In the world of trading, a common term you'll come across is market capitalisation, or simply market cap. It's a basic yet powerful tool used to assess the size and value of a publicly traded company. Whether you're a beginner trader or just trying to understand financial news better, getting to grips with market cap is an important step. It offers clarity when comparing companies and gauging their potential risks and rewards.

What is Market Capitalisation?

At its core, market capitalisation is the total market value of a company's outstanding shares of stock. It gives an indication of what the stock market believes a company is worth at any given time. When traders talk about how "big" a company is, they're often referring not to the number of employees or the amount of revenue, but to its market cap.

This metric is especially useful because it standardises size across companies of different industries and sectors. A technology firm and a utility company may operate entirely differently, but their market caps can still be compared side by side to assess their presence in the broader market.

How is Market Cap Calculated?

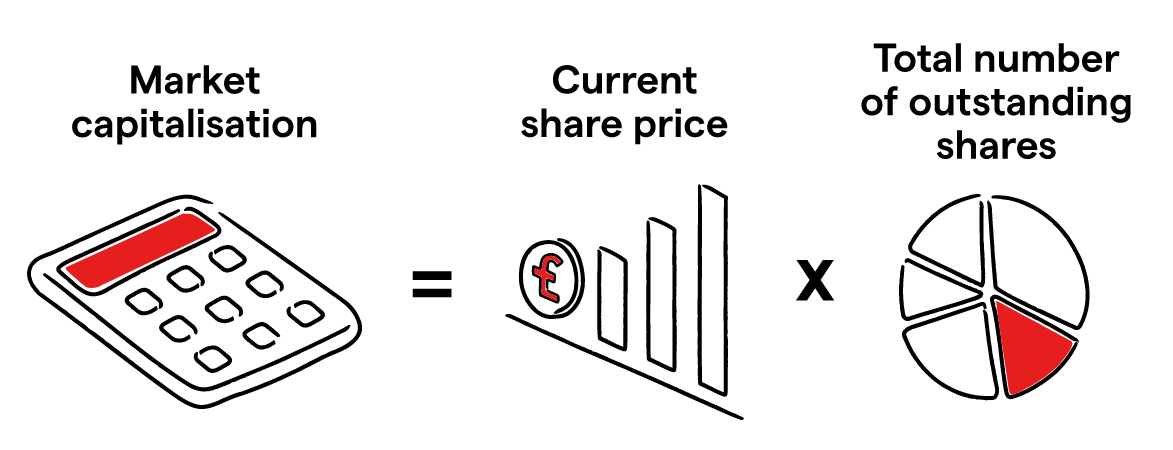

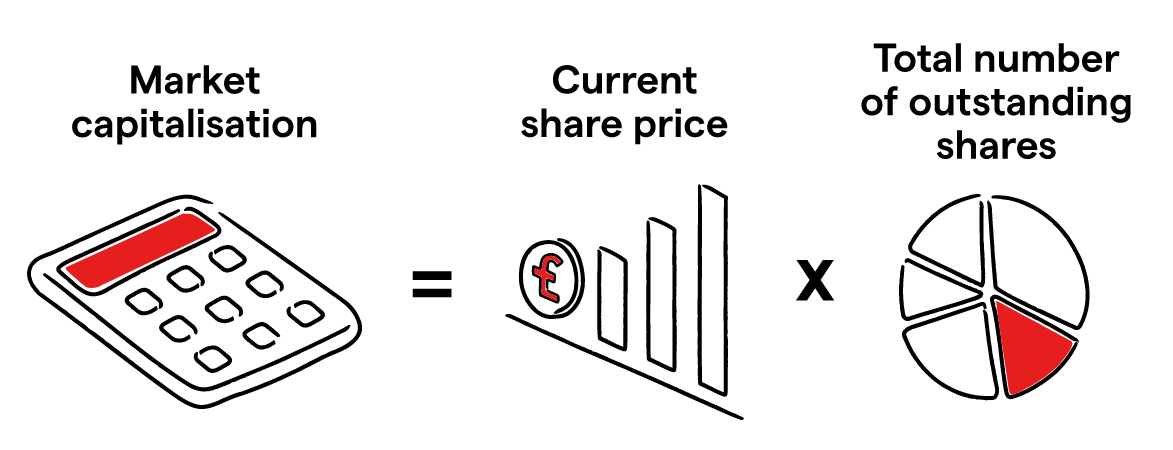

The calculation itself is straightforward. Market cap is determined by multiplying the current market price of a single share by the total number of outstanding shares. So, the formula is:

Market Capitalisation = Share Price × Total Outstanding Shares

For instance, if a company has 10 million shares in circulation and each share is priced at £50. the company's market cap would be £500 million. This figure fluctuates daily based on changes in the share price, making it a dynamic reflection of how the market views the company's value at that time.

It's important to note that this figure doesn't reflect how much a company is worth in terms of its assets, revenue or profits. Instead, it captures the market's perception, which can be influenced by a range of factors, from financial results and growth potential to trader sentiment and macroeconomic trends.

Why is Market Cap Important?

Understanding market cap helps traders place companies into broad categories, which can significantly influence investment strategy. It serves as a shorthand for gauging risk, stability, and growth potential.

Typically, larger companies – those with high market caps – are seen as more stable and less volatile. These are often well-established businesses with predictable earnings and a broad market presence. On the other hand, smaller companies may be in earlier stages of growth, offering greater potential for rapid expansion but also carrying higher risk.

Market cap also plays a role in how companies are weighted in stock market indices. For example, in the FTSE 100 or S&P 500. companies with higher market caps have more influence over the index's movements. For traders using passive funds that track these indices, this can directly affect the composition and performance of their portfolios.

Market Cap vs. Enterprise Value: What's the Difference?

While market cap is useful for understanding a company's size, it doesn't paint the full financial picture. That's where enterprise value (EV) comes in. EV gives a more comprehensive view by taking into account not just the market cap, but also the company's debt, cash reserves, and other liabilities.

The formula for enterprise value is:

EV = Market Cap + Total Debt – Cash and Cash Equivalents

This is particularly useful in comparing companies that might be similar in market cap but have very different financial structures. For example, two firms might each have a market cap of £1 billion, but if one has £500 million in debt and the other is debt-free, their enterprise values – and risk profiles – will differ considerably.

For traders looking to assess acquisition targets or get a deeper view of a company's valuation beyond its share price, enterprise value is often a more insightful metric than market cap alone.

Examples of Companies by Market Cap (Large, Mid, Small-Cap)

To put the theory into context, let's look at real-world examples across the market cap spectrum.

At the top of the scale, we have Apple Inc., a clear example of a large-cap company. With a market cap well above $2 trillion, it's considered one of the most valuable companies in the world. Large-cap firms like Apple, Microsoft, or Nestlé tend to be mature, financially sound, and widely followed by analysts.

Moving to the mid-cap category, companies such as Shopify or ASOS offer a balance between growth and stability. These businesses often operate in expanding markets and still have room for significant growth, but they're usually more established than small-cap firms.

Finally, small-cap companies include emerging startups and niche players, often trading on secondary exchanges or just starting to gain traction. These firms might be innovators or disruptors in their industries, but they typically experience higher volatility and greater uncertainty. Traders in small-caps often hope to identify the next big winner early, though the risks are notably higher.

Conclusion

Market capitalisation is more than just a number. It's a useful framework for thinking about company size, assessing investment risks, and shaping a diversified portfolio. While it doesn't tell the full financial story, it's an essential starting point for evaluating companies in the stock market. By understanding how market cap works and what it signals, traders can make smarter, more informed decisions in building and managing their investments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.