In the world of price action trading, certain concepts can give traders an edge by helping them understand how institutional players move the market.

One of these concepts is the Mitigation Block, which happens when the market returns to a prior order block to satisfy unfilled institutional orders, frequently resulting in significant price movements.

For traders who rely on supply and demand, smart money concepts (SMC), and price action, the mitigation block is a key tool for spotting potential reversals or continuation setups.

What Is a Mitigation Block?

A mitigation block is a pricing area, typically created by an order block, where institutions return to "mitigate" or settle previous positions before driving the price in the desired direction.

An order block is a consolidation area left behind by big players, often signalling where institutional orders were placed.

A mitigation block is when the price revisits that order block to absorb liquidity, fill pending orders, or trigger stop-loss clusters before continuing the trend.

In simple terms:

This return is referred to by traders as the mitigation process.

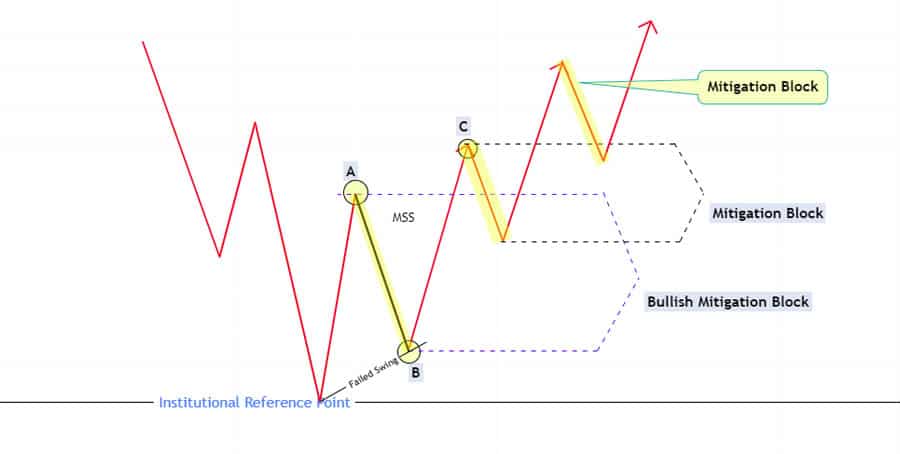

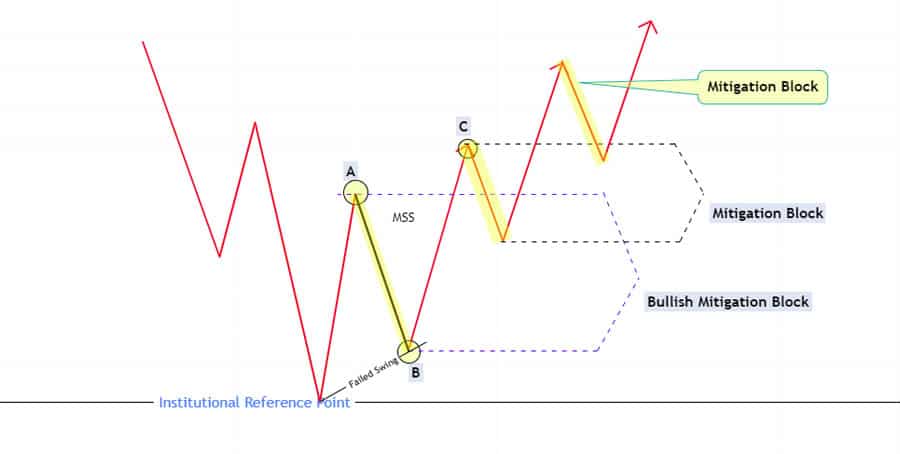

How Mitigation Blocks Form

Mitigation blocks are not random; they follow a process tied to order flow. Here's the general formation:

Institutional Entry: Price makes a strong impulsive move after consolidation (an order block).

Unfilled Orders: Institutions might not fill every position, resulting in price leaving liquidity behind

Price Revisit: Market retraces back into the original block to "mitigate" earlier imbalances.

Continuation or Reversal: After mitigation, the price often reacts sharply, continuing in the original direction or reversing if the block fails.

Think of it as the market taking a "breather" to pick up the rest of the orders before continuing the journey.

