The Australian dollar (AUD) plays a pivotal role in both the national economy and the global financial market. As one of the most actively traded currencies worldwide, it attracts the attention of investors, traders, and economists alike.

If you're exploring forex trading opportunities, understanding how the Australian currency works is essential. This guide explains the Australian currency, including its history, characteristics, and trading methods in global markets.

What Currency Does Australia Use Today?

Australia's official currency is the Australian dollar, abbreviated as AUD and symbolised by "$" or sometimes "A$" to differentiate it from other dollar-denominated currencies such as USD and CAD. It is the sole legal tender in Australia and its external territories, including Norfolk Island, Christmas Island, and the Cocos (Keeling) Islands.

The Australian dollar is subdivided into 100 cents, with coin denominations ranging from 5 cents to $2 and banknotes from $5 to $100. The currency is issued and regulated by the Reserve Bank of Australia (RBA), which oversees the country's monetary policy and ensures financial stability.

A Brief History of the Australian Dollar

Before 1966, Australia used the Australian pound, which was linked to the British pound sterling. However, to modernise the monetary system and simplify trade, Australia introduced the decimal-based Australian dollar on 14th February 1966. This event marked a significant shift, replacing the old pound-shilling-pence system with a more straightforward dollar-cent format.

Since its introduction, the AUD has undergone several transformations. Notably, Australia was among the first countries to introduce polymer banknotes, which are standardised now due to their durability and advanced security features.

Why the AUD Matters in the Global Economy

The Australian dollar is considered a commodity currency because Australia is a major exporter of iron ore, coal, gold, and natural gas. It gives the AUD a unique sensitivity to global commodity price movements, especially those involving China, one of Australia's top trading partners.

As a result, the AUD is frequently used as a proxy for global risk sentiment and commodity demand. Traders and investors often turn to the AUD during periods of economic growth and risk appetite while steering away from it during downturns.

