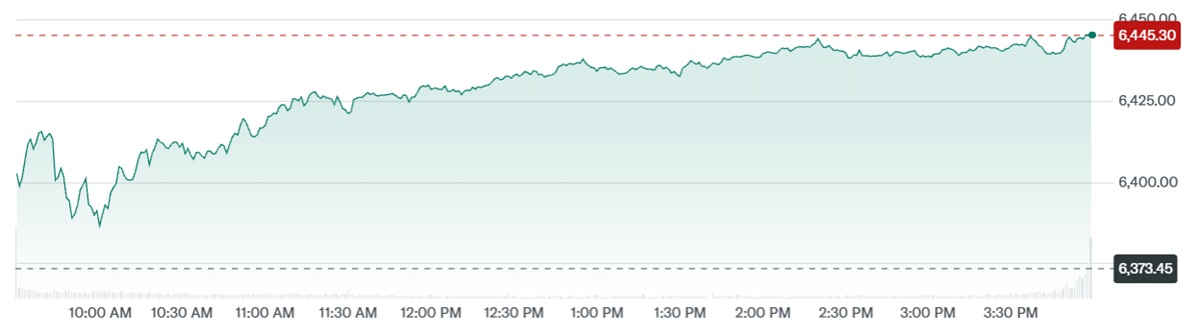

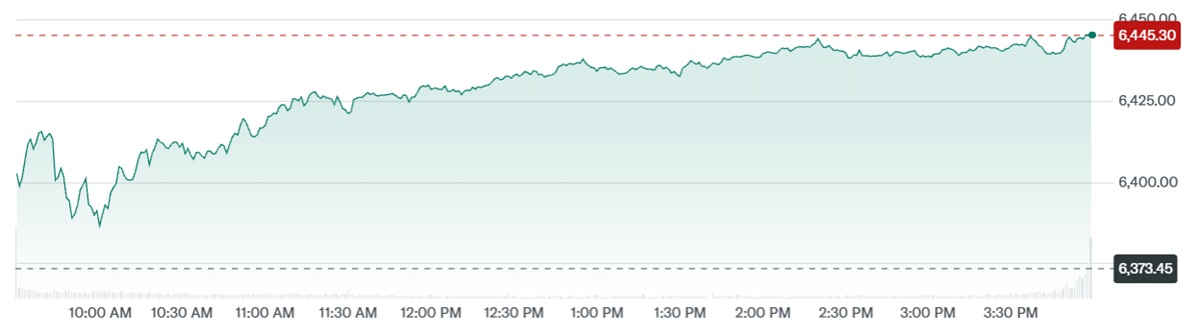

The S&P 500 has once again captured global attention, reaching an all-time high of 6.400 points at the close of trading. This milestone marks the index's continued upward trajectory, largely driven by the extraordinary performance of large technology companies. From Meta and Palantir to Nvidia and Microsoft, the gains of these tech giants underscore the growing influence of artificial intelligence (AI) as a key driver in the current bull market.

Investors and analysts alike are observing a shift: the S&P 500's gains are now heavily concentrated in the top-performing technology stocks, while many of the remaining constituents contribute less significantly to overall growth. This trend highlights both the opportunities and the risks inherent in investing in a market increasingly shaped by AI innovation.

Tech Giants Powering the S&P 500

Since the market bottomed, the largest 20 stocks in the S&P 500 have surged an average of 40.6%, far outpacing the broader index's 27.9% rise. Companies such as Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta (META), Broadcom (AVGO), Tesla (TSLA), JPMorgan (JPM), Netflix (NFLX), Oracle (ORCL), and Palantir (PLTR) are all benefiting to varying degrees from the AI revolution.

