US stocks closed sharply lower on Tuesday, with the Nasdaq Composite leading the sell-off and falling about 2 per cent, the S&P 500 retreating roughly 1.2 per cent and the Dow Jones Industrial Average slipping around 0.5 per cent.

The session was driven by a combination of profit-taking among high-flying AI and technology names, company-specific earnings reactions, and cautionary comments from senior banking executives about stretched valuations.

Investors should treat this move as a meaningful correction in the most richly valued segments of the market rather than immediate evidence of a systemic breakdown. That said, the composition of the sell-off — concentrated in AI, semiconductor and other growth stocks — increases the risk that losses could widen if macro data or liquidity conditions deteriorate.[1]

Index Performance: Daily, Weekly And Year-To-Date Context (US Stock Focus)

The table below summarises index performance for the session and places it in a short-term context. The percentages and points are taken from exchange and market coverage for the latest trading day.

| Index |

Close (Approx.) |

Daily Change |

5-Day Change (Approx.) |

YTD Change (Approx.) |

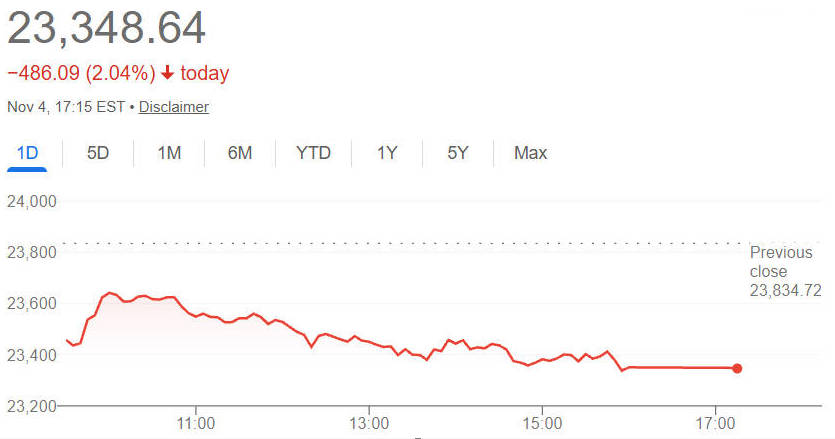

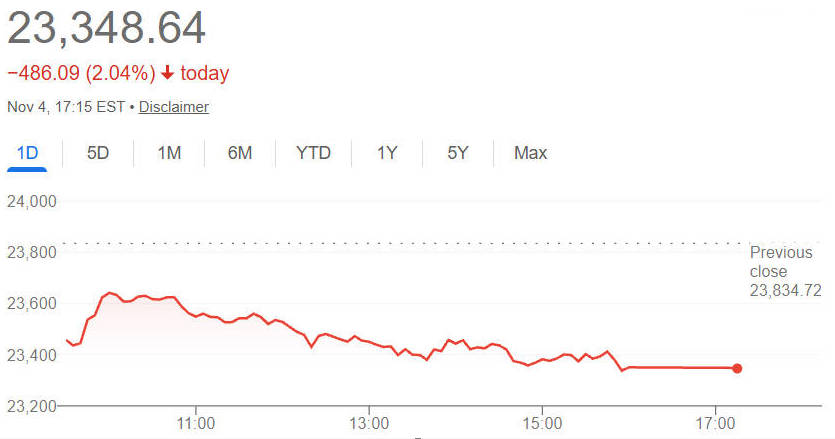

| Nasdaq Composite |

23,350 |

−2.0% |

−1.8% |

+21.1% |

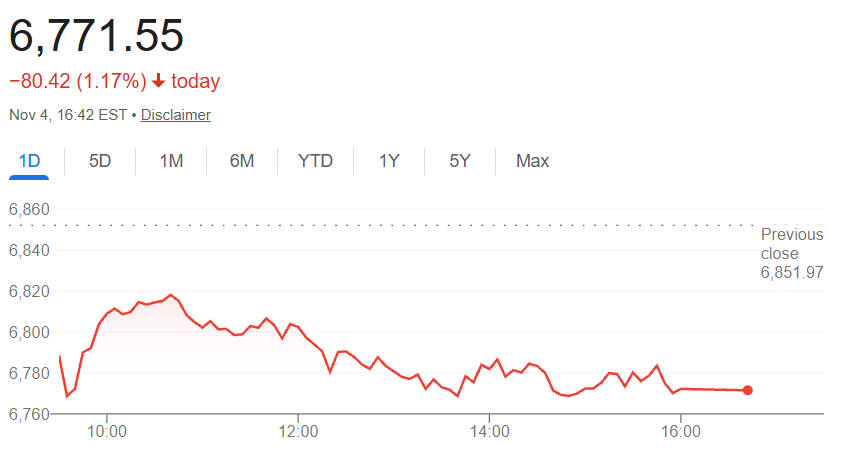

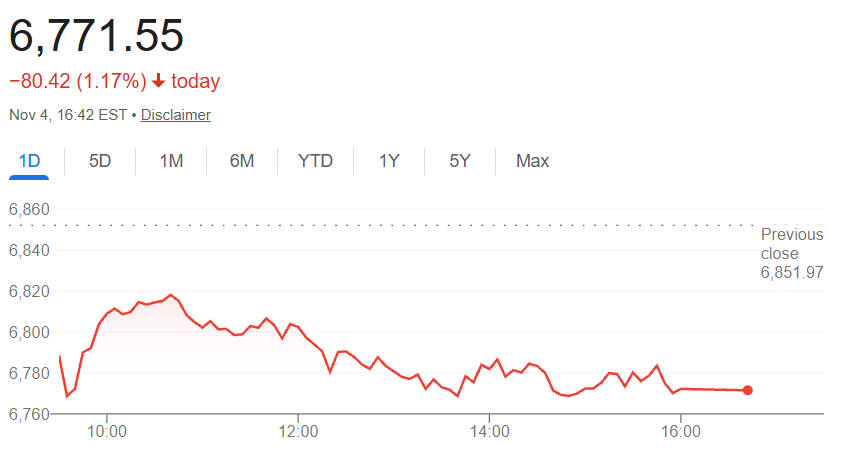

| S&P 500 |

6,772 |

−1.2% |

−1.1% |

+15.39% |

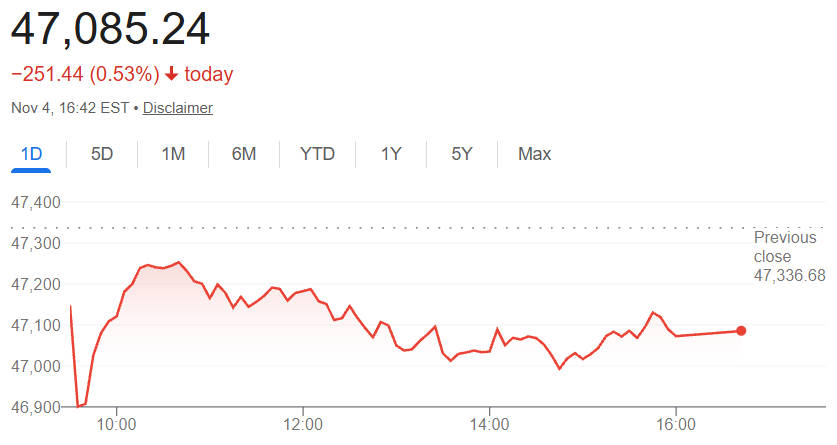

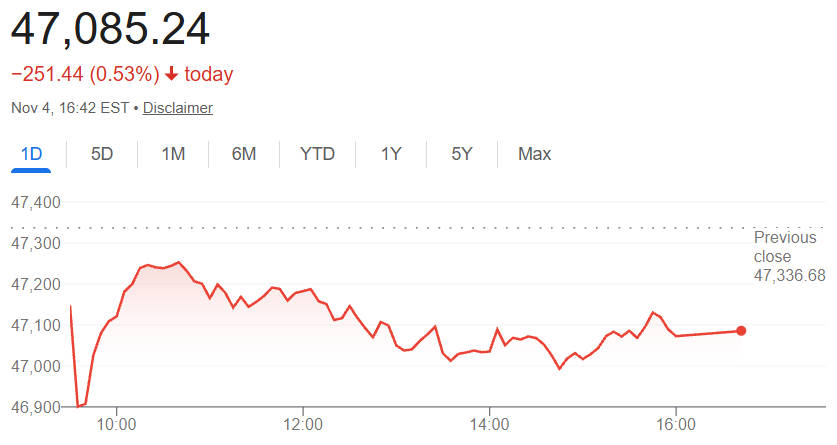

| Dow Jones Industrial Average |

47,085 |

−0.5% |

−0.4% |

+11.7% |

Contextually, the fall follows a period of strong gains in AI-related equities and semiconductors earlier in the year. Where previous rallies were broad-based within technology, the current retracement is concentrated, suggesting investors are selectively de-risking exposures that they perceive as most sensitive to valuation risk.

