Key Takeaways

Shifts in rate expectations are the single most influential driver of short-to-medium-term currency direction.

Central-bank credibility can mute the negative currency effects of transitory inflation.

Growing deficits and external financing needs are a multi-year drag on currency strength.

Have contingency hedges for sudden risk-off moves (safe-haven jumps, liquidity squeezes).

Structural demand can offset cyclical weakness; strategic shifts in global reserve holdings are gradual but consequential.

What Makes a Currency Strong or Weak

A currency's strength flows from monetary policy, inflation control, fiscal and trade fundamentals, political stability, and market perception. It can be reshaped quickly by global shocks or shifts in reserve status.

A strong currency usually reflects confidence in a nation's economy, fiscal stability, and international standing, whereas a weak currency can signal inflationary pressures, economic instability, or political uncertainty.

The remainder of this article explains each determinant in turn, illustrates how they operate in practice with recent October 2025 market examples, and provides practical takeaways for investors and policy-makers.

Influence of Central Bank Policies on Currency Valuation

Central banks are the primary architects of exchange-rate behaviour.

Their toolkit, including interest-rate settings, balance-sheet operations, and occasional direct FX intervention, alters capital flows and expectations.

1. Interest-rate differentials and capital flows

When a central bank maintains relatively higher real interest rates, foreign investors can obtain better returns on deposits, bonds and other carry trades denominated in that currency.

The result is increased capital inflows and appreciation pressure.

Conversely, expected rate cuts or an easing bias tends to reduce foreign demand and may lead to depreciation.

2. Monetary expansion versus contraction

Expansionary policies (quantitative easing, large bond purchases) increase domestic liquidity and can weaken a currency if investors see higher inflation risk or lower real returns.

Tightening (rate hikes, balance-sheet reduction) can strengthen the currency by reducing supply and increasing the return on assets denominated in that currency.

