In forex trading, one false move can cost you; but savvy traders know the secret weapon institutions use: the liquidity sweep.

This phenomenon is commonly referred to as a "stop hunt" or a "liquidity grab." But for the savvy trader, this trap isn't a threat - it's an opportunity. It is a strategy, a hidden trap that flushes out stop-losses before the market makes its real move.

This guide explains what a liquidity sweep is, how it operates in the forex and financial markets, how institutional traders leverage it to capture liquidity, and how you can identify and trade these movements effectively.

By the end of your reading, you’ll understand how to spot false breakouts, anticipate market reversals, and turn these liquidity traps into a profitable trading strategy.

What Is a Liquidity Sweep in Forex?

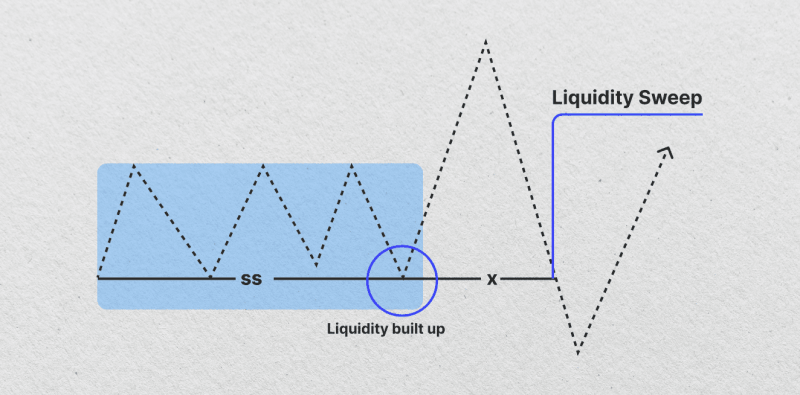

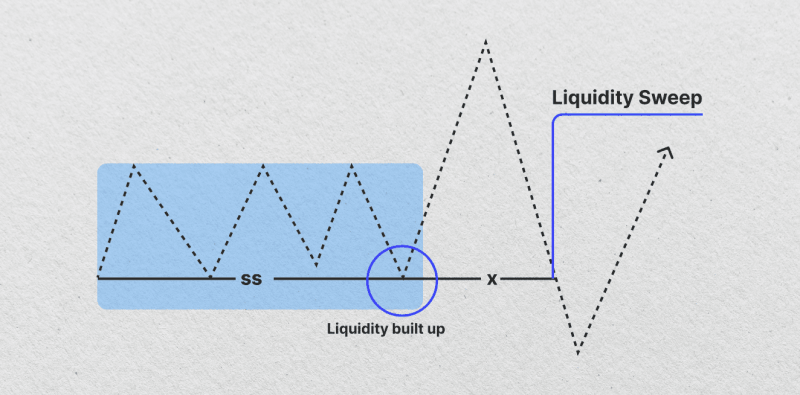

A liquidity sweep is a strategic market move where price deliberately breaks through key support or resistance levels to trigger stop-loss orders and capture market liquidity.

This often leads to a false breakout, where the price briefly pierces a critical level only to reverse sharply, trapping traders and absorbing pending orders.

This behavior is deliberate. Institutional traders, including hedge funds and investment banks, require sufficient liquidity to execute large block orders. Retail traders frequently place stop-losses just above resistance or below support, creating predictable pockets of liquidity.

Smart money exploits this, triggering stops to collect liquidity and establish positions in the opposite direction.

Rather than indicating a sustainable trend, a liquidity sweep typically signals a market reversal.

Traders who can identify and time these sweeps can capitalize on short-term price action, gaining from the sharp moves that occur after the trap is set. Understanding liquidity sweeps is essential for day traders, swing traders, and anyone navigating volatile financial markets.

Step-by-Step To Trade The Liquidity Sweep

Trading the liquidity sweep involves waiting for the trap to trigger, confirming rejection, and then entering with tight risk and favourable reward.

Here's a breakdown of how to trade it effectively:

Step 1: Mark Key Liquidity Zones

Identify major swing highs, lows, and psychological price levels. These are the locations where stops are situated.

Step 2: Wait for the Sweep

Do not anticipate the sweep, just let it happen. Watch for a sharp move through the level with a long wick, followed by a swift reversal candle.

Step 3: Confirm the Rejection

Look for a strong engulfing candle or pin bar that forms after the sweep. It confirms that Smart Money has dismissed the false breakout.

Step 4: Enter the Trade

Enter in the opposite direction of the sweep. For instance, if the price clears a high and then declines, you can enter a short position after validation.

Step 5: Place Stops and Targets

Place your stop above the wick of the sweep and target the opposite side of the range or next liquidity level. Use risk-reward ratios of 1:2 or better.

This strategy works well in confluence with:

How to Identify a Liquidity Sweep

Recognising a liquidity sweep in real time requires a sharp eye for market structure, price behaviour, and psychological levels. The price action around support and resistance will give you clues.