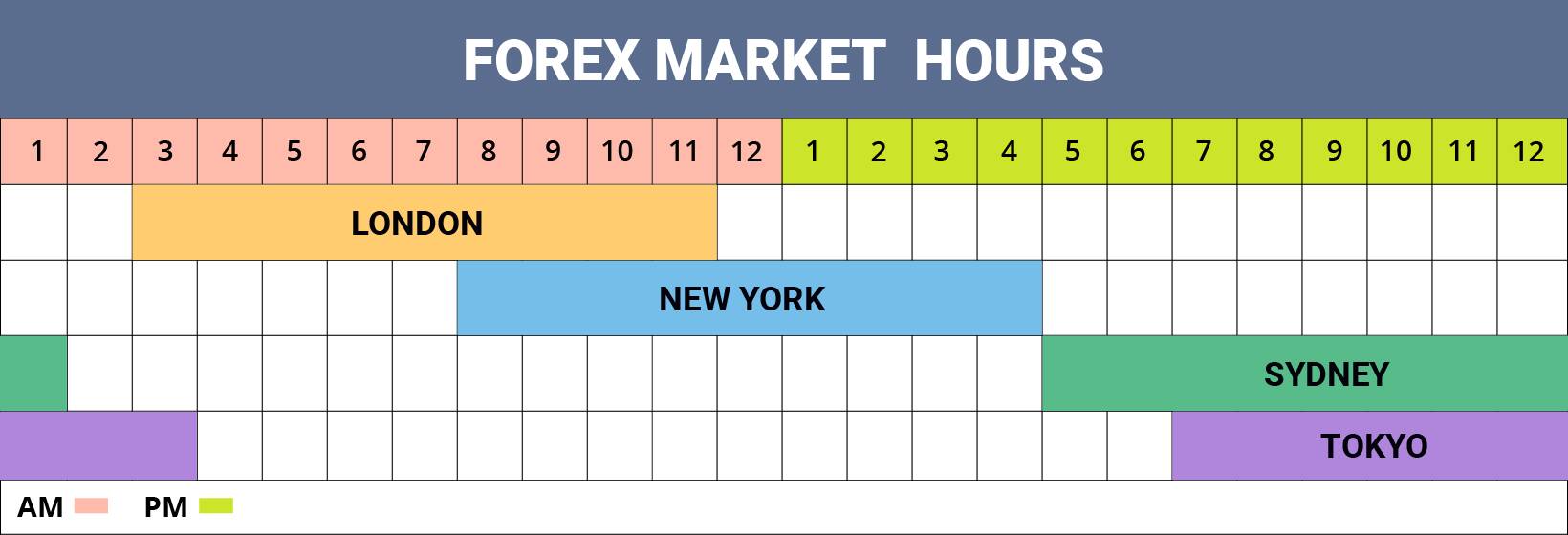

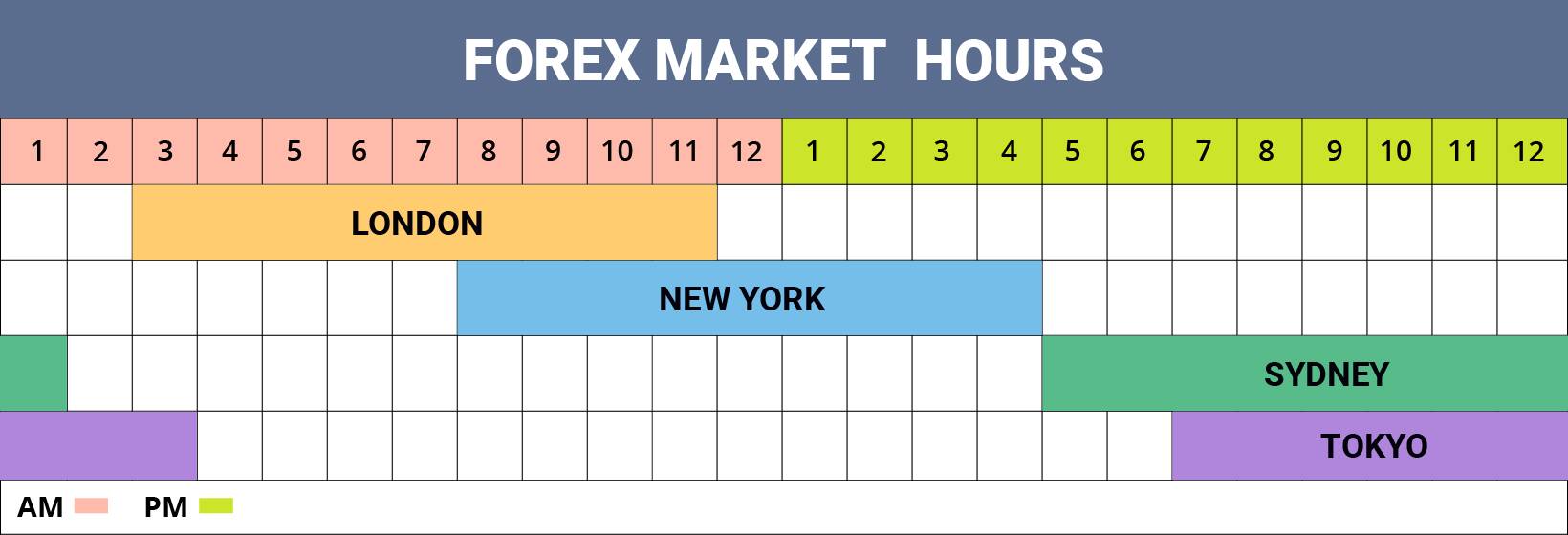

AUD Trading Sessions and Market Hours

The Australian dollar is most active during the Asia-Pacific trading session, particularly between 7:00 AM and 4:00 PM AEST (Australian Eastern Standard Time). It coincides with trading hours in Sydney and Tokyo, both of which heavily influence AUD price movements.

Liquidity increases during the overlap between the Asian and European sessions. The AUD/USD pair is also influenced during the US session due to its popularity among American traders.

Popular AUD Currency Pairs

Some of the most frequently traded AUD currency pairs include:

AUD/USD – Known as the "Aussie," this pair represents the exchange rate between the Australian and US dollar.

AUD/JPY – A volatile pair influenced by both commodity prices and market risk appetite.

AUD/NZD – This pair tracks the economic performance of two closely tied neighbouring countries.

EUR/AUD and GBP/AUD – Popular pairs for traders interested in cross-rate opportunities between Europe and Australia.

Exchange Rate Factors for Australian Currency

1) Interest Rates

The Reserve Bank of Australia's interest rate decisions are among the biggest drivers of AUD value. Higher interest rates tend to attract foreign capital seeking better returns, thereby increasing demand for the currency.

2) Commodity Prices

As a resource-rich nation, Australia's economy is closely linked to global commodity cycles. Rising prices for iron ore, coal, and gold often boost the AUD, while falling commodity prices can weaken it.

3) Trade Balance

Australia's trade balance (exports minus imports) also affects the AUD. A trade surplus generally strengthens the currency, while a deficit can weigh it down.

4) Political and Economic Stability

Market confidence in Australia's economic governance, fiscal policies, and geopolitical stability contributes to the attractiveness of the AUD in international markets.

How to Trade the Australian Dollar (AUD)

Trading the Australian currency is popular among both novice and experienced forex traders. It is one of the top five most traded currencies globally, paired commonly with the USD, EUR, JPY, and NZD.

1) Forex Market

The most direct method to trade AUD is through the foreign exchange (forex) market. This decentralised market allows traders to speculate on the value of the AUD relative to other currencies, such as AUD/USD, AUD/JPY, or EUR/AUD.

2) Futures Contracts

AUD futures contracts are standardised agreements traded on exchanges like the Chicago Mercantile Exchange (CME). These instruments are ideal for traders seeking exposure to the AUD with set expiry dates and contract sizes.

3) Exchange-Traded Funds (ETFs)

Currency ETFs such as the Invesco CurrencyShares Australian Dollar Trust (FXA) provide another route for investors to gain exposure to AUD without dealing with brokers.

