The iShares MSCI South Korea ETF (EWY) is a primary gateway for traders and investors seeking exposure to South Korea's dynamic equity market.

With the kospi index entering a bull market and new political leadership in place, understanding the outlook for EWY is crucial for those looking to capitalise on Asia's fourth-largest economy.

South Korea's Market in 2025: A Bullish Turn

South Korea's stock market has seen renewed optimism in 2025. Following Lee Jae-myung's election victory, the KOSPI index surged by 2.7% and officially entered a bull market, climbing over 20% from its April lows.

This rally is driven by expectations of pro-growth reforms, improved shareholder returns, and a more stable political environment after months of uncertainty. Financials, holding companies, and brokerages have led the charge, reflecting hopes for legislative changes that could further boost market sentiment.

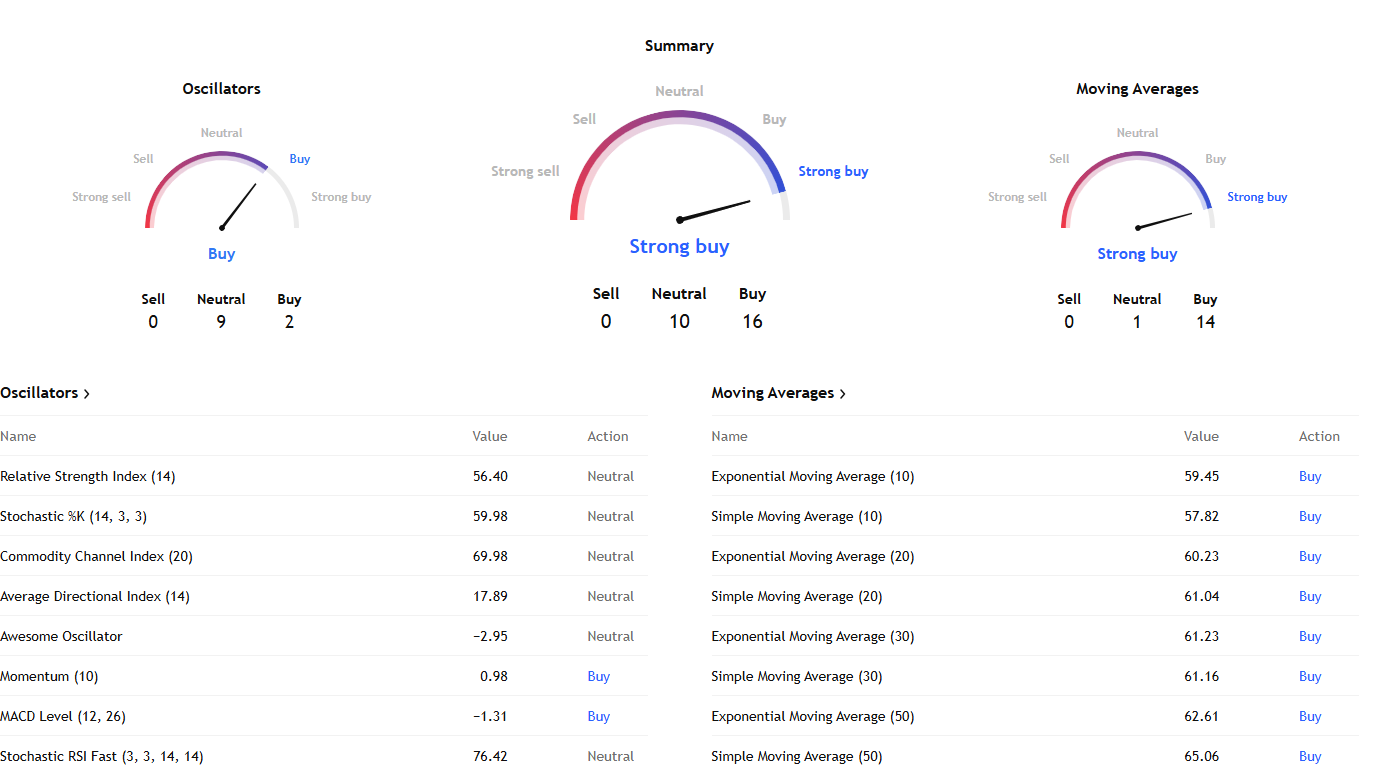

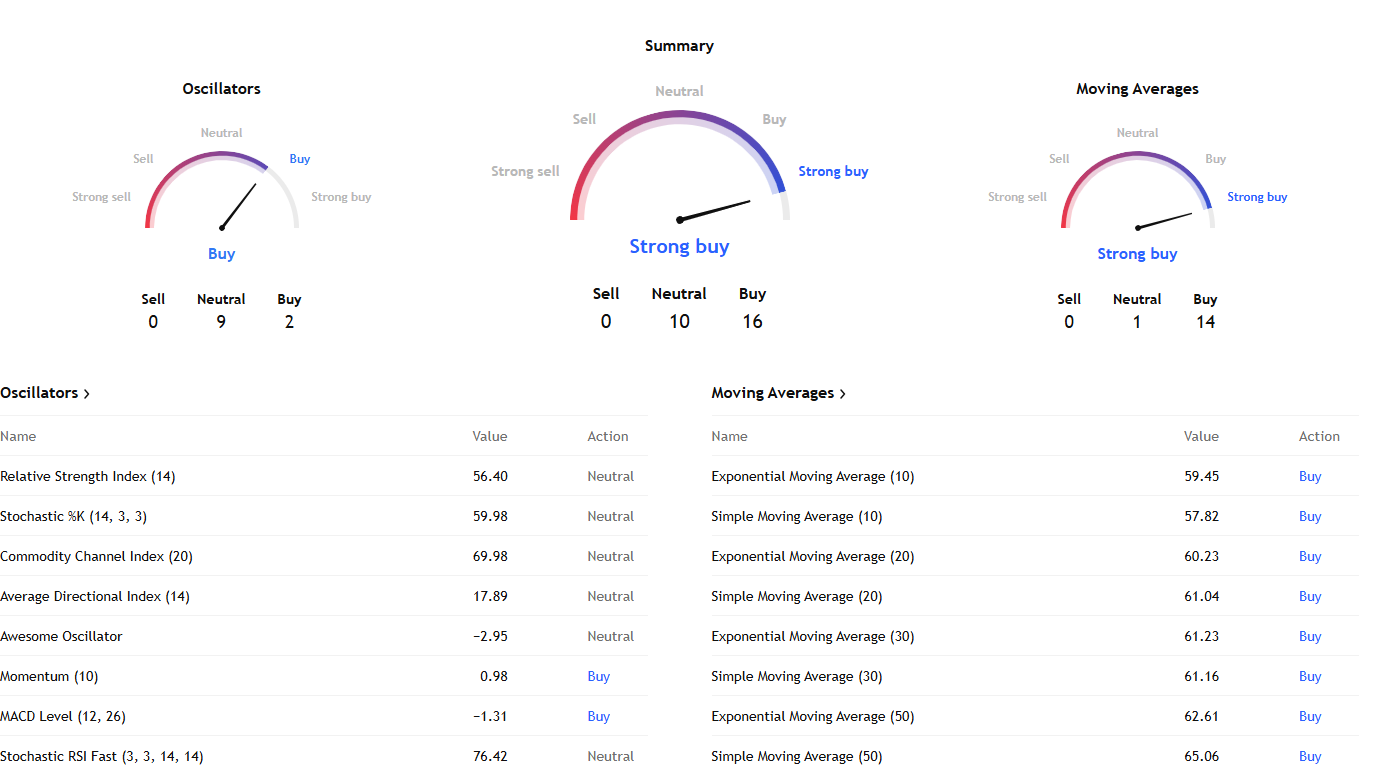

EWY ETF: Recent Performance and Technical Forecasts

EWY has mirrored the KOSPI's strength, with its price rising by 12.97% in the last month and 3.57% over the past year. Technical signals remain positive: both short- and long-term moving averages indicate a buy, and a rare “Golden Star Signal” appeared in March 2025, often a precursor to strong, sustained gains.

