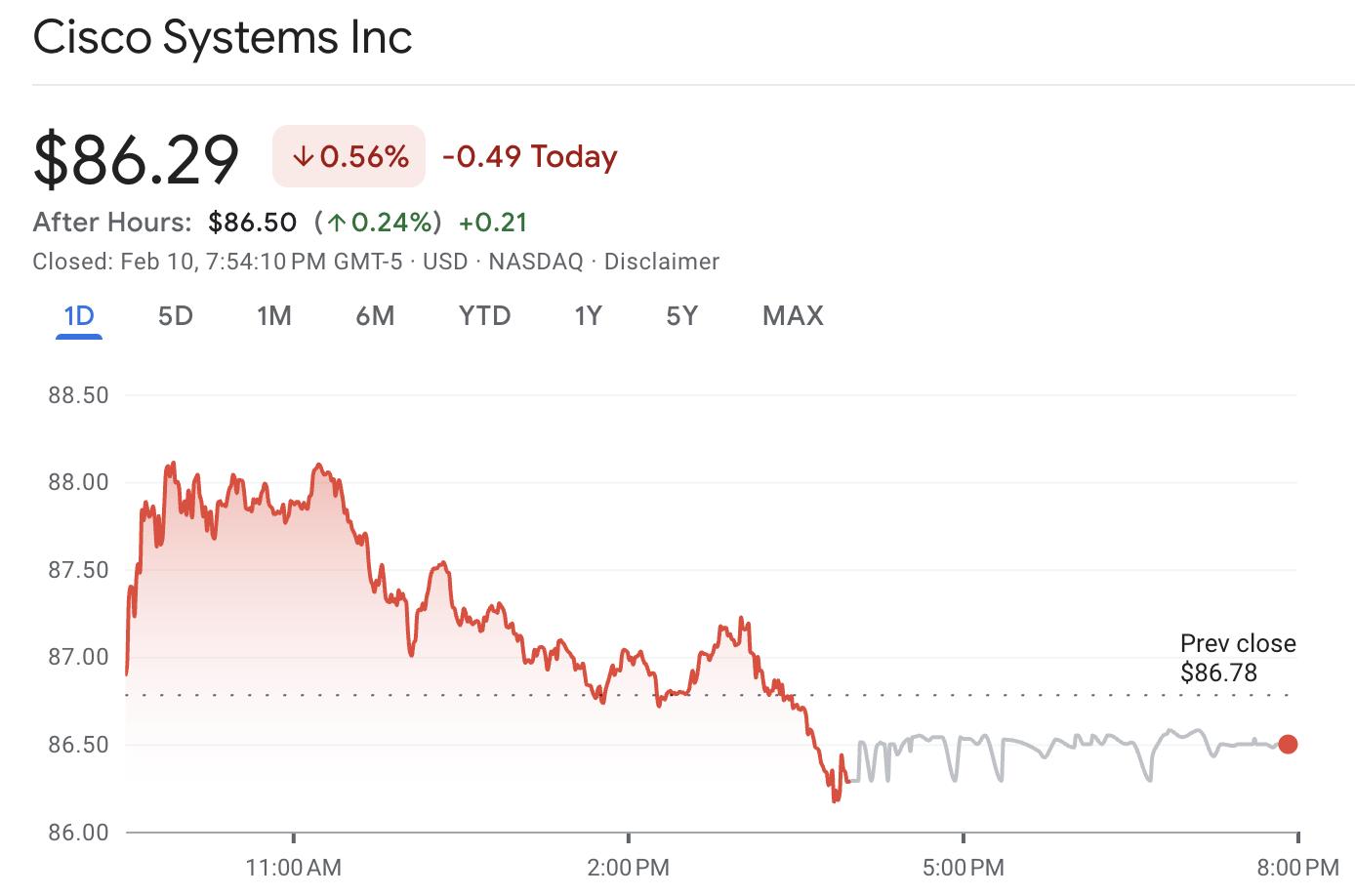

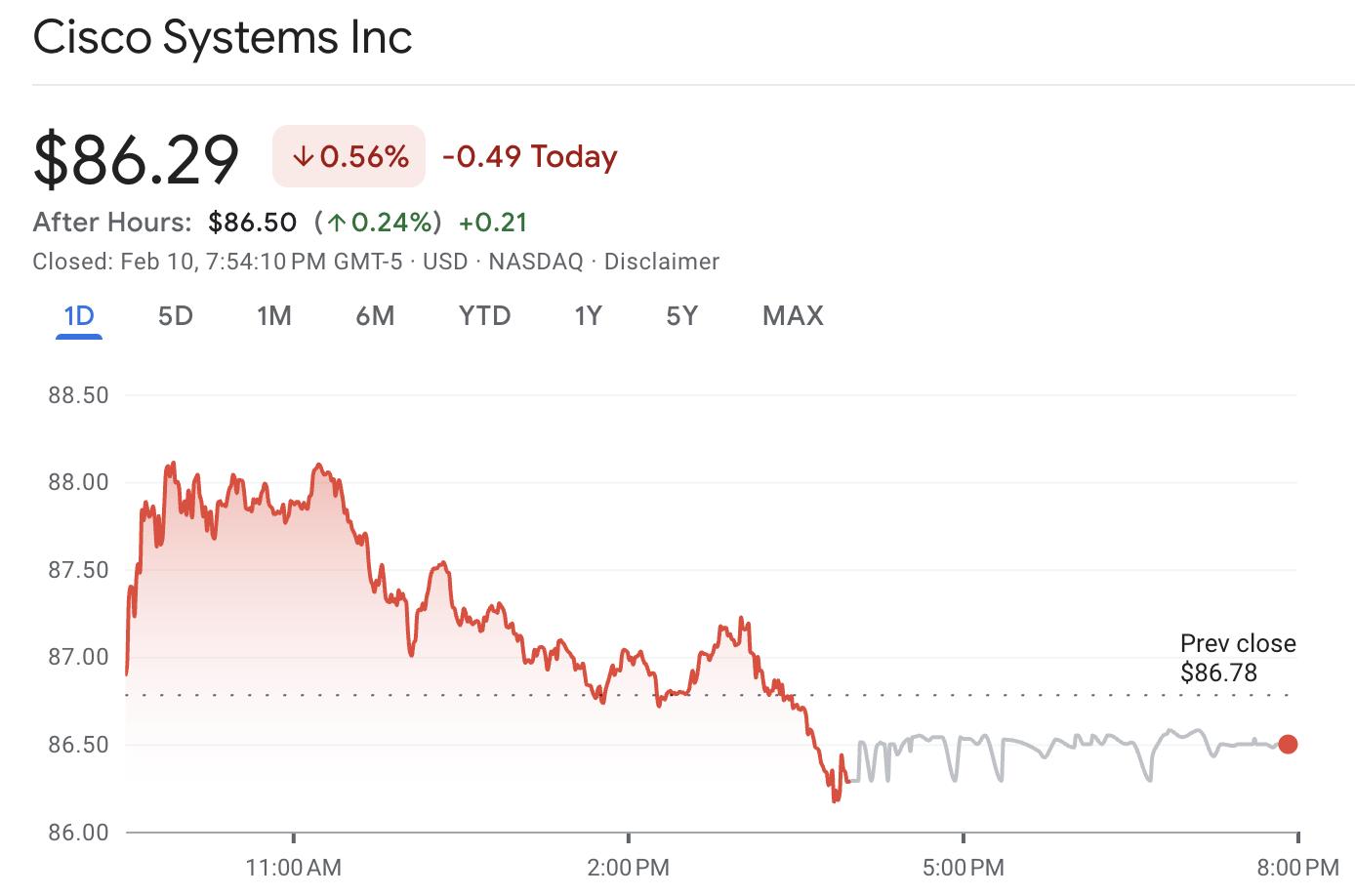

Cisco will report earnings today after the market closes, and the situation is atypical. CSCO enters earnings with strong momentum. The stock is trading near $86, close to its 52-week high, and the options market anticipates a larger-than-normal post-earnings move of approximately 5.97%.

This combination is significant because it raises expectations. When a stock is already elevated, simply exceeding estimates may not suffice. Traders typically look for consistent demand, strong order flow, and stable guidance to support continued positive momentum.

Below is a comprehensive pre-earnings overview, including the latest Q2 forecast range, key figures likely to influence initial trading, and a detailed CSCO technical analysis with relevant levels and indicators.

Cisco Earnings Preview: Time, Quarter, and the Q2 Forecast

CSCO reports after the market close on Wednesday, February 11, 2026, with the conference call scheduled for 1:30 PM PT. The results cover the quarter ending Saturday, January 24, 2026.

| Metric (Q2 FY26) |

Cisco guidance |

Midpoint |

Market consensus (approx.) |

| Revenue |

$15.0B to $15.2B |

$15.1B |

$15.12B |

| Non-GAAP EPS |

$1.01 to $1.03 |

$1.02 |

$1.02 |

Cisco Q2 Forecast

Cisco's own guidance for Q2 FY26:

Street consensus sits close to the midpoint:

Key Takeaway

Estimates are clustered close to guidance. That usually shifts attention away from the headline beat and straight into:

Forward guide

Order tone

Backlog durability

The Three Numbers Most Likely to Move CSCO After Earnings

1) Guidance

As current expectations meet the midpoint of the company's prior guidance, the market will prioritize the forthcoming guidance over last quarter's results.

