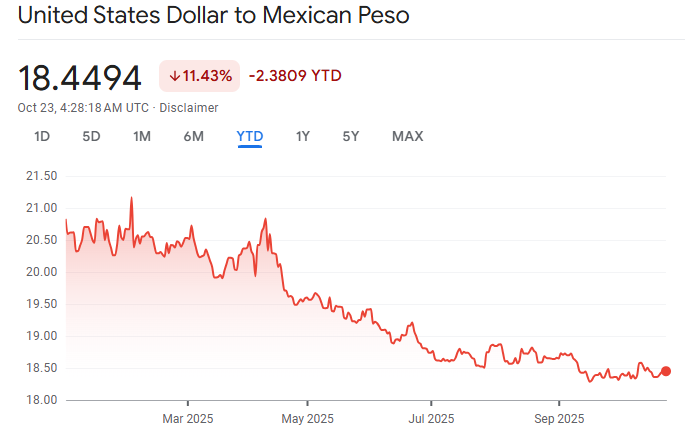

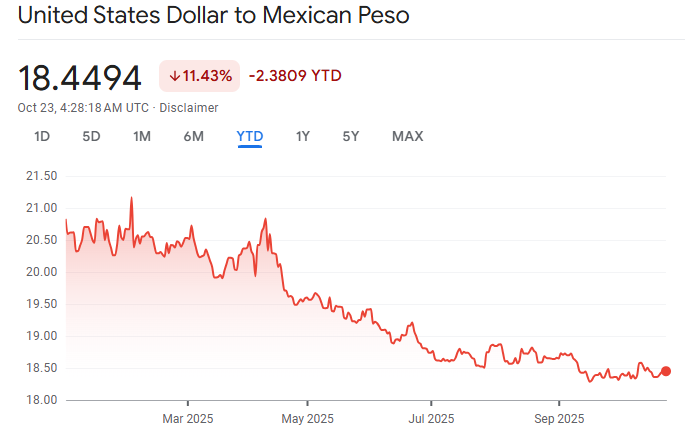

The quick and straightforward answer is yes; the Mexican peso (MXN) has shown net strength in 2025, trading around the MXN 18.3–18.6 per USD area in mid-October and outperforming many of its peers.

That strength is the result of a mix of macro and structural forces: a softer U.S. dollar and lower U.S. real yields, resilient Mexican external metrics (strong FX reserves and trade links to the U.S.), relatively attractive local yields (even after Banxico's gradual rate cuts), nearshoring and FDI inflows, and commodity support from oil prices.

However, the peso's path remains conditional as further appreciation depends on Fed policy, Mexican growth, remittance flows, oil dynamics and political risk at home. If U.S. financial conditions tighten again or remittances weaken further, MXN gains could reverse quickly.

How Strong Is the Mexican Peso Now? Latest Snapshot (October 2025)

As of October 2025, the USD/MXN has generally traded in the 18.3–18.6 band, with short-term intraday swings. Retail and institutional rate trackers show the local currency has traded near 18.45 MXN per USD in the latest sessions.

This marks a notable recovery from the MXN 20.23 per dollar level seen at the start of the year, and a far cry from its 2024 lows above 21 pesos.

Performance Data Overview (Oct 2025):

| Period |

USD/MXN Exchange Rate |

Peso Trend |

| October 2024 peak |

21.14 MXN/USD |

Weak peso due to tariffs |

| January 2025 average |

20.23 MXN/USD |

Slight improvement |

| June 2025 |

19.00–19.20 MXN/USD |

Strength recovery phase |

| October 2025 average |

18.33 MXN/USD |

Strongest level in 18 months |

Verdict: The peso has gradually strengthened throughout 2025, appreciating approximately 9–10% against the U.S. dollar year-to-date.

Comparing the Peso Globally: Latin America's Standout?

Among Latin American currencies, the peso remains the strongest performer in 2025 YTD.

| Currency |

YTD Change vs USD |

Notes |

| MXN (Peso) |

+9.4% |

Resilient, driven by rates and trade |

| BRL (Brazilian Real) |

+2.1% |

Volatile amid fiscal uncertainty |

| CLP (Chilean Peso) |

-6.3% |

Hit by commodity slowdown |

| ARS (Argentine Peso) |

-22.8% |

Chronic inflation, heavy pressure |

Mexico's disciplined policy and manageable debt continue to distinguish it from its peers.

Why Is the Mexican Peso Getting Stronger? 7 Reinforcing Drivers

1. A Softer U.S. Dollar and Easing Real Yields

One of the single biggest drivers for MXN in 2025 is the dollar's weakness compared with earlier cycles. After the Federal Reserve pivot from peak hawkishness, U.S. real yields softened and the dollar slipped, giving room for EM currencies to appreciate.

