Most traders spend countless hours perfecting their strategies, such as tweaking indicators, backtesting systems, or following gurus. Yet research and market reality tell us a harsh truth: strategy is only part of the equation. What often determines success or failure is not the chart setup, but the trader's psychology.

For example, recent surveys suggest that over 70% of retail traders cite emotional decision-making as the primary cause of their losses. In 2025, with markets swinging from Fed rate decisions to gold spikes and AI stock volatility, the ability to control your mindset is more valuable than ever.

This article explains why trading psychology matters, the psychological traps traders fall into, and practical tools to master your emotions for consistent performance.

What Is Trading Psychology?

Trading psychology refers to the mental and emotional factors that influence trading decisions. It covers everything from discipline and risk tolerance to confidence, fear, and greed.

In 2025, as AI trading systems, real-time news feeds, and high-frequency movements dominate, emotional resilience is as important as analytical skill.

Why Psychology Matters More Than Strategy?

As mentioned above, research indicates that 70–80% of retail traders incur losses, with trading psychology being a primary factor. [1]

Additionally, a BIS Behavioural Finance Review shows that traders who received structured psychological training experienced a 30% increase in account survivability after one year compared to those who did not.

Example of Fail Trading Psychology (2025)

Market Stress in 2025

Fed Policy Shifts: The September 2025 rate cut had shocked global markets. Many traders abandoned strategies mid-session due to fear of missing out (FOMO).

Gold's Surge to $3,650/oz: Traders who chased rallies without discipline suffered whipsaw losses when corrections came.

Crypto Volatility: Bitcoin's 15% decline in just one week in August 2025 demonstrated how emotional trading increases risk.

To quote Brett Steenbarger, a trading psychologist: "In volatile markets, it's never the strategy that fails first; it's the trader's ability to follow it."

In all these cases, strategies remained valid, but traders failed due to poor execution under pressure.

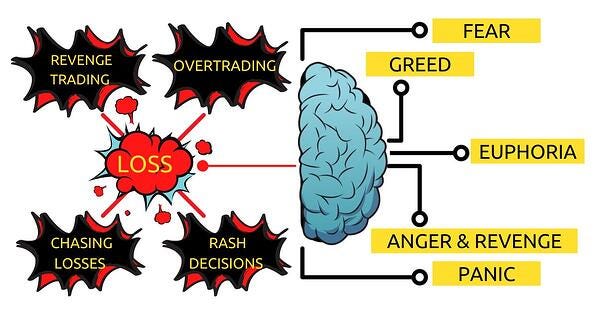

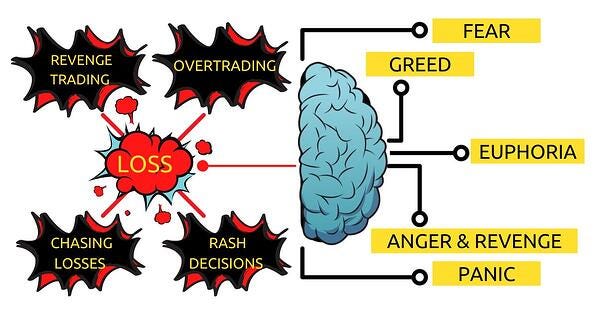

7 Common Psychological Traps Traders Face

1. Overtrading

Overtrading occurs when traders take excessive positions, frequently due to boredom or the misconception that "more trades equal higher profits."

Why it happens: boredom during quiet markets, desire to "make up" for losses, or the adrenaline rush of action.

Real-world example: A 2024 survey revealed that traders making over five trades daily were 40% more prone to consistent losses compared to those who traded selectively.

How to counter it: set daily trade caps, focus on quality setups, and review trade frequency in journals.

2. Fear of Missing Out (FOMO)

FOMO leads traders to jump into moves late, often at the peak of hype.

Why it happens: social media hype, herd mentality, or seeing others post gains.

Real-world example: When gold surged to $3,650/oz in September 2025, retail traders piled in after the peak. Many faced 8–10% drawdowns as gold corrected.

How to counter it: stick to predefined entry rules, and remember that missed trades are part of discipline.

3. Revenge Trading

Following a loss, some traders irresponsibly increase their bets in an attempt to "win it back." It often spirals into bigger losses.

Why it happens: emotional attachment to money, anger after losses, or impatience.