Sector And Industry Movers In The US Stock Market

Technology and semiconductors led the retreat, with numerous AI-linked components showing some of the largest intraday declines. Broader financials and certain defensive sectors offered modest support during the session. The following table highlights representative sector moves.

| Sector |

Approx. Daily Change |

Key Contributors |

| Technology |

−2.7% |

Nvidia, AMD, Palantir (notable declines) |

| Semiconductors |

−3.5% |

Chipmakers and equipment suppliers |

| Financials |

+0.5% |

Large banks modestly positive on rate views |

| Consumer Staples |

−0.2% |

Defensive, less volatile |

| Energy |

−0.4% |

Linked to oil price softness |

Semiconductor and AI-oriented names were disproportionally affected because investor positioning had become concentrated in these themes. As a result, when one or two headline events triggered sales — whether earnings or activist bets — that selling pressure propagated across the cohort.

Earnings And Company-Specific Drivers That Mattered For US Stocks

Earnings season remains a significant immediate driver of intraday moves. Several high-profile reports and after-hours outcomes shaped sentiment:

Palantir Technologies reported results that beat expectations on several metrics.

Nevertheless, the stock fell materially in subsequent trading as investors digested guidance, longer-term cadence and concerns about valuation; the sell-off was also amplified by notable public short positions and activist bets reported in the press.[2]

In some cases, companies that initially sparked rallies after reporting subsequently surrendered gains when investors re-examined profit margins, order books and capital-expenditure cadence.[3]

This pattern — strong headlines followed by profit-taking — contributed to a risk-off response across similar businesses.

Analysts repeatedly emphasised that headline beats do not immunise a share from selling if the market's expected growth trajectory or margin sustainability is questioned.

For market participants, this reinforces the need to assess guidance and order-book detail, not just headline numbers.

Macro Backdrop And Policy Risks Affecting US Stock Prices

Macroeconomic data and central bank guidance remain the primary determinants of medium-term equity valuations. Key considerations for investors include:

Labour-market prints, inflation measures such as CPI and core PCE, and the forward guidance from the Federal Reserve.

These inputs shape expectations for short-term interest rates and therefore the discount applied to long-duration growth equity cash flows.

Changes in rate expectations can disproportionately affect the valuation of AI and software companies that derive much of their value from long-run earnings.[4]

Comments from senior banking executives. In the most recent session, public warnings from high-profile bank chiefs regarding the potential for a market correction heightened investor caution and prompted some rebalancing in the most richly valued pockets of the market.[5]

Such remarks do not constitute macro policy but can affect sentiment and risk premia.

Investors should monitor the calendar for upcoming employment reports, inflation releases and Fed communications. Those items are likely to determine whether the correction remains shallow or becomes extended.

Market Structure: Breadth, Flows And Volatility In US Stocks

Market technicians and institutional traders will look at breadth and flow data to judge the quality of the move.

Breadth indicators such as the advance/decline ratio and the number of new 52-week highs versus new lows showed deterioration in the session, consistent with a concentrated sell-off in large growth names rather than a uniform market decline. A broad decline would be more concerning.

Volatility rose modestly, with the VIX moving higher on the day as traders priced greater uncertainty.

Options market activity suggested elevated hedging in technology-centric ETFs and among large cap names.

Exchange-traded funds and passive vehicles often amplify sector rotations because they concentrate exposures to narrow themes.

Recent inflows into AI and semiconductor ETFs had increased concentration risk; the current episode exposed how quickly such thematic flows can reverse.

Taken together, the market structure data point to a correction that is meaningful for tail and concentration risks but not yet equivalent to a systemic liquidity crisis.

Technical Analysis And Key Levels To Watch For US Stocks

From a technical perspective, the market is signalling short-term stress in the growth cohort while broader indices remain within recently established trading ranges.

Key levels for the S&P 500 and Nasdaq should be monitored closely. Short-term support for the S&P 500 lies near recent intraday lows and the 50-day moving average; a decisive break below these levels, confirmed by volume, would increase the probability of a deeper correction.

The Nasdaq is more susceptible to downside momentum because of its concentration in AI and semiconductor names.

If the Nasdaq experiences a sustained move below its 50-day moving average, traders should anticipate heightened volatility and seek explicit signals (volume confirmation, breadth deterioration) before extending shorts.

Momentum indicators such as RSI and MACD are beginning to show a loss of short-term bullish momentum for many large cap growth names.

Scenario planning should include: a sharp mean reversion rally if buyers re-enter, a consolidation phase, or a deeper correction if macro triggers occur.

Technical levels change with each trading day; it is prudent to use live charting tools and confirm signals across multiple time frames.

International Spillovers And Cross-Market Signals

US stock moves are having immediate global ramifications. Asian markets, particularly those with heavy semiconductor and technology exposure, experienced pronounced weakness following the US session.

