Anyone who trades regularly knows how messy price charts can get. Candles keep printing, indicators stack up, and before long it becomes hard to tell whether the market is actually trending or just chopping sideways. Renko charts were created to solve that problem.

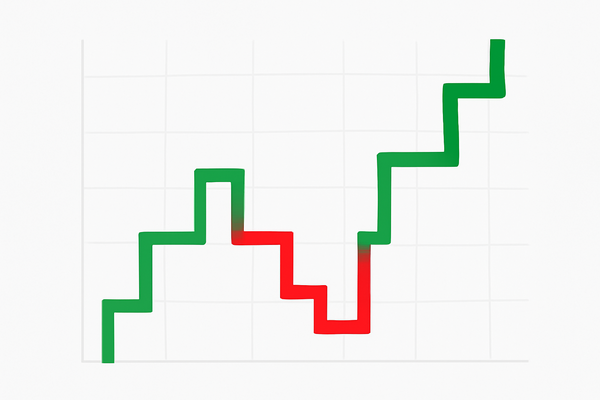

Instead of plotting price against time, Renko charts only respond when price moves by a meaningful amount. If the price doesn’t move far enough, nothing prints. This simple change removes much of the background noise and makes trends, pauses, and reversals easier to see at a glance.

This article breaks down what Renko charts are, how they work, their strengths and limitations, and how traders use them in real-world strategies.

What Are Renko Charts?

Renko charts originated in Japan and are a type of chart that differs significantly from common candlestick or bar charts. The name "Renko" is derived from the Japanese word "renga," meaning brick, which reflects the chart's distinctive appearance made up of uniform bricks or blocks.

Each brick in a Renko chart represents a fixed price movement rather than a fixed time period. For example, a brick might represent a price move of 10 pips in forex or a set dollar amount in stocks. A new brick is only added when the price moves by this predefined amount, either up or down. If the price fluctuates within the range, no new bricks are formed.

This structure means Renko charts ignore time entirely. Instead of showing how price changes every minute or hour, they show price momentum more clearly by focusing on significant moves. This can reduce noise and help traders see the bigger picture.

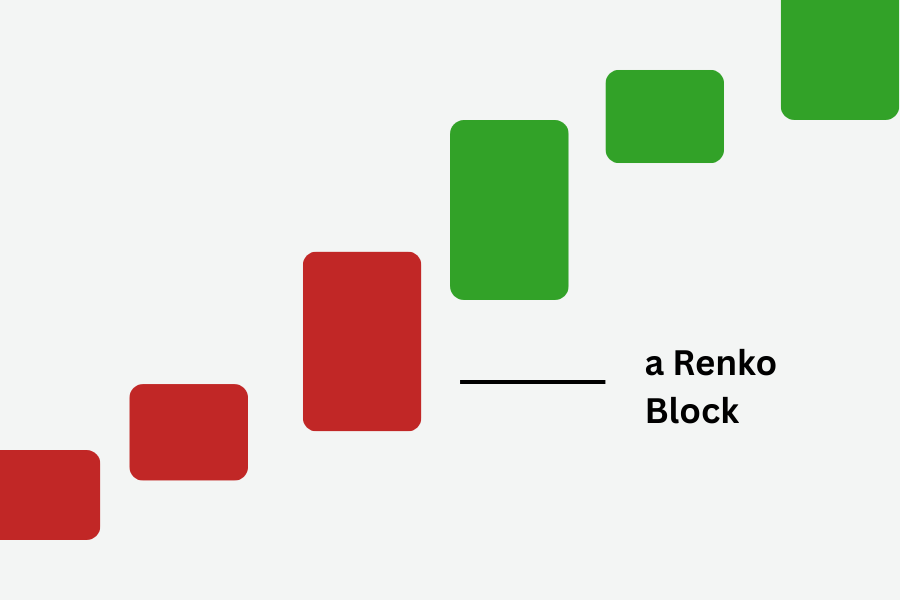

Brick In Renko Chart

A Renko brick size defines the price movement required to form a new brick on a Renko chart. Unlike traditional candlestick charts, which plot price action over fixed time intervals, Renko charts focus purely on price movement. Each brick represents a predefined amount of price change rather than elapsed time.

The size of each Renko brick is chosen by the trader and reflects how sensitive the chart is to market fluctuations.

