Scalping trading is a high-speed, high-frequency strategy employed by traders seeking to capitalise on small price movements for quick profits. While it's not for emotional traders, scalping can be highly profitable for disciplined traders who understand its mechanics.

In this guide, we'll explore what scalping trading is, how it works, popular strategies, tools needed, pros and cons, and how to get started in 2025.

What Is Scalping Trading?

Scalping is a short-term trading strategy that aims to profit from tiny price changes, often holding positions for just seconds to minutes. Traders using this technique—called scalpers—make dozens or even hundreds of trades per day to build up cumulative profits.

Unlike swing or position trading, focusing on larger trends, scalpers capitalise on small, repetitive price fluctuations. Speed, precision, and timing are key.

For example, scalping trading usually takes place on:

The shorter the timeframe, the more signals you get, but also the more noise, so precision is crucial.

Scalping vs Day Trading vs Swing Trading

| Feature |

Scalping |

Day Trading |

Swing Trading |

| Holding Period |

Seconds to minutes |

Minutes to hours |

Days to weeks |

| Number of Trades |

20–100+ per day |

2–10 per day |

1–5 per week |

| Stress Level |

High |

Moderate |

Low |

| Technical Skill |

High |

Medium |

Low to Medium |

| Ideal for |

Fast thinkers |

Intraday trend followers |

Part-time traders |

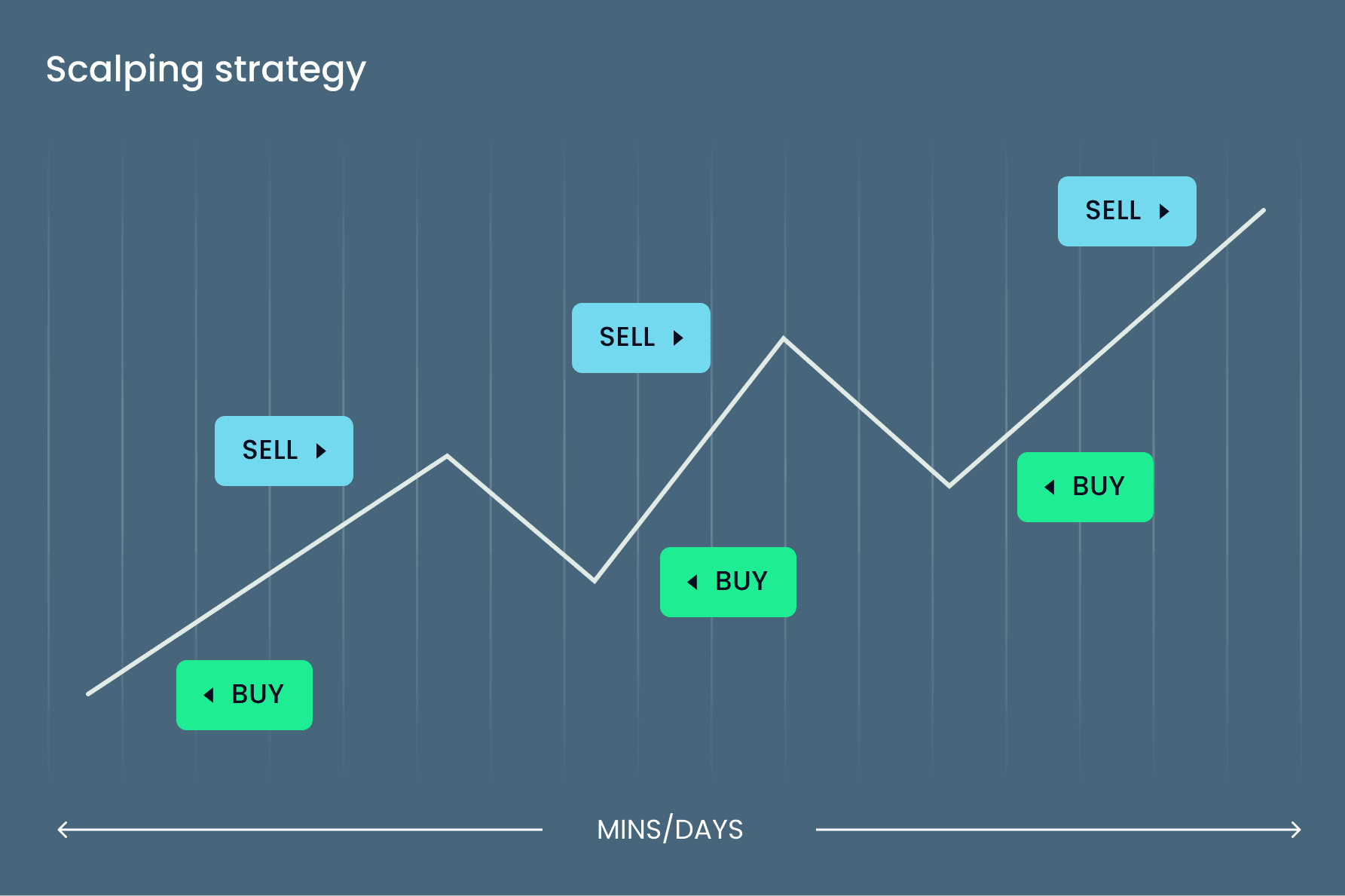

How Scalping Works

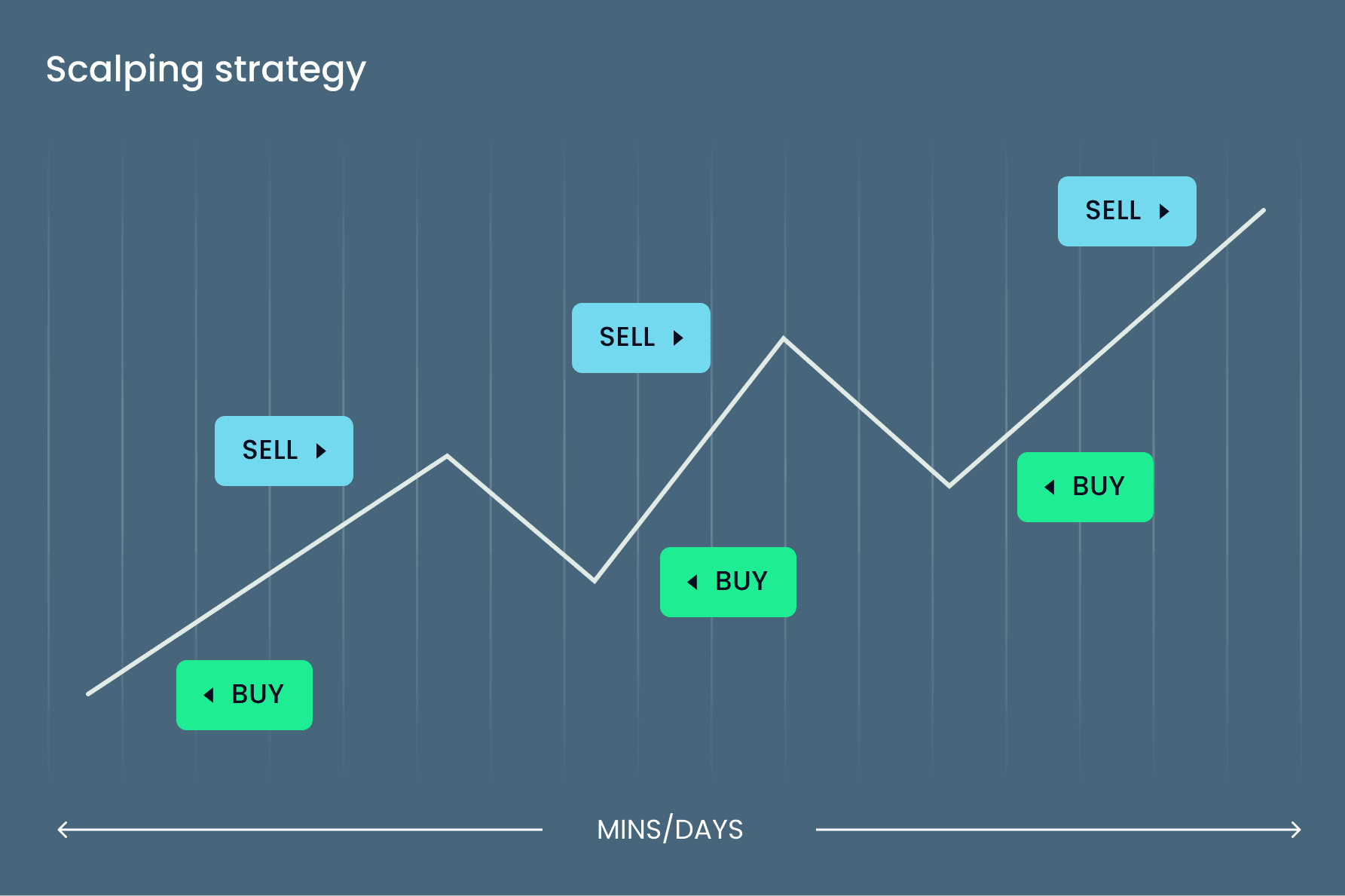

Here's a step-by-step breakdown of how scalping trading works:

Identify a micro-opportunity using technical indicators or patterns.