Types of Mitigation Blocks

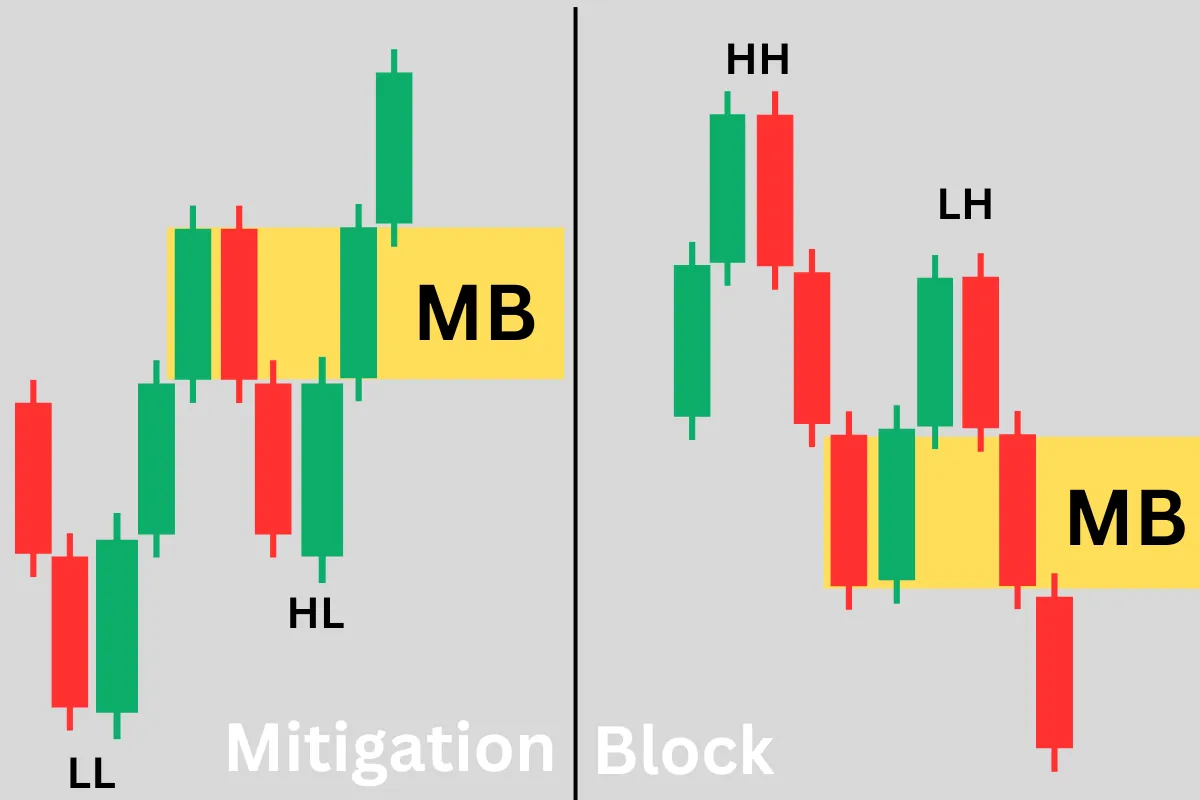

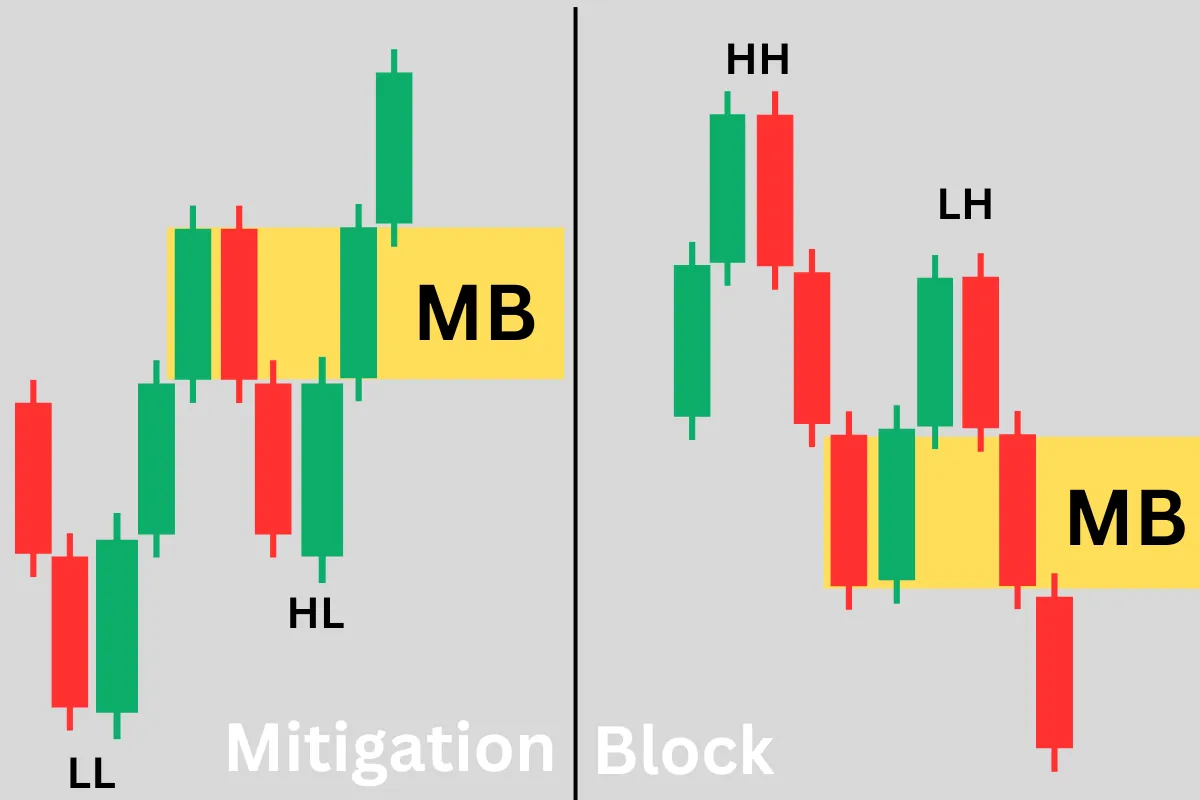

Mitigation blocks can appear in both bullish and bearish contexts:

1. Bullish Mitigation Block

Forms during an uptrend.

Price revisits a bullish order block (a down candle before a strong bullish move).

After mitigation, the price often rallies higher.

2. Bearish Mitigation Block

Forms during a downtrend.

Price revisits a bearish order block (an up candle before a strong bearish move).

After mitigation, the price usually drops further.

How to Identify Mitigation Blocks on Charts

Spotting mitigation blocks takes practice, but here are some steps:

Look for a strong impulsive move following a consolidation zone.

Identify the last bullish or bearish candle before that move (the order block).

Wait for the price to retrace back into that zone.

Confirm the reaction using candlestick patterns or volume.

Example:

In a bullish setup, find the last bearish candle before a strong bullish rally.

When the price retraces into that candle zone later, that becomes the mitigation block.

Mitigation Block Trading Strategy

Step 1: Identify Market Structure

Check if the market is trending up or down. Mitigation blocks are most effective when aligned with the larger trend.

Step 2: Locate Order Blocks

Mark the order blocks formed by impulsive moves.

Step 3: Wait for Mitigation

Be patient and wait for the price to return to the order block zone.

Step 4: Look for Confirmation

Use candlestick signals such as pin bars, engulfing candles, or rejection wicks to confirm entry.

Step 5: Place Trade

Entry: Near the mitigation block zone.

Stop-Loss: Just outside the block.

Take-Profit: Based on risk-reward ratio or next liquidity level.

Example of Trading Mitigation Block

Imagine EUR/USD is in a strong uptrend:

Price consolidates, then makes a sharp bullish rally from 1.0800 to 1.0950.

The last bearish candle before the rally is marked as the order block.

Later, the price retraces back to 1.0820.

That zone becomes the mitigation block where institutions finish filling orders.

Price then rallies again, continuing the uptrend.