For example, if a Renko brick size is set to 10%, a new brick will only appear once the price moves up or down by 10%. Smaller brick sizes highlight short-term price action, while larger brick sizes filter out market noise and emphasize broader trends.

A key characteristic of Renko charts is that bricks never form side by side. Instead, new bricks appear at a 45-degree angle above or below the previous brick, depending on price direction. This structure makes trend direction and reversals easier to identify.

How Do Renko Charts Work?

Renko charts build bricks at a consistent size. When the price increases by the brick size, a white or green brick is added above the previous one. When the price decreases by the brick size, a black or red brick is added below.

Because bricks only form after a defined price movement, sideways price action results in no new bricks. This filtering effect means that small fluctuations or minor reversals do not clutter the chart, helping traders avoid false signals and indecision.

Traders can set the brick size according to their preferences or trading style. Smaller bricks will create more detailed charts but may include more noise, while larger bricks focus on longer trends but may miss short-term opportunities.

Benefits Of Renko Charts

One of the biggest advantages of Renko charts is their ability to filter out market noise. By ignoring time and only focusing on significant price movements, Renko charts offer a clearer view of the trend. This can help traders make more confident entry and exit decisions.

Renko charts also make support and resistance levels easier to identify. Since bricks form only after price moves a fixed amount, these levels tend to appear as clear horizontal lines on the chart. This visual clarity simplifies technical analysis.

In addition, Renko charts work effectively alongside popular technical indicators such as moving averages, RSI, and MACD. Their structured layout makes it easier to recognize trend continuations and reversals, enabling traders to respond to changes in market direction with greater precision.

Overall, the simplicity and clarity of Renko charts make them a powerful tool for traders seeking better trend analysis and reduced emotional decision-making.

Limitations of Renko Charts

Despite their advantages, Renko charts are not perfect. Because they do not take time into account, they can sometimes experience market lag in fast-moving markets. Important price information occurring within the brick size may be overlooked until a new brick forms.

Renko charts can also give fewer signals compared to time-based charts, which might be a drawback for traders who rely on frequent trades or scalping. The choice of brick size is critical; too large and the chart may miss opportunities, too small and it may generate false signals.

Practical Tips for Using Renko Charts

To get the most out of Renko charts, it is important to experiment with different brick sizes to find the one that matches your trading style and market volatility. Combining Renko charts with volume indicators or oscillators can improve signal reliability.

It is also wise to use Renko charts in conjunction with traditional time-based charts. While Renko charts simplify trend analysis, time charts provide context on volume and timing which can be crucial for execution.

Above all, always use sound risk management. Like any trading tool, Renko charts do not guarantee profits. They are best used as part of a comprehensive strategy that includes stop losses and position sizing.

