Hedging in forex means taking one or more positions that offset potential losses from another trade, allowing traders to reduce exposure to market volatility. In simple terms, it's a way to protect your capital when currency prices move unpredictably.

In today's fast-moving forex markets, even skilled traders face unexpected swings triggered by interest rate shifts, geopolitical tensions, or economic data releases. Hedging provides a disciplined approach to navigate such uncertainty by managing risk rather than chasing returns.

This article breaks down the full meaning of hedging in forex, explains how it works, introduces key strategies used by professionals, and highlights both the benefits and limitations of using hedging as a risk-control tool in modern trading.

What hedging actually means in Forex

If you already hold a position or expect a cash flow in a foreign currency, a hedge is an additional position or contract intended to reduce the financial impact of an unfavourable currency move.

The goal is protection, not profit, although some hedges can produce gains as a by-product.

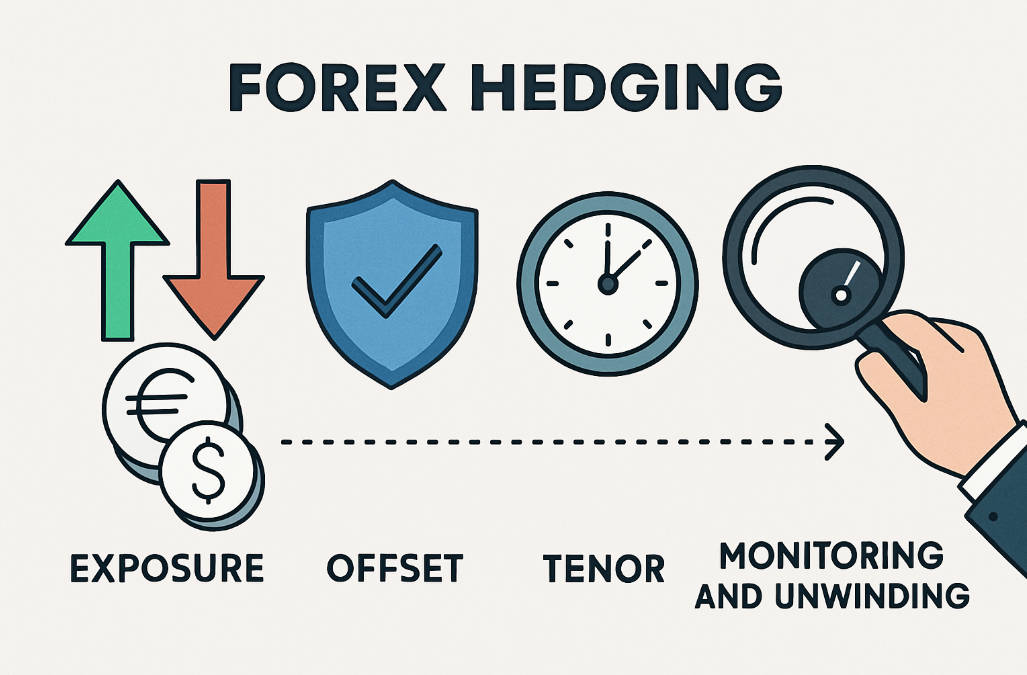

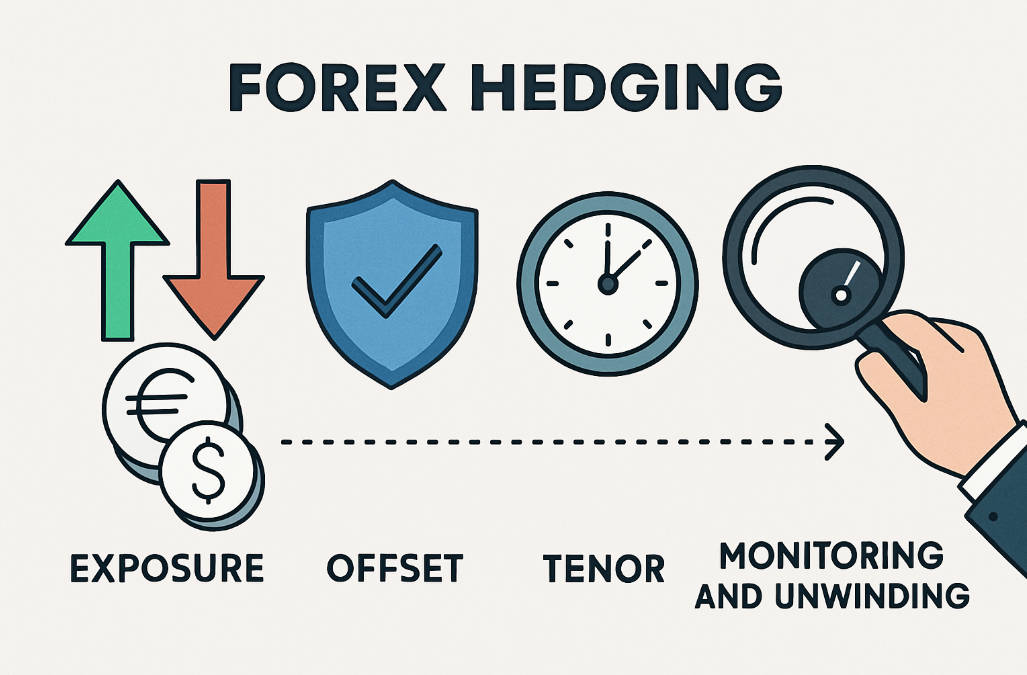

How hedging works — the simple mechanics

1) Identify exposure.

That might be an existing long position in EUR/USD, an expected payment in USD next month, or foreign revenues that the company will receive.

2) Choose an offset.

For a long position you typically take a short hedge (or buy a put option). For an expected receipt in a foreign currency you might sell that currency forward.

3) Select tenor and size.

Decide how long you need protection and whether to hedge fully or partially.

4) Monitor and unwind.

Market conditions, correlation and cost all matter — you close or adjust the hedge when the risk has passed or the hedge becomes inefficient.

Main hedging methods at a glance

Main Types of Hedging Strategies in Forex Trading

| Method |

What it does |

Typical user / use case |

| Spot + opposite trade (direct/same-pair) |

Open an opposing trade in the same currency pair (e.g., long EUR/USD + short EUR/USD) to offset risk immediately. |

