One of the most appealing aspects of forex trading is that the market operates 24 hours a day, five days a week. But just because you can trade at any time does not mean every moment offers equal opportunity.

Behind every profitable trade is an understanding of timing — and that starts with knowing how forex session times influence market behaviour.

Understanding Forex Session Times

Forex session times refer to the hours during which major global trading centres are open. These sessions generally follow the business hours of four financial hubs: Sydney, Tokyo, London, and New York.

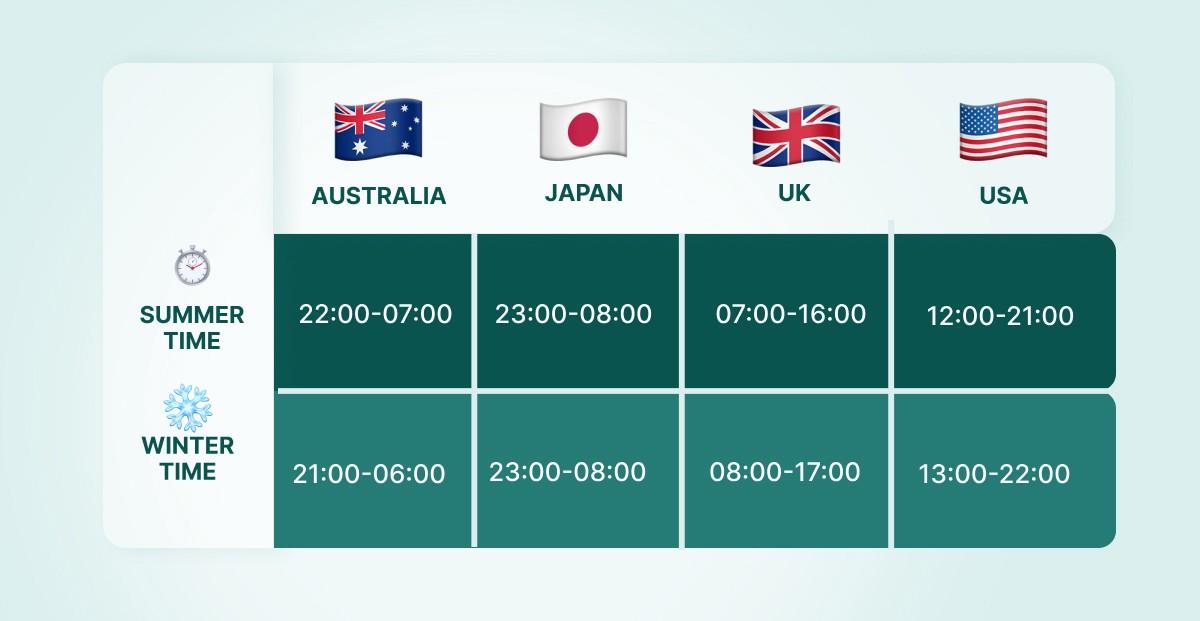

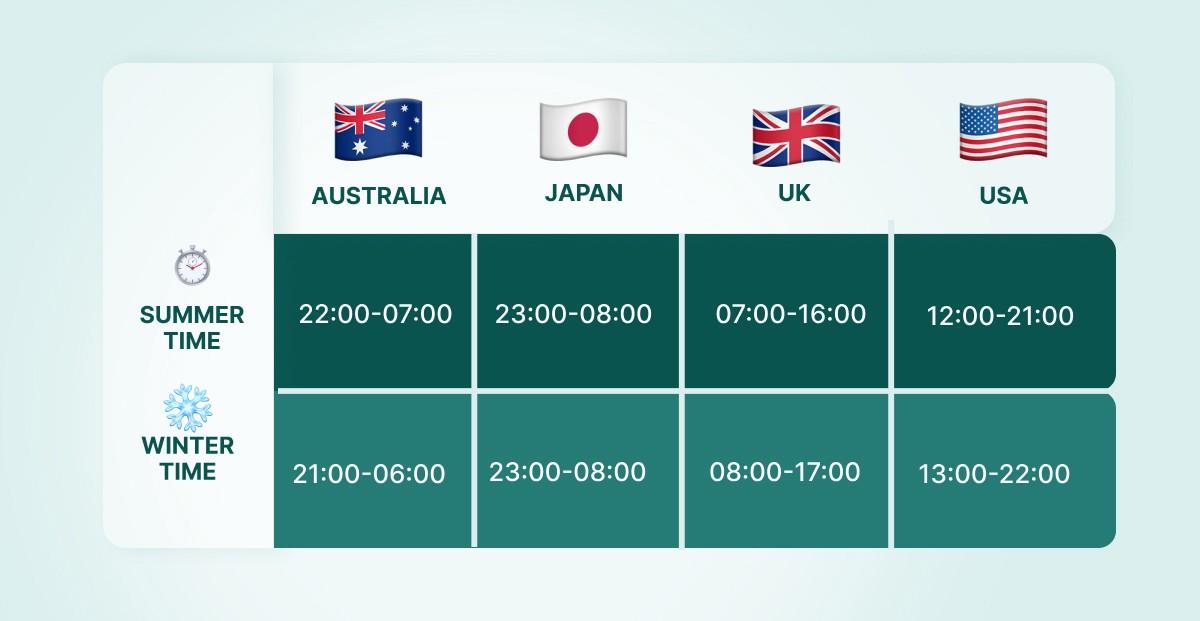

Here is a simplified view (in GMT):

Sydney session: 22:00 – 07:00

Tokyo session: 00:00 – 09:00

London session: 08:00 – 17:00

new york session: 13:00 – 22:00

Although forex is decentralised, these session times shape the rhythm of the market. Each one carries different levels of liquidity, volatility, and opportunity.

Liquidity and Volatility: Why Timing Impacts Strategy

Liquidity refers to how easily you can enter or exit trades without causing large price changes. Volatility measures how much price moves in a given period. Different forex session times offer different combinations of these two elements.

Asian Session (Tokyo): Tends to have lower volatility and more technical price movement. Good for scalpers and those trading yen crosses.

London Session: Known for its high liquidity and sharp price action. Ideal for day traders and breakout strategies.

New York Session: Continues strong volume, especially during the London–New York overlap. Great for trading major pairs like EUR/USD or GBP/USD.

Sydney Session: Often the quietest, but may offer opportunity for those trading AUD or NZD pairs.

Matching your strategy with the right forex session times can make a significant difference to trade outcomes.