Trading Strategies for Renko Charts

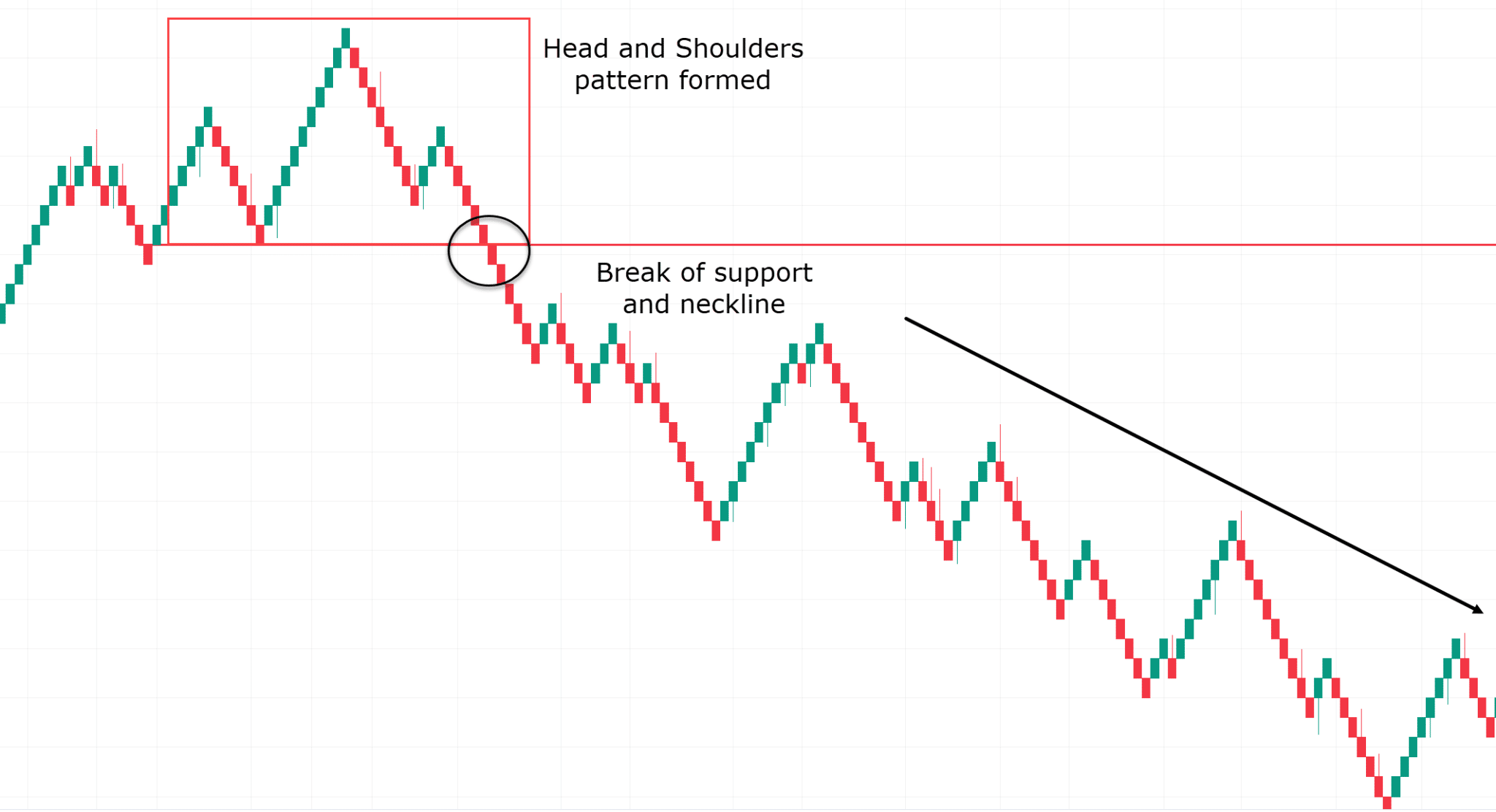

Trend-Following Strategy: Renko charts are highly effective for trend trading because consecutive bricks clearly show sustained direction. Traders typically enter after multiple bricks confirm the trend and stay in the trade until a reversal brick appears.

