Rare quarters and valuable quarters define what quarters are worth money through scarcity, intrinsic value, and enduring demand.

Quarters are twenty-five cent coins issued by the United States Mint and designed primarily for circulation. In everyday use, a quarter represents a fixed monetary value and little more.

Over time, however, changes in metal composition, minting volumes, and economic conditions have caused certain quarters to separate themselves from standard currency and enter the field of collectible and investment assets.

When analysts and collectors ask what quarters are worth money, they are not referring to modern clad coins still commonly found in circulation. Instead, they are examining valuable quarters supported by intrinsic or structural value and rare quarters whose worth is driven by scarcity and limited supply.

These coins no longer behave like currency. They behave like tangible assets governed by supply, demand, and market psychology.

What Quarters Are Worth Money in Today’s Market

From a financial perspective, quarters are worth money only when market forces override their face value. This occurs when supply becomes constrained, demand remains durable, or intrinsic worth exists independent of denomination.

A quarter becomes worth money when it contains precious metal, was produced in limited quantities, has a low survival rate, or maintains consistent demand across multiple economic cycles. Condition further amplifies value by reducing the number of acceptable examples available for trade.

These same principles govern commodities, fine art, and other alternative assets. Coins that satisfy more than one of these criteria tend to demonstrate stronger long-term price performance.

Quick Summary Of Valuable and Rare Quarters:

Washington Silver Quarters (1932-1964)

Standing Liberty Quarters (1916-1930)

Barber Quarters (1892-1916)

High-Condition Early Washington Quarters

Proof Quarters with Limited High-Grade Populations

1916 Standing Liberty Quarter

1932-D Washington Quarter

1932-S Washington Quarter

Draped Bust Quarters (1796-1807)

Capped Bust Quarters (1815-1838)

Mint Error Quarters

Valuable Quarters: Intrinsic Value and Market Stability

What Are Valuable Quarters

Valuable quarters are coins that consistently trade above face value because their worth is supported by tangible, repeatable characteristics. These quarters are widely recognized, actively traded, and easier to price due to established market benchmarks.

Rather than relying on extreme scarcity, valuable quarters derive strength from metal content, age, and condition. As a result, they tend to exhibit lower volatility and stronger liquidity than rare quarters.

List of Valuable Quarters and Why They Are Worth Money

1. Washington Silver Quarters (1932-1964)

Washington quarters minted between 1932 and 1964 are among the clearest examples of valuable quarters. Composed of ninety percent silver, these coins possess intrinsic value directly tied to precious metal markets.

Their worth increases during inflationary periods or times of currency uncertainty, as silver functions as a store of value. Because they are widely recognized and actively traded, Washington silver quarters remain liquid while gradually appreciating as supply diminishes.

At a minimum, the silver content alone provides a value floor; the melt value for a standard 1932- 1964 Washington silver quarter is around $11.50 based on current silver prices.

Beyond metal content, the full numismatic value depends on date, mint mark, and condition: lightly circulated common dates often trade in the $15-$100+ range, while well-preserved or better-grade coins (especially key dates such as 1932-D or 1932-S) can command hundreds or thousands of dollars at auction.

2. Standing Liberty Quarters (1916-1930)

Standing Liberty quarters are valuable due to their silver content, age, and historical significance. Although many were produced, heavy circulation reduced the number of high-quality survivors.

The typical market values for Standing Liberty quarters vary widely depending on date and condition: average condition examples of early issues like the 1916 quarter can range from roughly $5,000 to over $37,000 or more in uncirculated mint state.

Meanwhile, more common dates in circulated grades may range from around $20- $600 or higher for mid-tier graded coins, and superior certified high-grade specimens (especially key dates) can exceed $20,000- $40,000+ at auction.

Higher mint state examples, particularly at MS64-MS65 and above for key dates like 1916 or scarce varieties, can command prices well into the five-figure range.

As a result, condition plays a decisive role in pricing. Well-preserved examples command premiums even for common dates, reinforcing their status as valuable quarters rather than purely historical coins.

3. Barber Quarters (1892-1916)

Barber quarters maintain value through a combination of age, silver composition, and long-standing collector demand. While many dates in circulated grades may be modestly priced.