In the previous report, CSCO guided Q2 revenue to $15.0B to $15.2B and non-GAAP EPS to $1.01 to $1.03.

The key question is whether management will raise, maintain, or lower its guidance, as even minor changes can significantly impact the stock price when it is trading near its peak.

2) Backlog and Contract Visibility (RPO)

Backlog is a key indicator of confidence. At the end of the October quarter, remaining performance obligations totalled $42.9 billion, up 7% year over year.

Product RPO also increased by 10%, with long-term product RPO reaching $11.8 billion, which is a 13% increase.

A useful metric is RPO coverage:

Dividing RPO of $42.9 billion by the quarterly revenue guidance midpoint of approximately $15.1 billion yields a coverage ratio of about 2.84 times.

This metric does not predict quarterly results, but it indicates whether visibility is improving or declining. If management signals slowing RPO growth, the market may quickly re-rate the stock.

3) Margins

CSCO's prior guidance implies stable profitability (non-GAAP gross margin of 67.5%–68.5% and operating margin of 33.5%–34.5%).

Management also flagged that margin and EPS guidance include estimated impacts tied to trade policy.

Traders will look for clear indications regarding:

whether cost pressures are easing

whether pricing is holding

whether the product mix is leaning toward higher-margin software and services

Will the New AI Networking Hardware and Systems Affect Cisco Earnings?

Yes. Just before the earnings report, CSCO announced new AI networking hardware and systems designed to support very large AI clusters. They highlighted claims of improved performance and energy efficiency, stating that the new platform will be shipped this year.

For traders, this matters for one reason: it raises expectations that demand isn't just "steady"; it's expanding into a new upgrade cycle. If the earnings call tone doesn't match that narrative, the stock can fade even on a beat.

What the Options Market Is Pricing for CSCO?

One widely-circulated estimate going into this print is about a 5.97% move in either direction.

Using the latest close near $86.29, that implies roughly:

Here's what makes that interesting:

In short, options are pricing a move big enough to either retest last week's lows or break into new highs.

CSCO Technical Analysis (Daily): Trend Is Up, but Momentum Is Stretched

| Indicator |

Value |

Interpretation for traders |

| Last price |

$86.29 |

Trading near the top of the recent range |

| RSI (14) |

73.08 |

Momentum is strong, but stretched (overbought zone) |

| ATR (14) |

$1.95 |

Typical daily swing about 2.3%

|

| 20-day SMA (derived) |

$78.64 |

Price about 9.73% above, trend is extended |

| 50-day SMA (derived) |

$77.74 |

Price about 11.00% above, strong intermediate trend |

| 200-day SMA (derived) |

$70.27 |

Price about 22.79% above, long-term uptrend intact |

| 52-week high / low |

$88.19 / $52.11 |

Stock is ~2% below highs after a big 12-month run |

| Avg daily volume |

~22.23M |

Liquidity is strong; earnings can still gap hard |

CSCO is experiencing a strong uptrend; however, it is also above key averages, which increases the likelihood of sharp pullbacks in case of any disappointment.

This is not necessarily bearish, but it does mean earnings reaction risk is higher since much of the good news is already reflected in the stock price.

Support and Resistance

| Level type |

Zone |

Why traders care |

| Resistance |

$88.19 |

52-week high area; breakout level |

| Resistance |

$91.44 |

Rough upside edge of a ~6% earnings move |

| Support |

$84.80–$85.00 |

Near-term pullback area from recent closes |

| Support |

$82.00–$83.00 |

Prior consolidation zone; failure here changes the tone |

| Support |

$78.64 |

20-day average; a deeper reset without breaking the uptrend |

Summary

Uptrend is clean (price above 20/50/200-day averages), but momentum is hot enough that earnings need to "feed" the trend to keep pushing higher.

Frequently Asked Questions (FAQ)

What Time Are Cisco Earnings Today?

Cisco reports after the market close on February 11, 2026, with the conference call set for 1:30 PM PT (4:30 PM ET). The report covers the quarter ending January 24, 2026.

What Are the Q2 Forecasts for Cisco?

Cisco guided $15.0B to $15.2B revenue and $1.01 to $1.03 non-GAAP EPS. Street consensus sits around $15.12B revenue and $1.02 non-GAAP EPS.

What Move Is the Options Market Pricing for CSCO?

About 5.97% up or down, which is roughly $81.14 to $91.44 based on the latest close near $86.29.

Why Does CSCO Guidance Matter More Than the Headline Beat?

Because CSCO is already up strongly into the event, the market often rewards higher forward confidence, not just a small Q2 beat.

Conclusion

In conclusion, the setup into Cisco earnings today is bullish, but it's also crowded. CSCO is near its highs with overbought momentum, and the options market is pricing about a 6% move.

The first reaction will likely be about guidance, with backlog visibility and margin tone deciding whether a pop holds or fades.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.