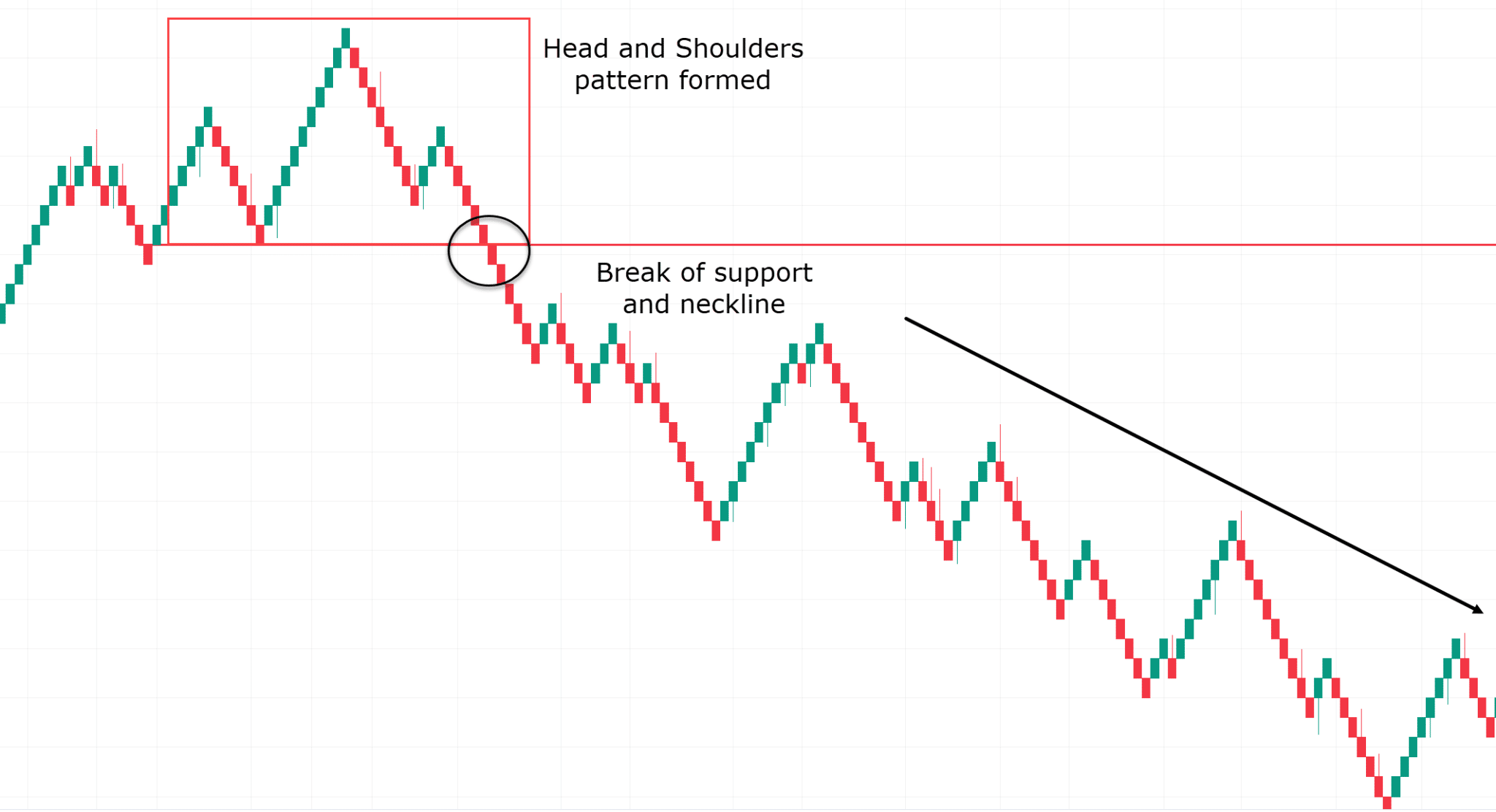

Breakout Trading Strategy: Breakouts on Renko charts occur when price prints a new brick beyond a previous support or resistance level. Because Renko filters out small fluctuations, breakout signals tend to be cleaner and less prone to false moves.

Range Trading Strategy: In sideways markets, Renko charts can highlight well-defined horizontal support and resistance zones. Traders look to buy near the lower boundary of the range and sell near the upper boundary, exiting when a breakout brick appears.

Pullback (Retracement) Strategy: During strong trends, temporary counter-trend bricks can signal pullbacks rather than full reversals. Traders often enter when the main trend resumes after one or two opposing bricks.

Reversal Trading Strategy: Reversals are identified when bricks switch direction after a prolonged trend. Additional confirmation from indicators like RSI or MACD can help reduce false reversal signals.

Support and Resistance Strategy: Because Renko bricks form only after meaningful price movement, support and resistance levels appear cleaner and more reliable. Trades are often taken near these levels with stops placed beyond the last reversal brick.

Frequently Asked Questions (FAQ)

1. Are Renko charts suitable for all financial markets?

Renko charts can be used across forex, stocks, indices, commodities, and cryptocurrencies because they are based on price movement rather than time. However, their effectiveness depends on market volatility and the chosen brick size.

2. What is the best Renko brick size for trading?

There is no single best brick size, as it depends on the asset, timeframe, and trading style. Traders typically adjust brick size based on volatility, with smaller bricks for short-term trading and larger bricks for trend-focused strategies.

3. Can Renko charts be used for intraday trading?

Yes, Renko charts can be applied to intraday trading, but smaller brick sizes are usually required to capture shorter price movements. Traders should be aware that smaller bricks may increase noise and false signals.

4. Do Renko charts work better with indicators or price action alone?

Renko charts can be effective on their own due to their clean trend structure, but many traders combine them with indicators like RSI, MACD, or moving averages. This combination can help confirm signals and improve overall trade reliability.

Conclusion

Renko charts offer traders a unique way to filter market noise and focus on meaningful price movements. By simplifying the visual representation of trends, these charts can help traders make clearer and more confident decisions.

While not without limitations, when used correctly and alongside other tools, Renko charts can significantly enhance your trading strategy. If you have found traditional charts too noisy or confusing, it may be worth exploring Renko charts as a practical addition to your trading toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.