Short-term traders who want immediate offset. |

| Cross-pair (correlation) hedge |

Use a different but correlated currency pair to offset exposure (e.g., hedge EUR/USD with GBP/USD). |

Traders using relationships between pairs; may reduce cost vs direct hedges. |

| Forward contracts / futures |

Lock an exchange rate for a future date (forwards are OTC; futures are exchange-traded). |

Corporates with known future cash flows or investors seeking simple rate certainty. |

| Options (puts / calls) |

Buy the right — but not the obligation — to exchange at a set rate. Offers downside protection while preserving upside. |

Companies or traders who want asymmetrical protection (pay a premium). |

| Swaps (currency swaps / cross-currency swaps) |

Exchange cash flows in two currencies over time, often used for long-term funding or interest exposure management. |

Corporates and institutions managing longer-term obligations. |

Notes:

Each approach has pros and cons — forwards give certainty but no upside; options cost a premium but keep upside; cross-pair hedges rely on correlations that can change.

Benefits and drawbacks of hedging in Forex

Pros and Cons of Using Hedging in Forex Markets

| Benefits |

Drawbacks |

| Reduces downside risk and smooths cash flows |

Limits potential profits when markets move favourably |

| Reduces emotional decision-making in volatile events |

Direct transaction costs (spreads, commissions) and option premiums |

| Helps with budget planning and corporate forecasting |

Overnight/rollover (carry) costs and opportunity cost of capital |

| Can be tailored to time horizon and intensity of risk |

Hedging can be operationally complex and requires monitoring |

Implementing a hedging plan — step by step

Follow a disciplined process rather than ad-hoc trades.

Measure exposure clearly. Quantify currency amounts, timing and whether exposure is transactional (invoices, payroll) or translational (reporting of foreign assets).

Define objectives. Are you protecting profits, stabilising cash flow, or limiting balance-sheet translation risk? The objective determines instrument choice.