Mitigation Blocks in Forex vs Other Markets

Forex: Common due to high liquidity and institutional dominance.

Stocks: Appear after earnings or major news releases when institutions adjust positions.

Crypto: Visible in volatile moves, especially around Bitcoin and altcoins.

Mitigation Block vs Order Block

| Feature |

Order Block |

Mitigation Block |

| Definition |

Zone where institutional orders were originally placed |

Revisit of the order block to fill remaining orders |

| Market Reaction |

Initial impulsive move |

Retracement to absorb liquidity |

| Trader’s Use |

Identify where the move started |

Spot re-entry opportunities |

| Bias |

Often first touch |

Often second touch |

Tips for Trading Mitigation Blocks Like a Pro

-

Combine mitigation blocks with a higher timeframe analysis.

Use them with liquidity zones and fair value gaps (FVGs).

Don't trade every block. Be selective.

Backtest historical charts to build confidence.

Continue learning Smart Money Concepts (SMC) as mitigation is one part of the bigger picture.

Frequently Asked Questions

1. What Is a Mitigation Block In Trading?

A mitigation block is a price zone where the market revisits a previous order block to absorb liquidity and fill remaining institutional orders before proceeding in the intended direction.

2. Are Mitigation Blocks Reliable for Forex Trading?

Yes, mitigation blocks are commonly utilised in Forex trading because they indicate institutional order flow, but traders need to pair them with confirmation signals and risk management for effectiveness.

3. What Risks Are Involved in Trading Mitigation Blocks?

The primary risk is that some mitigation blocks may fail, allowing the price to surpass them. Relying solely on mitigation blocks without confluence or stop-loss protection can lead to losses.

Conclusion

In conclusion, mitigation blocks are a powerful price action concept that helps traders understand where institutions are entering the market.

By learning to identify these zones, waiting for prices to revisit, and applying proper confirmation, traders can find high-probability entries with low risk.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.