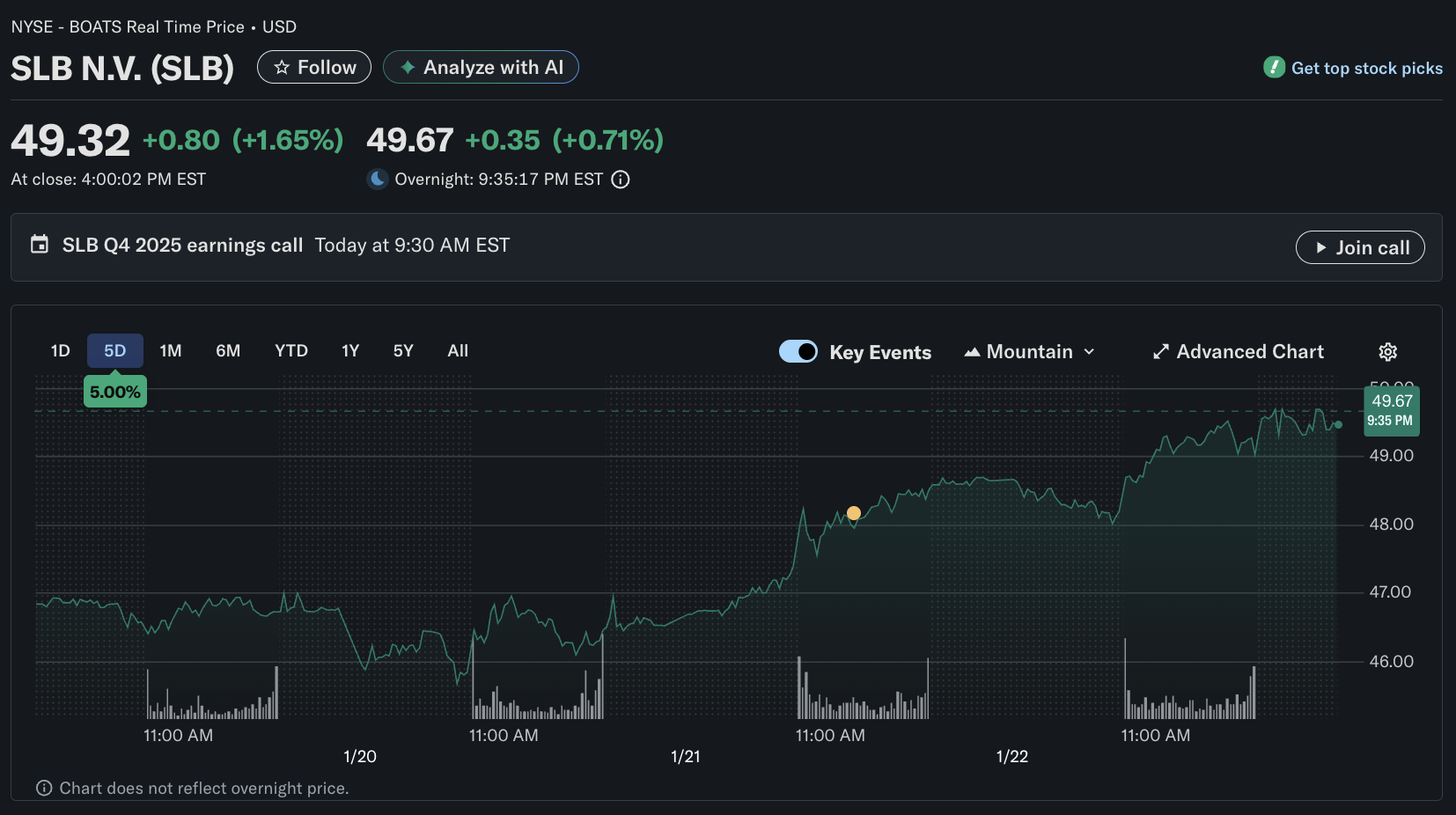

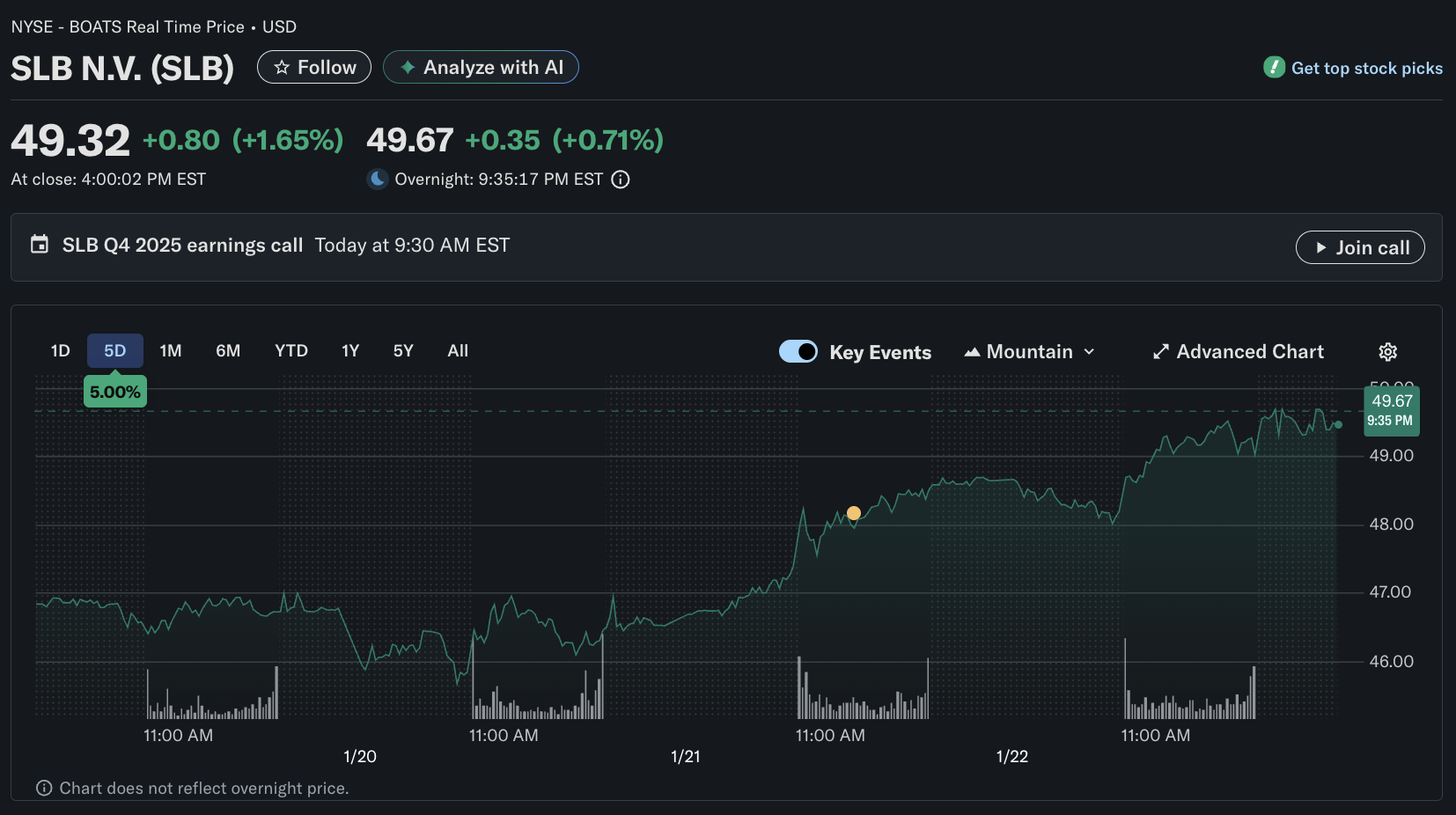

SLB stock enters late January with a rare mix of momentum and macro uncertainty. Shares closed at $49.32 on January 22, 2026, after a sharp rally that has pulled the stock far above its major moving averages and pushed RSI to about 80, a level that often signals crowded positioning rather than fresh value.

The next confirmed catalyst is SLB earnings on January 23, 2026 (before market open), where guidance and cash-return priorities matter as much as the headline beat or miss.

The timing is awkward for oilfield services. Crude prices have sagged toward the high-$50s to low-$60s area in January, while US drilling activity remains soft, with US rigs at 544 in the latest weekly count and oil rigs near 410.

