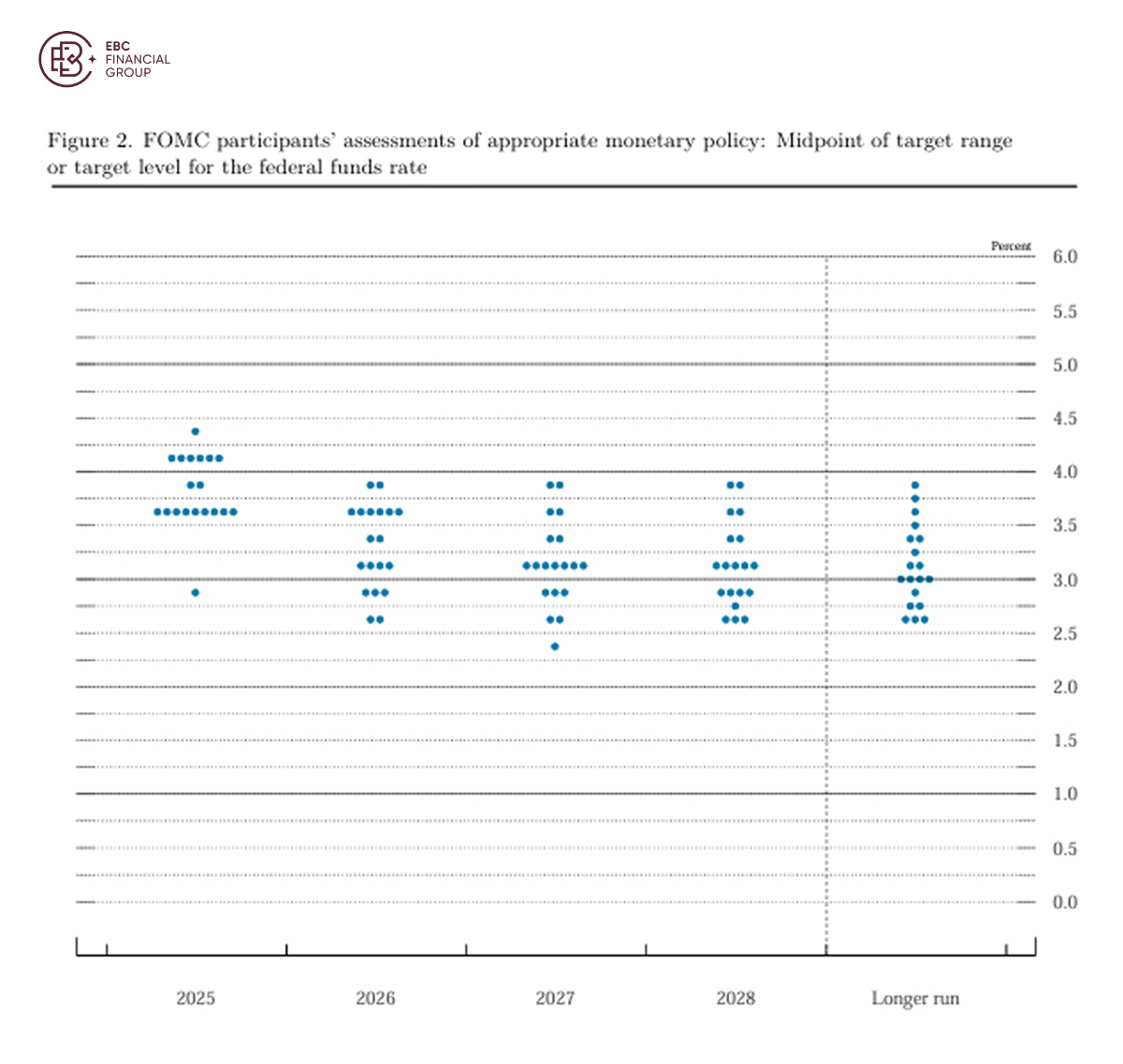

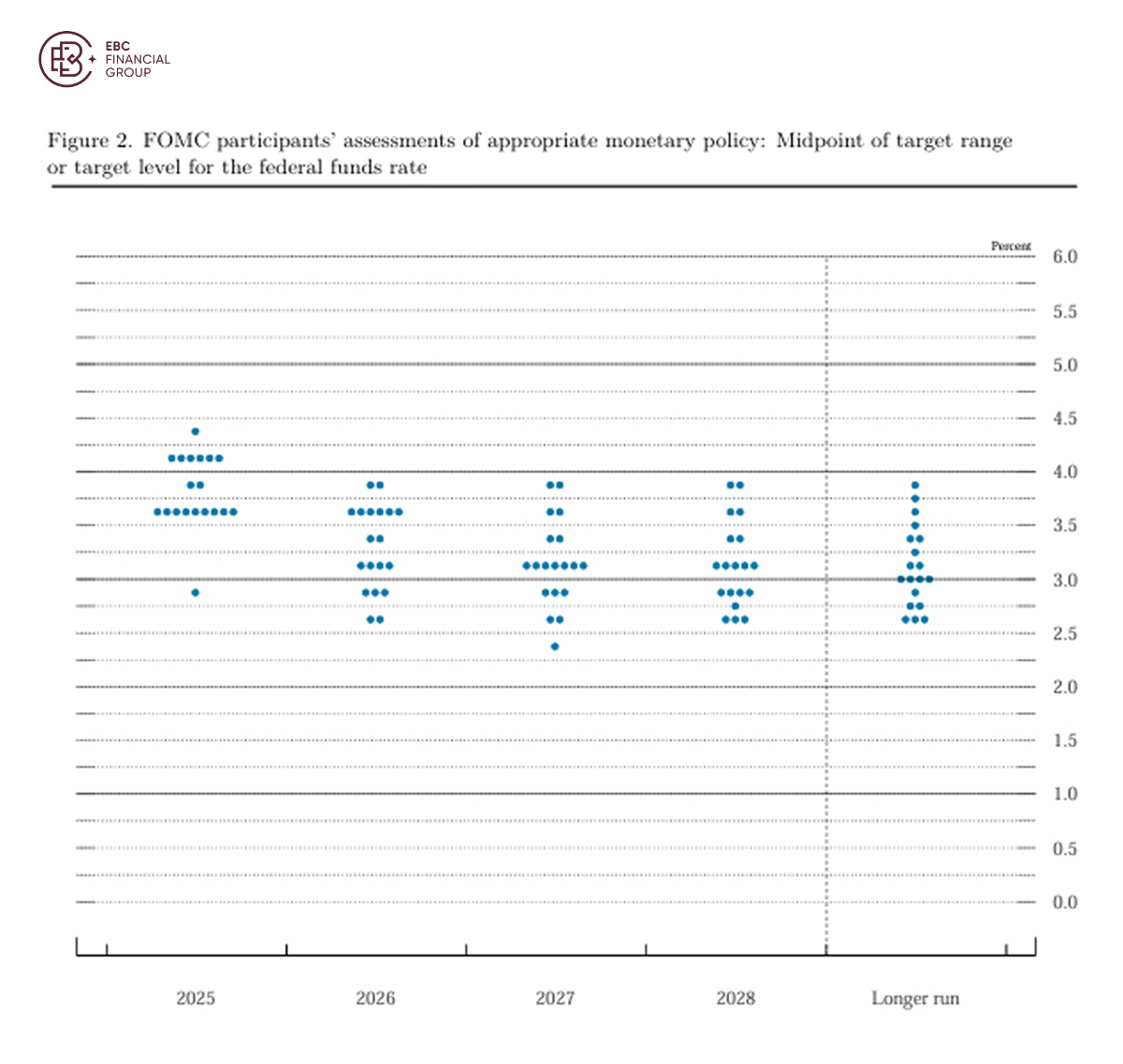

The Fed resumed interest rate cuts and opened the door to further easing but

tempered its message with warnings of sticky inflation, sowing doubt over the

pace of future policy adjustments.

"We've had a rather cautious ... view here for a while" given a lack of

clarity and direction, said Larry Hatheway, global investment strategist at the

Franklin Templeton Institute.

Chair Powell is torn between upside risks to inflation and a cooling job

market. The central bank's projections still put inflation ending this year at

3%, while revising growth target up to 1.6%.

Asian central banks may find more room to ease policy going forward.

Rate-setter in China will likely opt to ease policy further as economic data

weakens and as stock market begins to struggle.

"To be sure, these measures should be incremental, as policymakers don't need

major stimulus to reach the 5% GDP target. In our view, they … won't want to

overachieve it, either," said Macquarie.