Open a trade for a very short time (e.g., 10 seconds to a few minutes).

Exit quickly with a small profit (or minimal loss).

Repeat the process multiple times a day.

Long-term profitability depends on keeping a high win rate, strict risk management, and minimal transaction costs.

Scalping works best in markets that are:

Common Markets Scalpers Focus On

| Market |

Why It's Ideal |

| Forex |

Tight spreads, high liquidity |

| Indices (e.g., S&P 500, NASDAQ) |

Good volatility, consistent moves |

| Stocks (e.g., tech stocks) |

Volume and intraday patterns |

| Futures contracts |

Leverage and fast price changes |

Tools Traders Use for Scalping

| Tool |

Description |

Why It Matters |

| Low-Latency Broker |

A broker that offers fast trade execution, tight spreads, and minimal slippage. |

Speed is critical in scalping—delays can turn a profitable trade into a loss. |

| Direct Market Access (DMA) |

Provides direct access to order books and institutional liquidity. |

Gives scalpers better pricing and faster execution. |

| Hotkeys and One-Click Trading |

Keyboard shortcuts for instant trade execution. |

Reduces lag time when opening and closing trades. |

| Economic Calendar |

Real-time updates on market-moving news and reports. |

Scalpers often avoid trading during major news to reduce slippage risk. |

| Multiple Monitors or Mobile Workspace |

