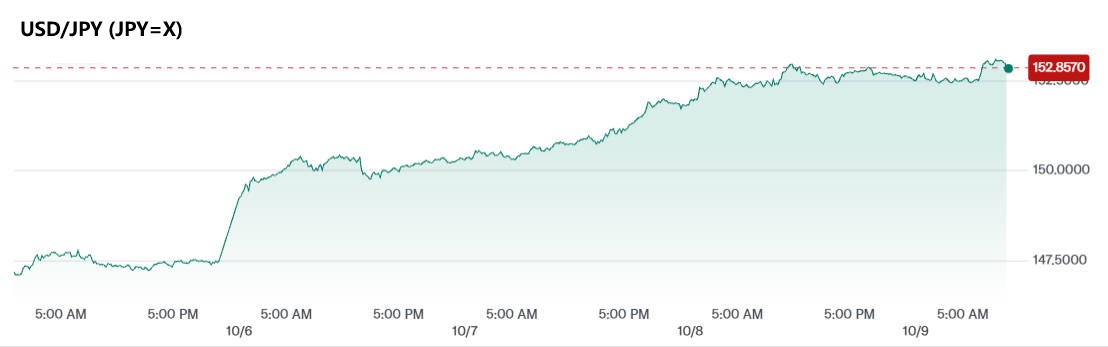

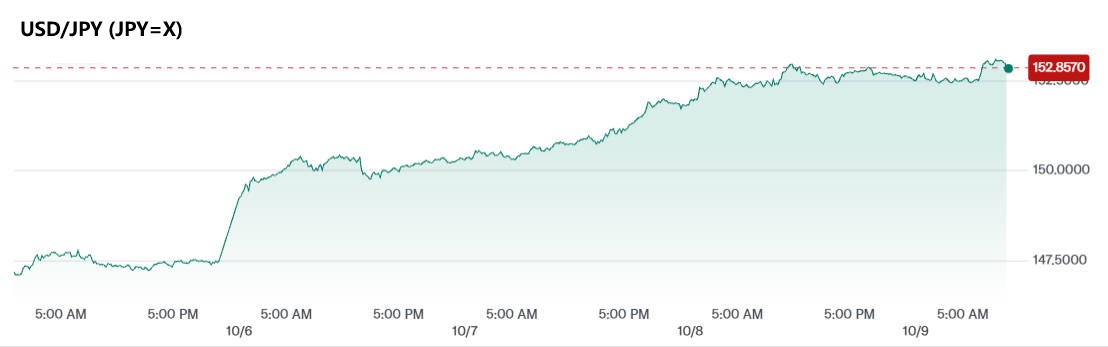

The U.S. dollar traded around ¥153.0 against the Japanese yen on 9 October 2025. marking the currency's weakest levels in roughly eight months as political shifts in Tokyo and a wide US–Japan yield gap pushed demand for dollars higher. The pai's intraday range was about 152.42–153.21.

What moved USD/JPY today

Political catalyst in Japan. Markets pushed the yen lower after the selection of Sanae Takaichi as the ruling party leader and the market's quick re-pricing of Japan's fiscal and monetary outlook.

Commentators say expectations of easier fiscal policy have reduced odds of an immediate BOJ tightening — a dynamic widely labelled the "Takaichi trade."

Large US–Japan yield differential. The US 10-year yield was about 4.13%–4.14% on 9 October while the Japan 10-year sat near 1.69%; the spread remains in the region of ~244 basis points, supporting dollar carry flows into USD/JPY.

Risk and positioning flows. Hedge funds and FX desks reported renewed selling of the yen into the political newsflow; market commentary has amplified both technical buying and verbal intervention chatter from officials.

Key market data about USD/JPY to watch

| Metric |

Value |

| Current USD/JPY (approx.) |

¥152.98–¥153.00. |

| Today's range |

152.42 – 153.21. |

| Change this week |

Yen has weakened over 3% this week amid political moves; some market commentary puts the one-week move nearer 3.7%. |

| US 10-year yield |

~4.13% – 4.14%. |

| Japan 10-year yield |

~1.69%. |

| BOJ short-term policy rate |

0.50% (complementary deposit facility / short-term rate levels) |

Technical snapshot for USD/JPY

| Item |

Level / note |

| Immediate support (today's low) |

152.42 (intra-day low). |

| Immediate resistance (today's high) |

153.21 (intra-day high). |

| Near-term range traders watch |

152.0 – 155.0 (psychological / option and dealer interest — 155 flagged in market commentary as an intervention "watch" area). |

Traders should note that technical momentum indicators have been biased to the upside this week; a sustained close above 153.2–153.5 would likely attract additional momentum buying, while a failure to hold 152.0 could encourage short-covering and rapid mean reversion.

Why the numbers matter — macro context

Policy divergence: The US–Japan yield gap is a primary mechanical driver of the move. Higher US long-term yields relative to JGBs makes dollar carry attractive and incentivises position-taking in USD/JPY.

The market is pricing a slower path to BOJ normalisation given political uncertainty, despite the BOJ having lifted short-term rates earlier in the year to around 0.5%.

Fiscal vs monetary dynamics: Takaichi's policy stance (pro-growth, pro-spending) has increased the chance of fiscal loosening; markets interpret this as supply/demand pressure that can keep the yen weak in the near term — even if the BOJ later tightens in response.

Comments from advisers and former BOJ officials have been mixed, so the timing of any policy shift remains data-dependent.

Market positioning, intervention risk and what to watch next

1) Positioning

Dealers report increased short-yen exposure from funds and leveraged accounts. That positioning raises the chance of fast intraday moves if the news flow changes.

2) Intervention risk

Market participants have begun to discuss a notional "red line" near 154–155 where Japan's Ministry of Finance (MOF) / BOJ might be prompted to act, based on precedent and recent analyst work.

Verbal warnings or 'jawboning' from officials typically come first; actual market intervention is judged costly and used rarely.

3) Data & calendar

Key events that will shape short-term direction:

BOJ minutes and policy calendar (next scheduled meetings through Oct–Dec).

US inflation and payrolls, which influence Fed expectations and the US yield curve. (See CME FedWatch for market odds.)

Quick practical note for traders and editors

Traders: watch 152.4 and 153.2 as the immediate intraday bookends; manage stops carefully because the political news component can produce gap risk.

Editors / publishers: verify the live USD/JPY quote at the moment of publication — FX is fast-moving and the snapshot above is accurate only to the timestamp cited. Use an L1 live feed (Reuters, Bloomberg, or your usual market data provider).

Conclusion

USD/JPY is moving on a mix of political re-pricing in Japan and the large US–Japan yield differential. Near term, expect elevated volatility around psychological levels (152–155), with intervention talk rising if the pair approaches the mid-154 to 155 area.

The next decisive moves will likely come from either: clearer BOJ guidance, concrete fiscal policy announcements in Tokyo, or fresh US macro surprises that shift the yield curve.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.