The market is forcing investors to separate durable international and production-linked demand from cyclical North America exposure, and to decide whether the latest upside narrative is an earnings-driven rerating or a policy-driven spike that can fade just as quickly.

What Time Is SLB's Earnings Report Today

SLB will release fourth-quarter and full-year 2025 results before the US market opens on Friday, January 23, 2026, followed by a conference call at 9:30 a.m. Eastern Time.

Results release: Pre-market (US), January 23, 2026

Conference call: 9:30 a.m. ET

That timing matters. The first complete reaction often begins pre-market and then gets "validated" or reversed once regular liquidity arrives, especially for a stock sitting at a new high.

SLB Stock Set Up For January 2026 Earnings

From a trading standpoint, the numbers tell the story. SLB stock rose roughly 23% from the January 2 close to January 22, and about 29% from December 31 to January 22. Volume also spiked on several up-days, suggesting institutional participation rather than a retail-only burst.

That matters because oilfield services rallies typically need follow-through from two sources: (1) a precise inflection in upstream spending or pricing power, and (2) earnings visibility that convinces investors the cycle is not rolling over. Today, the first leg is mixed. The US rig count is not accelerating, and the oil price backdrop is not signaling scarcity.

The second leg depends on whether management can show that production-adjacent demand and international resilience offset North American softness. At the same time, integration synergies lift margins even amid a choppy commodity tape.