When DXY falls and real yields decline, global carry flows and capital search for yield often benefit currencies like MXN because they combine decent nominal yields with lower perceived risk vs smaller EMs.

The peso's correlation with the dollar/real-yield complex has been strong in 2025.

2. Relatively Attractive Local Yields

Policy rate at the start of 2025: 10.00%

Current benchmark rate (October 2025): 8.50%, after multiple cuts of 50 basis points each

Although Banxico has been cutting rates (the benchmark was lowered to 8.5% in September), Mexico's real and nominal yields remain high compared with many advanced economies and some EM peers. [1]

That still leaves a carry cushion for foreign investors who can lock in local yields, especially when U.S. yields are easing.

The combination of yield and decent macro buffers (reserves, manageable public debt) encourages portfolio flows into peso assets.

3. Strong External Position: Reserves, Trade and Proximity to the U.S.

Mexico's integration with the U.S. economy remains an advantage. The large two-way goods trade provides stable FX corridors. Mexico's FX reserves, roughly $244–247 billion, allow the central bank to intervene to defend stability or smooth volatility when needed.

Even when Mexico runs monthly trade swings, the deep trade relationship and nearshoring trends generate confidence among international investors.

4. Nearshoring and Robust FDI Into Manufacturing

Remittance inflow (Jan–Sept 2025): ~$48.5 billion (~6% increase YoY).

Foreign Direct Investment (H1 2025): Over $26 billion, led by automotive, energy, and tech sectors.

Global companies are increasingly shifting their production and diversifying supply chains away from China and toward Mexico, a trend known as nearshoring. This move results from lower logistical risks and the proximity to U.S. markets.

New manufacturing investments and crucial contracts in various sectors, including automotive and electronics, have led to an increase in demand for the peso. Heightened capital expenditures and corporate dollar sales support this increase.

U.S. Commerce Department data show that cross-border manufacturing exports reached nearly $520 billion in 2025, up 12% YoY.

This structural reallocation of production supports both trade receipts and longer-term forex demand for MXN. Market research and institutional notes in 2025 repeatedly flagged Mexico as a beneficiary of reshoring.

5. Oil Prices and Commodity Support

Mexico is an oil exporter; higher oil prices typically help government revenues and FX inflows. While oil forecasts for 2025 were more moderate than the earlier spike years, crude still trades at levels that provide support to Mexico's fiscal receipts and foreign currency earnings. [2]

Mexico's current account deficit narrowed to ~0.5% of GDP, according to Banxico's Q3 report, while FX reserves hover near $210 billion, among the strongest safety cushions in Latin America.

Even a modest increase in Brent crude prices supports the peso's resilience compared to a scenario where oil prices collapse. The dynamics linked to commodities are vital because fuel revenues are significant for public finances and external balance.

6. A Cooling but Stable Remittances Picture

Remittances are a crucial source of foreign currency for Mexico (historically over $60 billion a year). In 2025, remittance growth weakened, with some months even experiencing declines. This trend was influenced by changes in U.S. labour and immigration policies, as well as a softer job market in the early to mid part of the year.

Despite this decline, remittances remained substantial in absolute terms and continued to support household foreign exchange (FX) income. While the decrease offset the strength of the peso, it did not eliminate the other positive factors at play. [3]

It is vital to closely monitor remittance trends, as a sustained decline could remove a crucial support level for the Mexican peso (MXN).

7. Policy Credibility and Reserve Buffers

Banxico's trustworthiness in pursuing inflation goals, as inflation stayed within the target range after disinflation, facilitated cautious easing without disturbing markets.

The credibility of the central bank and its substantial reserves decreases the likelihood of a chaotic correction, instilling confidence in investors to maintain peso assets, even amidst spikes in volatility.

The fact that Banxico cut rates despite divided votes signalled a careful, data-driven approach rather than a policy panic.

What Could Stop the Mexican Peso's Rally? 4 Main Downside Risks

Although structural factors stay favourable, late 2025 presents some challenges to watch closely.

1. Tariff Escalation and U.S. Trade Tensions

Renewed U.S. trade actions under President Trump's 2025 administration added friction. Tariffs on Chinese tech imports and threats of automotive tariffs on Mexico created uncertainty.

Analysts note that these could weaken the peso toward 20–21 per dollar if extreme measures materialise.

For now, stronger bilateral relations have contained volatility, but the risk persists.