The ETF's price currently sits at $65.57, with short-term forecasts suggesting a potential rise of 9.38% over the next three months, targeting a range between $57.05 and $71.80.

Support levels are identified at $63.00 and $58.55, while resistance is near $65.78. Volume divergence—rising prices on falling volume—suggests traders should watch for early signs of a reversal, but the overall trend remains bullish.

Historical Perspective: EWY's Long-Term Returns

Looking back, EWY has delivered a compound annual return of 8.13% since June 2005, with a total return of 151.51% over 20 years. However, this journey has not been without volatility: the ETF endured a maximum drawdown of -70.13%, requiring nearly a decade to recover.

Over the past five years, annualised returns have been 4.60%, while the past decade saw a more modest 1.33% annualised gain. These figures highlight the cyclical nature of South Korea's market and the importance of timing for traders.

EWY in Context: Comparisons with Other ETFs

Compared to leveraged alternatives like KORU, EWY offers a more stable, diversified approach to South Korean equities. KORU's 3x leverage can produce amplified gains in bullish periods but carries significantly higher risk and volatility—its 10-year annualised return is -14.10%, versus EWY's 3.59%.

When compared to the SPDR S&P 500 ETF (SPY), EWY's 10-year annualised return of 3.59% lags behind SPY's 13.07%, but EWY's 1.98% dividend yield is higher than SPY's 1.20%.

