Social trading is changing how people invest by letting users follow and automatically copy the trades of experienced investors. Instead of relying on complex research or expensive advisors, investors can tap into the shared knowledge of a global trading community.

For beginners, it offers a simple way to learn, apply strategies, and potentially earn all within one platform.

Unlike traditional investing, which can feel overwhelming and solitary, social trading makes markets more accessible and transparent by linking newcomers with skilled traders.

What Is Social Trading?

Social trading, also known as copy trading or mirror trading, is a method of trading where individuals can automatically copy the trades of more experienced and successful traders.

This allows beginners to mirror the strategies of seasoned professionals without needing to have deep knowledge or experience of the markets themselves.

The idea behind it is that you can potentially achieve similar financial outcomes without having to manage every trade yourself by following or copying a skilled trader,

Social trading platforms typically provide a marketplace where traders can share their strategies and insights, allowing others to follow their trades or interact with them to discuss strategies.

It's a way for individuals to tap into the collective intelligence of the trading community and learn while they earn.

Types of Social Trading Platforms

Social trading platforms have developed into several main categories that serve different kinds of investors. Knowing how each one works helps you choose the right option for your experience level and investment goals.

1. Copy Trading Platforms

These platforms let users automatically copy the trades of professional investors. Every buy and sell is replicated in real time, following the same strategy and timing.

It’s an easy way for beginners to participate in markets without having to analyze every detail themselves. Examples include EBC Financial Group.

2. Signal-Based Platforms

Instead of copying trades directly, signal platforms send alerts from expert traders. You can see when and why a trade is made, then decide if you want to follow it. This setup gives more control to users who still want professional guidance but prefer to manage their own risk.

3. Community-Based Platforms

These work like social networks for investors. Traders share insights, post performance results, and discuss market ideas openly. You can learn from others while building your own strategy, which makes these platforms useful for education and idea sharing.

Each type offers a different mix of automation, control, and learning, so it’s important to choose based on your trading confidence and involvement level.

How To Start Social Trading Now

Getting started with social trading is straightforward, but success depends on understanding the process and choosing the right tools. Here’s a simple breakdown to help you begin with confidence.

1. Choose a Reliable Social Trading Platform

Your platform is your gateway to the markets. Pick one that’s regulated, transparent, and offers a user-friendly interface. Check factors such as available assets, platform fees, and performance tracking tools.

Platforms like EBC Financial Group provide access to verified traders and detailed analytics, helping you make informed decisions.

2. Define Your Goals and Risk Level

Before copying trades, decide what you want to achieve whether it is steady growth, short-term profits, or passive income. Your objectives determine which traders you should follow.

Also, understand your risk tolerance. High-risk traders might deliver faster returns but can also lead to bigger losses. Lower-risk strategies tend to grow more slowly but offer more stability.

The key is finding a balance between your comfort level and your financial goals.

3. Select the Right Trader to Copy

After funding your account, browse available traders and review their performance, trading style, and consistency. Most platforms show data on win rates, risk scores, and average returns.

Once you select a trader, you can copy their trades automatically and set your own limits, such as stop-loss levels and maximum investment size.

This gives you control over risk while following proven strategies.

4. Learn and Adjust as You Go

Social trading isn’t just about copying but it’s about learning. Watch how professional traders manage entries, exits, and risk. Participate in community discussions, read trader insights, and ask questions.

Over time, you’ll understand how different markets behave and may start adjusting your own strategy. The goal is to evolve from copying trades to confidently managing your portfolio.

Pro Tip:

Start small and diversify across two or three traders rather than relying on one. Track your results weekly, and don’t hesitate to pause copying when market conditions become unpredictable. Consistent review builds smarter habits

Risks And Benefits Of Social Trading

Social trading simplifies market participation, but it’s important to weigh both its advantages and potential downsides before getting started.

| Benefits |

Risks / Limitations |

| Accessibility: Makes trading approachable for beginners by allowing them to follow experienced investors. |

Dependence on Others: Success relies heavily on the trader being copied, as poor choices can lead to losses. |

| Learning Opportunity: Helps users understand trading strategies in real time. |

Market Volatility: Even skilled traders cannot avoid market swings or unpredictable events. |

| Diversification: Allows copying multiple traders across different markets or asset classes. |

Emotional Bias: Some users may overreact to short-term performance, switching traders too often. |

| Transparency: Many platforms display full performance metrics, risk scores, and trading history. |

Fees and Slippage: Some platforms charge commissions or experience trade execution delays that reduce returns. |

| Community Support: Traders can interact, share strategies, and build confidence through insights. |

Regulatory Differences: Not all platforms are equally regulated, which may affect investor protection. |

What to Look Out For in Social Trading

Social trading can make investing easier, but it’s important to stay careful. Here are a few things beginners should watch for:

1. Overhyped Results

Some traders show big profits without showing their losses. Always check their full history and long-term performance before copying anyone.