4) Contracts for Difference (CFDs)

CFDs allow traders to speculate on AUD price movements without owning the currency. These are high-risk, leveraged instruments popular with short-term traders.

Strategies for Beginners Trading the AUD

If you're new to trading the Australian dollar, consider these beginner-friendly strategies:

1) Trend Following

Focus on identifying major trends using moving averages. Trade in the direction of the trend and avoid entering positions against the prevailing market momentum.

2) Breakout trading

Watch for key support and resistance levels on charts. When price breaks through these levels with high volume, it often leads to strong moves that can be capitalised on.

3) Range Trading

During periods of low volatility, the AUD shifts within a specific range. Buying at support and selling at resistance can be effective in such scenarios.

Consistency and discipline are critical. Avoid overtrading and always keep risk-reward ratios in check.

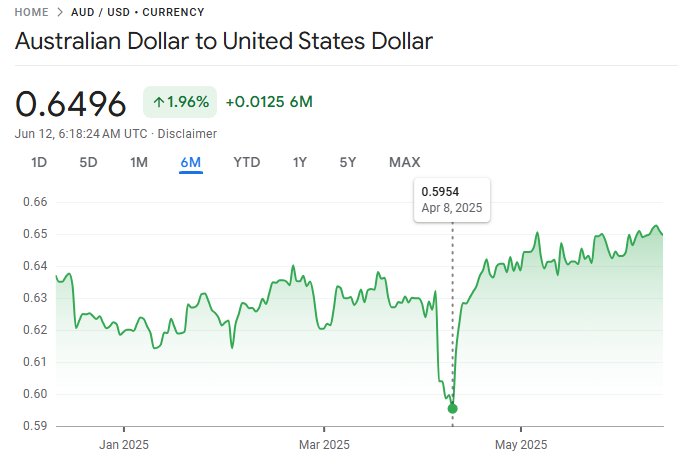

AUD Performance in 2025: What to Expect Before 2026

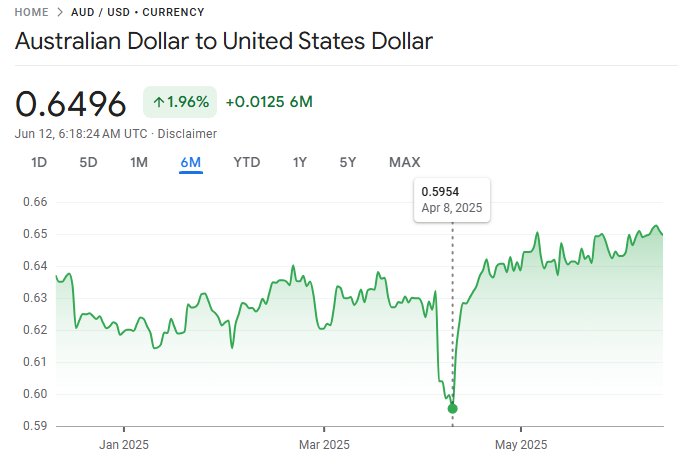

As of mid-2025, the Australian dollar (AUD) has displayed notable resilience while navigating global headwinds. It began the year near its five-year lows—around 0.6150 against the US dollar—but gradually strengthened, trading in the 0.65–0.6550 range by June. This recovery reflects a mix of external and domestic dynamics:

1) Currency Strength & Technical Support

The AUD/USD reclaimed the 0.6500 level amid global USD softness, pausing after hitting fresh 2025 highs near 0.6550.

Technical indicators show support around 0.6434 (200‑day SMA) and resistance near 0.6545, the 2025 high.

2) Interest Rate Divergence

The Reserve Bank of Australia (RBA) initiated 2025 with a slight easing—reducing rates to around 3.85% and projecting cuts toward 3.20% by 2027.

Meanwhile, the US Federal Reserve has maintained a data‑dependent stance, suggesting possible rate cuts by September. This shifting dynamic narrowed the AUD's yield disadvantage and provided a modest boost.

3) China's Mixed Economic Signals

Improvements in Chinese industrial output spurred optimism, yet weak retail and investment data tempered enthusiasm.

Australia's trade linkage to China means China's economic health remains a key driver for AUD performance.

4) Commodity Markets & Export Dynamics

Despite some headwinds from China, continued strength in commodities—particularly iron ore and copper—offers underlying support to the AUD.

UBS forecasts see potential strengthening to ~0.68 by late 2025 amid resilient commodity prices.

5) Market Sentiment & Speculative Positioning

Recent CFTC statistics indicate an increase in net short positions, implying a growing bearish sentiment.

However, technical momentum continues to be positive, with the upside limited around the 2025 high.

Conclusion

In conclusion, the Australian dollar is more than just a means of exchange in Australia; it is a critical player in global finance.

From its commodity-based dynamics to its role in the FX market, the AUD provides numerous opportunities for those willing to study its patterns and risks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.