Intuit (INTU) shares have declined significantly in advance of the February 26 earnings report, as investors reassess the valuation of this high-expectation, long-duration software company amid increasing focus on tax-season performance. The decline has been pronounced: INTU closed at $434.09 on February 3, representing a 10.9% single-day loss on elevated trading volume. This extends a multi-week downturn, transforming the stock from a perceived stable compounder to a focal point for risk reduction.

A pronounced selloff of this nature typically reflects multiple contributing factors. These include heightened earnings convexity, where small adjustments in guidance can drive significant price volatility, a sector-wide recalibration of software risk premiums, and difficult year-over-year comparisons following last year’s strong tax-season performance.

Intuit’s second-quarter guidance, for the period ending January 31, remains unchanged: management projected Q2 revenue of $4.519–$4.549 billion and non-GAAP EPS of $3.63–$3.68. If market expectations exceeded this guidance, the resulting downward pressure on the stock is justified.

INTU Stock Dropping: Key Factors

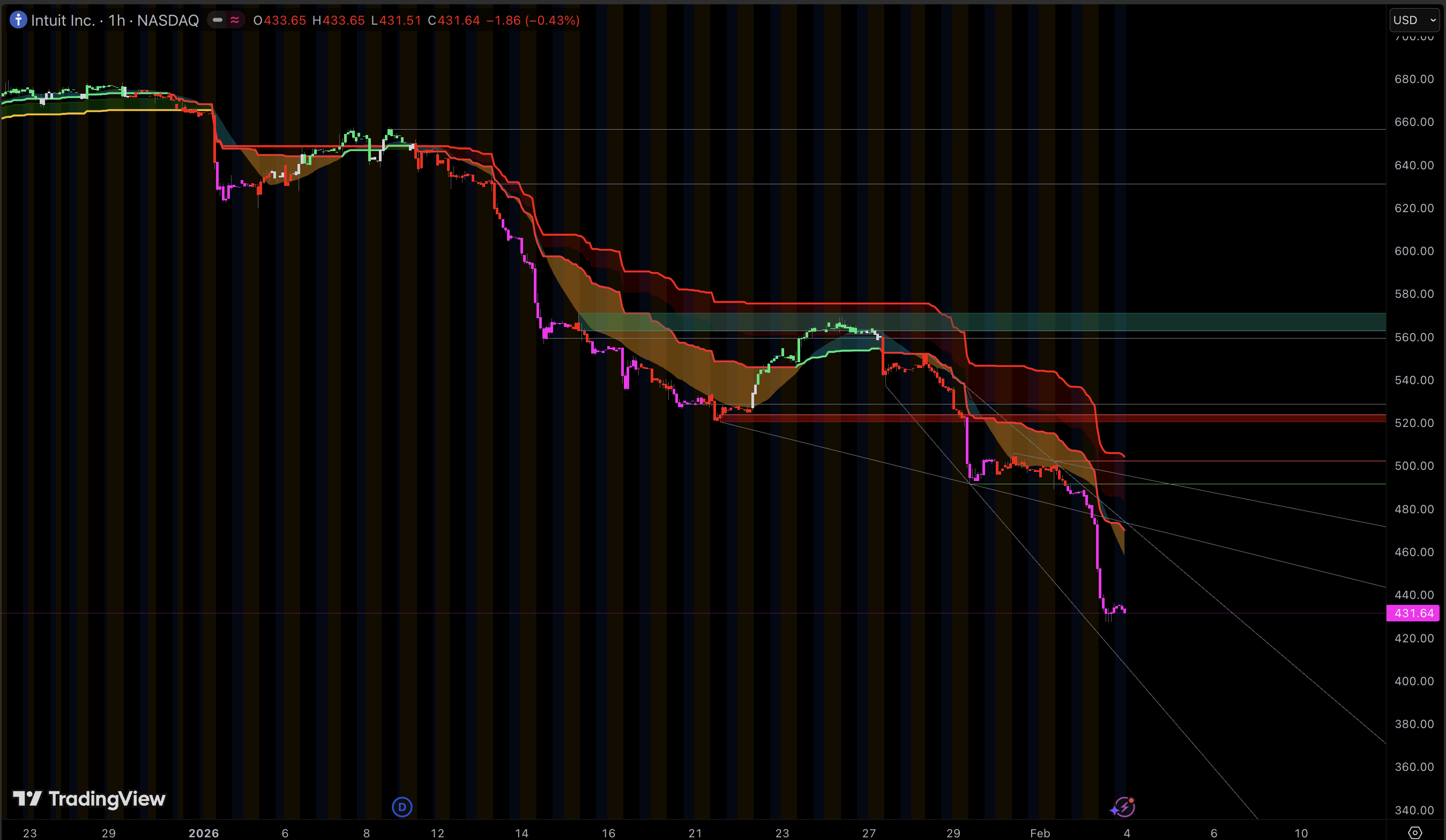

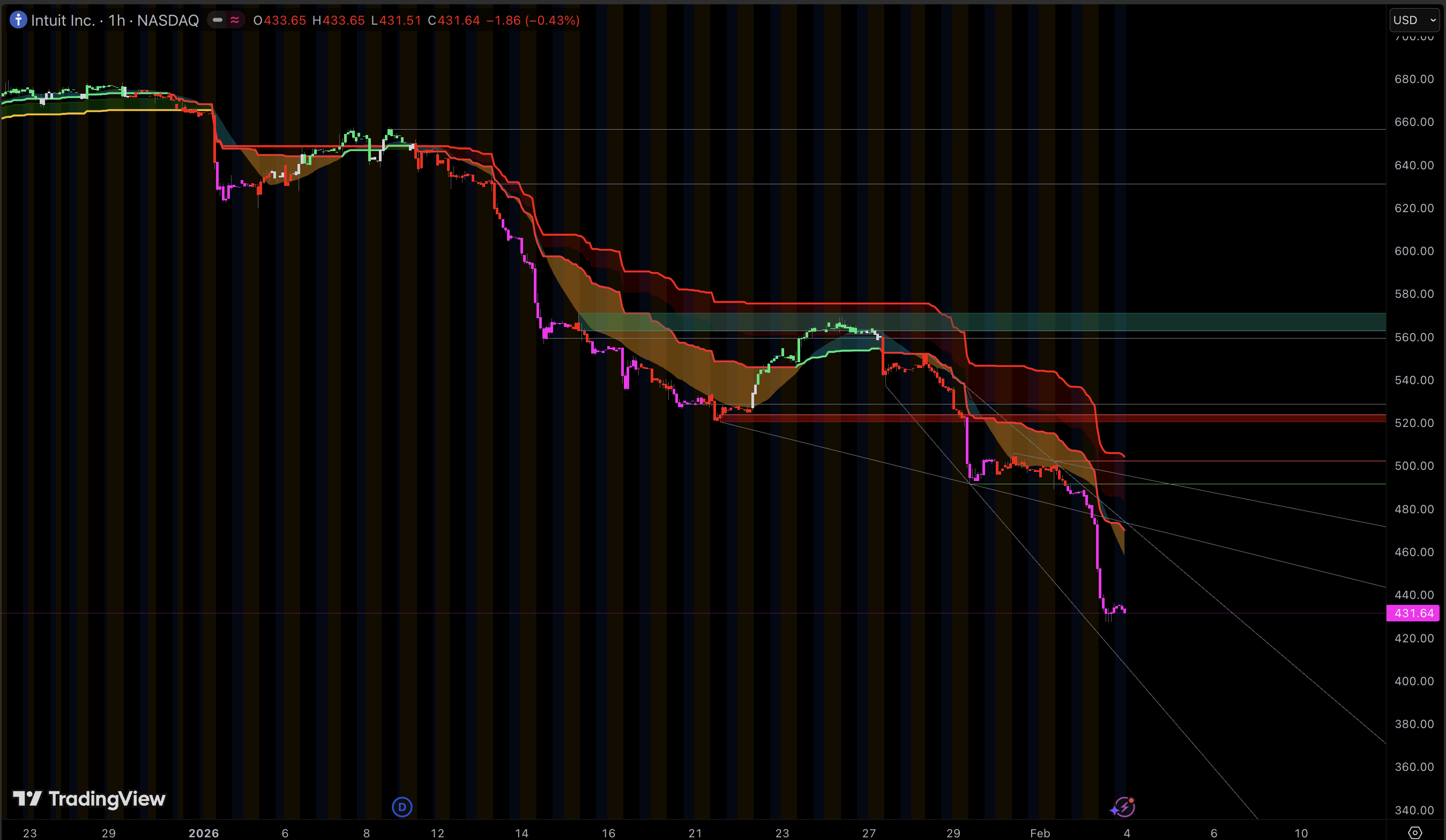

The recent decline in INTU represents both a continuation of an existing trend and a sudden shock. The stock fell 10.9% on February 3 and is now down 35.7% from late December levels, illustrating a typical pattern of valuation compression combined with forced selling.

