USD/JPY is trading in the mid 150s and remains dominated by policy differentials between the United States and Japan, evolving yield dynamics, and flows driven by risk sentiment and speculative positioning.

The Bank of Japan maintains a data dependent approach to normalisation while Japanese authorities have stepped up verbal warnings about rapid currency moves. The main near term risks for the pair are shifts in Fed expectations, incremental BoJ policy signals, and any signs of official intervention.

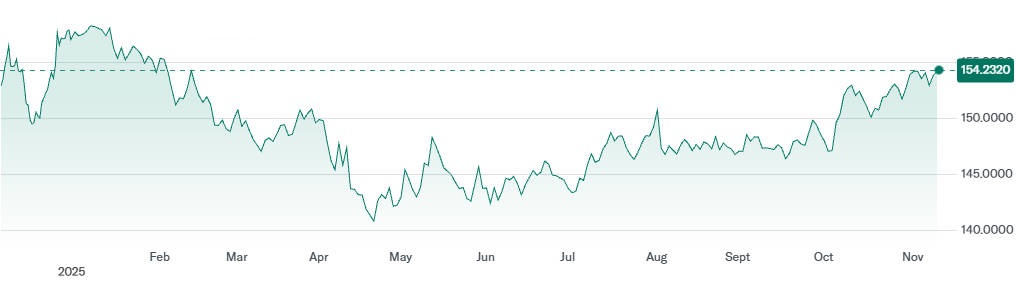

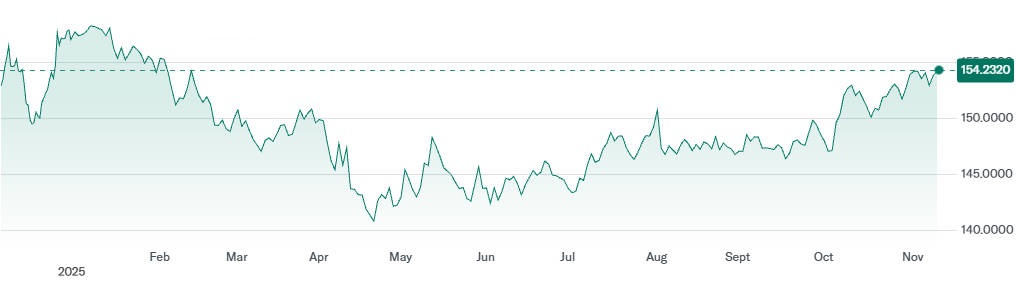

Current Price, Daily Range And Volatility Context of USD/JPY

As of 11 November 2025. USD/JPY is trading around 154.1. The pair recorded an intramonth high near 154.49 and a low around 152.97 in the first half of November. Implied and realised volatilities rose through October into early November as markets digested BoJ normalisation talk and shifting US yield expectations. Traders should expect higher intraday ranges on major macro releases or official comments.

Macro Backdrop: United States Monetary Policy And The Dollar Outlook

The United States effective federal funds rate remains materially higher than Japanese short rates, creating a persistent yield advantage for the US dollar. Market expectations about the path for the Fed change with each major economic release and influence the dollar via both yield and risk channels.

Any sustained move toward earlier or larger Fed easing than currently priced could reduce the yield advantage that supports long USD/short JPY positions. Conversely, resilient US data that preserves a higher yield path would tend to support the dollar.

Bank Of Japan Stance And Domestic Dynamics Affecting USD/JPY

The Bank of Japan has normalised policy from very low levels earlier in 2025 and is publicly framing policy as data dependent. The BOJ published its monetary policy outlook and statements in late October and left open the possibility of further gradual normalisation subject to developments in inflation and wage growth.

Domestic GDP and wage readings will be the decisive inputs for the BOJ. Market participants should treat BOJ communications and minutes as high information content for JPY direction.

Government Comments And Intervention Risk

Japanese officials have increased the intensity of verbal warnings about the yen after it weakened to eight month lows earlier in November 2025. The finance minister publicly stated that the government is monitoring FX developments with high urgency and warned about one sided rapid moves in the currency markets.

Verbal warnings are not equivalent to intervention, but they raise the probability of stepped up official surveillance and, in a disorderly move, intervention could become an option. Market participants should treat intervention as a low probability but high impact tail risk.

Japan Economic Fundamentals: Inflation, Wages And Growth

Headline and core inflation in Japan have moved closer to policy targets in 2025. supported by energy and services price changes and by some notable wage gains in key sectors.

However, growth indicators are mixed and third quarter activity showed signs of softness in certain components. The durability of wage growth will be a critical determinant of whether inflation becomes self sustaining and whether the BOJ will accelerate normalisation. If wages prove persistent, the yen is likely to find structural support over time.

Yield Structure And Carry Considerations

US Treasury yields continue to offer a significantly higher nominal yield than Japanese Government Bonds. At the same time, JGB yields have risen as the BOJ moved toward normalisation, but the gap with US yields remains wide enough to sustain carry oriented flows into dollar assets.

Key variables to monitor are the front end Treasury yields, the 10 year differential, and JGB auction results, because changes in these areas tend to cause rapid adjustments in FX positioning.

Liquidity, Positioning And Market Structure Considerations

Speculative Positioning.

Public reports show that speculative traders have maintained net short positions in the yen in recent weeks. Crowded short yen positions can exacerbate moves on shifts to risk off or on intervention talk.