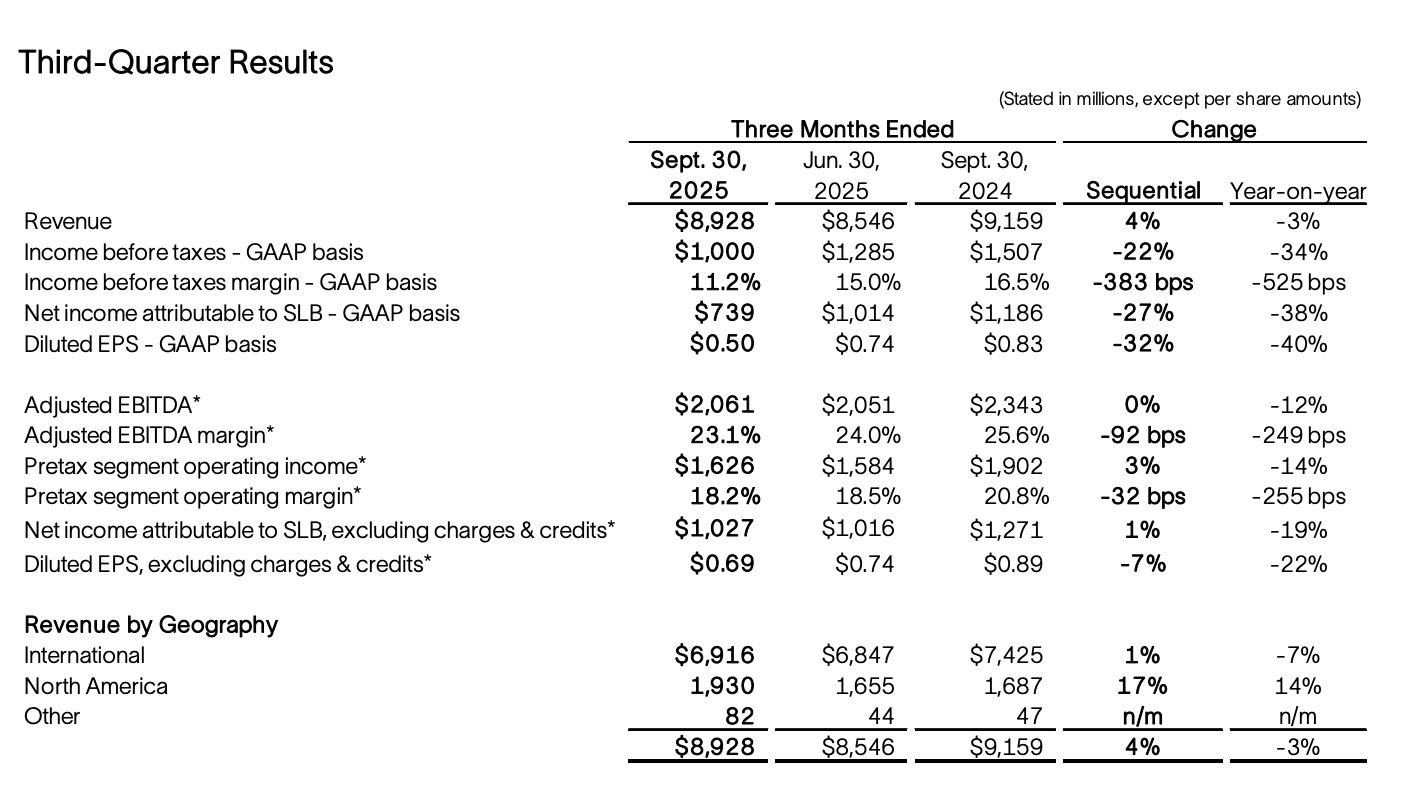

Recent Performance Versus The Q4 Bar

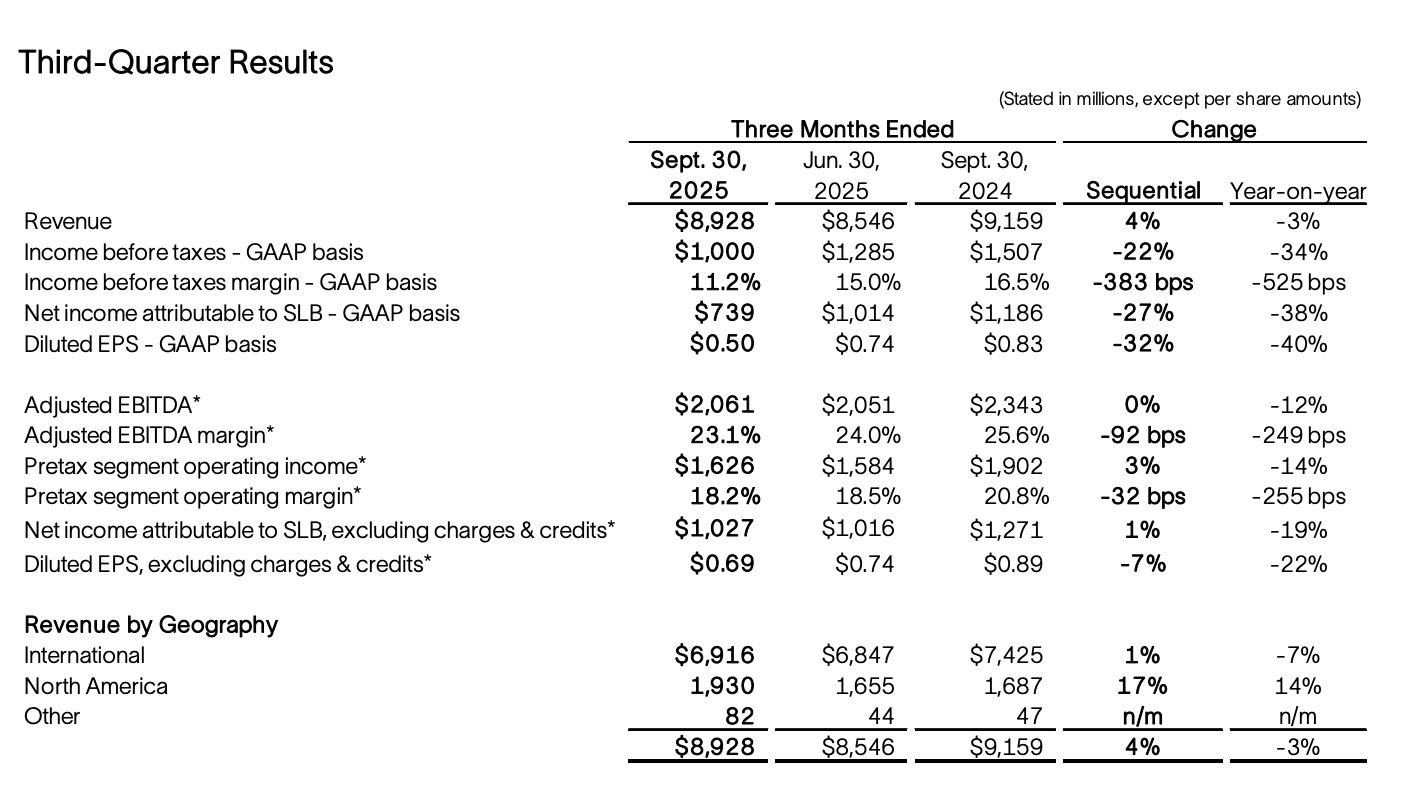

| Metric |

Q2 2025 (Actual) |

Q3 2025 (Actual) |

Q4 2025 (Consensus) |

| Revenue |

$8.55B |

$8.93B |

$9.54B |

| EPS (ex charges/credits) |

$0.74 |

$0.69 |

$0.74 |

| Adjusted EBITDA |

$2.05B |

$2.06B |

n/a |

| Free cash flow |

$0.62B |

$1.10B |

n/a |

Q2 and Q3 show a pattern that has frustrated investors: revenue stability, but profit sensitivity to mix and pricing. Q4'sQ4's setup implies revenue growth but demands cleaner incremental margins to justify the stock's January move.

What SLB Earning Results Will Move SLB Stock Today

1) Guidance that validates the breakout, or caps it

Because the stock has already repriced, guidance is likely to drive the first clean directional move. Investors will look for management language that implies confidence in international operations, pricing discipline, and stable conversion to free cash flow in a roughly $60 WTI environment.

2) Margin and conversion, not just revenue growth

With consensus targeting $9.54B in quarterly revenue, the question is how much of that translates into operating leverage. If the quarter shows that mix or costs are eroding incremental margins, the market can quickly rerate the stock even on a nominal beat.

3) ChampionX integration execution

The ChampionX deal is not just about scale. It is about mix, margins, and resilience. Management expects annual pretax synergies of about $400 million within three years, and has explicitly framed 70–80 percent of that synergyrealization as a 2026 story rather than a distant aspiration.

Investors will listen for evidence of procurement savings, footprint rationalization, back-office consolidation, and early cross-selling across production chemicals and artificial lift.

4) International strength versus North America's softness

With U.S. oil rigs still at 410 in the latest weekly count, the burden of " growth with quality" falls heavily on international and offshore activity rather than a shale rebound. Any hint that international is slowing can compress the multiple quickly, because it attacks the stabilizer investors are paying for.