Allows traders to view different charts and assets simultaneously. |

Improves multitasking and quick decision-making. |

| Low-Cost Fee Structure |

Brokers with commission-free or low-spread accounts. |

Scalpers make many trades; lower costs improve profitability. |

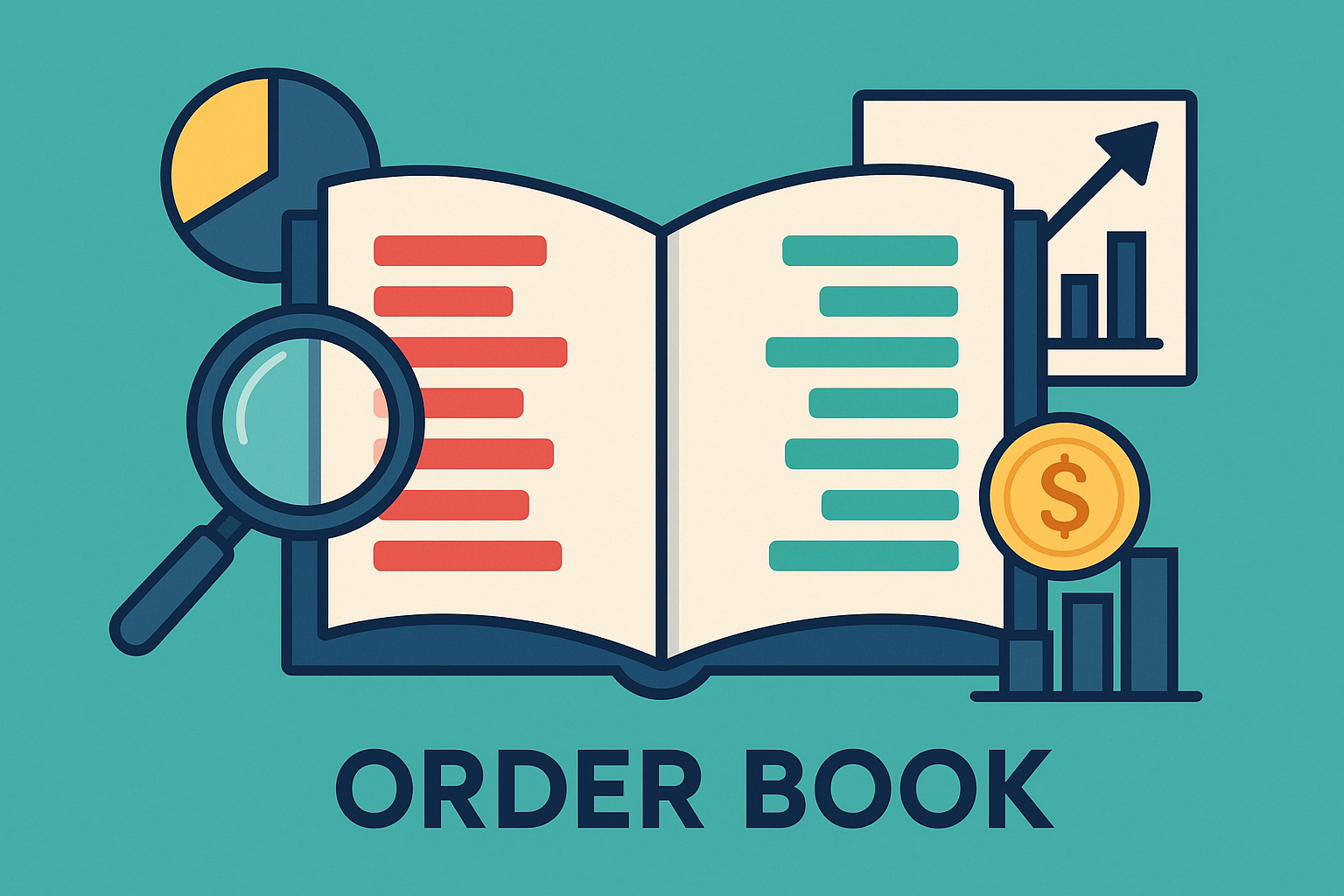

| Order Book (Level 2 Data) |

Shows bid and ask depth from market participants. |

Helps detect order flow and liquidity zones. |

| Tick Charts or Renko Charts |

Charts based on trade count or price movement, not time. |

Filter noise and highlight momentum better than minute charts. |

Top Scalping Trading Strategies for Quick Profits

1. EMA Crossover Scalping

Uses fast and slow Exponential Moving Averages (e.g., 5 EMA and 20 EMA).

Buy signal when the faster EMA crosses above the slower EMA.

Common in trending markets.

2. VWAP Bounce Strategy

Trades bounce from the Volume Weighted Average Price line.

Entry when price pulls back to VWAP and shows reversal patterns.

Often used by institutional scalpers.

3. Bollinger Band Squeeze

It focuses on low-volatility periods followed by breakouts.

Trade the breakout after the band's contract and then expand.

It is ideal for spotting fast volatility bursts.

4. Support and Resistance Bounce

Identify short-term key levels.

Enter trades when price tests and rejects those levels with volume confirmation.

Works well in range-bound or sideways markets.