Barber quarters with key dates or strong condition can be worth significantly more; values for collectible issues can range from roughly $20–$500 for common mid-grade examples up to tens of thousands of dollars for high-grade or rare varieties such as 1896-S or 1913-S, and the most exceptional collector-grade pieces have historically approached six figures at auction

4. High-Condition Early Washington Quarters

Certain Washington quarters from the 1930s and early 1940s are notably valuable when preserved in mint-state condition because relatively few survive free from wear or surface damage; these high-grade survivors are consistently in demand from advanced collectors.

While common circulated examples of these dates often trade only modestly above intrinsic silver value, certified mint-state specimens from MS63 and above can command multiple hundreds to several thousand dollars or more depending on exact date, mint mark, and overall appeal

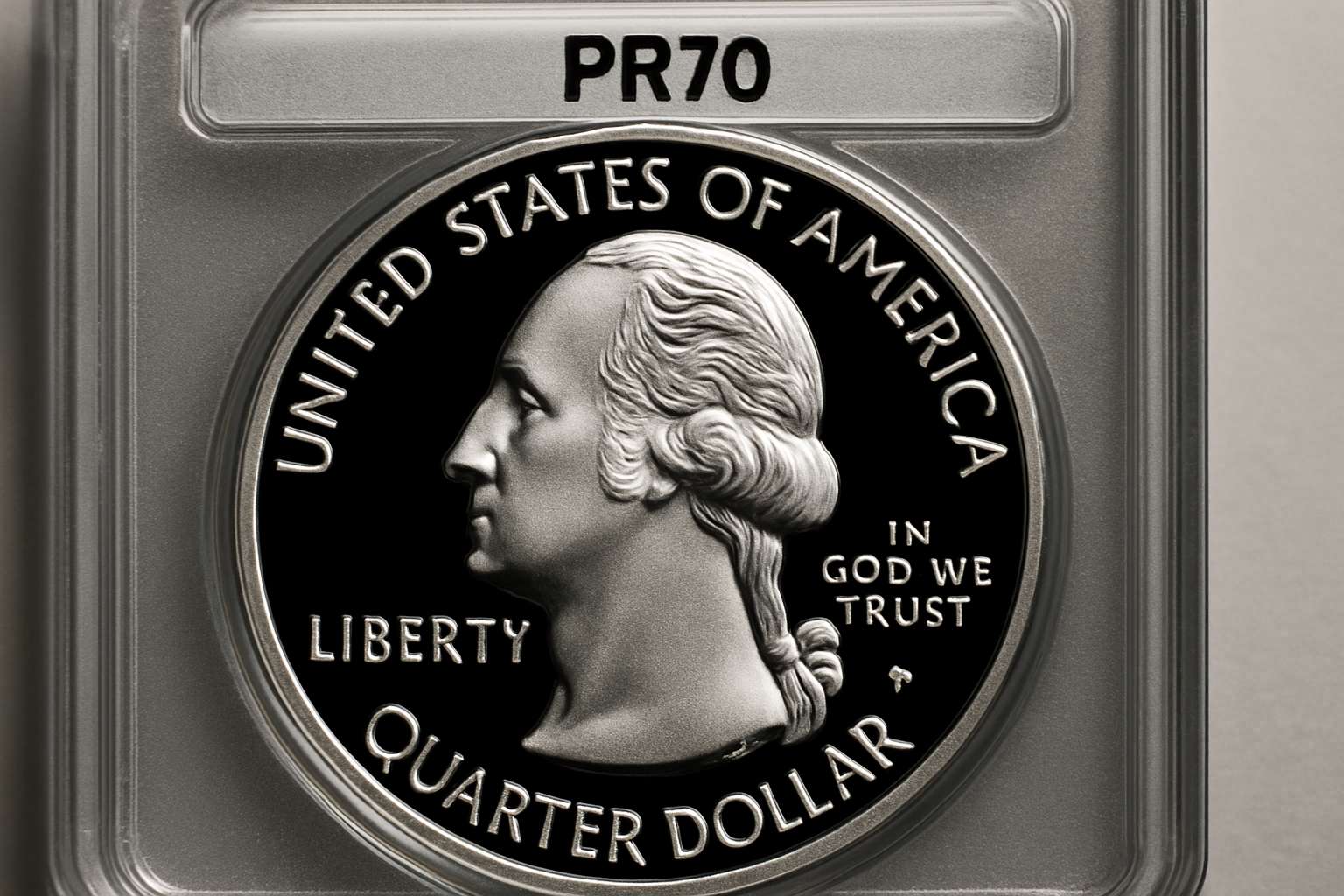

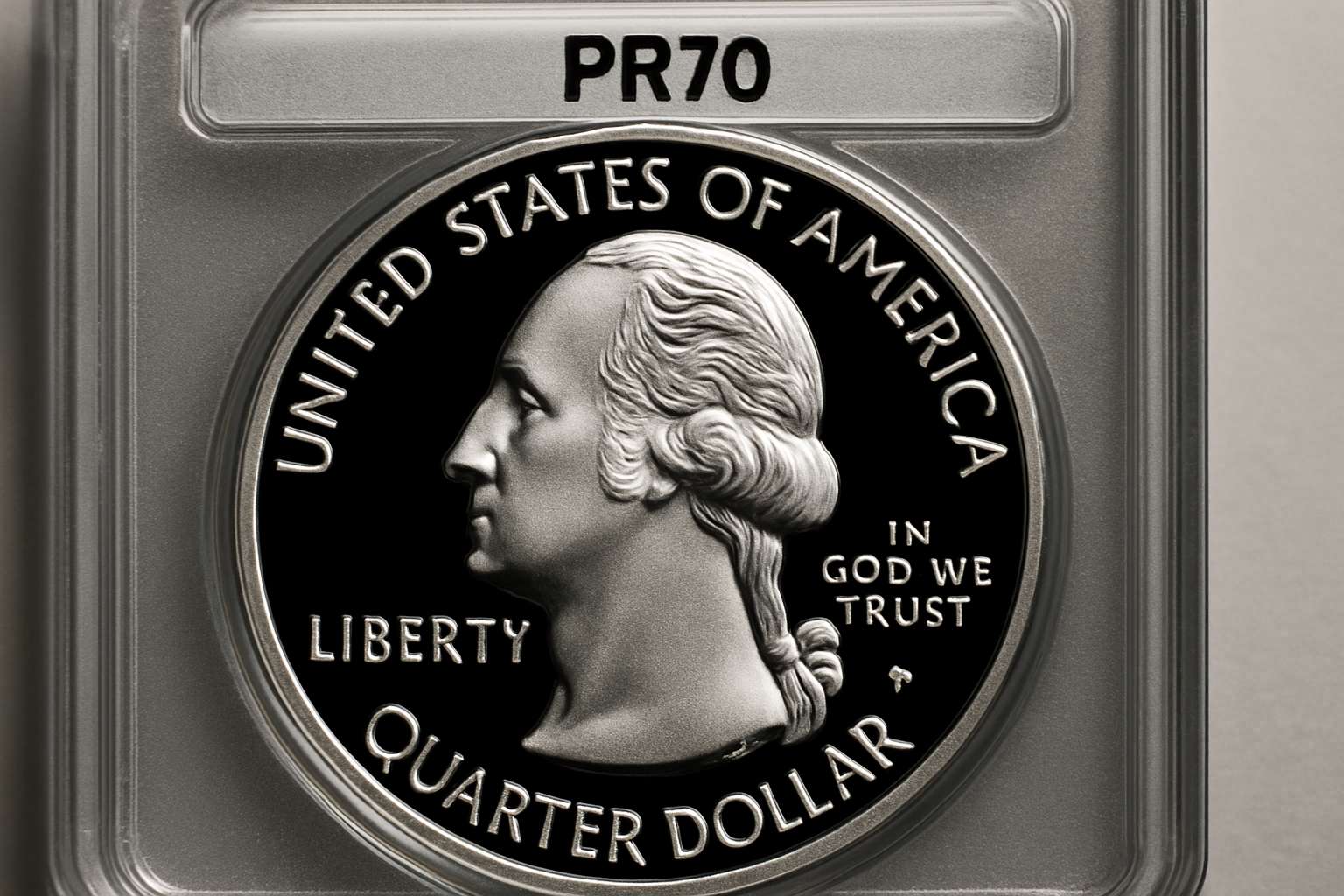

5. Proof Quarters with Limited High-Grade Populations

Proof quarters were struck specifically for collectors, but only a small percentage survive in flawless condition. Coins that achieve top grading levels command premiums because population data confirms their scarcity at the highest standards.