Nonetheless, analysts largely expect the yuan to strengthen to 7 by the end

of this year as Beijing focuses on countering deflation and bolstering growth.

The Chinse currency has jumped since early April.

The share of the yuan in global foreign exchange reserves could rise well

beyond the current 2 percent level, according to a chief economist at US banking

giant Goldman Sach's China arm.

Outlier

The BOJ kept its policy rate steady at 0.5% on Friday, in line with the

forecast from a Reuters poll of economists. The decision came as core inflation

dipped to its lowest since November 2024 in August.

The so-called "core-core" inflation rate, which strips out prices of both

fresh food and energy, was at 3.3%, down from 3.4% in July. The reading has run

above the 2% target for several years.

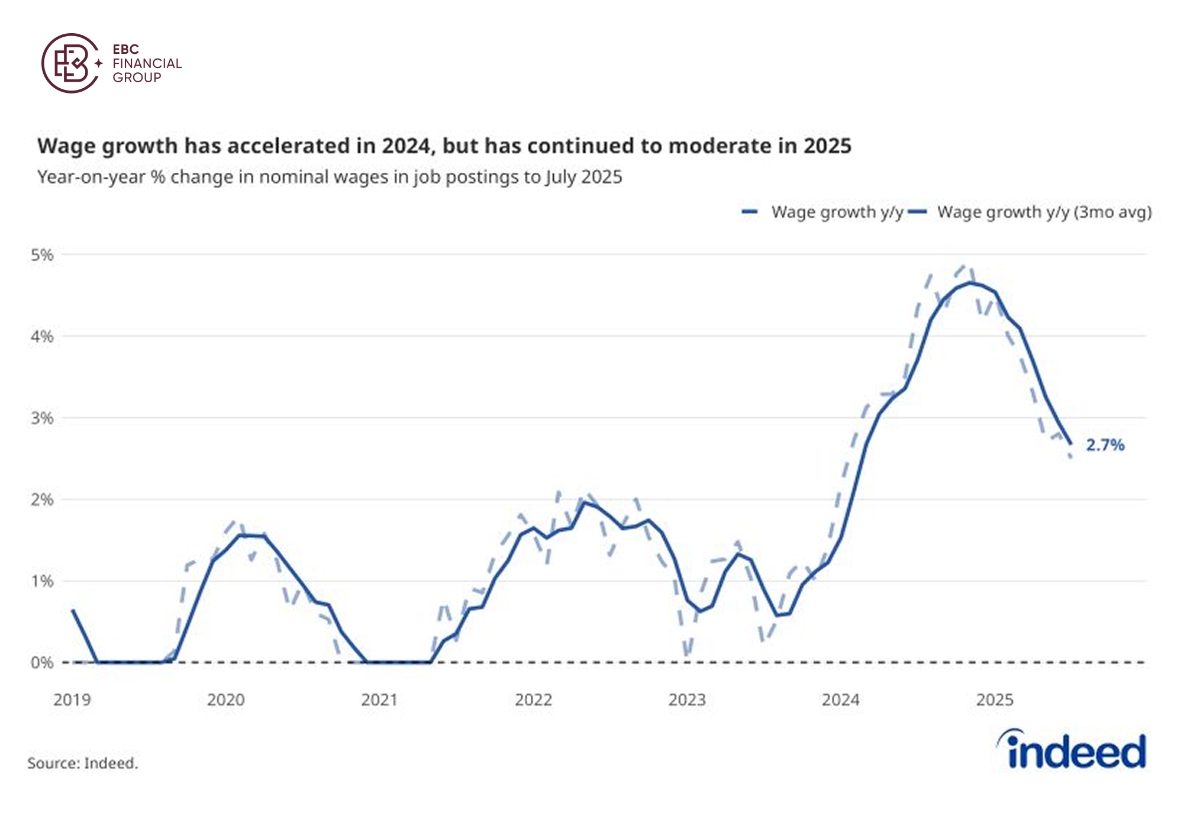

Real wages turned positive for the first time in seven months in July on the

back of hefty summertime bonuses, while consumer spending rose for the third

straight month, government data showed.

Policymakers will insist on QT even if Sanae Takaichi, a proponent of

aggressive monetary easing, becomes the next premier, former central bank

executive Tomoyuki Shimoda said on Thursday.