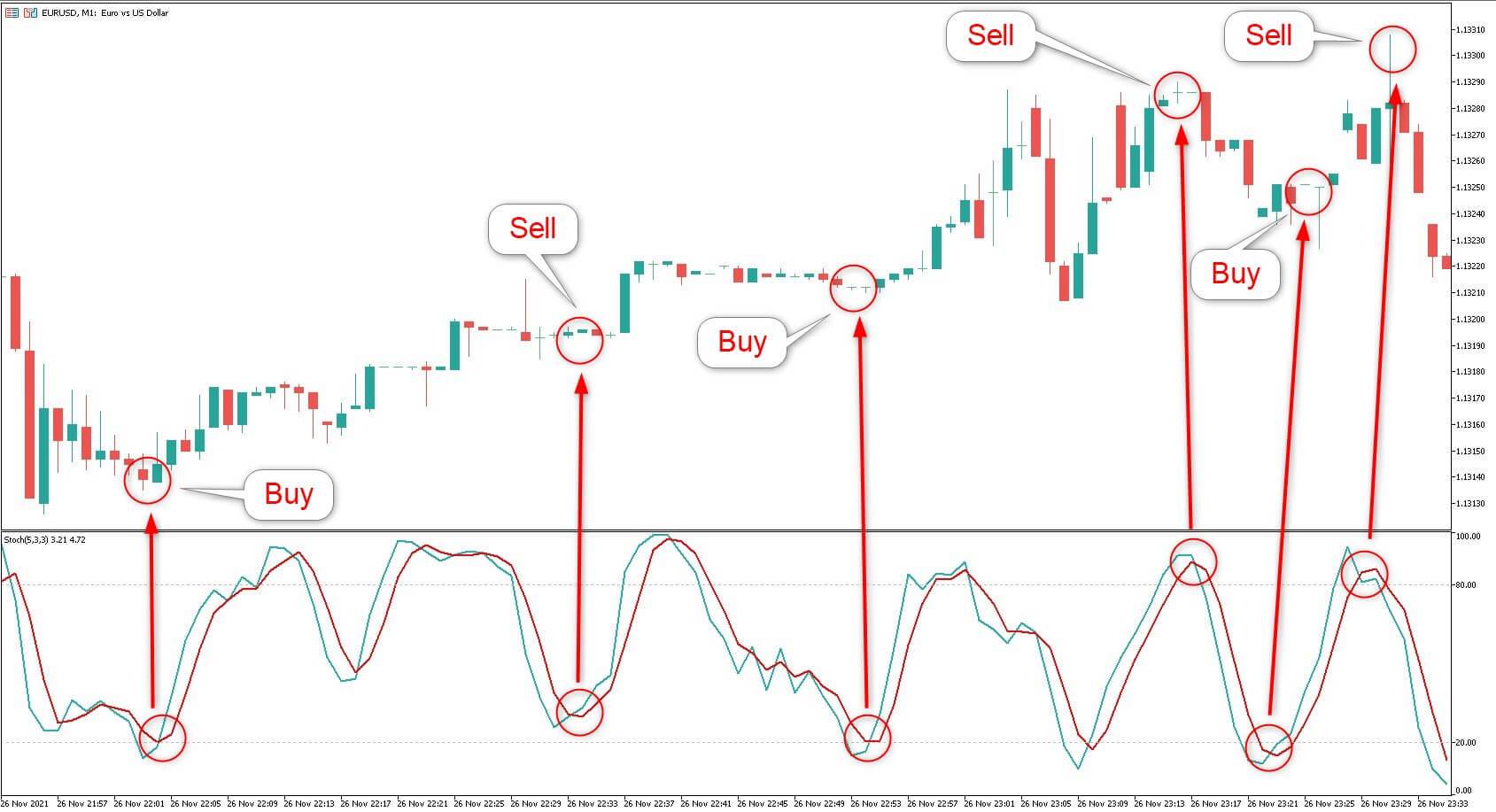

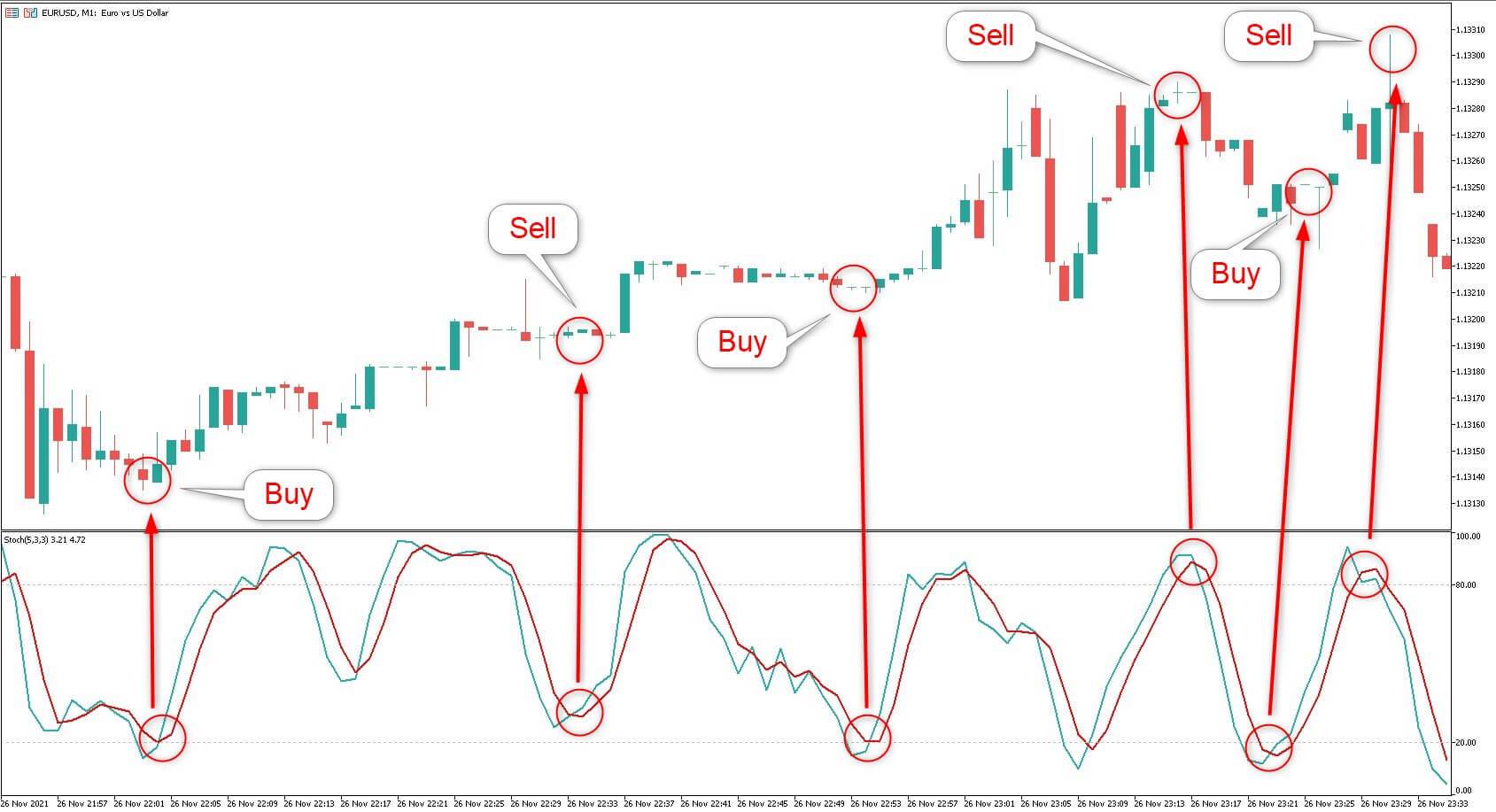

5. Stochastic Momentum Scalping

Trader utilises the Stochastic Oscillator to time entries at overbought and oversold zones.

Combine with candlestick reversal patterns (e.g., pin bars or engulfing candles).

Good for fading short-term exhaustion moves.

6. Price Action Scalping

Focuses on raw price movements—no indicators.

Look for Chart Patterns like micro double tops/bottoms, flags, or wicks.

Requires experience but eliminates indicator lag.

7. Order Flow/Depth of Market (DOM) Scalping

Monitor large orders and liquidity zones using Level 2 or order book data.

Trade with or against large players depending on flow analysis.

Advanced, but very powerful with the correct data feeds.

Real-World Example

Let's say you're scalping the EUR/USD on a 1-minute chart.

You spot RSI at 25 and the price at the lower Bollinger Band.

You buy at 1.0750 with a target of 1.0755 and stop-loss at 1.0747.

The price rebounds and hits your target within 1 minute.

You close with a 5-pip gain, risking 3-pips (1.66:1 ratio).

Repeat this setup 20 times per day with an 80% win rate—and you're a profitable scalper.

Pros and Cons of Scalping

| Aspect |

Pros of Scalping |

Cons of Scalping |

| Profit Speed |

Fast results—profits in minutes or seconds |

Losses can also come quickly |

| Market Exposure |

Very limited exposure to overnight risk |

Requires constant screen time |

| Trade Frequency |

Many trade opportunities per day |

Can lead to burnout or overtrading |

| Market Conditions |

Works well in all types of markets (trending or ranging) |

