The UK’s Autumn Budget 2025 has landed at a moment when global financial markets are finely attuned to fiscal credibility and macroeconomic discipline.

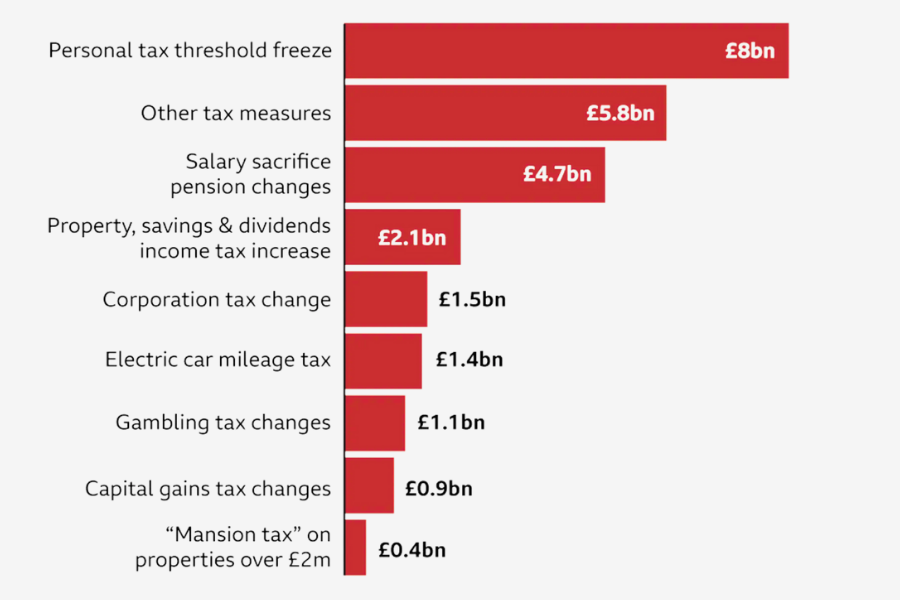

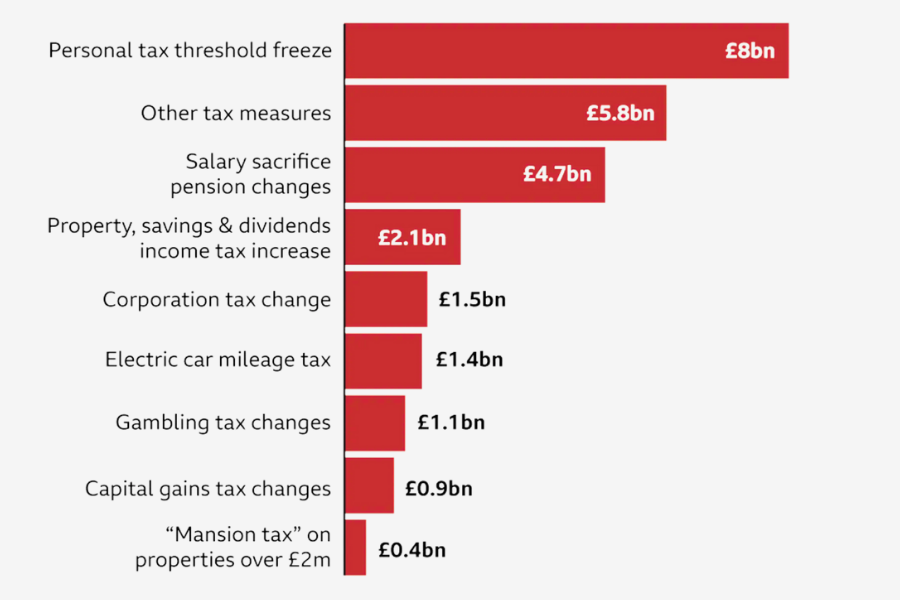

After months of speculation and shifting political signals, the announcement of £26bn in tax increases, spread across businesses, households, and specific high-income brackets, has delivered both clarity and contention.

This article examines how markets have reacted, what the measures mean for UK assets, and how investors should interpret the government’s attempt to steady public finances without derailing economic momentum.

Market Reaction: Stability Over Shock

The initial market reaction was characterised by reassurance rather than turbulence. UK equities showed measured movements, avoiding the kind of volatility spikes that historically accompany large fiscal adjustments.

The broader FTSE complex traded within normal ranges, with cyclical sectors slightly softer but defensive stocks experiencing modest support.

Gilts were the clearer barometer of investor sentiment. Yields edged slightly higher at the long end, reflecting increased issuance expectations, but overall market positioning suggested confidence that the Budget represented a disciplined approach rather than a dramatic expansion of borrowing.

This was particularly relevant in the wake of global concerns about sovereign debt trajectories, where countries such as the US, France, and Japan have been scrutinised for rising debt-to-GDP ratios.

Sterling also reacted calmly. The currency strengthened marginally, supported by expectations that a more predictable fiscal path could reduce risk premiums embedded in UK assets.

A stabilised policy backdrop tends to favour currencies, especially when paired with expectations that the Bank of England could shift toward an easing cycle in 2026 without facing fiscal headwinds.

A Budget Focused on Revenue Consolidation

At the core of the Autumn Budget lies a clear shift toward revenue-based consolidation. Rather than relying heavily on spending cuts, the government opted for targeted tax increases designed to plug structural gaps and signal a commitment to long-term fiscal sustainability.