3. Direct FX intervention

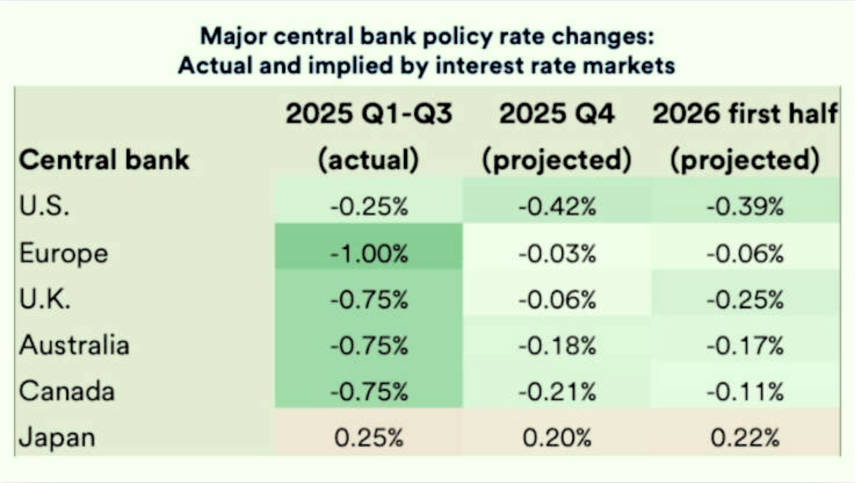

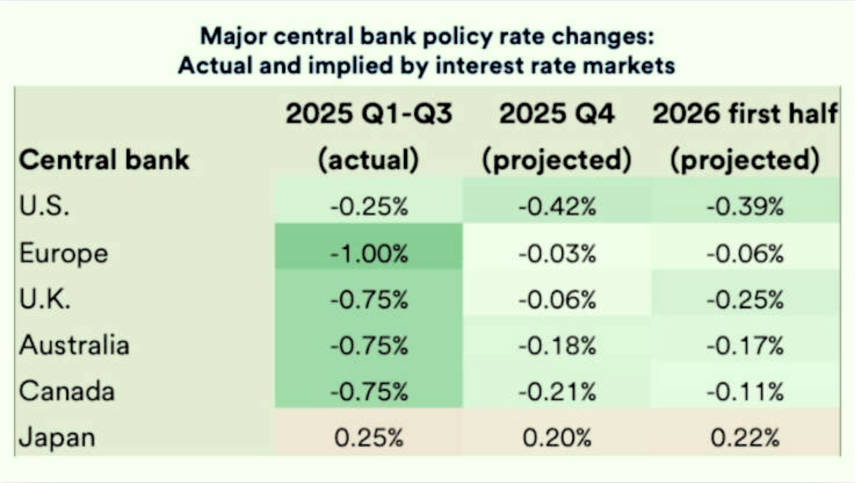

Practical example (October 2025):

Markets have been reassessing the US Federal Reserve's policy path, and that reassessment has contributed to a modest DXY rebound in mid-October 2025.

That dynamic illustrates how shifts in perceived central-bank direction can translate rapidly into currency moves.

Inflation Dynamics and Purchasing Power Effects

Inflation is a direct measure of how a currency's purchasing power changes over time; it therefore anchors medium- to long-term currency valuation.

Domestic inflation:

Sustained high inflation erodes purchasing power and usually leads to depreciation unless offset by significantly higher nominal interest rates.

Inflation differentials:

If Country A has lower inflation than Country B, Country A's currency tends to appreciate in real terms (purchasing power parity logic), all else equal.

Policy credibility:

Central banks that credibly anchor inflation expectations help stabilise and often strengthen their currencies.

Example note:

The market reaction to inflation prints and inflation expectations continues to be a live driver of FX volatility in 2025: central-bank credibility remains one of the most important long-run determinants of exchange-rate stability.

Economic Performance and Fiscal Stability

Exchange rates reflect relative economic fundamentals. Investors price a combination of growth prospects, fiscal durability and structural competitiveness into currencies.

1. GDP growth and structural momentum

Strong growth attracts foreign direct investment (FDI) and portfolio flows; these raise demand for the domestic currency.

Structural advantages (productivity, technology exports) produce sustained external demand and currency support.

2. Government debt and deficits

Elevated debt-to-GDP ratios or persistent deficits can undermine confidence, raising risk premia on sovereign assets and pressuring the currency.

The market closely monitors whether fiscal deficits are financed through domestic saving or external borrowing.

The latter is usually more negative for the currency.

External Trade Position and Current Account Implications

Trade flows are the engine of currency demand. The current account captures net exports, income flows and transfers; persistent imbalances map to FX pressure.

Trade surpluses generate foreign demand for the domestic currency, as exporters convert their receipts, supporting appreciation.

Trade deficits must be covered by capital inflows or reserve drawdowns; chronic deficits often coincide with currency depreciation.

Commodity dependence also plays a role. Resource exporters' currencies often display higher volatility because commodity price swings directly affect national receipts and FX demand.

Recent observation (Oct 2025):

Commodity currencies in some regions stabilised in October as global sentiment improved, while economies with persistent deficits (or perceived structural trade weaknesses) saw greater exchange-rate pressure.

Political Governance, Stability, and Geopolitical Risk

Investor confidence depends on predictable institutions and credible policy frameworks.

Political stability sells:

Countries with transparent policy frameworks, independent judicial and monetary institutions, and predictable policy cycles attract capital and preserve currency strength.

Geopolitical shocks:

Wars, sanctions, or abrupt regulatory changes rapidly reduce cross-border capital flows and can trigger steep depreciation.

Policy predictability:

Well-communicated fiscal and monetary plans reduce uncertainty premiums attached to the currency.

Case in point (Oct 2025):

Sterling came under pressure in mid-October amid concerns about the UK's economic growth, fiscal outlook, and political uncertainty. This episode highlighted how political and policy ambiguity can materially affect FX valuations.

Market Perception, Speculation and Investor Behaviour

FX is the largest, most liquid financial market; short-term price moves are often dominated by flows driven by sentiment and risk appetite.

1. Speculative leverage:

2. Hedging behaviour:

3. Sentiment indicators:

Illustration (Oct 2025):

In mid-October, safe-haven flows into the Japanese yen and spikes in gold prices reflected a temporary rise in investor risk aversion, a classic example of sentiment overriding fundamentals in the short term.