Not all assets are suitable (low liquidity = poor execution) |

| Capital Requirements |

Can start small with leverage |

Small gains require tight cost control |

| Risk Per Trade |

Small, controlled risk per position |

Higher cumulative risk if undisciplined |

| Learning Curve |

Mastering scalping makes you a sharp trader |

Steep learning curve for beginners |

| Technology Dependency |

Great platforms and tools enhance precision |

Without high-speed tools, strategy suffers |

| Emotional Control |

Teaches quick decision-making under pressure |

Emotionally exhausting, especially after losses |

| Scalability |

Easily applied to multiple instruments |

Difficult to scale with large capital (slippage) |

Is Scalping Trading Right for You?

Scalping is best suited for:

Traders who enjoy fast-paced action

Those with time to monitor markets closely

Traders who are technically inclined and disciplined

People with access to high-speed trading platforms

It's not ideal for:

Traders who can't handle stress

Those who want passive or long-term strategies

Investors with high trading fees

Conclusion

In conclusion, scalping trading can be one of the most rewarding short-term trading methods, but it demands a clear strategy, disciplined execution, and emotional control. It's not a "get-rich-quick" scheme but rather a professional-grade technique that requires serious preparation and practice.

If you're looking for fast profits and have the time and discipline to master a high-frequency strategy, scalping might be your trading style in 2025.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.