In risk management and forecasting, "black swan event" has become crucial for understanding rare, high-impact occurrences that defy expectations.

Coined by Nassim Nicholas Taleb, a former Wall Street trader and risk analyst, the black swan theory explains why some of the most significant events in history are not just unexpected — they're entirely outside the realm of what we think is possible.

This article explores what black swan events are, provides notable examples, and discusses how we can prepare against the unforeseen threat.

Black Swan Event Definition

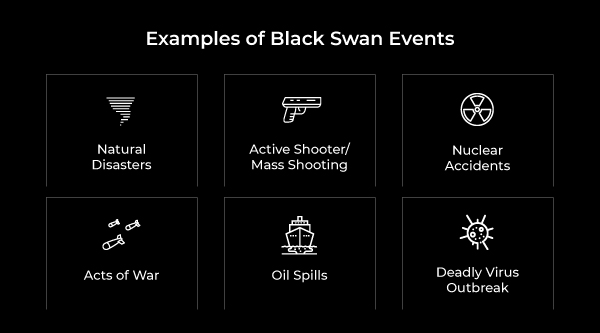

A black swan event is unpredictable and has massive, far-reaching consequences. According to Taleb, such events share three key characteristics:

Rarity: They lie outside the realm of regular expectations because nothing in the past can convincingly point to their possibility.

Extreme Impact: They have a significant effect on the world, often reshaping industries, economies, or societies.

Retrospective Predictability: After the event occurs, people will try to rationalise it as if it could have been expected despite its unpredictability.

The term "black swan" originates from the ancient belief that all swans were white, a notion debunked when black swans were discovered in Australia. This metaphor illustrates how a single unexpected event can invalidate long-held assumptions.

Black Swan vs Other Rare Events

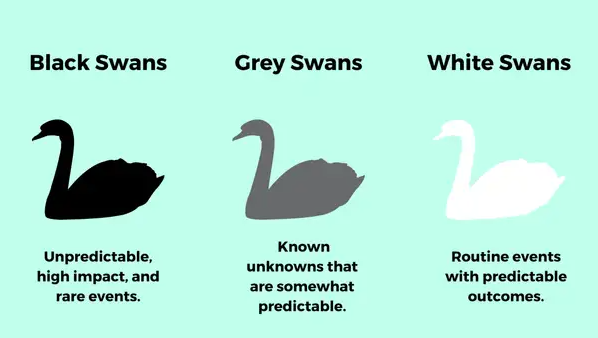

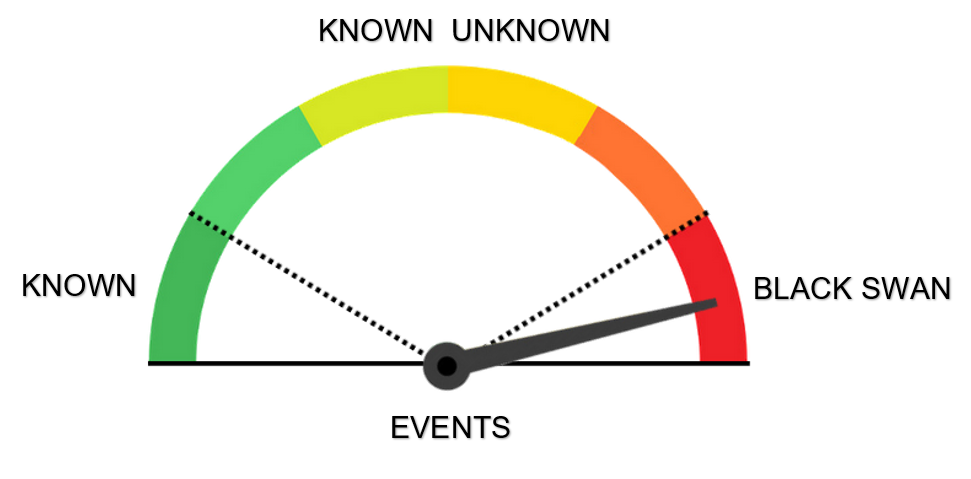

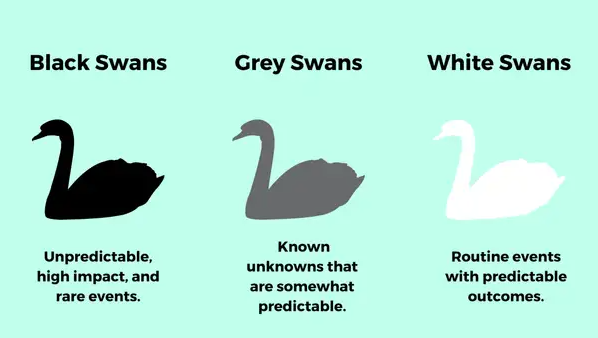

However, not all rare or impactful events qualify as Black Swans. For instance, Taleb differentiates between

Black Swans: Unpredictable and impactful events.

