Mega-cap tech strength can lift the headline indices, but narrow breadth, small‑cap weakness, and policy uncertainty show risks beneath the surface, even as semiconductors stay firm.

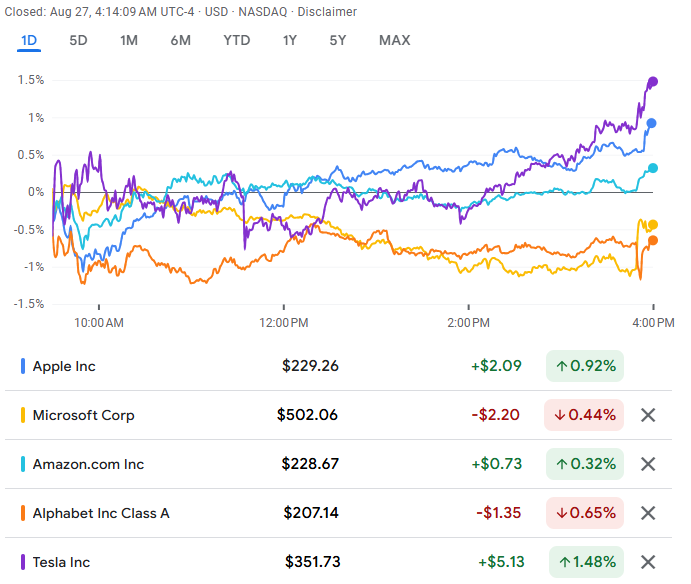

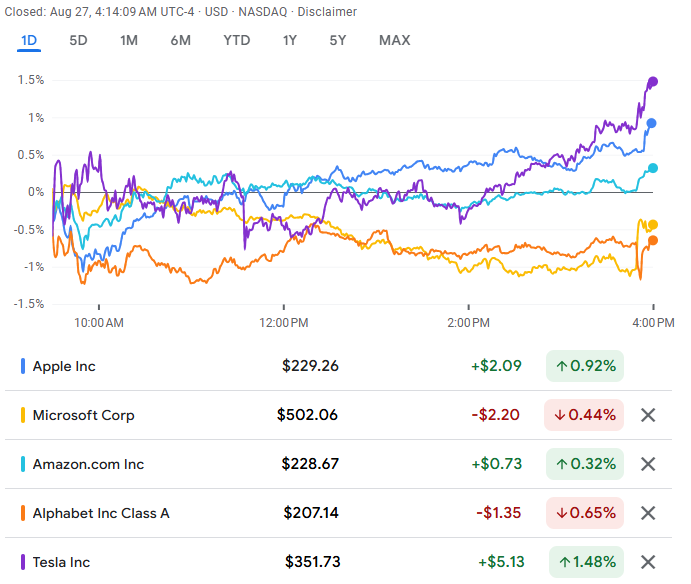

Market Close Snapshot

US stock futures today point to a cautious open after a modestly higher cash close led by mega-cap technology and semiconductors. Futures are a temperature check between sessions. Flat to slightly positive readings usually mean the market is waiting for fresh catalysts such as earnings, inflation data, or policy news. Small moves in futures can hint at who may lead after the bell. Leadership can tilt to chips and mega-caps if yields ease. It can swing back to defensives and value if policy risk rises.

At the prior close, the S&P 500 rose about 0.41%, the Nasdaq Composite gained roughly 0.44%, and the Dow Jones Industrial Average added about 0.30%. Semiconductors outperformed. The PHLX Semiconductor Index closed at 5,807.92, up 0.90% on the day. Small caps were weaker. The Russell 2000 finished at 2,339.17, down 0.78%.

The “Magnificent Seven” added about $370 billion in market value in a single session last week. That shows how concentrated gains can lift headline indices even when broader participation is uneven.

Policy headlines also shaped sentiment. Tension over Federal Reserve independence and leadership added uncertainty to the rate path and investor confidence. Into the close, the 10‑year Treasury yield hovered near 4.255% and the dollar eased slightly. That mix can help growth and chip shares in the short term. It does not settle the bigger macro risks.

What's Driving the Split?

Mega‑caps continue to carry a large share of index performance, especially around pivotal earnings and AI‑linked catalysts, which can make the major benchmarks look stronger than the average stock. Chipmakers have benefited from steady demand signals and supportive rates, helping the sector climb even on days when worries about policy or growth weigh on other areas.

By contrast, small‑caps' drop at the close points to sensitivity to financing costs and growth fears, reminding that a durable rally usually needs broader participation to be healthy. Rate and dollar moves still matter for factor leadership, and the modest retreat in the dollar alongside steady long‑end yields can lift tech in the short run while leaving the bigger macro picture unresolved.

Key Takeaways at the Close

-

S&P 500 +0.41%, Nasdaq Composite +0.44%, Dow +0.30% show modest index gains driven by large‑cap leadership.

-

Semiconductors +0.90% (SOX 5,807.92) confirm chips' role in supporting risk appetite.

-

Russell 2000 −0.78% (2,339.17) flags ongoing breadth and financing concerns outside mega‑caps.

-

“Mag 7” added about $370B in one session last week, highlighting concentration risk.

US stock futures today suggest a cautious, news‑sensitive open; follow‑through depends on yields, earnings, and policy tone.

By the Numbers

| Indicator (close, 26 Aug 2025) |

Level/Change |

Context |

| S&P 500 |

+0.41% |

Lifted by large-cap tech into the cash close. |

| Nasdaq Composite |

+0.44% |

Tech strength ahead of key AI earnings. |

| Dow Jones Industrial Average |

+0.30% |

Positive but lagging growth benchmarks. |

| PHLX Semiconductor (SOX) |

5,807.92 (+0.90%) |

Chips extend leadership on demand and rates. |

| Russell 2000 (RUT) |

2,339.17 (−0.78%) |

Small-caps were weaker at the close. |

| “Mag 7” market-cap move |

≈+$370B (one session, last week) |

Concentration can boost indices despite mixed breadth. |

| 10-year UST yield |

~4.255% |

A level that can still support growth multiples. |

Are Mag 7 Gains Masking Risks?

Yes—when a handful of mega‑caps contribute most of the gains, the headline indices can look healthier than the average stock, particularly if small‑caps are soft and sector breadth is mixed. That pattern can leave portfolios exposed if a single earnings miss or policy shock hits the leaders, because concentrated gains can unwind faster than broad rallies.

The stronger close in semiconductors offers support under the surface, but the weaker small‑cap finish suggests investors should still watch for broader participation before calling it a durable advance.

What to Watch Next

-

Earnings and guidance from AI and chip leaders, which can reset tech sentiment in a single session.

-

The policy path and Fed signalling, given recent tensions over central bank independence and implications for rates.

Breadth measures, such as advance/decline and small‑cap performance, are used to confirm whether leadership is widening.

Conclusion

Mega‑cap tech can power the indices higher, but the close shows a split market where chips are firm, small‑caps are softer, and policy risk still lingers, so headline gains should be weighed against participation. Watching breadth, rates, and upcoming earnings will help tell whether strength broadens out or remains concentrated in a few very large names.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.