5) Capital returns and balance sheet posture

SLB's valuation framework increasingly depends on disciplined cash return alongside execution. Investors will want clarity on the pace of buybacks relative to integration costs and working-capital needs, especially now that the stock trades at ~16.6x forward P/E rather than a "cheap-cycle" multiple.

6) Event-driven optionality, especially on geopolitics

Oilfield services can trade on policy optionality faster than they can realize the revenue. In that world, management's tone on timing, contract visibility, and receivables discipline matters because it distinguishes real backlog from headline beta. With Brent near the mid-$60s, the market's tolerance for "someday upside" is lower than it was in $80 oil.

Venezuela Optionality: Real Upside, Real Timeline Risk

SLB stock has been pulled higher by the prospect of Venezuela reopening trade. The narrative is straightforward: if sanctions ease and infrastructure investment returns, oilfield services companies could see incremental work that is both urgent and equipment-intensive.

Recent reporting has highlighted policy shifts and reform signals that have revived investor attention, even as the on-the-ground investment case remains complex.

Two constraints matter for pricing this optionality:

Speed: Even if policy barriers fall, mobilizing equipment, re-staffing operations, and securing payment mechanisms takes time.

Scale versus expectations: Venezuela can move sentiment more than near-term earnings. The market can price " future backlog" instantly, while reported revenue arrives over quarters.

For SLB, the bullish case is that Venezuela becomes a high-return pocket of work that complements international strength. The bearish case is that the trade becomes a headline-driven premium that fades if timelines slip. In the current tape, the risk is not that Venezuela does nothing, but that the stock already discounts a best-case path.