Global Economic Shocks and External Factors

External shocks are the wildcards that can abruptly reshape currency hierarchies.

Pandemics or natural disasters can disrupt production and trade, weakening the affected currencies.

Financial stress events such as credit or banking crises in one region may trigger global repricing and safe-haven flows.

Multilateral policy action, including coordinated central-bank or fiscal responses, can stabilise markets but may also influence medium-term dynamics.

Recent example:

Late-October market episodes (mid-October turbulence) showed how regional banking concerns and global risk repricing led to fast switches in FX positioning and asset prices. That episode underscores how quickly FX leadership can change when risk factors surface.

Reserve Currency Status and International Demand

Reserve status creates structural demand and buffers a currency from some cyclical pressures.

Global usage:

A currency widely used for invoicing, trade settlements and reserves enjoys persistent external demand.

Reserve accumulation:

Central-bank reserve buying supports long-term demand and reduces volatility.

Strategic trends:

Long-term moves, such as dedollarisation efforts, can gradually shift the relative strength of major currencies, but change is typically slow.

Context:

The U.S. dollar's role as the principal global reserve currency continues to underpin its medium-term strength, even amid cyclical dips.

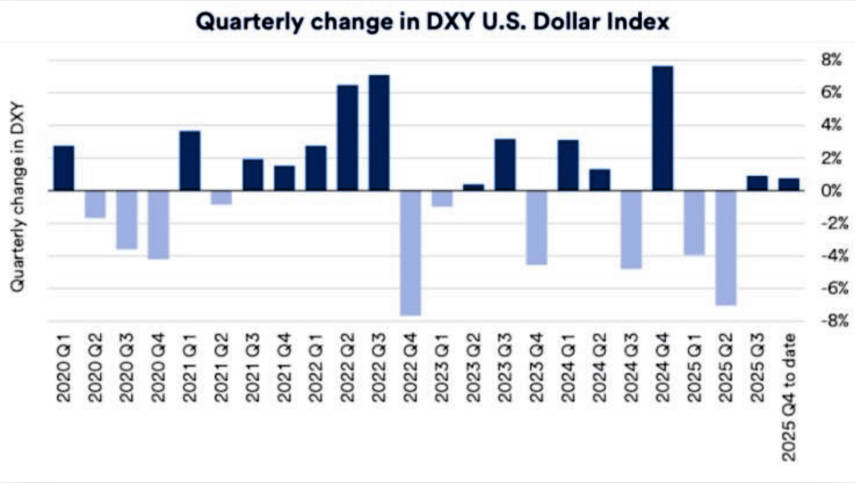

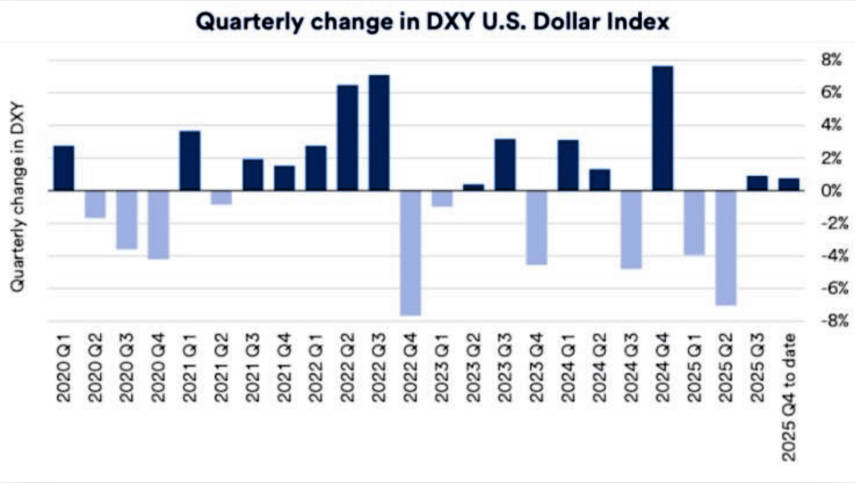

Market commentary in October 2025 noted a range-bound DXY as the market balanced Fed outlook, growth data and safe-haven demand.