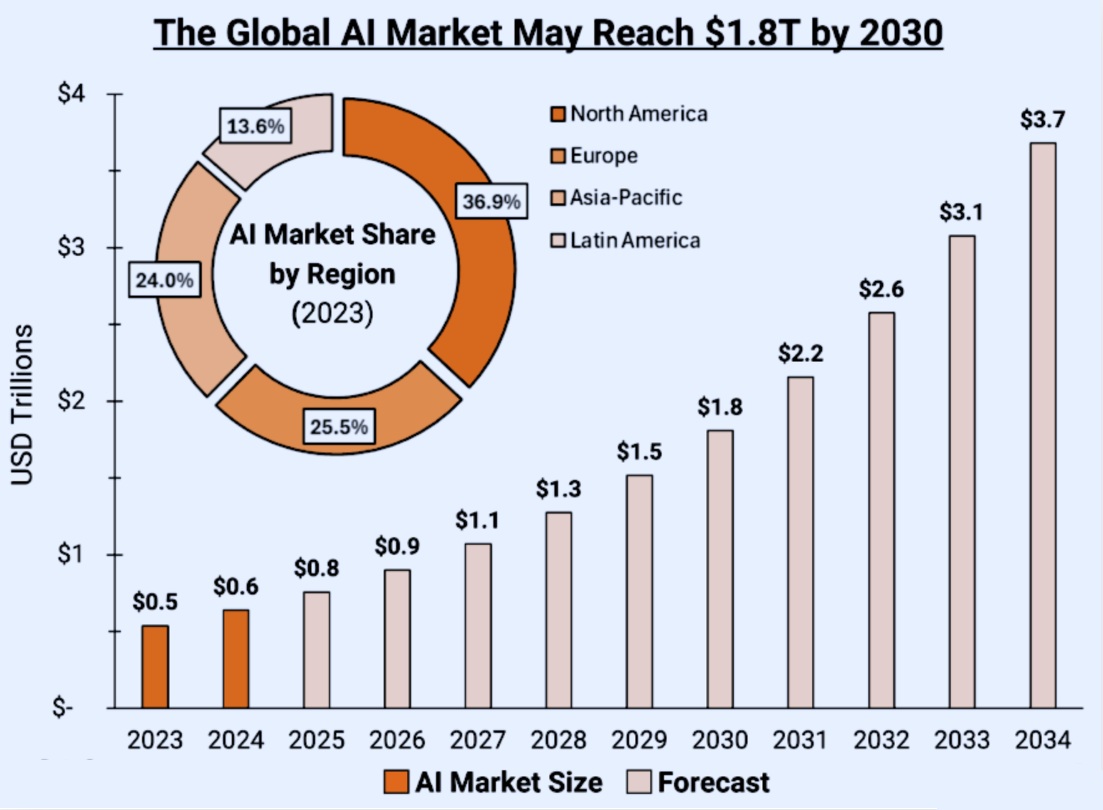

Jessica Rabe, co-founder of DataTrek Research, notes that firms leveraging disruptive technologies like AI are likely to continue driving market returns. These companies are not only raising the S&P 500's valuation but also setting the stage for broader economic transformation through innovation.

Sector Performance and AI Influence

The recent market rebound has a distinctly AI-related character. Information Technology (XLK) and Industrials (XLI) sectors are outperforming, illustrating how AI adoption extends beyond traditional tech firms into manufacturing, industrial applications, and broader business infrastructure.

Scott Chronert, Citigroup's U.S. equity strategist, has raised the S&P 500 year-end target to 6.600 points, citing AI-driven gains in the industrial sector as evidence that the technology's impact is spreading across the economy. Similarly, John Stoltzfus of Oppenheimer & Co. forecasts an even higher target of 7.100 points by the end of 2025. emphasising that AI adoption could drive long-term growth across multiple sectors.

Investor Sentiment and Valuation Concerns

Despite soaring stock prices, investor sentiment remains complex. According to a recent Bank of America survey, 91% of global fund managers believe U.S. equities are overvalued—the highest reading in over a decade. Yet, allocation to U.S. stocks has risen slightly, reflecting continued confidence in the S&P 500's leading companies.

Concerns about an "AI stock bubble" have risen, with 41% of investors acknowledging it as a risk, and 14% naming it the primary concern. Meanwhile, interest in emerging markets has increased, spurred by a weaker dollar and optimism about China's economic recovery.

Risks in the Current Market Environment

While AI is powering the S&P 500. some strategists caution that current valuations may not be sustainable. Barry Bannister, chief equity strategist at Stifel, compares today's market to the late 1990s tech boom. High P/E ratios, concentrated gains among a few tech giants, and heightened IPO activity could leave the index vulnerable to sharp corrections, potentially dropping to around 5.500 points in a market downturn.

Bannister emphasises that early AI-driven capital expenditure and pre-emptive procurement cannot alone sustain long-term economic growth. Investors should be aware that while innovation is creating short-term opportunities, valuation risks remain a critical consideration.

Conclusion

The S&P 500 continues to be the benchmark of U.S. equity market performance, now heavily influenced by AI-driven growth and large technology companies. While the index has reached unprecedented highs, investors must balance optimism with caution, recognising both the potential for continued gains and the risks posed by elevated valuations.

Understanding the forces behind the S&P 500—from sector-specific AI innovation to concentrated stock performance—enables investors to make more informed decisions and navigate a rapidly evolving market landscape with greater confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.