Have you ever wondered why stock prices sometimes move in ways that make no sense? Or why a currency pair suddenly spikes only to crash minutes later? In many cases, this isn't natural market movement; it's market manipulation.

Market manipulation involves the intentional alteration of asset prices for individual profit. It can be as subtle as spreading false rumours about a company or as bold as executing large fake orders to mislead traders. It is a serious issue that undermines the fairness and integrity of financial markets worldwide.

This article examines recent insights into market manipulation, including how to identify it, the common techniques employed by manipulators, and actionable steps that every trader can take to avoid becoming a victim of these unlawful activities.

What Is Market Manipulation in Trading?

Market manipulation involves deliberate actions or schemes designed to deceive investors by artificially affecting the supply or price of securities. Instead of letting supply and demand dictate prices, manipulators utilise deceptive tactics to make assets look stronger or weaker than they really are.

In most countries, market manipulation is illegal. Manipulation occurs in various markets, including stocks, forex, and cryptocurrency, primarily because it is challenging to monitor all activities.

The aim of these manipulators is straightforward: they seek to deceive traders into buying or selling assets to profit from the resulting artificial price movements.

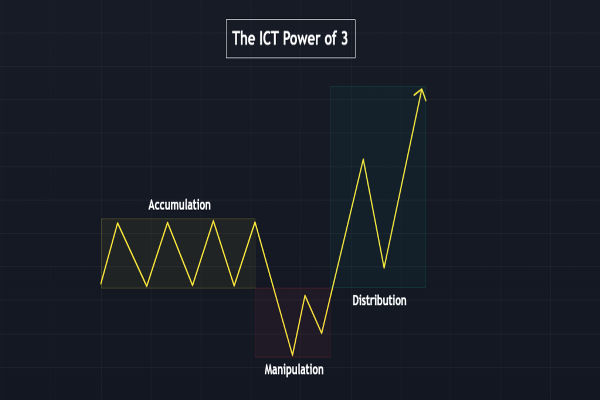

Common Types of Market Manipulation in 2025

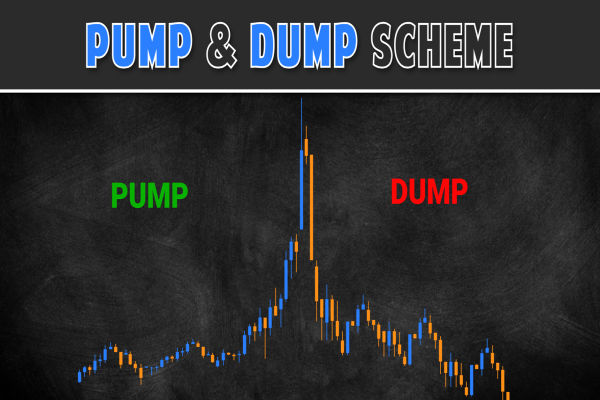

1) Pump-and-Dump Schemes

This occurs when manipulators pump (artificially inflate) the price of an asset by spreading hype or engaging in aggressive buying, then quickly dump (sell off) their holdings, leading to a price crash.

Where it happens most: Penny stocks and cryptocurrency.

Example: A small altcoin suddenly surges 200% in hours after social media hype, only to crash once insiders sell.

2) Spoofing and Layering

Spoofing involves placing large fake orders on one side of the market to mislead others into thinking there is strong demand or supply. Layering involves placing multiple such orders at different price levels. Once prices move, the manipulator cancels the orders.

Impact: Misleads traders into entering positions based on false demand.

Example: A large sell order on a stock causes panic, but it's cancelled right after small traders sell their shares.

3) Wash Trading

Wash trades occur when a trader buys and sells the same security simultaneously to create a misleading impression of market activity and volume.

Why it matters: Fake volume attracts new traders, enticing them to believe the asset is in demand.

Common in: Crypto exchanges with low regulations.

4. Rumour-Based Manipulation

Spreading false or exaggerated news about a company or currency to influence prices.