Recent Market Snapshot and Visual Context

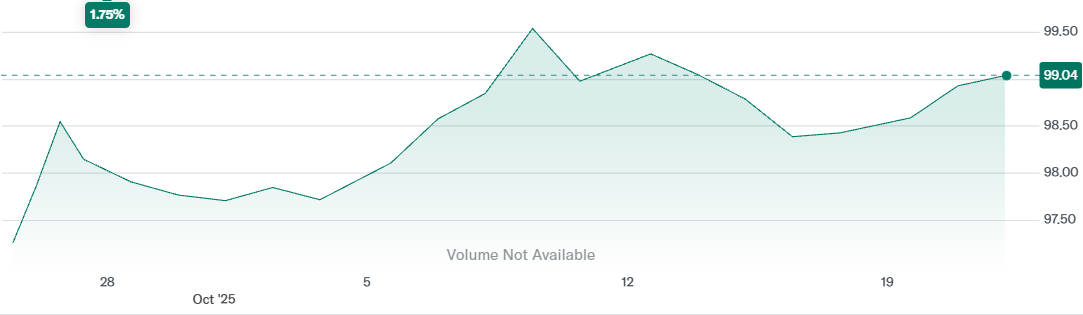

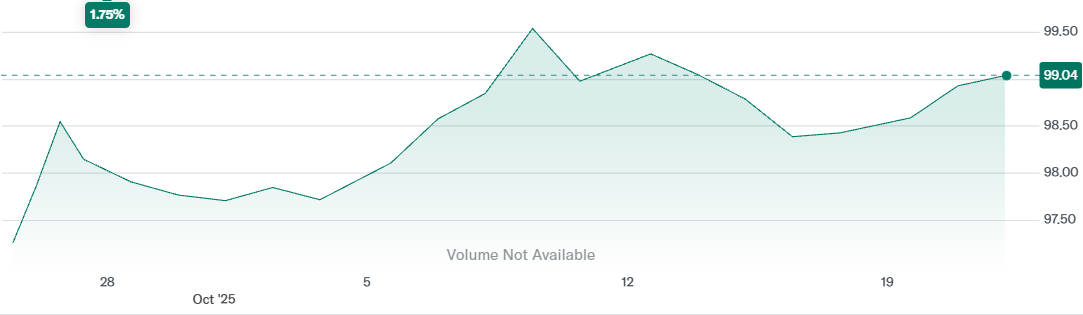

U.S. Dollar Index (DXY)

Selected closing values for October 2025 and highlights a modest rebound from early-month lows.

This reflects market reassessment of rate expectations and risk flows.

