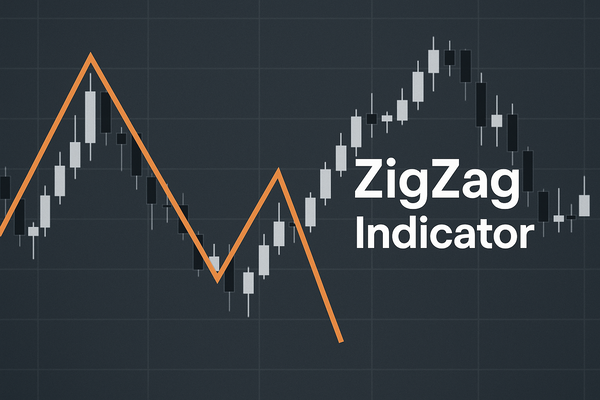

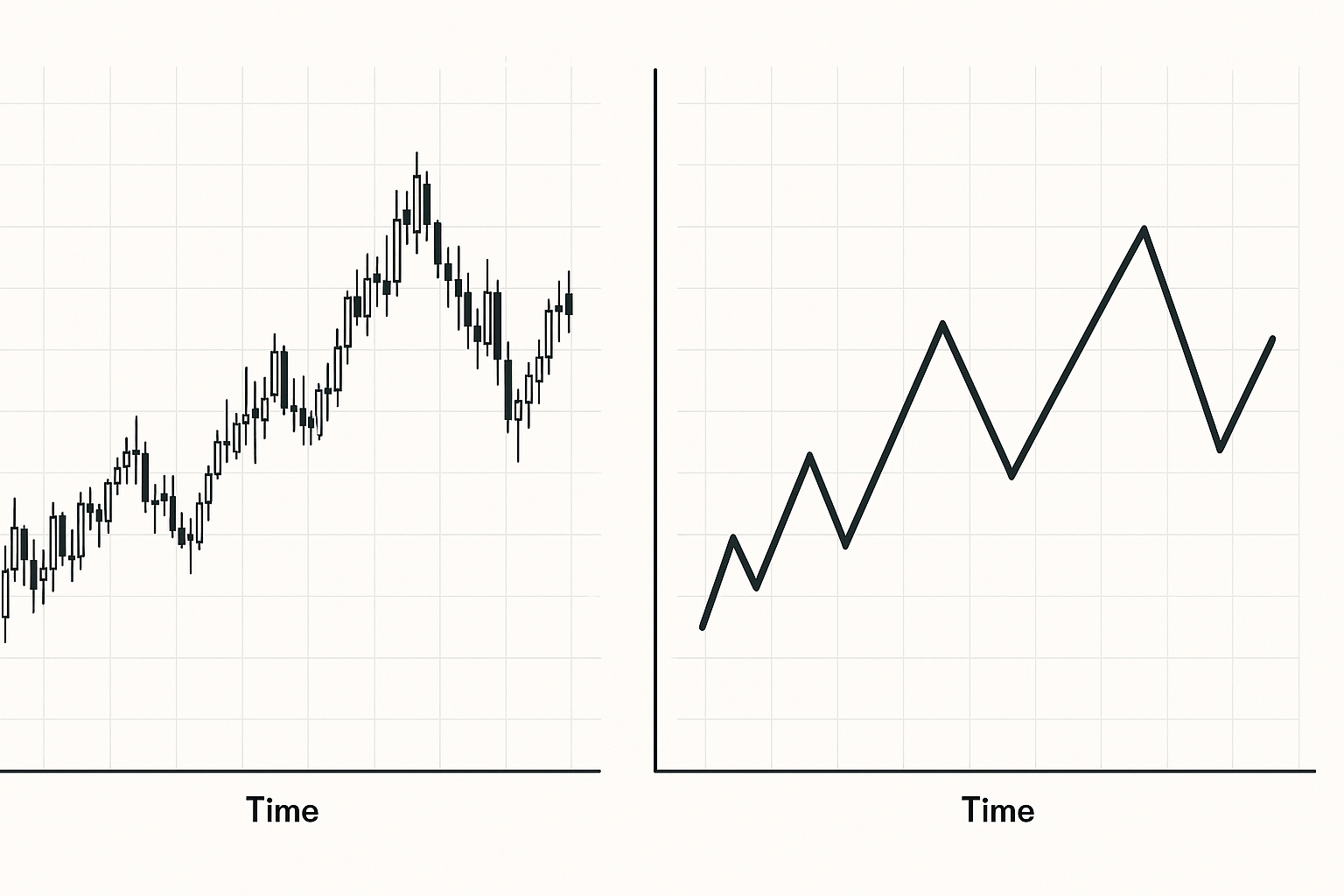

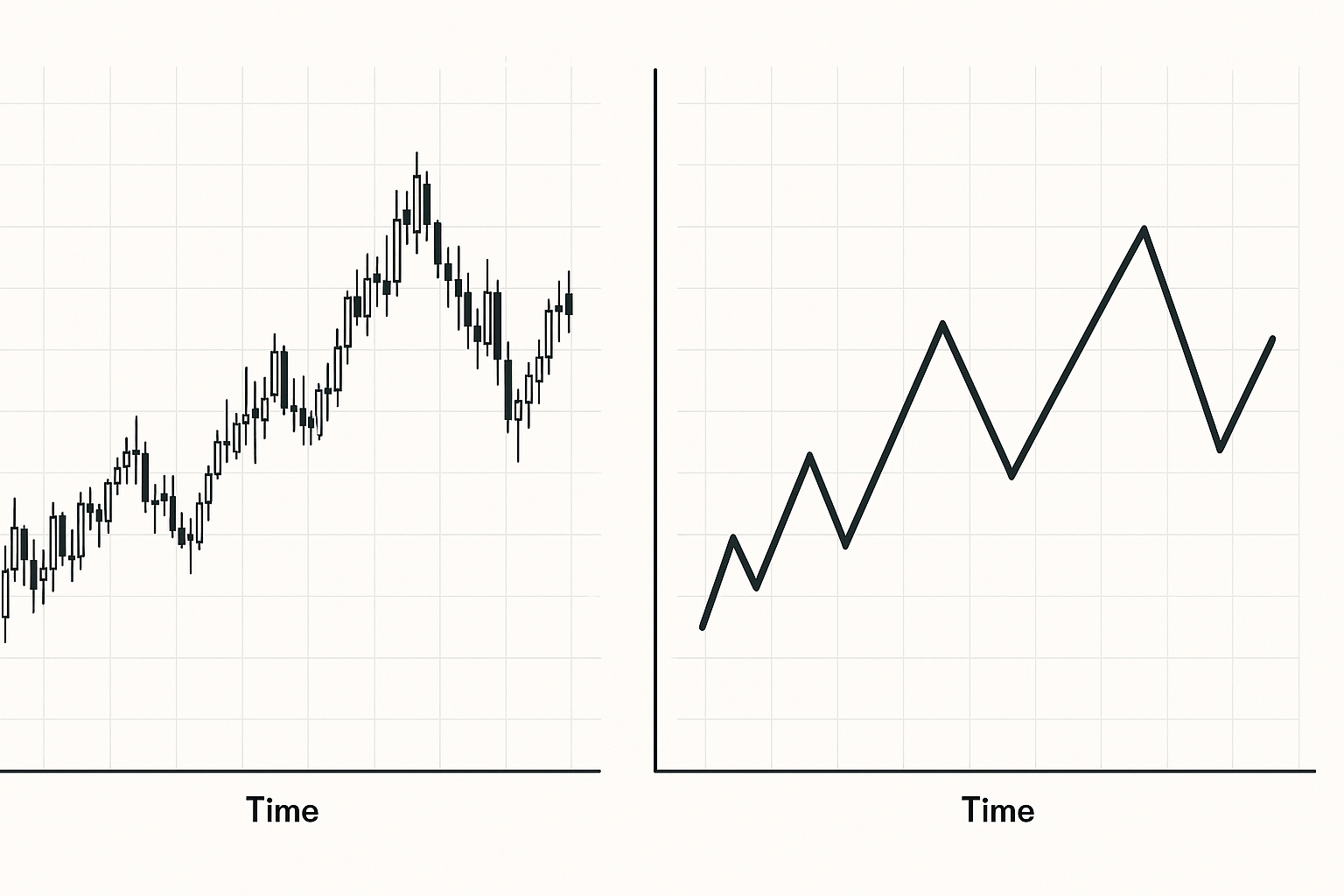

The ZigZag indicator is a favourite among traders who prefer clean, clutter‑free charts. By ignoring small and insignificant price moves, it connects only the most meaningful highs and lows, making trends, reversals, and patterns much easier to see. This filtering effect helps traders focus on big-picture structure while avoiding the distraction of every minor tick.