Real-world example: During the August 2025 crypto crash, Binance reported that 35% of liquidations resulted from traders who increased leverage after initial losses. [2]

How to counter it: pause after losses, reduce position sizes, or even stop trading for the day.

4. Confirmation Bias

Confirmation bias refers to the tendency to seek information that reinforces your current beliefs while disregarding contradictory evidence.

Why it happens: ego and the desire to be "right."

Real-world example: Many traders in early 2025 maintained long positions on the dollar, disregarding Fed indications of rate cuts, and were surprised when the USD declined significantly in the middle of the year.

How to counter it: force yourself to write down opposing scenarios before entering a trade.

5. Loss Aversion

Traders often hold losing trades too long to avoid accepting a loss, even when the rational move is to exit.

Why it happens: human brains perceive losses as twice as painful as equivalent gains.

Real-world example: In 2025, retail FX accounts saw a surge in forced stop-outs when traders held onto JPY shorts too long during a yen rally.

How to counter it: pre-set stop-loss orders and reframe losses as "business expenses."

6. Impatience & Need for Action

Some traders feel compelled to trade constantly, even in flat or low-volatility markets.

Why it happens: dopamine from trading, impatience for results, or unrealistic expectations.

Real-world example: During the quiet April 2025 equity lull, many retail traders over-leveraged small moves and saw accounts wiped when volatility spiked suddenly in May.

How to counter it: develop routines outside trading, such as backtesting or journaling, to channel energy productively.

7. Overconfidence

Winning streaks can lead traders to believe they are "invincible," often increasing risk recklessly. [3]

Why it happens: euphoria from profits, misattributing luck as skill.

Real-world example: Several prop traders in mid-2025 who overexposed themselves to tech stocks during the AI rally faced 30–40% drawdowns when earnings disappointed.

How to counter it: treat every trade independently, reduce size after wins, and stick to your risk management rules.

How to Improve Your Trading Psychology?

1. Build Emotional Awareness

2. Structure Discipline

Set stop losses and take profits beforehand, before starting trades.

Automate entries/exits where possible to avoid manual panic.

3. Train Under Stress

4. Stay Physically & Mentally Healthy

Research indicates that inadequate sleep raises the likelihood of taking risks by 25%.

Meditation and mindfulness practices can lower cortisol levels, reducing impulsive trading.

The Psychology–Strategy Balance

| Factor |

Strategy-Driven |

Psychology-Driven |

Why Psychology Wins |

| Trade Entries |

Indicators, signals |

Discipline to wait |

Most lose by entering too early or late |

| Risk Management |

Stop-loss rules |

Ability to stick to stops |

Traders move stops when emotional |

| Position Sizing |

Formula-based |

Avoiding greed/fear |

Greed often overrides formulas |

| Trade Exits |

Technical targets |

Patience & confidence |

Many cut winners short |

| Long-Term Consistency |

Backtesting edge |

Emotional resilience |

Burnout ruins good strategies |

Practical Takeaways include:

Master yourself before you master the markets.

Treat losses as data, not personal failures.

Establish routines from sleep to nutrition, to pauses, to maintain a focused mind.

Utilise modern tools (AI alerts, automated risk controls) to enforce discipline.

Frequently Asked Questions

1. What Are the Biggest Psychological Biases in Trading?

FOMO, overtrading, revenge trading, loss aversion, and overconfidence.

2. Which Is More Important: Strategy or Psychology?

Both matter, but psychology determines whether you stick to your strategy even after failure.

3. Do Professional Traders Also Struggle With Emotions?

Yes. Many hedge funds employ psychologists to support traders in handling stress.

4. Are There Tools to Help With Trading Psychology?

Absolutely. In 2025, trading journals, biofeedback applications, meditation timers, and coaching programs within trading communities are gaining popularity.

Conclusion

In conclusion, strategies are increasingly commoditised in modern trading as algorithms, AI bots, and copy trading systems are everywhere. The one true edge a trader can still build is psychological resilience.

Thus, forget strategy alone. Focus on psychology. In trading, mindset is not only crucial but also the true advantage.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.fxstreet.com/education/why-do-most-retail-traders-fail-and-what-can-i-do-to-improve-my-chances-of-success-202503311406

[2] https://www.binance.com/en/square/post/08-03-2025-8-1-9-222-27801406963881

[3] https://www.researchgate.net/publication/385639845_Analysis_of_Retail_Investors%27_Trading_Psychological_Characteristics_Based_on_Big_Data