Liquidity Windows.

Liquidity can thin around Japanese holidays and major US data releases, which increases the likelihood of sharp intraday spikes and wider execution spreads.

Order Flow Sensitivity.

Large directional moves are typically accompanied by reduced market depth, so execution risk rises materially during those episodes.

These structural features make disciplined sizing and stop placement essential in any active USD/JPY exposure.

Technical Structure: Key Levels And Momentum Readings For USD/JPY

Immediate Support.

The 150.0 to 151.5 band provides near term support and corresponds to recent consolidation lows and short term moving averages.

Immediate Resistance.

The 154.5 to 155.0 area marks the nearest technical resistance defined by monthly peaks. A sustained break above 155 would be technically significant and likely to attract momentum buying.

Medium Term Range.

If momentum extends, 158 to 160 becomes a plausible medium term target based on extension levels and prior structural resistance. Conversely, a break below the low 150s would raise the probability of a pullback to the mid 140s.

Momentum Indicators.

Weekly trend indicators remain biased to the upside while daily oscillators show consolidation, indicating that traders should expect range bound intraday movement punctuated by breakouts.

Traders should update technical charts intraday before execution because levels can shift with rapid market moves.

Plausible Paths For USD/JPY

| Scenario |

Description |

Key Triggers |

Near Term Target |

| Continued Yen Weakness |

The dollar extends gains as the BOJ remains cautious and US yields stay elevated. |

BOJ signals patience; US data remains resilient; low intervention probability. |

155 to 160. |

| Rangebound Consolidation |

The pair moves within a band while market participants digest mixed central bank signals. |

Conflicting data; balanced speculative positioning. |

150 to 155. |

| Yen Rebound Or Intervention |

The yen strengthens sharply either through market forces or official support. |

Strong Japanese data; clear BOJ hawkish pivot; verbal or actual intervention. |

145 to 150. |

Trading Strategies And Practical Risk Controls For USD/JPY

This section provides trade concepts suitable for different time horizons and a compact risk checklist.

1. Suggested Trade Concepts

Momentum Breakout.

Consider a staged long position above a confirmed close above 155 with stops under the consolidation low. Limit exposure because liquidity may be reduced in large moves.

Mean Reversion.

Consider short term sell on strength if the pair approaches the 158 to 160 zone and yields or risk sentiment do not confirm the move. Use options if the downside tail risk is a concern.

Carry Income.

For investors with longer horizons, a hedged carry stance via synthetics can harvest the yield gap while limiting severe JPY appreciation risk. Regularly reprice hedges as central bank expectations evolve.

Volatility Plays.

Buy straddles around major central bank announcements or non farm payrolls if implied volatility is not elevated and a surprise seems possible.

2. Risk Controls And Execution Notes

Position Sizing.

Keep individual trade risk to a small fraction of portfolio capital and scale in or out as liquidity permits.

Stop Placement.

Use stops that take into account wider spreads during low liquidity windows.

Correlation Monitoring.

Check correlations to US yields and the Nikkei to avoid multi asset concentration.

Official Comments Watchlist.

Maintain a short list of BOJ, Ministry of Finance, and finance minister events to anticipate spikes or shifts in verbal intervention risk.

Correlations And Cross Market Signals Worth Watching

US 10 Year Yield.

Moves in the US 10 year yield materially affect carry and directional flows for USD/JPY.

Dollar Index.

Parallel moves in the dollar index provide context for USD/JPY; divergence can pinpoint idiosyncratic JPY flows.

Nikkei And Japanese Equities.

Risk on flows into Japanese equities can coincide with yen weakness when foreign inflows favour equities or when domestic investors sell foreign bonds.

Commodity Prices And Risk Sentiment.

Broader risk on or off moves driven by commodity swings or geopolitical events can quickly flip FX flows and force rapid position adjustments.

Calendar And Event Risk: High Impact Items For Traders

Bank Of Japan Policy Statements And Minutes.

These contain the most direct information on BOJ intent and will influence both JGBs and JPY.

US Data.

Monthly US CPI and non farm payrolls are primary drivers of Fed expectations and dollar direction.

Japanese CPI And Wage Data.

Wage round outcomes and the national CPI print are key inputs for the BOJ.

Official Speeches.

Remarks by the finance minister and MOF officials can shift intervention probabilities, and central bank speeches can alter market pricing quickly. Traders should maintain a rolling event calendar and mark expected volatility windows.

Recent Historical Performance Table For USD/JPY

| Month End / Date |

USD/JPY Level |

Monthly Change (%) |

| May 2025 |

141.35 |

+1.4 |

| Jun 2025 |

144.65 |

+2.4 |

| Jul 2025 |

147.06 |

+1.7 |

| Aug 2025 |

147.39 |

+0.2 |

| Sep 2025 |

147.92 |

+0.4 |

| Oct 2025 |

151.15 |

+2.2 |

| 11 Nov 2025 (intramonth) |

154.12 |

intramonth appreciation from October |

This historical perspective highlights the appreciable move in USD/JPY since mid 2025 and the acceleration into October and early November. Update these series with your execution provider for live trading decisions.

Conclusion

USD/JPY (adjustable) is currently in a high attention state for market participants. The interplay between Fed path uncertainty and the BOJ data dependent route, together with elevated speculative positioning and stronger verbal intervention rhetoric, creates an environment where both directional trends and sharp reversals are likely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.