Fundamental analysis is one of the most important tools for traders looking to understand the broader market and make informed decisions. It's the process of analysing economic, financial, and other qualitative factors that could impact the value of a particular asset. By studying these factors, traders can assess whether an asset is undervalued or overvalued and predict its future price movement.

In this article, we'll explore what fundamental analysis is, how it's used by traders, and why it's such a crucial part of successful trading strategies.

What Is Fundamental Analysis?

Fundamental analysis is the study of the underlying factors that affect an asset's value. This includes a wide range of economic indicators, financial data, and other qualitative information. Traders use fundamental analysis to assess the long-term viability and potential of an asset, whether that be a stock, currency, commodity, or another financial instrument.

Rather than focusing on past price movements, as technical analysis does, fundamental analysis seeks to understand what's driving the asset's value. This might include:

Economic indicators: such as GDP growth, inflation rates, and unemployment data

Interest rates: Central bank policies can have a major impact on asset values

Corporate earnings: for stocks, traders will analyse a company's financial health

Political events: elections, policy changes, and geopolitical events can all influence market sentiment

By considering these factors, traders aim to make predictions about the future direction of an asset's price.

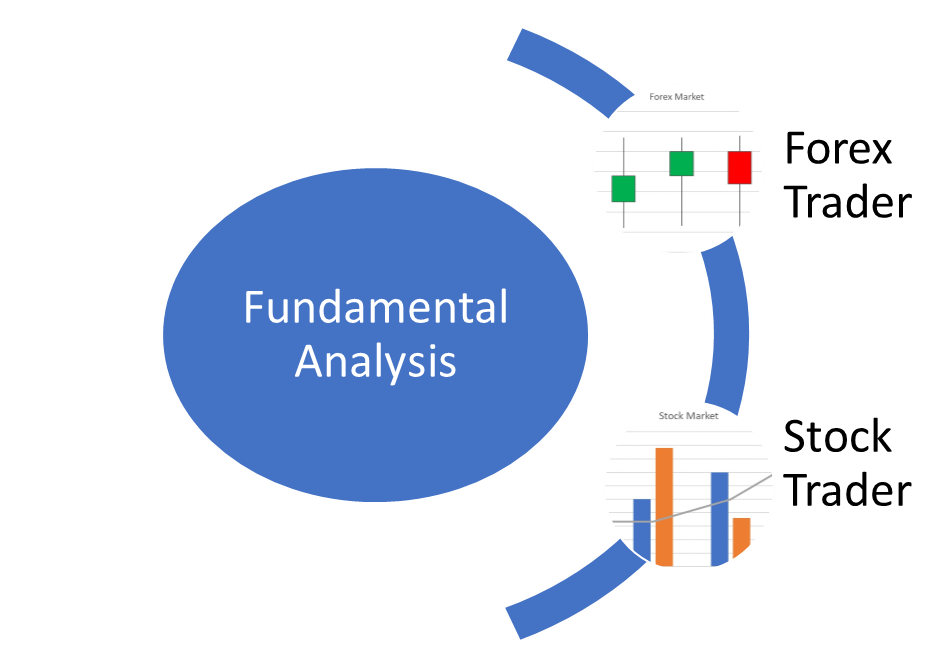

How Traders Use Fundamental Analysis

Traders rely on fundamental analysis for different purposes, depending on their trading style and the market they're involved in. Here's how traders typically use it:

1. Stock Traders

For stock traders, fundamental analysis involves evaluating the financial health of a company. This includes looking at metrics like:

By understanding the financial performance and outlook of a company, traders can decide whether the stock is undervalued or overvalued. For instance, if a company has strong earnings and low debt, it may be a good investment, even if the stock price is temporarily low.

2. Forex Traders

For forex traders, fundamental analysis focuses on the economic strength of a country. Factors like GDP growth, interest rates, inflation, and unemployment play a significant role in currency value. For example, if a central bank raises interest rates, the currency typically appreciates as investors move capital into higher-yielding assets.

Traders use fundamental analysis to predict how economic events or news will impact currency prices. This could include:

Economic reports (like job data, inflation rates, etc.)

Central bank policies

Political developments (like elections or geopolitical risks)

3. Commodity Traders

In commodity markets, fundamental analysis involves understanding supply and demand factors. This could include:

Natural resource availability (e.g., oil supply or agricultural yields)

Seasonal demand changes

Geopolitical tensions that affect the supply of certain commodities

For example, a drought might lead to lower crop yields, affecting the price of agricultural commodities. By studying these factors, traders can make better predictions about commodity price movements.

Why Fundamental Analysis Is Important for Traders

While technical analysis provides insights into price movements, fundamental analysis gives traders the bigger picture. It helps traders understand why prices move the way they do and what might influence those movements in the future. Here are a few reasons why fundamental analysis is so important:

1. Understanding the Bigger Picture

By examining economic reports, corporate earnings, and geopolitical events, traders gain a better understanding of the underlying factors that influence market movements. This helps them make more informed decisions and reduce the risk of trading purely based on price patterns.

2. Predicting Long-Term Trends

While technical analysis can help with short-term price predictions, fundamental analysis is invaluable for assessing long-term trends. For example, if a country is experiencing strong economic growth, its currency may appreciate over time, even if there are short-term fluctuations.

3. Identifying Undervalued or Overvalued Assets

Through fundamental analysis, traders can identify assets that are undervalued or overvalued. If a stock is undervalued based on its earnings and market conditions, it might present a good buying opportunity. Conversely, if an asset is overvalued, traders might decide to avoid it or short it.

Combining Fundamental and Technical Analysis

While fundamental analysis focuses on the "why" behind price movements, technical analysis focuses on the "what" — that is, what has happened in the market. Combining both analyses allows traders to make more comprehensive decisions. For example, a trader might use fundamental analysis to determine that a company's stock is undervalued, and then use technical analysis to find the best time to enter the market.

Common Challenges in Fundamental Analysis

While fundamental analysis is an essential tool for traders, it can be challenging to use correctly. Here are a few common difficulties:

Overloading with Information: There's an overwhelming amount of economic data available. It's easy to get bogged down in the details and lose sight of the bigger picture.

Subjectivity: Interpreting economic data can be subjective. Different traders may interpret the same report in different ways.

Lagging Data: Economic data often comes with a delay, meaning it may not be as useful for making immediate trading decisions.

Despite these challenges, fundamental analysis remains a vital part of any trading strategy. By focusing on the key economic indicators and staying updated on news, traders can avoid common pitfalls and use fundamental analysis effectively.

Final Thoughts

Fundamental analysis is a powerful tool for traders seeking to understand the broader forces that drive asset prices. By focusing on economic indicators, corporate health, and geopolitical events, traders can assess whether an asset is overvalued or undervalued and make more informed decisions.

Whether you're trading stocks, forex, or commodities, fundamental analysis provides the insights needed to make smarter, long-term trades. Combine it with technical analysis to create a well-rounded trading strategy that increases your chances of success in the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.