Choose method and tenor. Match the hedge to timing (short-term news event vs long-term revenue stream). Options suit a one-off event; forwards suit predictable receivables.

Calculate cost vs benefit. Include bid/ask spreads, commissions, rollover/swap charges (for leveraged spot/CFD positions) and option premiums. Only hedge if the expected benefit justifies the cost.

Set clear execution and exit rules. Pre-define triggers for unwinding: dates, profit/loss thresholds or changes in the underlying exposure.

Monitor correlations and market conditions. Correlations used for cross-pair hedges can break down — track them and be ready to adjust.

Broker and platform considerations — what to check

Before placing hedges, verify how your broker handles positions and what costs apply.

1) Hedging vs netting settings:

Some platforms operate a hedging model (where opposing positions remain open separately) and others net opposing trades into a single position.

If your broker nets by default, you cannot hold a long and short in the same pair as separate hedges — the positions will offset instead. Always confirm the platform model.

2) Margin and margin calls:

Hedging usually reduces market risk but can still consume margin — check margin rules for hedge positions.

3) Costs (rollover, spreads) and execution policy:

If you intend to hold hedges overnight, rollover/swap charges matter; for short-term hedges, execution speed and spread are important.

Example — EBC Financial Group:

EBC presents itself as a multi-entity broker with multiple regulated subsidiaries (UK FCA, Cayman CIMA, Australia ASIC and others) and offers trading on popular platforms (MT4/MT5) and CFD/forex trading.

Practical example — trader hedging ahead of a central-bank decision

A trader holds a long position of 100.000 EUR/USD before a European Central Bank (ECB) policy announcement due in three days. They fear that a dovish surprise could weaken the euro.

Identify exposure: 100.000 EUR long (spot).

Options: Buy an at-the-money EUR put option that expires one week after the event — this sets a floor for the rate while keeping upside. Cost is the option premium.

Direct hedge (alternative): Open a short EUR/USD position of partial size (e.g., 50.000) to limit downside while keeping some exposure to the upside. This approach has lower upfront cost but will require margin and could produce rollover costs if held longer.

Decision and monitoring: If ECB publishes as expected, close the hedge; if markets become more volatile, consider extending/rolling the option or adjusting hedge size.

Common mistakes and how to avoid them

1) Over-hedging:

Locking in too much protection removes any chance of profit and can be costly. Hedge what you need, not everything you fear.

2) Ignoring costs:

Rollover charges, wide spreads and option premiums add up — always model net outcomes.

3) Assuming correlations are permanent:

A cross-pair that was tightly correlated may diverge in stressed markets. Monitor correlations regularly.

4) No exit plan:

Failing to define when to unwind a hedge can lock in unnecessary costs or leave you over-protected after the risk fades.

Frequently Asked Questions (FAQ)

Q1. Is hedging the same as speculation?

No. Hedging seeks to reduce risk and limit losses; speculation seeks to profit from market moves. Hedging generally reduces potential profit in exchange for lower downside.

Q2. Can a hedge guarantee zero loss?

No — a well-constructed hedge can substantially reduce exposure, but nothing eliminates all risk. Imperfect hedges, correlation breakdowns and counterparty risks (in OTC instruments) mean residual risk remains.

Q3. Does hedging always cost money?

Yes in one way or another: direct hedges incur spreads/commissions and rollover costs; options require upfront premiums. Weigh these costs against the value of protection.

Q4. Should beginners hedge?

Beginners can benefit from learning basic risk management (stop-losses, position sizing) before using complex hedges. Simple partial hedges are sometimes useful, but complexity increases operational risk.

Q5. Do all brokers allow same-pair hedges?

No. Platform/account models differ: some allow independent opposing positions (hedging mode), while others automatically net opposing trades. Check your broker's policy before planning hedges.

Conclusion

Hedging in forex is a practical, widely used method to reduce currency risk. It comes in many forms — direct opposing trades, cross-pair hedges, forwards, options and swaps — and each has trade-offs in cost, complexity and effectiveness.

The most important rule is discipline: know your exposure, match the hedge to your need, account for costs, and confirm your broker's rules before you place the trade. When done thoughtfully, hedging moves currency risk from an unknown variable to a manageable, budgeted item.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.