South Korea and Taiwan saw notable selling pressure among chip makers, while European markets also reflected risk-off sentiment in their technology components.

Treasury yields and currency markets reacted with modest shifts, as investors reassessed rate expectations in light of equity weakness.

The cross-market transmission emphasises that a US-centred valuation correction in AI and semiconductors can quickly become global because of integrated supply chains and multinational revenue streams.

Investment Implications And Tactical Ideas For US Stock Investors

This section sets out practical guidance for different investor profiles.

1. For long-term investors

Reconcile each holding with your time horizon and thesis.

High-conviction investors should use dislocations to add systematically, for example by dollar-cost averaging into positions rather than making lump-sum purchases at the trough.

Evaluate whether the business fundamentals — revenue growth, margin trajectory, and addressable market — remain intact.

Consider trimming the most extended holdings to rebalance portfolio risk, particularly if a holding has become an outsized position relative to your plan.

2. For traders and short-term investors

Use clear stop-loss rules and manage position sizing tightly.

Shorting or buying put options can be appropriate if you have a high conviction view, but cost and timing are critical. In a market where headline risk is high, favour shorter maturities for option hedges.

Consider pair trades: long selected defensive or value names while shorting overextended growth stocks to reduce market beta.

3. Thematic and sector views

Frequently Asked Questions

Q: What caused the Nasdaq to fall by roughly 2 per cent today?

A: The decline was led by profit-taking in AI and high-growth technology stocks, exacerbated by company-specific reactions to earnings and public warnings from some banking executives about stretched valuations. The effect was concentration-driven: when a handful of large components moved heavily, the Nasdaq, which is technology-heavy, bore the brunt.

Q: Is this short-lived correction likely to become a larger bear market?

A: At present, the consensus among many market commentators is that this is a valuation-driven correction rather than the start of a bear market. That evaluation could change if key macro indicators — notably employment and inflation prints — unexpectedly weaken or if liquidity conditions tighten. Investors should watch forthcoming economic data and Fed communications closely.

Q: Should I sell my technology holdings immediately?

A: Investment decisions should be based on your personal time horizon, risk tolerance and the fundamental characteristics of each company. For many long-term investors, indiscriminate selling is not recommended. Instead, consider measured rebalancing, partial profit-taking, or option-based hedges if you are concerned about further near-term downside.

Q: Which sectors offer defensive protection in the current environment?

A: Traditionally defensive sectors include consumer staples, healthcare and utilities. Financials can act as a partial hedge if yields move higher, but sector selection must be aligned with the broader macro outlook and your risk profile.

Q: Which data points should investors prioritise over the next month or two?

A: Monthly employment data, CPI/PCE inflation readings, Fed minutes and key corporate earnings reports for large technology companies should be prioritised. These inputs will help determine whether the market's repricing continues or stabilises.

Q: How can I validate whether a genuine market re-rating is occurring?

A: Use a combination of valuation metrics (PE and PS ratios versus long-run averages), sector breadth measures, fund flow data into thematic ETFs, and trends in earnings revisions.

A sustained re-rating typically shows up as multiple metrics moving together: deteriorating earnings revisions, persistent outflows from thematic ETFs, and expanding dispersion between price performance and fundamentals.

Conclusion:

The recent sell-off in US stocks is a reminder that periods of concentrated gains can reverse quickly when sentiment shifts. For investors, the immediate priorities are to assess portfolio concentration, preserve optionality through appropriate cash or hedging, and distinguish between short-term noise and durable changes to a company's fundamentals.

Tactically, long-term holders should use the correction to review positions and consider measured additions where the thesis remains intact. Active traders can exploit volatility with disciplined risk management, while opportunistic investors might survey idiosyncratic dislocations in quality names that temporarily trade off with the sector.

Finally, remain attentive to the macro calendar: employment, inflation and central bank commentary will be the decisive inputs for whether the market's repricing is temporary or the prelude to a deeper rotation.

Sources:

[1]https://www.barrons.com/articles/stocks-today-ai-stocks-palantir-amd-209537d9

[2]https://finance.yahoo.com/news/palantir-stock-falls-nearly-8-on-valuation-fears-after-results-top-wall-street-estimates-211457379.html

[3]https://www.indmoney.com/blog/us-stocks/why-palantir-stock-fell-despite-strong-earnings-report

[4]https://www.reuters.com/world/china/global-markets-global-markets-2025-11-05/

[5]https://nypost.com/2025/11/04/business/dow-falls-450-points-as-goldman-sachs-morgan-stanley-warn-of-market-correction/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.