Japan's exports fell for a fourth straight month last month with

manufacturing sector hit by higher tariffs. The yen has appreciated against the

dollar by around 6% this year, adding to trade pressures.

Currency move has historically had a major impact on BOJ decisions. Its exit

from decades-long ultra-loose policy last year was partly due to the yen's

plunge to near two-decade lows.

RBC BlueBay has established a long position in the Japanese yen, noting that

the yen will approach 140 per dollar in the short term, with a medium-term fair

value near 135.

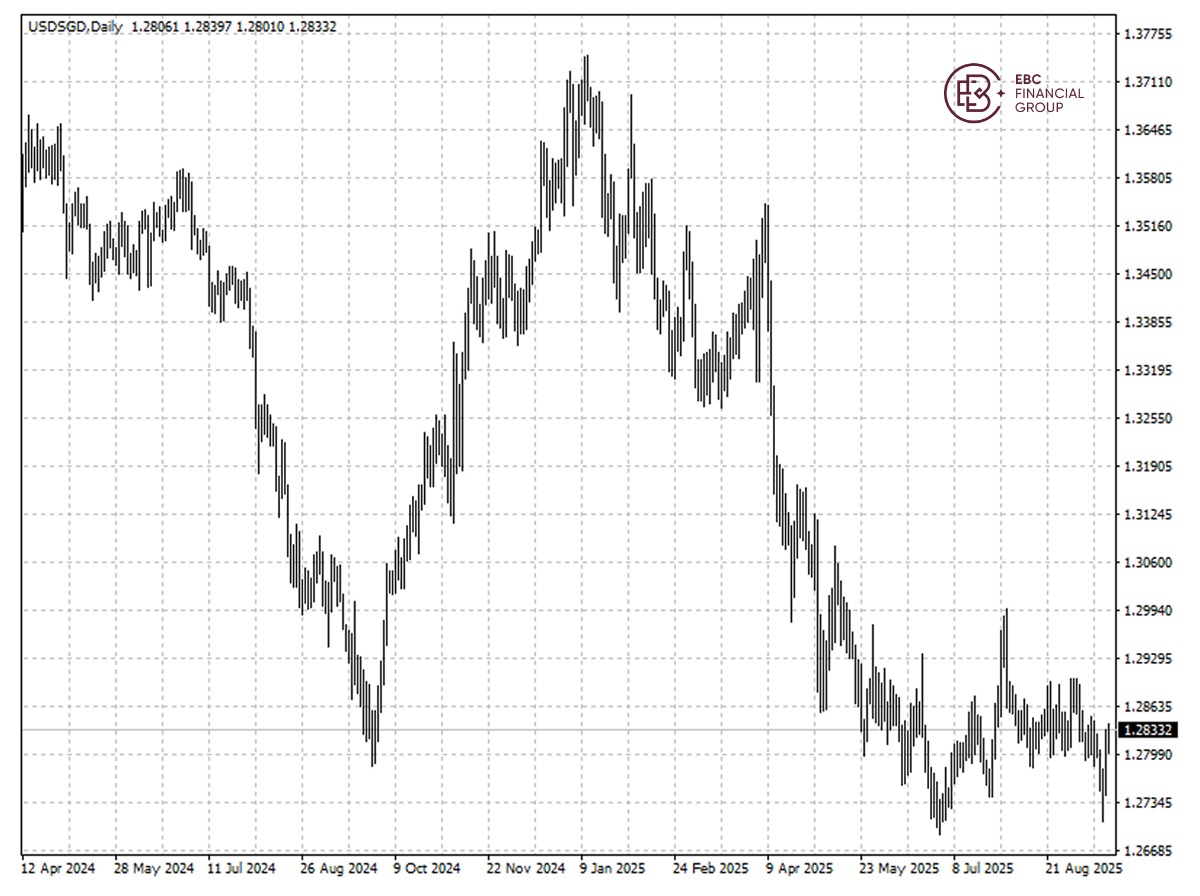

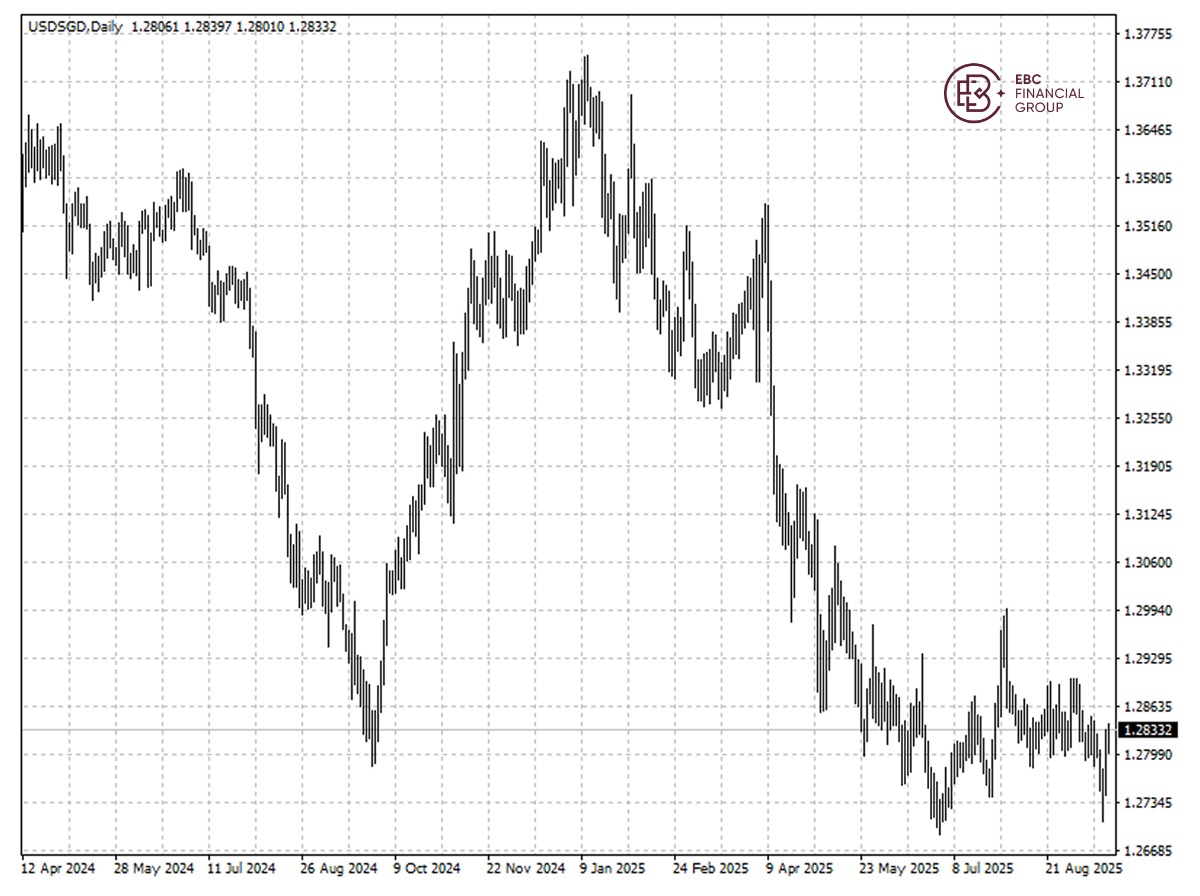

Quasi-safe-haven

Both the Swiss franc and gold are benefiting from the dollar's weakness and

growing safe-haven demand. Against the backdrop, there could be an alternative

in the making: the Singapore dollar.

There is a chance the Singapore dollar will strengthen to parity against its

US counterpart in the next five years to confirm its role as the "Swiss franc of

Asia", Jefferies Financial Group said in July.

Whereas Switzerland is likely to return to negative rates sooner rather than

later, Singapore's bond yields well above 1% still look attractive to

conservative money focused on wealth preservation.

Unlike most nations, Singapore does not use interest rates to manage its

currency, but instead strengthens or weakens the Singapore dollar against a

basket of its main trading partners in a policy band.

The exact exchange rate is not set, rather the Singaporean dollar can move

within the set policy band, whose precise levels are not disclosed. Similarly,

the SNB pegged the franc against the euro until January 2015.

Ministry of Trade and Industry announced this month that GDP is expected to

grow by 2.4% in 2025. The economy grew a faster-than-expected 4.3% in the

previous quarter, avoiding a technical recession.

What gets in the way of the Singaporean dollar's gains is uncertainty about

China-US trade talk. The government also may not welcome a sharp rise in the

currency in that it is reliant on exports the most among developed

countries.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.