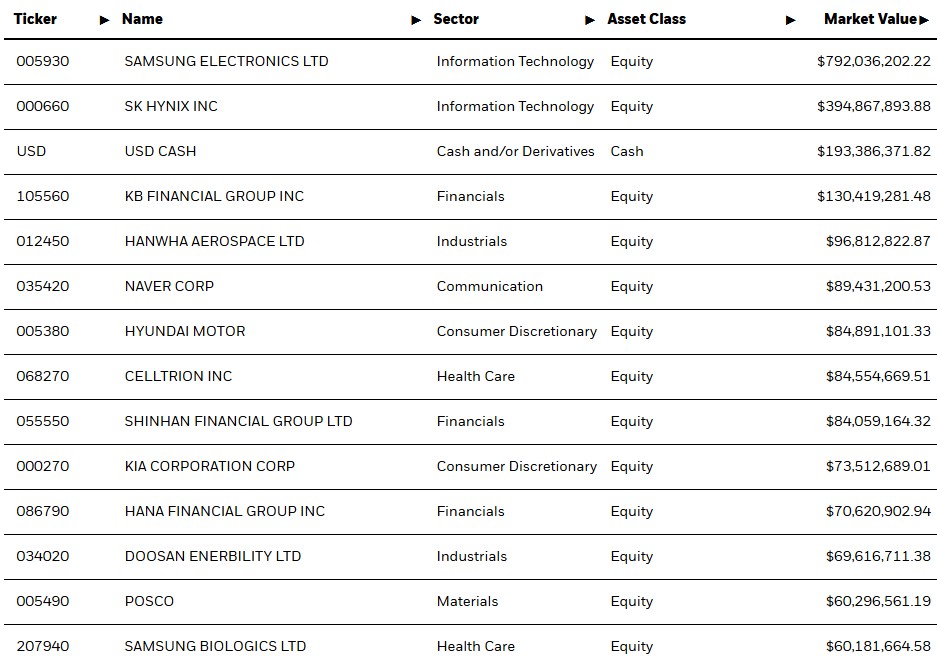

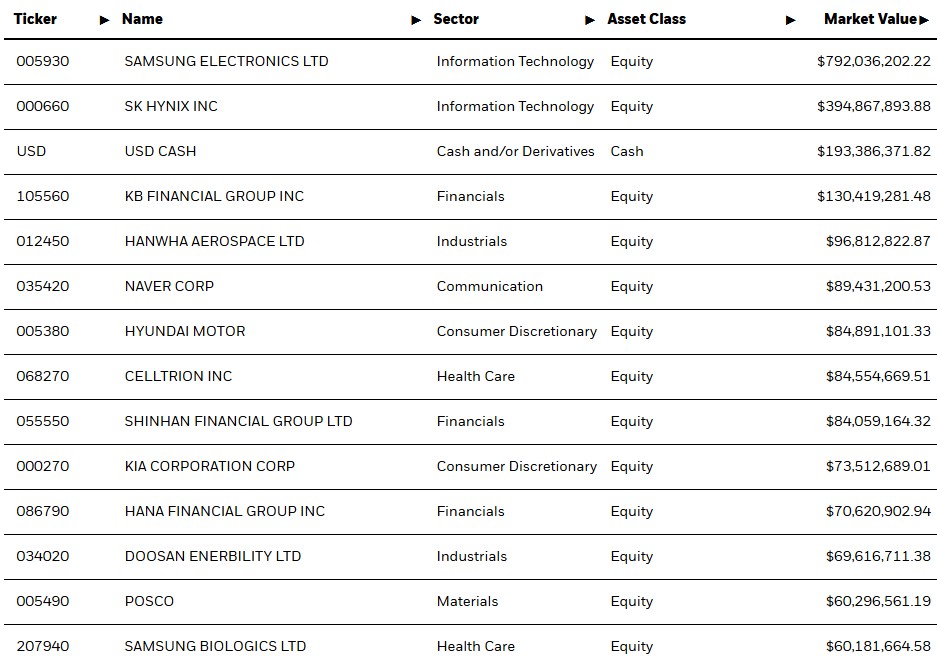

EWY is also more concentrated, with over 36% of its holdings in the information technology sector, led by giants like Samsung Electronics and SK Hynix. This focus means EWY's fortunes are closely tied to global tech demand, making it both an opportunity and a risk for traders.

Dividend Trends and Yield

EWY pays an annual dividend, with a current yield of 1.98% and a payout of $1.30 per share in the past year. Dividend growth has been uneven, with a 21.37% decline in the last year, reflecting market volatility and earnings fluctuations among South Korea's leading firms. Despite this, the yield remains competitive for an equity ETF in the region.

Sector Leadership and Market Drivers

Technology remains the backbone of South Korea's equity market, and thus EWY's portfolio. Samsung Electronics alone accounts for over 23% of the fund's assets, with SK Hynix and Samsung SDI also featuring prominently. Industrials and materials are the next largest sectors, followed by consumer discretionary and financials.

The outlook for EWY is closely linked to global semiconductor demand, export growth, and domestic reforms. The new administration's focus on shareholder returns and potential regulatory changes could further enhance the appeal of South Korean equities in the coming quarters.

Forecasts: What's Next for EWY?

Analysts expect continued momentum for EWY in the near term, especially if reform measures are enacted and global tech demand remains robust. The ETF's technical outlook is positive, with buy signals across multiple timeframes and a bullish market backdrop. However, traders should remain vigilant for signs of reversal, particularly if volume continues to diverge from price gains.

Longer-term, EWY's prospects will depend on the resilience of South Korea's export sector, the success of domestic reforms, and the global appetite for technology stocks. While historical returns have been cyclical, the current environment suggests potential for further gains, especially if political stability and economic reforms deliver as promised.

Conclusion

EWY ETF stands at the intersection of South Korea's dynamic market, global technology trends, and domestic political reform. With a strong start to 2025, positive technical signals, and a history of resilience, EWY offers traders a compelling way to participate in South Korea's growth story.

As always, monitoring market signals, sector trends, and policy developments will be key to navigating what's next for South Korea stocks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.