As of late 2025, typical proof Washington quarters from the 1930s through the 1960s often sell in the low hundreds of dollars for common dates and grades, with the best-preserved examples (especially from early years or with Deep Cameo designation) commanding significant premiums over typical bullion or circulated values.

Rare Quarters: Scarcity-Driven Assets

What Makes Rare Quarters Different

Rare quarters derive most of their value from limited availability. These coins often have low original mintages, extremely low survival rates, or unique production characteristics that cannot be replicated.

They trade less frequently, exhibit wider pricing spreads, and require specialized market knowledge. From a financial perspective, rare quarters resemble illiquid alternative assets where scarcity dominates price discovery.

List of Rare Quarters and Why They Command Premiums

1. The 1916 Standing Liberty Quarter

The 1916 Standing Liberty quarter is one of the most recognized rare quarters in U.S. coinage. Its low original mintage and heavy early circulation drastically reduced surviving examples.

Its values typically range from $3,000- $6,000 in lower circulated grades, while well-preserved or certified mint-state examples frequently trade from $15,000 to $40,000 or more, depending on condition.

Demand remains strong because the coin is essential for completing the series. Prices rise sharply with incremental improvements in condition.

2. The 1932-D and 1932-S Washington Quarters

Produced during the Great Depression, the 1932-D and 1932-S Washington quarters are key dates with persistently strong demand.

In late 2025, circulated examples generally range from $75- $300, while higher-grade certified coins commonly command $1,000 to $10,000+, with top-condition examples achieving significantly higher prices.

3. Draped Bust Quarters (1796-1807)

Draped Bust quarters represent the earliest years of U.S. quarter production. Surviving examples are extremely limited, with many held in long-term collections or institutions.

Even heavily worn examples typically begin around $5,000- $10,000, while better-preserved or historically important specimens can exceed $50,000 to well into six figures, driven almost entirely by rarity and historical significance.

4. Capped Bust Quarters (1815-1838)

Capped Bust quarters serve as a transitional series between early and modern U.S. coinage. As of late 2025, common circulated examples often range from $150- $600, while scarce dates or high-grade certified coins can command several thousand dollars, with exceptional examples reaching much higher levels.

5. Mint Error Quarters

Mint error quarters form a specialized subset of rare quarters, with value determined by the type, visibility, and severity of the error. In the current market, authenticated error quarters may range from $200- $1,500 for minor errors, while dramatic or unique errors can command several thousand dollars or more, depending on collector demand.

Rare Quarters vs Valuable Quarters: Market Comparison

| Feature |

Valuable Quarters |

Rare Quarters |

| Primary Value Driver |

Metal content and condition |

Scarcity |

| Liquidity |

Higher |

Lower |

| Price Stability |

Higher |

Lower |

| Volatility |

Moderate |

High |

| Market Role |

Value preservation |

Scarcity appreciation |

Tips for Identifying Quarters Worth Money

Understanding what quarters are worth money requires more than knowing dates and mint marks. Applying disciplined evaluation practices can help avoid costly mistakes and improve long-term outcomes.

Second, pay close attention to the condition. Wear, surface damage, and cleaning can significantly reduce value. Even rare quarters can lose much of their worth if improperly handled or altered.

Fourth, rely on professional grading for higher-value coins. Independent grading provides authentication, protects market value, and improves liquidity when selling.

How to Estimate What Your Coin Is Worth

When evaluating what quarters are worth money, calculators are most effective for identifying valuable quarters such as silver quarters. They quickly show whether a quarter’s metal content alone places it above face value.

For rare quarters, calculators often underestimate value because rarity premiums vary widely and depend on auction results rather than static pricing models. In these cases, calculators should be used only as a starting point.

Step 1: Identify the Coin Accurately

Before using a calculator, confirm the coin’s denomination, year, and mint mark. Misidentifying a mint mark or date can lead to incorrect estimates.

Step 2: Determine the Metal Type

Check whether the coin contains precious metal. For U.S. coins, this often depends on the year. Entering the wrong metal category will distort the estimate.

