The US dollar to Australian dollar (USD to AUD) exchange rate is a key metric for traders, travellers, and businesses alike. Over the past several years, the currency pair has experienced significant swings, reflecting global economic shifts, commodity cycles, and changing monetary policy.

In this article, we highlight the biggest highs and lows for USD to AUD in recent years and explore the factors behind these dramatic moves.

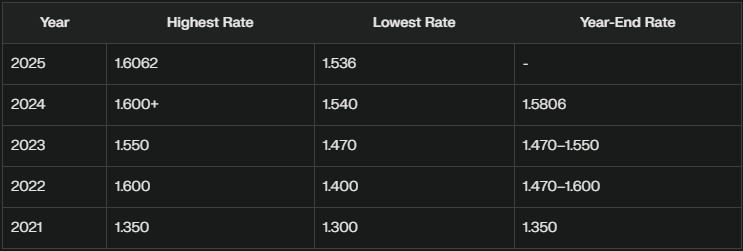

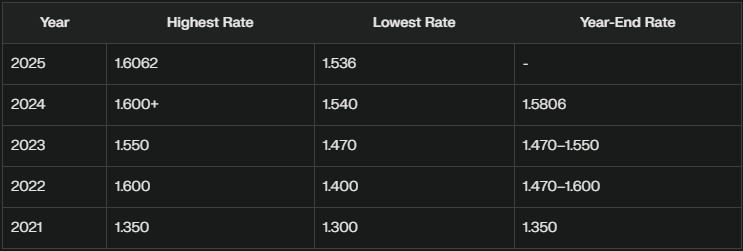

USD to AUD: Recent Highs and Lows

2020–2025: Volatility Amid Global Change

The last five years have seen the USD to AUD rate fluctuate in response to pandemic disruptions, inflation shocks, and policy changes in both the US and Australia.

The exchange rate peaked at 1 USD = 1.67964 AUD, according to XE historical data. This marked a period when the US dollar was particularly strong against the Aussie dollar, often corresponding with global risk aversion and strong demand for the US dollar as a safe haven.

The pair hit a low of 1 USD = 1.44533 AUD, reflecting periods when the Australian dollar gained strength, often due to rising commodity prices or positive economic data from Australia.

2024–2025: A Closer Look

2024 Year-End: The rate closed at 1 USD = 1.5806 AUD on 31 December 2024.

2025 Highs: In early 2025, the rate reached 1 USD = 1.6062 AUD in January, before easing back to 1 USD = 1.5917 AUD by the end of April.

Recent Lows: In May 2025, the rate briefly dipped to 1 USD = 1.536 AUD on 6 May, before rebounding to 1 USD = 1.572 AUD by 12 May.

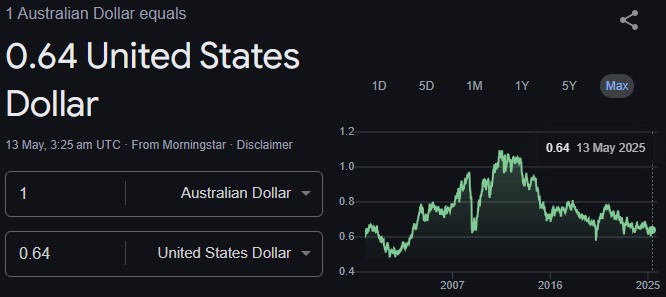

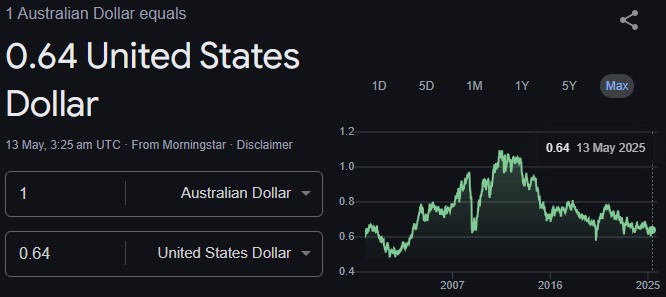

AUD/USD Perspective

When viewed in reverse (AUD to USD), the Australian dollar's annual average against the US dollar has shifted from 0.66 in 2023 to 0.63 in 2025, with a low of 0.60 and a high of 0.65 so far this year.

What Drives the USD to AUD Exchange Rate?

1. Commodity Prices

Australia's economy is heavily reliant on commodity exports, particularly iron ore, coal, and gold. When global commodity prices rise, the Australian dollar tends to strengthen, pushing the USD to AUD rate lower. Conversely, falling commodity prices often weaken the AUD.

2. Interest Rate Differentials

The gap between US Federal Reserve and Reserve Bank of Australia (RBA) interest rates is a major driver. When US rates rise faster than Australian rates, the US dollar attracts more capital, strengthening against the AUD.

3. Global Risk Sentiment

The US dollar is considered a “safe haven” currency. During global uncertainty or financial market stress, investors flock to the USD, causing the USD to AUD rate to rise. In calmer times, the AUD can recover as risk appetite returns.

4. Economic Data and Policy

Key data releases-such as GDP growth, employment numbers, and inflation-in both the US and Australia can trigger sharp moves in the exchange rate. Central bank policy shifts, especially unexpected rate hikes or cuts, also play a crucial role.

Key Milestones: USD to AUD Exchange Rate (2020–2025)

Trends and Outlook

2020–2021: The pandemic's onset saw the USD surge against the AUD as global markets panicked, but stimulus and commodity booms helped the AUD recover.

2022–2023: Volatility persisted with inflation and central bank tightening, but the AUD found support from strong export demand.

2024–2025: The US dollar regained strength amid renewed global uncertainty and rising US interest rates, pushing the USD to AUD rate to multi-year highs before easing in May 2025.

Final Thoughts

The USD to AUD exchange rate has experienced notable highs and lows in recent years, shaped by global events, commodity cycles, and central bank policies.

For traders, investors, and anyone dealing with US or Australian dollars, understanding these trends is essential for making informed decisions in a dynamic currency market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.