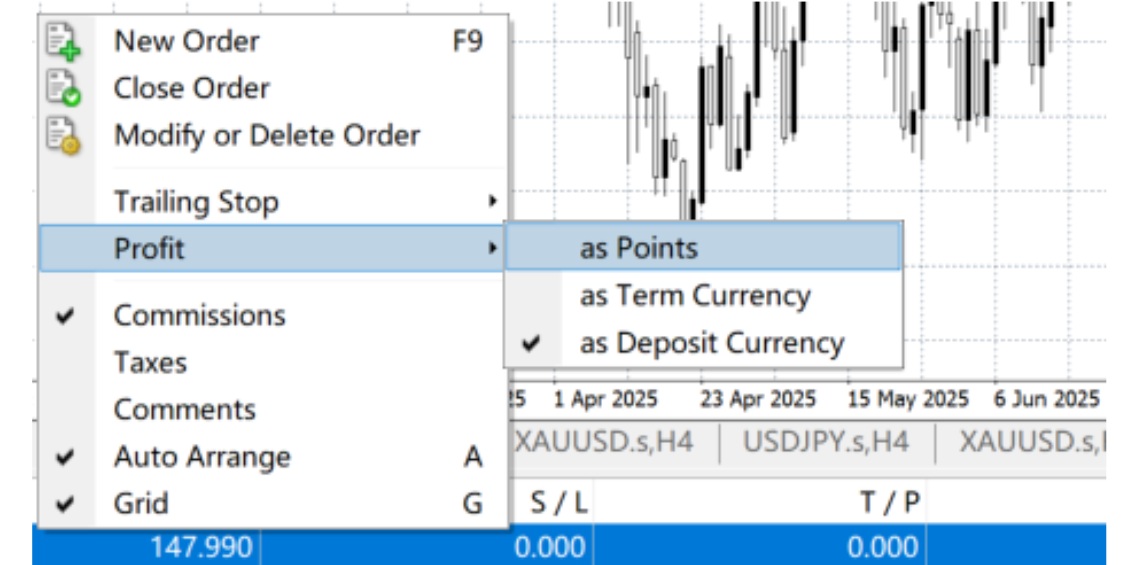

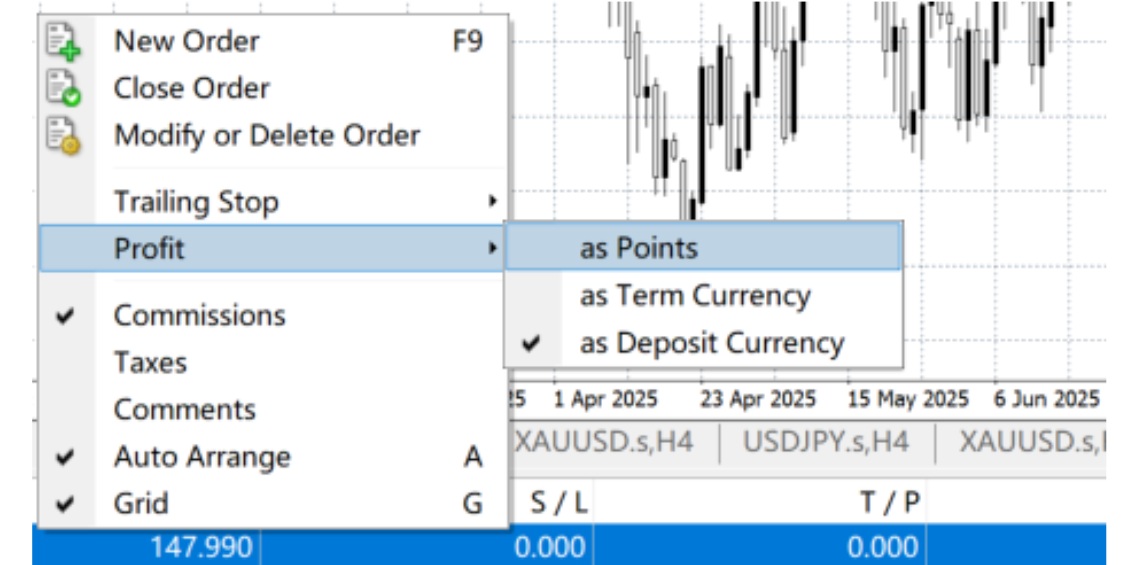

In the order modification screen, you can also choose how to display profit:

In points: Shows the number of points gained.

In monetary value: Displays the current value of the order.

In account currency: The standard display of floating profit or loss.