Look for a strong move beyond a known support or resistance level, followed by an aggressive rejection. The sweep will often be characterised by a sudden spike in volatility, a quick wick, and then a reversal candle or engulfing pattern signalling the shift in momentum.

Timing is also important. Liquidity sweeps frequently occur when:

Price-sweeping liquidity is often not a continuation. When you see a false breakout that fails to sustain itself and returns inside the prior structure, it's likely a sweep has just occurred.

How Smart Money Uses Liquidity Sweeps

The institutional trading model focuses on accumulation and distribution. Before a major move, smart money needs to absorb liquidity. Liquidity sweeps act as their trap, allowing them to:

Collect orders at optimal prices

Trap retail traders on the wrong side

Create momentum through false breakouts

By identifying where retail traders are most vulnerable, institutions use liquidity sweeps to manipulate prices temporarily and gain a strategic advantage.

Once the sweep occurs, the institutions can ride the true move often the opposite of what most retail traders expect.

Best Forex Pairs and Timeframes For Liquidity Sweeps

Certain forex pairs and market conditions are more prone to liquidity sweeps:

Highly liquid pairs: EUR/USD, GBP/USD, USD/JPY, and XAU/USD tend to exhibit clear sweeps.

Secondary pairs: USD/CHF and GBP/JPY can also show strong liquidity-driven spikes.

Optimal timing: Sweeps are most frequent during London and New York session opens, or around high-impact news events.

Chart timeframes: Intraday traders may use 5-15 minute charts; swing traders can observe 1-4 hour charts for confirmation.

Intraday traders may use the 15-minute or 5-minute chart to spot the sweeps, while swing traders may observe 1-hour or 4-hour charts. Combining timeframes offers the best entries with macro confirmation and micro precision.

Common Mistakes Traders Make

Even experienced traders can fall into traps when trading liquidity sweeps. Avoid these common errors:

Jumping in too early: Entering a trade before the sweep confirms often leads to being caught in the false breakout.

Ignoring market context: Trading sweeps without considering overall trend, session volatility, or macro factors can result in losses.

Poor risk management: Oversized positions or improper stop placements can amplify losses.

Misreading signals: Confusing a true breakout for a sweep, or vice versa, can lead to premature exits or entries.

Real-World Example

Imagine EUR/USD has been trading in a tight range with a visible resistance at 1.0950. Retail traders identify this level and either:

Sell at the resistance with stop-losses above 1.0960 or

Set buy stops just above 1.0950, anticipating a breakout.

Institutions push the price up through 1.0965, triggering the stop-losses and breakout entries.

But instead of continuing higher, the pair sharply reverses and drops below the range, stopping out breakout buyers and squeezing short sellers.

This entire sequence is the liquidity sweep, a calculated move designed to fill large orders before reversing direction.

Risk Management Tips

Liquidity sweeps are high-probability setups but can be volatile. Protect your capital with these practices:

Position sizing: Trade smaller sizes in relation to account balance during high-volatility moves.

Stop-loss placement: Place stops just beyond the wick of the sweep to avoid premature exit.

Risk-reward ratio: Aim for at least 1:2 or better to ensure trades are profitable over time.

Scaling out: Consider partial exits at intermediate levels to lock in profits while letting the remainder ride.

Why Liquidity Sweeps Works in 2025's Forex Market

With algorithmic and smart money tactics increasingly prevalent in the FX markets, retail traders in 2025 face more advanced forms of manipulation. However, the core behaviour of stop-hunting hasn't changed, it has become more precise and frequent.

The rise of prop firms, social trading platforms, and crowd psychology makes stop clusters easier to predict. As a result, liquidity sweeps remain one of the most exploitable patterns for those who understand market structure.

Whether you're trading major news events or daily session opens, liquidity sweep setups are among the most powerful tools a modern forex trader can add to their playbook.

Frequently Asked Questions (FAQ)

1. What is the difference between a Liquidity Sweep and a True Breakout?

A sweep is a false breakout marked by a long wick and immediate reversal. A true breakout closes decisively outside the level and often retests before continuing the trend.

2. What is the most important SMC concept to use with a sweep?

The Order Block left at the high/low of the sweep. This marks the precise point where institutional money entered the market.

3. How often do Liquidity Sweeps occur?

Most frequently around major session opens (London/New York) or during high-impact news events, when liquidity and volatility are highest.

4. Does this strategy work on stocks or crypto?

Yes. The principle of stop-hunting liquidity is a fundamental market mechanism that works in any highly liquid asset (Forex, Gold, major indices, Crypto).

Conclusion

In conclusion, liquidity sweeps in forex represent both a danger and an opportunity. To untrained eyes, they appear as breakouts or volatility spikes. However, an informed trader indicates institutional activity as an opportunity to trade the reversal assuredly.

Thus, stay patient, stay observant, and let the market show its hand. When it does, you'll know how to take the trade and ride the move just like the pros.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.