White Swans: Predictable events with known risks.

Grey Swans: Rare events that are conceivable but not expected.

This classification helps in understanding and preparing for various types of risks.

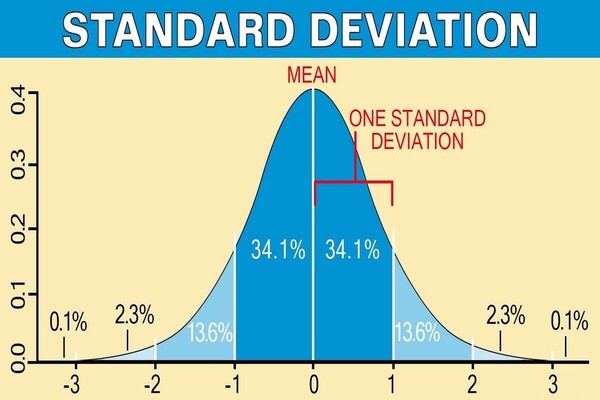

The Psychology Behind Black Swan Events

Human psychology plays a significant role in our inability to predict black swan events. For example, cognitive biases, like focusing on known risks and ignoring unknown ones, can create a false sense of security. After a black swan event, hindsight bias often leads people to believe it was predictable, even when it wasn't.

This psychological tendency to rationalise unexpected events after they happen can hinder our ability to prepare for future uncertainties. Acknowledging these biases is crucial for developing strategies to mitigate the impact of unforeseen events.

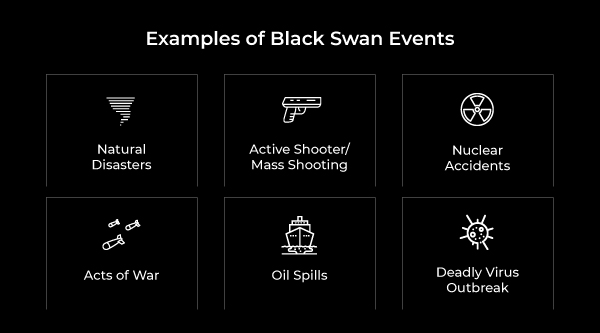

Notable Examples

1. The 9/11 Terrorist Attacks (2001)

The September 11 attacks were unforeseen and had a profound impact on global politics, security, and the economy. The event led to wars, increased security measures worldwide, and significant changes in foreign policy.

2. The 2008 Global Financial Crisis

Triggered by the collapse of the housing bubble in the United States, the crisis led to a severe global economic downturn. Despite warning signs, the scale and speed of the collapse were unexpected, leading to widespread financial reforms.

3. The COVID-19 Pandemic (2020)

While some experts had warned of the potential for a global pandemic, the rapid spread and impact of COVID-19 caught much of the world off guard. The pandemic disrupted economies, healthcare systems, and daily life immensely.

4. The Fukushima Nuclear Disaster (2011)

An earthquake and tsunami led to a nuclear meltdown at Japan's Fukushima Daiichi Nuclear Power Plant. The disaster had significant environmental and political repercussions, leading to changes in energy policies worldwide.

5. The Sinking of the Bayesian Yacht (2024)

A luxury yacht named Bayesian sank off the coast of Sicily after being hit by a rare and severe tornado-like waterspout. The sudden and unpredictable nature of the event, which resulted in multiple fatalities, exemplifies a black swan occurrence in maritime contexts.

In Financial Markets

Financial markets are also particularly susceptible to Black Swan events due to their complexity and interconnectedness. Examples include:

Dot-com Bubble Burst (2000): An overvaluation of internet companies led to a significant market crash.

Flash Crash (2010): A rapid, deep, and volatile drop in security prices, followed by a quick recovery, highlighting the fragility of Automated Trading systems.

These events underscore the importance of robust risk management and the limitations of traditional forecasting models.

8 Ways to Prepare Against Black Swan Events

1. Build Financial and Structural Resilience

The first line of defence against black swan events is structural resilience. It includes both personal and institutional measures to absorb shocks without catastrophic failure.