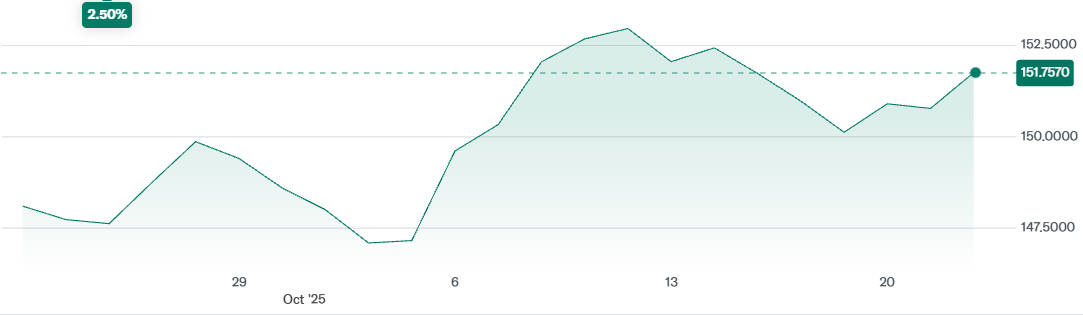

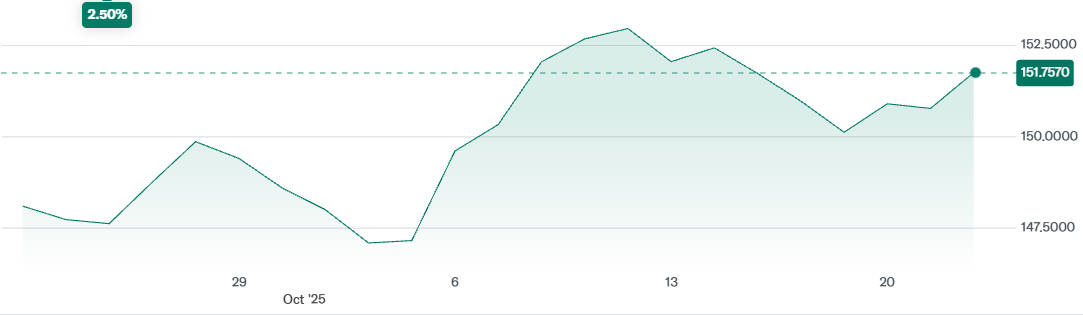

USD/JPY exchange rate:

Selected October snapshots showing the yen's relative strength during mid-October safe-haven bids, consistent with market commentary on safe-haven flows and domestic Japanese developments.

Key Determinants of Currency Strength or Weakness

| Factor |

Effect on Currency Strength |

Representative Example (2025) |

Example (Oct 2025) |

| Monetary Policy |

Interest rate decisions, liquidity control, FX interventions |

Tightening (higher rates, reduced liquidity) strengthens; easing weakens |

DXY rose on Fed outlook shift |

| Inflation |

Relative price stability and purchasing power |

Low/stable inflation supports; high inflation erodes value |

USD steady with controlled inflation |

| Economic & Fiscal Health |

GDP performance, debt sustainability, productivity |

Strong growth and low debt strengthen; weak growth and high deficits weaken |

GBP fell amid UK growth worries |

| Trade Balance |

Net export performance and foreign demand |

Surpluses appreciate currency; persistent deficits depress it |

Commodity FX stabilised as trade improved |

| Political Stability |

Governance quality, policy predictability |

Stability attracts capital; uncertainty triggers outflows |

GBP pressured by political uncertainty |

| Market Sentiment |

Investor confidence, risk appetite, hedge fund flows |

Risk-on supports higher-yield currencies; risk-off supports safe havens |

JPY gained on safe-haven demand |

| External Shocks |

Global crises, wars, natural disasters |

Shocks often cause depreciation or volatility spikes |

Risk repricing hit FX mid-Oct |

| Reserve Demand |

International use and central-bank reserves |

Reserve status sustains demand and buffers volatility |

USD upheld by reserve status |

Conclusion

Currencies are the price of money relative to other monies, and that price is set by a layered interaction of policy, fundamentals and market psychology.

The examples from October 2025 show precisely how these forces operate together: central-bank expectations, safe-haven flows, trade and fiscal considerations all contributed to observable moves in DXY, USD/JPY and GBP.

Armed with a systematic framework and the ability to read both data and sentiment, investors and policy-makers can navigate FX risk more effectively.

Frequently Asked Questions

Q1: How quickly can a central-bank decision move a currency?

Often within minutes to hours for high-liquidity pairs; markets price even guidance and speeches. Larger, policy-level decisions have multi-day and multi-month effects.

Q2: Can a country fix its currency level permanently?

Maintaining a fixed peg is technically possible but costly: it requires large reserves or capital controls. Over time, fundamental imbalances tend to reassert themselves unless underlying economic conditions change.

Q3: Are reserve currencies immune to depreciation?

No — they can depreciate; reserve status moderates but does not eliminate cyclical or structural weakness.

Q4: Should corporates hedge FX exposure in the current environment?

If exposures are material, yes. Hedging strategies should match the company's cash-flow horizon and risk tolerance.

Q5: Which indicators are most useful for anticipating currency moves?

A combination of (i) central-bank communications, (ii) inflation and employment data, (iii) trade and current-account balances, and (iv) risk-sentiment indicators (volatility indexes, credit spreads).

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.