Step 3: Choose a Conservative Condition

When in doubt, select a lower condition category. Many coins appear better than they actually are, and overestimating conditions is a common mistake.

Step 4: Review the Output as a Range

Treat the calculator result as a rough range, not a guaranteed price. Market conditions, buyer demand, and authentication all influence final sale values.

Remember, calculator estimates tend to be:

More accurate for bullion-based coins

Less accurate for rare and condition-sensitive coins

Conservative for high-grade examples

Professional valuation always requires comparison with recent verified sales.

How Market Cycles Affect Quarters Worth Money

Market cycles play a meaningful role in determining which quarters outperform at different points in time. During inflationary or currency-uncertain environments, valuable quarters often benefit first because their silver content provides intrinsic support and attracts capital seeking tangible stores of value.

In contrast, during periods of strong economic growth or heightened collector participation, rare quarters tend to outperform as demand shifts toward scarcity-driven assets and competition intensifies for limited surviving examples.

Over longer time horizons, quarters with fixed supply, historical significance, and consistent collector interest tend to compound value more reliably than ordinary circulation coins, as diminishing availability gradually reinforces pricing power across market cycles.

Risk Considerations When Buying Quarters Worth Money

Despite their appeal, quarters worth money carry risks. Authentication and grading accuracy are critical, as counterfeits and misattributions can distort value. Rare quarters also present liquidity risk, as selling may require time and specialized channels.

Professional discipline, verification, and long-term perspective are essential.

Frequently Asked Questions (FAQ)

1. What quarters are worth money today?

Quarters worth money today include pre-1965 silver quarters, high-grade proof issues, key-date Washington quarters, early U.S. quarters, and verified mint error coins. Their value is driven by metal content, scarcity, condition, and sustained demand rather than face value. Coins meeting multiple criteria typically command the strongest premiums.

2. Are rare quarters riskier than valuable quarters?

Rare quarters generally carry higher risk because they are less liquid and more sensitive to collector sentiment. Prices can fluctuate significantly based on availability and demand, and selling often requires patience. Valuable quarters tend to offer greater price stability due to intrinsic support.

3. Can modern quarters ever become valuable?

Most modern quarters remain worth face value, but exceptions exist. Coins preserved in exceptional condition or featuring authenticated mint errors can achieve meaningful premiums. Over time, limited survival in top grades can elevate select modern issues into the valuable category.

4. Is silver content the most important factor in determining value?

Silver content establishes a baseline value for valuable quarters, particularly during inflationary periods. However, rarity, condition, and historical significance often outweigh metal content when determining the value of rare quarters. The most valuable coins usually combine multiple value drivers.

5. How does condition affect the value of quarters worth money?

Condition directly impacts value by reducing the number of acceptable examples available for trade. Minor differences in wear or surface quality can lead to substantial price changes, especially for rare quarters. Professional grading is often essential for accurate valuation.

Key Takeaways

What quarters are worth money is determined by economic factors such as intrinsic metal content, scarcity, condition, and long-term demand rather than face value.

Valuable quarters typically derive their worth from silver content, age, and condition, offering greater liquidity and price stability compared to rarer coins.

Rare quarters command premiums primarily due to limited supply, low survival rates, or unique production characteristics, which can lead to higher volatility and lower liquidity.

Quarters minted before 1965 often contain silver, providing an intrinsic value floor that supports pricing during inflationary or uncertain economic periods.

Condition matters significantly. Small differences in wear or preservation can result in substantial value differences, especially for rare and high-grade quarters.

Coin value calculators are useful screening tools for identifying potentially valuable coins but should not be relied upon as final pricing authorities.

Market cycles influence performance, with valuable quarters tending to perform well during inflationary environments and rare quarters often outperforming during strong collector-driven markets.

Professional practices such as authentication, grading, and long-term holding strategies are essential for managing risk and preserving value when dealing with quarters worth money.

Final Thoughts

Understanding what quarters are worth money requires a clear distinction between valuable quarters and rare quarters. Valuable quarters offer intrinsic support, liquidity, and stability, while rare quarters derive value almost entirely from scarcity and historical importance.

When analyzed professionally, rare quarters and valuable quarters are not novelties. They are tangible assets governed by fixed supply, enduring demand, and the same economic forces that shape all markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.