2. Signs of Domestic Economic Slowdown

Mexico's GDP growth forecast for 2025 is subdued:

Lower growth can weigh on peso resilience over time, especially if investment slows or remittance expansion moderates.

3. Overvaluation Warnings

Large institutions, including Bank of America (BofA), declared in mid-2025 that the peso appeared "overvalued" after extended rallies. The bank advised clients to short MXN against the euro, citing potential economic downturn and a proposed remittance tax.

Historically, such overvaluation phases have preceded moderate corrections rather than deep crashes, but the suggestion underscores market sensitivity.

4. Continued Rate Cuts Could Narrow Carry Advantage

While attractive rates drew investors for carry trades, further Banxico cuts could reduce the peso's yield premium. Projected estimate that rates may reach 7.0% by the end of 2025, influenced by the Federal Reserve easing and domestic inflation.

If the Federal Reserve delays its own cuts, relative rate differentials could tighten, reducing appetite for peso positions.

Three Scenarios for USD/MXN Over the Next 6–12 Months

Scenario 1: Base Case (50%)

USD/MXN: Trades in the 18.0–18.8 range through Q4.

Conditions: Stabilising inflation, gradual Banxico easing, mild Fed cuts.

Outcome: Peso stable or slightly stronger.

Scenario 2: Bull Case (30%)

Assumptions: Fed cuts aggressively; oil stable; nearshoring flows accelerate.

Projection: USD/MXN could approach 17.5 by Q2 2026.

Drivers: Rising FDI, remittance growth, improving sentiment.

Scenario 3: Bear Case (20%)

Assumptions: U.S. tariffs widen, Fed delays cuts, Banxico over-eases.

Projection: Peso weakens to 20.0–21.0 MXN/USD.

Drivers: Shrinking carry appeal and capital outflows.

Expert Forecasts: Where Will the Peso End 2025?

| Source |

End-2025 USD/MXN Forecast |

Peso Direction |

| UBS (Milenio, Jan 2025) |

19.50 |

Slightly stronger |

| Banamex (March 2025) |

21.00 |

Weaker outlook |

| Banco de México (SHCP) |

18.70 |

Gradual appreciation |

| LongForecast (Oct 2025) |

18.30 |

Stable-to-strong peso |

| BofA (May 2025) |

20.50 |

Overvalued, correction likely |

Consensus range:

Analysts predict a USD exchange rate of 18.3-19.5 by the end of 2025, assuming stable U.S. policies and mild global economic growth.

What Traders and Investors Should Monitor in the Following Months?

If you own peso assets or trade USD/MXN, monitor these seven items closely as they'll typically send early warning or confirmation signals.

USD index (DXY) & U.S. real yields (TIPS)

Banxico decisions and minutes

Mexico CPI & core inflation (INEGI)

FX reserves updates

Remittance flows and U.S. migration policy headlines.

Oil prices (Brent/WTI)

Portfolio flows & local bond yields (MXN government bonds)

Frequently Asked Questions

Q1: Has the Peso Actually Strengthened in 2025?

Yes. MXN has been among the better-performing EM currencies in 2025.

Q2: Will Banxico Rate Cuts Weaken the Peso?

Rate cuts create downward pressure, but the effect depends on relative U.S. policy, reserves, and flows.

Q3: Should I Hedge MXN Exposure Now?

If you have material short-term MXN exposure, prudently sized hedges make sense.

Q4: Why Is the Peso Considered a "Carry Trade" Favourite?

Because of its high real yields, stable macroeconomic policy, and relatively low volatility compared to other emerging-market counterparts.

Q5: Could Mexico's 2026 Election Affect MXN Volatility?

Yes. Analysts broadly expect increased peso volatility approaching Mexico's 2026 presidential election, as political uncertainty, policy continuity, and U.S. relations come to the forefront.

Conclusion

In conclusion, the Mexican peso is indeed stronger in 2025, both in exchange rate and underlying fundamentals. The steady increase in value from earlier in the year is not coincidental; it results from credible central bank policies, strong investor confidence, and Mexico's evolving economic role in a changing global supply landscape.

However, this strength is not guaranteed, and the peso remains susceptible to fluctuations in the dollar, renewed global risk aversion, further declines in remittances, oil price shocks, or unexpected political developments at home.

If you are trading or investing in MXN, consider the current strength to be conditional and have contingency plans in place to hedge against unforeseen changes in U.S. policy or remittance flows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/americas/bank-mexico-lowers-benchmark-interest-rate-750-2025-09-25/

[2] https://www.jpmorgan.com/insights/global-research/commodities/oil-price-forecast

[3] https://www.dallasfed.org/banking/pubs/dfb/2025/2504-dunbar-remit