Key measures include:

Adjustments to corporate taxes, especially for large multinational firms.

Threshold changes to personal taxation for upper-income households.

Closing various reliefs and loopholes that contributed to revenue leakage.

Improved enforcement and compliance mechanisms.

While the precise distribution of the tax burden will evolve as legislation moves through Parliament, the headline takeaway: £26bn of incremental revenue, is significant within the context of a government seeking stability rather than immediate growth stimulus.

Crucially, the Chancellor framed these measures as components of a “fiscal stabilisation phase,” signalling restraint in the near term while leaving open the possibility of growth-oriented investments later in the parliamentary term.

Impact on the UK Economy

Short-term Economic Effects

In the near term, higher taxes may exert a mild cooling effect on consumption and corporate investment.

Households facing higher tax obligations may scale back discretionary spending, and small to medium enterprises, already navigating higher financing costs, could adjust hiring and capital expenditure plans.

However, these effects are unlikely to be contractionary on their own. Markets generally assess the overall fiscal stance rather than individual lines, and a credible budget often supports lower long-term yields, which in turn fosters investment.

Medium-term Considerations

The bigger question is whether the UK can pivot from stabilisation to growth. While the Budget focuses on balancing the books, the country continues to grapple with structural issues:

productivity growth that has lagged developed peers

ongoing challenges in energy, housing, and infrastructure

post-Brexit trade frictions that still weigh on export competitiveness

an ageing population and rising health-care commitments

Addressing these requires a longer-term strategy that the Budget intentionally avoided for now. Markets appear to understand this, not expecting immediate transformation but seeking evidence that fiscal discipline will not come at the expense of future competitiveness.

Sector-by-Sector Market Implications

Different sectors of the UK market will experience the Budget in varied ways. Some, especially those sensitive to consumer demand, may face short-term headwinds, while others could benefit from greater policy stability.

Financials

Banks and insurers responded positively to the stability narrative. Higher long-term gilt yields can improve margins for insurers, while clarity around government borrowing supports risk models for banks.

Consumer Discretionary and Retail

These sectors are more vulnerable. With tax rises affecting higher-earning households, retail and hospitality businesses may face slower demand growth, particularly in luxury and higher-priced segments.

Real Estate and Infrastructure

Property developers and REITs saw mixed reactions. While higher taxes do not directly target property, the adjustment in yields and the broader macro outlook influence capital flows. Stable gilt markets are a net positive for long-duration assets, including real estate.

Energy and Utilities

These remain anchored by regulatory frameworks, and the Budget did not impose major new burdens. Investors focused instead on the knock-on effects of lower long-term borrowing costs, which support project financing.

Technology and Growth Sectors

Higher taxes on profits could marginally dampen expansion plans for domestic tech firms. That said, global factors continue to dominate valuations here, including US monetary policy and AI-driven capital expenditure cycles.

Investor Sentiment and Global Context

Investors increasingly benchmark UK fiscal moves against developments in other advanced economies. With global debt ratios rising, fiscal discipline has become a competitive asset in attracting international capital.

In this context, the Autumn Budget’s measured tone, revenue-focused consolidation without aggressive austerity aligns the UK with a broader trend toward gradual but necessary fiscal tightening.

This positioning helps sustain investor confidence, especially among sovereign wealth funds, pension funds, and cross-border asset managers seeking stable returns.

The key risk lies in economic performance. If growth underperforms in 2026 and 2027, the government may face difficult choices about whether to extend tax increases or introduce the very spending cuts it has tried to avoid.

Outlook: What to Watch Next

Over the coming months, several indicators will shape market interpretation of the Budget’s effectiveness:

gilt issuance schedules and long-term yield movements

Bank of England policy direction

business investment data

household spending patterns

revisions to GDP and productivity metrics

global macro headwinds, especially US monetary policy

If the government can preserve credibility while gradually enabling a growth narrative through targeted sector investments or regulatory improvements, the UK could strengthen its competitive position.

For now, markets appear to accept the stabilisation-first strategy, perceiving it as a necessary foundation for future economic planning.

Frequently Asked Questions

1. Why did the UK government introduce £26bn in tax rises?

The tax increases aim to stabilise public finances, reduce borrowing needs, and signal fiscal credibility after a period of uncertainty. This approach prioritises long-term sustainability over immediate stimulus.

2. How have markets reacted to the Autumn Budget?

Markets were calm and largely positive. Gilts saw modest yield movements, equities were stable, and sterling strengthened slightly due to reduced policy uncertainty.

3. Will the Budget hurt economic growth?

In the short term, higher taxes may weaken consumption and corporate investment modestly. However, fiscal stability can support lower long-term yields, which benefits investment and borrowing conditions.

4. What sectors are most affected?

Consumer-facing sectors may experience headwinds, while financials and utilities benefit from yield stability. Real estate and long-duration assets are sensitive to gilt market performance.

5. What should investors watch going forward?

Key indicators include gilt issuance, inflation trends, Bank of England policy, and GDP performance. Global macro conditions will also shape investor sentiment.

Summary

The Autumn Budget 2025 delivered £26bn in tax rises aimed squarely at restoring fiscal stability. Markets responded with calm acceptance, recognising the value of predictability after months of uncertainty.

While the measures may generate short-term drag on certain sectors, the overarching effect is a firmer fiscal footing. Whether this stabilisation evolves into a coherent growth strategy will determine the long-term trajectory of UK assets and investor confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.