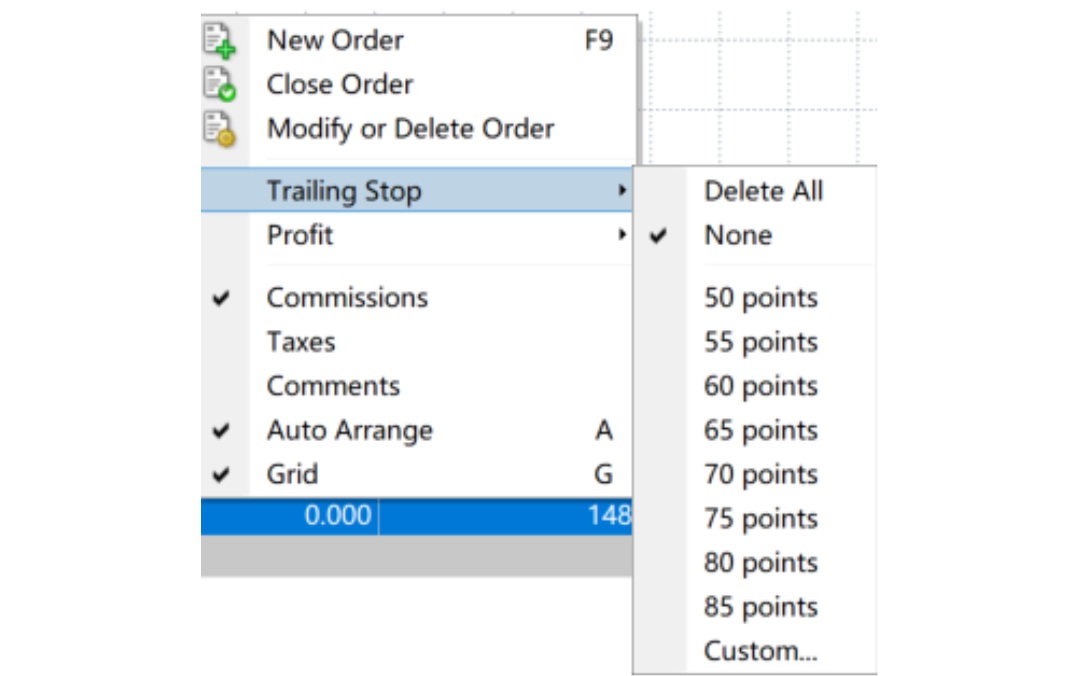

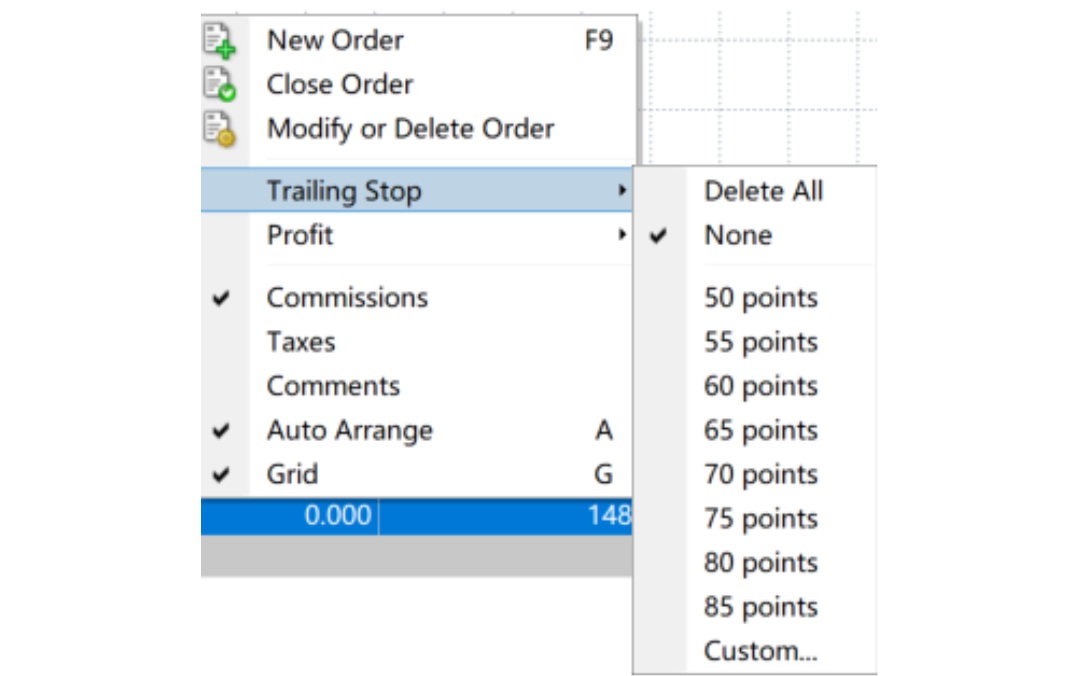

3. Trailing Stop

A trailing stop is an advanced type of stop-loss in MT4. It automatically adjusts the stop-loss as the price moves in your favour.

For example, if XAU/USD is at $3.500 and you set a trailing stop 20 points below at $3.480. and the price rises to $3.600. the stop-loss will move up to $3.580. maintaining a 20-point gap from the current price.

A trailing stop allows traders to lock in profits while leaving room for further gains, making it a highly useful tool.

In short, mastering stop-loss is the first step to establishing a solid footing in the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.