2. Unregulated Platforms

Only use platforms that are properly regulated. This helps protect your money and ensures fair trading practices.

3. Blind Copying

Don’t copy traders without understanding what they’re doing. High-risk traders can make fast gains, but they can also lose money quickly.

4. Emotional Reactions

Avoid jumping between traders just because of short-term losses or gains. Stay patient and focus on steady results.

5. Hidden Costs

Watch out for extra fees or slow trade execution that can reduce your profits. Always read the platform’s terms and try a demo account first.

Social trading works best when you stay informed and think long term.

The Future of Social Trading

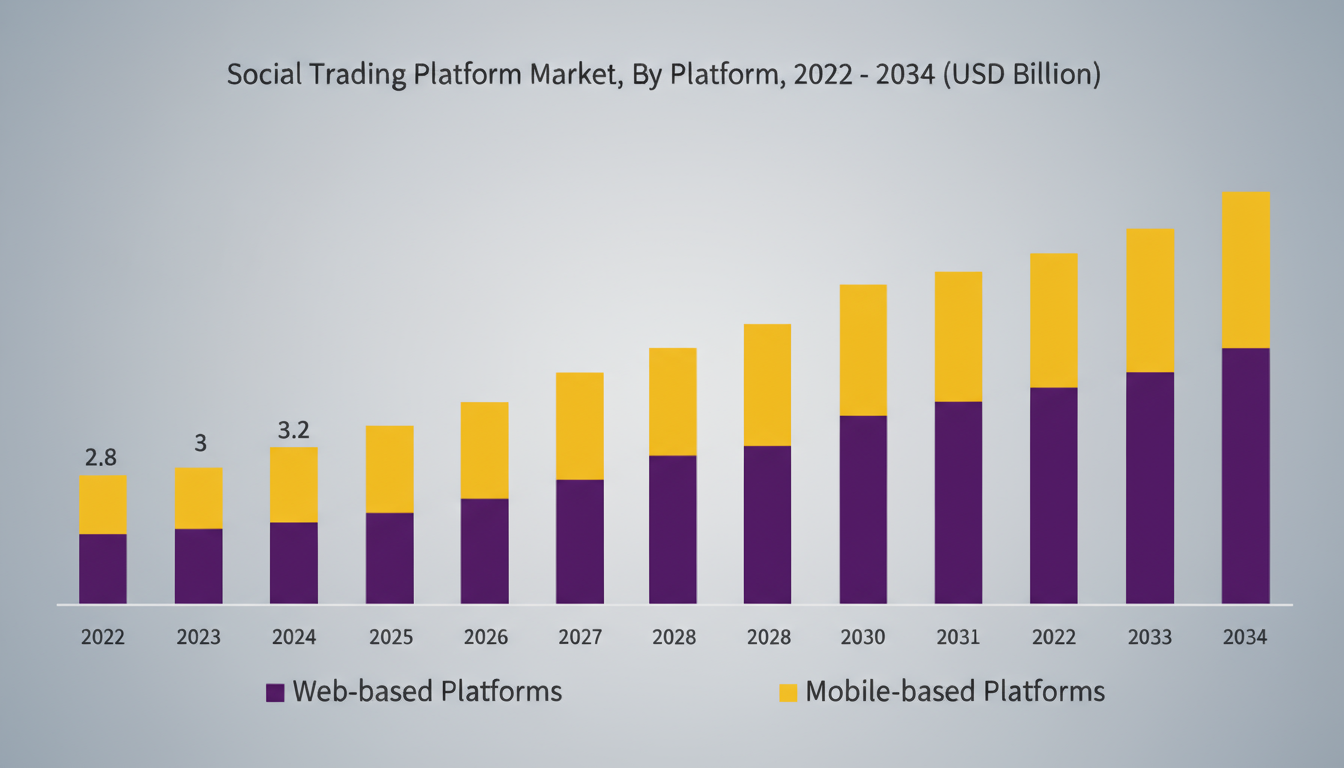

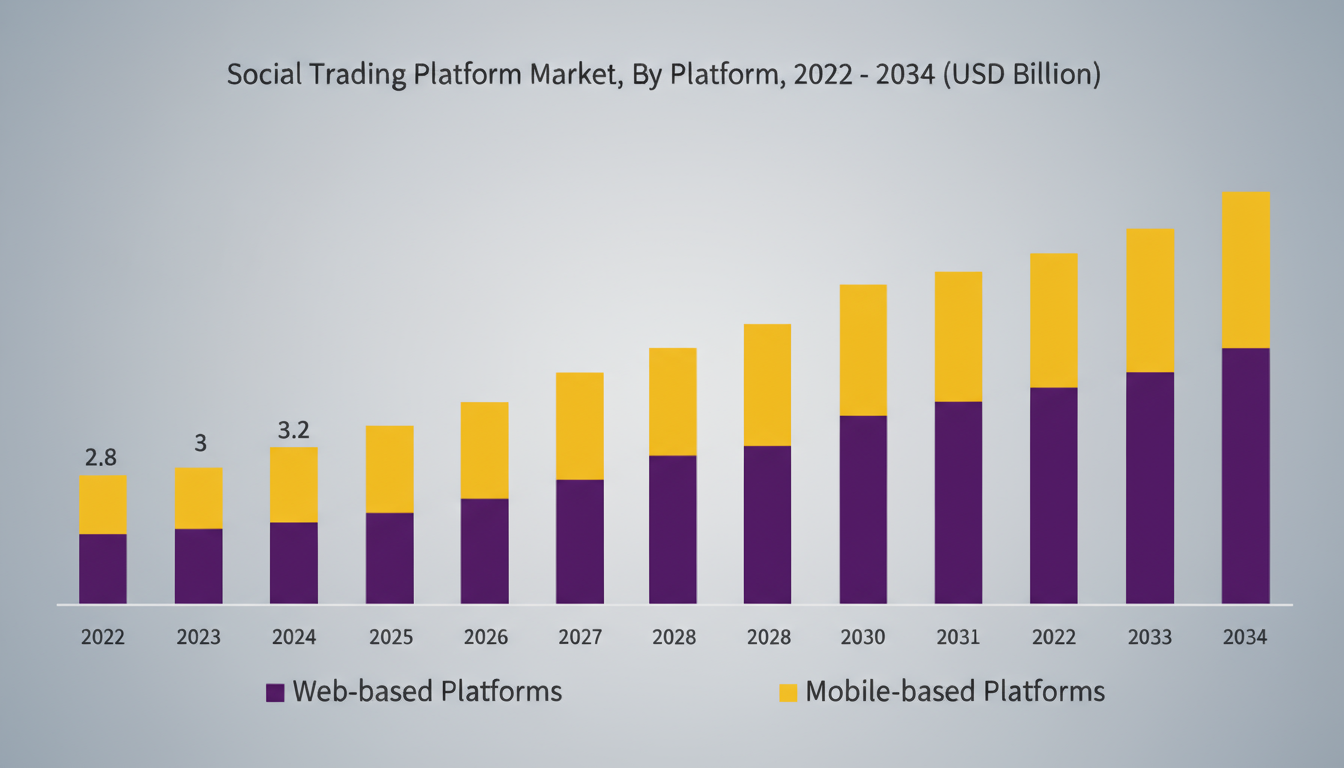

The future of social trading looks bright as technology continues to evolve. The global social trading platform market size is USD 3.20 billion in 2024, with projections to USD 6.50 billion by 2032.

Artificial intelligence (AI) and machine learning are set to make platforms smarter by improving trade analysis, pattern recognition, and risk management.

These tools can help traders make faster and more informed decisions.

Blockchain technology is also expected to play a key role in shaping the next generation of social trading.

By increasing transparency and security, blockchain can build greater trust between traders and platforms. Smart contracts such as self-executing agreements stored on the blockchain may one day automate trade copying, reducing the need for centralised control.

Regulation will remain another important factor. Governments around the world are tightening rules to protect investors and ensure fair trading practices. As the industry matures, traders should stay informed about both new technologies and evolving regulations.

Frequently Asked Questions (FAQ)

1. Is social trading good for beginners?

Yes. Social trading is ideal for beginners because it allows them to learn from experienced traders while actively participating in the market. It’s a practical entry point, especially when paired with proper risk management.

2. Can I lose money with social trading?

Yes. Like all forms of investing, social trading carries risk. Even top-performing traders can face downturns, so it’s essential to diversify and never invest money you can’t afford to lose.

3. Do I need experience to start social trading?

No. Most platforms are designed for beginners and include performance statistics, guides, and community discussions to help you learn as you go.

Conclusion

Social trading has made investing more accessible by allowing beginners to learn directly from experienced traders. It bridges the gap between education and real-world market participation, helping users build confidence while potentially earning returns.

However, success depends on choosing a reliable platform, managing risks wisely, and diversifying your portfolio.

With a thoughtful approach, social trading can be both a practical entry point for new investors and a valuable learning tool for long-term growth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.