Recent Performance of SLB stock: 1 week, 1 month, 1 year

| Timeframe |

Reported performance |

What it tells you |

| 1W |

+5.9% (January 15 close $46.57 → January 22 close $49.32) |

A late-stage push into earnings; expectations are elevated. |

| 1M |

+28.7% (December 22 close $38.33 → January 22 close $49.32) |

The market has materially repriced the 2026 narrative in weeks. |

| 1Y |

+16.7% |

SLB is outperforming its own recent baseline, but the current leg is unusually steep. |

SLB earnings expectations: What Street is looking for

| Item |

Market expectations for Q4 2025 |

Prior quarter (Q3 2025 actual) |

| Revenue |

$9.54B |

$8.93B |

| EPS (normalized) |

$0.74 |

$0.69 |

Those numbers frame the event, but they do not decide it. If SLB lands near expectations, the stock reaction typically hinges on whether guidance supports continued margin progress and whether management can point to tangible ChampionX synergy capture in 2026.

How Big A Move Are Traders Already Making

Options-based " expected move" estimates indicate the market is pricing roughly a 3.1 percent swing around the earnings event.

Using the $49.32 close from January 22, a 3.1 percent move translates to about $1.53.

| Measure |

Approximate value |

| 3.1% of $49.32 |

$1.53 |

| Implied downside band |

$47.79 |

| Implied upside band |

$50.85 |

Note: This is not a forecast. It is a translation of implied volatility into price space, a helpful reminder that nuance in guidance can matter more than the headline EPS.

SLB Stock Technical Analysis

| Indicator / Level |

Latest value |

Signal / comment |

| RSI (14) |

78.656 |

Overbought conditions; risk of a “sell the news” pullback rises if guidance is merely in-line. |

| MACD |

0.680 |

Positive momentum; trend remains constructive into the print. |

| MA20 (simple) |

48.02 |

Price above trend support; first area the market often tests after an earnings gap. |

| MA50 (simple) |

47.12 |

Medium-term uptrend support; a break below would change post-earnings tone. |

| MA200 (simple) |

41.83 |

Long-term structure remains bullish while price stays well above. |

Support And Resistance Zones To Watch

Immediate support

$49.12–$49.02: Classic pivot support band that often acts as the first "hold or slip" area after a volatile open.

$48.54: The prior session low; a clean break below can accelerate mean reversion.

$47.12–$48.02: Confluence zone around MA50/MA20; a decisive failure would imply the breakout needs time to rebuild.

Resistance and upside targets

$49.58: The fresh high; a quick reclaim after a dip would signal buyers still control the tape.

$49.68–$49.79: Upper pivot resistance bands that often cap the first post-earnings impulse unless guidance is clearly upside.

~$50.85: The options-implied "event band" on a strong upside surprise.

Frequently Asked Questions (FAQ)

1) When are SLB earnings, and when is the call?

SLB will release Q4 and full-year 2025 results before the market opens on January 23, 2026, followed by a conference call at 9:30 a.m. ET. The timing concentrates reaction into pre-market liquidity and the opening hour.

2) What are analysts expecting for SLB earnings?

Consensus expectations center on $0.74 normalized EPS and $9.54B revenue for Q4 2025. With the stock already at a new high, the market focus shifts to guidance, margins, and cash-return confidence rather than a small beat.

3) Why does ChampionX matter so much for SLB stock in 2026?

ChampionX expands SLB's production-linked exposure and adds a synergy lever that management pegs at ~$400M annual pretax within three years, with most targeted for 2026. Early execution signals can support multiple even if oil stays range-bound.

4) How much could SLB stock move after earnings?

Options-based estimates imply a 3.1 percent move around the event. That is meaningful but not extreme, which often means the "direction" depends on whether guidance meaningfully changes 2026 expectations rather than on the quarterly EPS alone.

5) Does US activity matter if SLB is more international?

Yes, but differently. SLB's international footprint reduces pure shale dependence, yet US activity still shapes sentiment and short-cycle service pricing across the sector. With U.S. oil rigs at 410 in the latest weekly data, the market is less likely to reward a thesis built on a near-term shale rebound.

Conclusion

SLB stock is entering January 23 with momentum, elevated expectations, and a valuation that requires confirmation. The quarter's consensus targets are clear, but the decision variable is not the headline EPS. It is whether management can credibly defend 2026 earnings quality through margin conversion, measurable ChampionX synergy capture, and disciplined cash returns, even with crude prices sitting near $60 and US drilling signals still muted.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

1. SLB Q3 2025 Earnings

2. SLB Acquisition of ChampionX