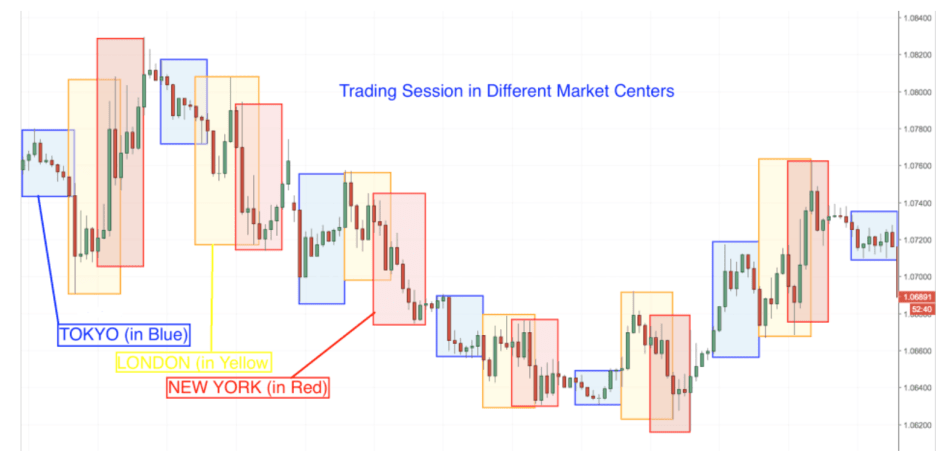

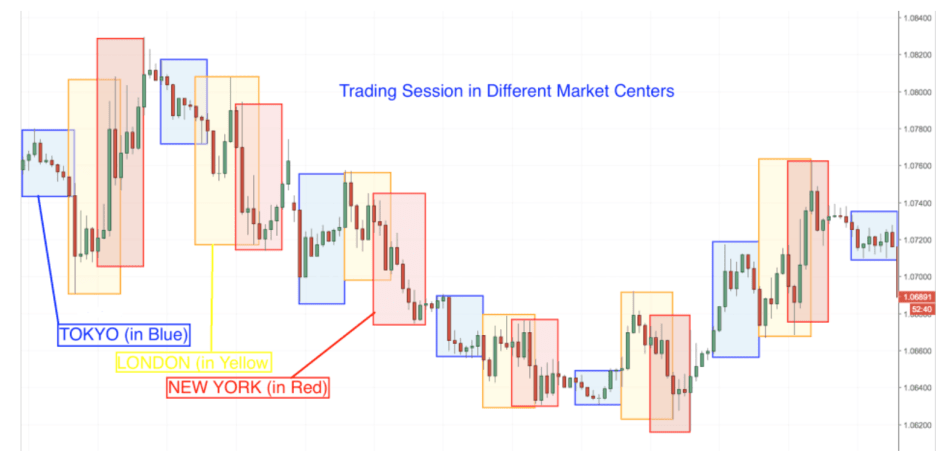

Session Overlaps: When Markets Come Alive

The most active periods in forex often occur during overlaps between sessions. These are windows where two major markets are open simultaneously, and trading volume surges.

London–New York Overlap (13:00 – 17:00 GMT): This is the most liquid and volatile time. Major economic news from both regions can trigger large moves.

Tokyo–London Overlap (08:00 – 09:00 GMT): A brief period with moderate action. Can offer unique price setups for GBP/JPY or EUR/JPY.

Session overlaps are prime opportunities for intraday traders seeking quick moves and tighter spreads.

The Role of Economic News in Session Times

Economic releases are often timed to coincide with peak business hours in their respective regions. For example:

US Non-Farm Payrolls are released during the New York session.

European Central Bank announcements usually occur during the London session.

Japanese monetary policy decisions land during the Tokyo session.

Understanding forex session times helps traders plan for when these high-impact events are most likely to shake up the markets.

Common Misconceptions About Forex Session Times

Let's bust a few myths that could mislead traders:

Myth: You can trade profitably at any hour.

Reality: Illiquid hours (e.g., during Sydney only) can lead to wider spreads and unpredictable price action.

Myth: More volatility always means more opportunity.

Reality: Volatility without direction can cause whipsaws that stop traders out prematurely.

Myth: All sessions are equal for all currency pairs.

Reality: AUD and NZD pairs may see better movement during the Sydney–Tokyo hours, while EUR/USD thrives in the London–New York overlap.

Forex session times do not just tell you when the market is open — they tell you when your strategy is most likely to succeed.

Customising Strategy by Session

Some traders adjust their entire plan around forex session times. Here are a few tailored approaches:

Asian Session Traders: Focus on range-bound strategies or mean reversion with pairs like AUD/JPY or USD/JPY.

European Session Traders: Consider trend-following setups or breakout strategies, especially for GBP/USD or EUR/GBP.

US Session Traders: Use momentum-based strategies during news hours, often involving USD crosses.

Rather than forcing trades into quiet hours, it pays to schedule trading activities to align with your chosen currency pairs and market personality.

The Role of Copy Trading and Sessions

On platforms like EBC's zero-fee copy trading environment, traders are not just watching charts — they are watching each other. Timing matters here too.

Followers often prefer traders whose strategies align with the most active forex session times. A trader who performs well during volatile sessions like London–New York may attract more followers compared to one operating during the quieter Sydney hours.

Copy trading highlights how collective learning, transparency, and optimal session selection work together.

Final Thoughts

Forex session times are more than a technicality — they are a strategic tool. Knowing when to trade can be just as powerful as knowing what to trade.

Whether you are a manual trader or a copy trader, aligning your methods with the right sessions improves your chances of success. It allows you to anticipate movement, manage risk, and adapt to each region's rhythm. Timing, in forex, is everything.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.