5. Bear Raids

In a bear raid, manipulators short-sell heavily while spreading negative rumours to drive a stock's price down.

6. Cornering the Market

This involves accumulating a large amount of control over an asset to dominate its price.

Real-World Examples and Recent Cases of Market Manipulation

In 2025, market manipulation still unfortunately persists. For instance, the Indian Securities and Exchange Board recently barred a US trading firm, Jane Street, from participating in Indian markets amid allegations of manipulation involving arbitrage and derivative trades worth $566 million.

Additional Examples include:

GameStop Short Squeeze (2021): Hedge funds heavily shorted GME stock, leading to accusations of a bear raid. Retail traders on Reddit fought back, causing a historic short squeeze.

Crypto Pump Groups: Groups on Platforms like Telegram coordinate pump actions on small altcoins, attracting new traders before dumping their holdings.

LIBOR Scandal (2012): Several major banks have manipulated interest rate benchmarks, impacting global financial markets.

These instances demonstrate that manipulation is a reality; it occurs at all levels, from retail groups to large institutions.

How to Spot Market Manipulation

While it's impossible to predict every scheme, you can look for warning signs:

Unusual price spikes without clear news or a fundamental reason.

Sudden increases in trading volume for illiquid assets.

Fake news or hype is spreading across social media.

Large orders appear and disappear quickly in the order book.

Extreme volatility in assets that normally trade steadily.

If something feels "too good to be true," it probably is.

How to Avoid Market Manipulation in Trading?

For traders and investors, it's essential to develop proactive strategies to avoid falling prey to manipulation:

Do Your Own Research: Base decisions on verified, fundamental data rather than rumours or hype.

Beware of "Too Good to Be True" Offers: Be sceptical of sudden price surges or promises of quick profits.

Use Limit Orders: Refrain from using market orders, as they may be affected by artificial price fluctuations.

Diversify Your Portfolio: Spreading risk can reduce exposure to manipulated stocks.

Monitor Your Trading Activity: Regularly review your account and trade history for irregularities.

Stay Informed of Market News: Follow updates from regulatory bodies and trusted financial news sources.

Report Suspicious Activity: Notify your broker or regulator if you come across suspect trades or price behaviour.

Why Market Manipulation Matters to Traders and Investors?

Understanding manipulation is crucial because:

It distorts fair value, making it harder to trade based on true fundamentals or technical signals.

It can lead to unexpected losses, especially for beginners who follow price moves without research.

Recognising manipulation early can help you avoid traps and sometimes even profit by trading against manipulators.

The Future of Market Manipulation: Increased Regulation and Detection

Regulators worldwide are enhancing detection and enforcement mechanisms:

Strengthening surveillance using AI and big data analytics.

Whistleblower programs offering protection and rewards for informants.

Imposing heavy penalties, trading bans, and corrective actions.

Educating investors about market manipulation warning signs and prevention.

India and international bodies such as the US SEC, UK FCA, and European ESMA are leading efforts to safeguard equity and commodity markets.

Frequently Asked Questions

1. What Are the Common Signs of Market Manipulation?

Sudden price spikes without news, unusual order cancellations, volume surges, and heavy promotion of a stock on social media.

2. Is Insider Trading Considered Market Manipulation?

Insider trading based on non-public information is illegal and often overlaps with manipulative practices if it distorts market fairness.

3. What Should I Do if I Suspect Market Manipulation?

Report suspicions to your broker or the relevant market regulator for investigation.

Conclusion

In conclusion, market manipulation poses a serious risk to the integrity of financial markets and the confidence of investors worldwide. From pump and dump to spoofing and rumour-based manipulation, the tactics may vary, but the goal is always the same: to profit at the expense of uninformed traders.

The good news is that by spotting warning signs, practising risk management, and focusing on transparent markets, you can avoid most traps. Remember, the market rewards patience, discipline, and knowledge, not impulsive reactions to hype.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.