However, the ZigZag is not a crystal ball. It is a mapping tool, best used alongside confirmation methods and proper risk management. Let's explore how it works, how to set it up, and ways to use it effectively in real trading.

What the ZigZag Indicator Does

At its core, ZigZag simplifies price action. It highlights major swings, removes noise, and makes trend structure easier to read. This clarity helps in:

-

Identifying the prevailing trend

-

Spotting chart patterns like double tops/bottoms or head and shoulders

-

Marking support and resistance based on past swing highs and lows

Reviewing past price behaviour without distractions from micro-movements

Unlike moving averages or oscillators, ZigZag is not predictive — the most recent swing can change until confirmed. Traders should treat the last leg with caution.

Core Settings Explained

The indicator's performance depends largely on three settings:

Depth – Minimum number of candles before a pivot is confirmed. A higher depth means fewer pivots and less noise.

Deviation – The minimum percentage change in price required to create a new leg. A small deviation produces more lines; a larger deviation focuses on only the biggest moves.

Backstep – The minimum number of candles between two pivots to prevent them from clustering too close together.

Typical starting points:

-

Intraday trading: Depth 12–20 | Deviation 3–5% | Backstep 3–5

-

Swing trading: Depth 24–48 | Deviation 5–10% | Backstep 5–8

For highly volatile instruments, increase Backstep to reduce whipsaws.

Adding ZigZag to Your Chart

On MT4 or MT5:

-

Open your trading chart.

-

Go to Insert → Indicators → Custom → ZigZag.

-

Adjust Depth, Deviation, and Backstep to suit your market and timeframe.

Save the template for consistency across charts.

How to Read ZigZag Swings

The ZigZag's straight lines guide you in recognising:

-

Trend direction: Higher highs and higher lows = uptrend; the opposite indicates a downtrend.

-

Pullbacks and impulses: Compare leg sizes. Strong moves with shallow pullbacks show trend strength.

Key levels: Past swing highs/lows can be used for stops and targets.

It's even more effective when you use a higher timeframe ZigZag for market bias and a lower timeframe ZigZag for fine-tuning entries.

Practical Trading Strategies

1. Trend Pullback Continuation

First, confirm a strong uptrend or downtrend through a sequence of swings. Wait for a corrective leg to form, then look for a momentum signal — such as RSI turning back in the trend's favour — before entering in that direction. Stops should go beyond the last corrective swing, with targets near prior swing highs or lows.

2. Reversal at Structure

Mark major past swings and look for the price to test these areas. If the swing fails to extend and shows divergence or strong rejection, consider a reversal trade. Enter on a break in the opposite direction with stops beyond the failed swing.

3. Fibonacci Levels with ZigZag

Once two ZigZag points define a leg, apply Fibonacci retracements and projections to identify possible retracement levels and profit targets.

Risk Management with ZigZag

Good risk control means:

-

Placing stops just beyond the last confirmed pivot

-

Position sizing so risk per trade remains consistent

-

Adjusting settings for higher volatility conditions

Avoiding trades right before high-impact news events

By tying stop placement and targets to swing structure, trades are aligned with actual market behaviour.

Common Mistakes to Avoid

Some traders misuse ZigZag as a direct entry trigger. Others over-optimise settings for past performance, only to find they fail in changing market conditions. The biggest error is acting on an unfinished ZigZag leg — patience is vital.

When ZigZag Adds the Most Value

ZigZag is especially useful after volatile moves, for reviewing and journaling past trades, and for pattern recognition. It works best in trending conditions and on charts where price movement is not too erratic.

Final Tip:

Treat ZigZag as a map, not a signal. Combine it with confirmations such as price action or momentum indicators, and it can significantly improve trade filtering and timing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.