Advanced Micro Devices (AMD) has been one of the most talked-about tech stocks in recent years, riding the wave of artificial intelligence (AI) optimism and strong demand for high-performance computing. However, its latest earnings report and subsequent stock movement have brought fresh scrutiny to its long-term prospects. The AMD stock price fell more than 6% in after-hours trading following the release of its Q2 2025 results—underscoring the market's sensitivity to AI growth figures and uncertainties surrounding its business in China.

AMD's Q2 Performance: Revenue Rises, But AI Momentum Stalls

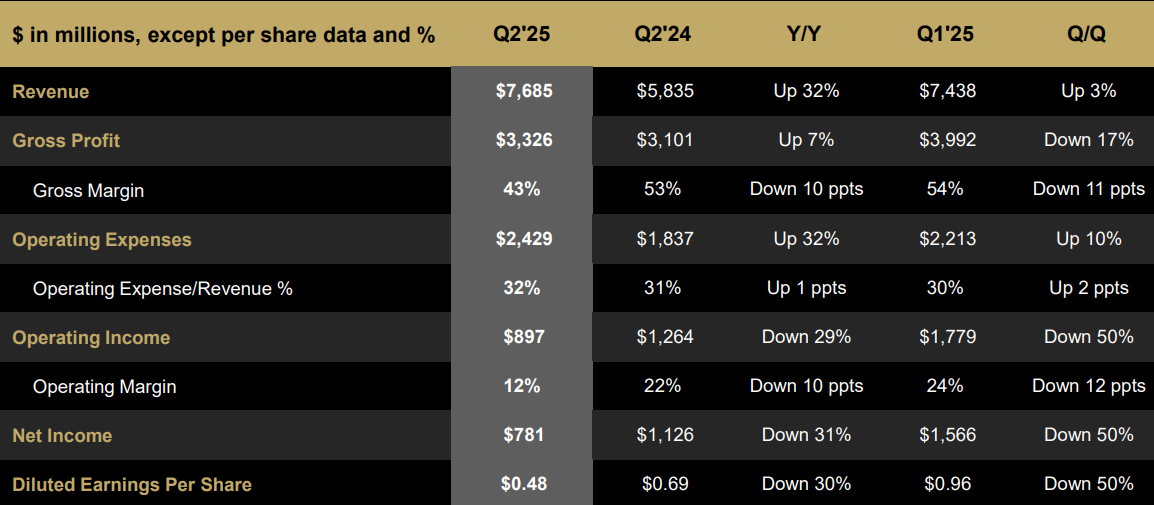

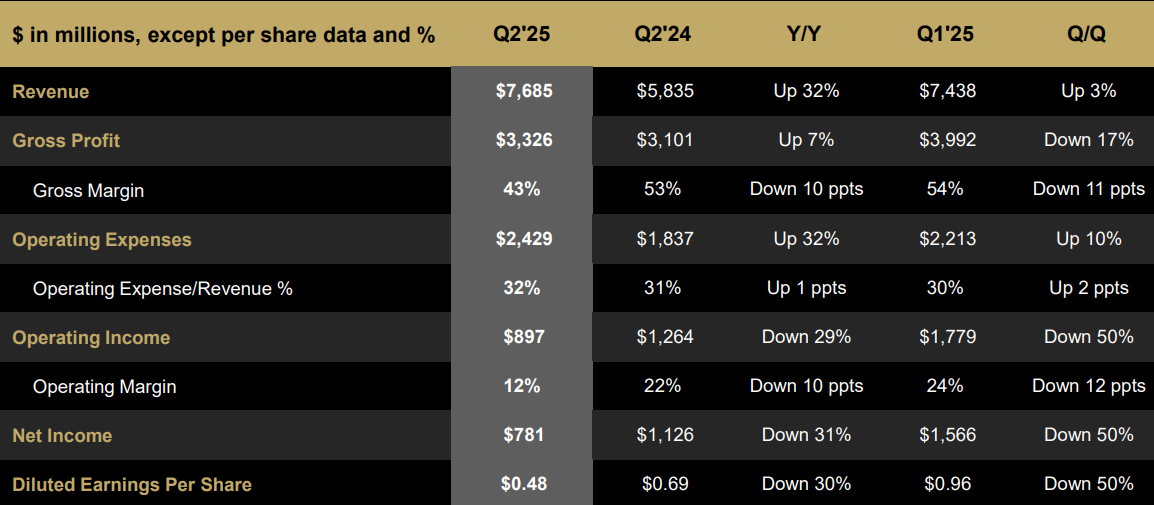

On 5 August 2025. AMD reported its second-quarter financial results, posting $7.7 billion in revenue, a 32% year-on-year increase. Non-GAAP earnings per share came in at $0.48. reflecting a 30% decline compared to the same period last year.

The company's data centre segment—a key growth area driven by AI—generated $3.2 billion in revenue, up 14% year-over-year. However, this represented a significant slowdown compared to the previous quarter's 57% growth, largely attributed to restrictions on exports of AMD's MI308 AI accelerators to China.

This sudden deceleration has caused concern among analysts and investors. Despite AMD's impressive year-to-date stock performance—up 43% in 2025. outpacing Nvidia's 29%—its AI revenue growth still lags behind Nvidia, casting doubt on its ability to challenge the market leader in the AI chip space.

Market Reacts: Stock Price Under Pressure

Following the earnings release, AMD's stock price slid 6.3% in after-hours trading, falling to $163.28 per share at the time of writing. This decline reflects investor anxiety around the slower-than-expected AI momentum and ongoing geopolitical challenges affecting sales in China.

Dan Morgan, portfolio manager at Synovus Trust, noted:

"The relatively flat data centre revenue is enough to trigger concern. A large portion of AMD's valuation hinges on the success of its data centre business."

China Market Uncertainty Looms Large

The situation in China adds another layer of complexity. AMD has declined to forecast any revenue from MI308 chip sales to China for Q3. citing regulatory uncertainty. CEO Dr Lisa Su stated:

"Since our licence is still under review, we are not including any MI308 revenue from China in our third-quarter outlook."

China remains a critical market for AI hardware, and AMD's ability to regain access will significantly influence its performance in the coming quarters. While the company maintains a strong global footprint—ranking as the second-largest GPU manufacturer behind Nvidia—its dependency on regulatory clearance highlights the geopolitical risks baked into its valuation.

The Road Ahead: Can AMD Regain Momentum?

Looking forward, AMD has issued an optimistic revenue forecast of around $8.7 billion for Q3. beating analyst expectations. This suggests resilience in other business areas and growing interest from major AI players such as Meta and OpenAI, who are reportedly exploring AMD chips as alternatives to Nvidia's dominant offerings.

However, the AMD stock price will likely remain volatile as investors weigh its ability to accelerate AI growth, navigate export restrictions, and capitalise on demand from global hyperscalers.

Conclusion: A Pivotal Moment for AMD

The latest earnings report has placed AMD stock price under the microscope. While the company shows strength in topline growth and continues to gain favour among major tech clients, slower AI acceleration and China-related uncertainties are significant headwinds. The coming quarters will be crucial in determining whether AMD can solidify its role as a serious AI contender—or remain in Nvidia's shadow. For now, investors must balance short-term volatility with AMD's long-term potential in one of the most transformative sectors of modern computing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.