For individuals and investors:

Maintain a diversified investment portfolio. Exposure to a mix of assets such as stocks, bonds, commodities, real estate, and cash ensures that a downturn in one sector doesn't wipe out your financial standing.

Keep an emergency fund with 3 to 12 months' living expenses in liquid, safe assets.

Avoid excessive leverage. Debt magnifies losses during financial shocks.

For businesses:

Reduce dependency on single suppliers or revenue streams.

Maintain adequate cash reserves and contingency funding.

Use flexible supply chains and decentralised operations that can adapt quickly to disruption.

2. Apply Redundancy and Optionality

Borrowing from systems design, incorporating redundancy (backup systems) and optionality (keeping alternatives open) is crucial to surviving the unknown.

Redundancy means having spare capacity, such as extra resources or contingency plans that may seem unnecessary under normal conditions but are critical during crises.

Optionality involves positioning yourself or your business in a way that allows you to benefit from positive surprises while limiting exposure to negative ones.

For example, owning skills or assets that become more valuable in crisis (such as coding during a digital transition or farmland during food inflation) can turn volatility into opportunity.

3. Monitor Early Warning Indicators and Weak Signals

Although black swan events appear "out of nowhere," many are preceded by subtle clues or weak signals—patterns, data anomalies, or whispers in niche communities.

In finance, indicators like the volatility index (VIX), unusual spikes in credit default swaps, or flattening yield curves may signal that something is off.

In technology, exponential growth in unregulated sectors (e.g., cryptocurrency in 2021) may precede rapid reversals or regulation shocks.

Staying informed through a mix of traditional news, academic research, and independent experts can help catch these early signals, even if the exact outcome remains unknown.

4. Stress Testing and Scenario Planning

Stress testing is a proactive method used by central banks, corporations, and investors to simulate how a portfolio or system would respond under extreme conditions.

For businesses: conduct scenario planning for events like massive cybersecurity breaches, global supply chain collapse, or commodity price spikes.

For investors: test portfolios under historical crash scenarios, such as the 2008 financial crisis or the COVID-19 market shock.

For individuals: consider how job loss, inflation, or sudden relocation might affect your finances and lifestyle.

This mental rehearsal uncovers vulnerabilities and helps you respond more calmly and decisively when chaos unfolds.

5. Embrace Antifragility

Coined by Nassim Nicholas Taleb—the originator of the black swan theory—antifragility refers to systems that benefit from volatility and shocks. While fragile systems break under stress and robust ones survive, antifragile ones improve under stress.

In investing, this might involve strategies that capitalise on volatility, such as options trading or volatility arbitrage.

In business, launching small-scale experiments or pilot projects can lead to unexpected upsides in turbulent environments.

Designing for antifragility means prioritising learning, flexibility, and adaptability over optimisation and efficiency.

6. Question Assumptions and Biases

One of the main reasons black swan events catch people off guard is cognitive bias. Common pitfalls include:

Normalcy bias: the assumption that things will continue as they always have.

Confirmation bias: filtering out information that doesn't align with your existing worldview.

Hindsight bias: assuming after the fact that you "knew it all along."

To counter these, cultivate intellectual humility and regularly question prevailing narratives. Encourage debate, seek contrarian viewpoints, and avoid "groupthink" environments.

7. Implement Strong Governance and Decentralised Decision-Making

In large organisations, bureaucracies, or governments, hierarchical decision-making can slow response times and amplify failure during crises. Instead, decentralised models that empower local teams or units to make decisions often respond more effectively.

During COVID-19, some decentralised healthcare systems adapted faster to regional outbreaks than centralised ones.

Agile businesses that allowed managers to act independently weathered supply chain breakdowns more efficiently.

Empowering decision-making at lower levels and creating networks instead of pyramids helps contain damage and encourages faster innovation when facing the unexpected.

8. Stay Insured—Literally and Figuratively

Whether through actual insurance products or broader risk mitigation strategies, protection against tail events is vital.

Purchase health, life, disability, and business interruption insurance as needed.

In finance, consider hedging strategies like put options or inverse ETFs.

These safety nets can absorb some immediate impacts and buy time for adaptation.

Conclusion

In conclusion, black swan events remind us of the limitations of our knowledge and the importance of humility in planning and forecasting. By understanding the nature of these rare but impactful occurrences, we can better prepare for future uncertainties.

Emphasising resilience, adaptability, and awareness of cognitive biases can help individuals and organisations navigate the unpredictable landscape shaped by black swan events.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.