The onset of tax season increases the importance of early performance indicators, although the second quarter represents only the initial phase. The IRS began the 2026 filing season on January 26 and anticipates approximately 164 million individual returns. As a result, investors are seeking early insights into TurboTax product mix and conversion rates, despite the fact that peak financial results will materialize in subsequent periods.

Discrepancies between guidance and expectations are more consequential than surpassing consensus estimates. Intuit’s Q2 guidance projects non-GAAP EPS of $3.63–$3.68 and revenue of $4.519–$4.549 billion. For premium-valued stocks, market participants focus on the trajectory of future outlooks rather than isolated quarterly results.

Investor risk appetite for software companies has declined. The sector experienced a pronounced shift toward risk aversion, with widespread concerns about AI-driven competition increasing volatility and raising the required return for highly valued platforms.

Options market pricing indicates expectations of significant earnings volatility. Near-term implied price movements around the earnings period have been estimated in the low-to-mid teens, reinforcing pre-earnings risk reduction and discouraging investors from maintaining positions through the earnings announcement.

Technical indicators suggest capitulation conditions. With the RSI(14) near 13 and the stock trading well below key moving averages, these factors may attract value-oriented buyers but also indicate disrupted investor positioning and a compromised trend structure.

The Setup Traders Are Pricing, Not What The Business “Did” Today

1) A Valuation Reset Hits Premium-Quality Software First

When discount rates stay elevated, markets compress multiples on durable compounders because a larger share of their valuation is “long duration,” meaning it relies on cash flows many years out. With the 10-year Treasury yield around 4.29% (latest available), that headwind remains real.

INTU’s drop also mechanically lowers its forward multiple. Using Intuit’s fiscal 2026 non-GAAP EPS guidance of $22.98 to $23.18, the move from roughly $487 to $434 compresses the implied forward P/E from about 21x to under 19x. That is a pure “price” effect, but it reflects how quickly sentiment can shift when investors demand a higher risk premium ahead of a binary catalyst.

Valuation and expectations snapshot

| Metric |

Value |

| Last close (Feb. 3) |

$434.09 (down 10.9% on the day) |

| Q2 FY2026 period |

Quarter ended Jan. 31 |

| Q2 FY2026 guidance |

Revenue $4.519–$4.549B; non-GAAP EPS $3.63–$3.68 |

| FY2026 guidance (range) |

Revenue $20.997–$21.186B; non-GAAP EPS $22.98–$23.18 |

| Short interest (Jan. mid-month) |

~1.88% of float, low but not zero |

| Options-implied move (earnings window) |

~13% weekly, ~16% monthly |

The most important takeaway from this table is not the absolute numbers. It is the gap risk. When implied moves are in the teens, and the stock has already broken trend, investors demand cleaner evidence that the next guidance step is stable.

2) “Agentic AI” Headlines Are Forcing A New Moat Debate

Recent product releases highlighting desktop “agent” behavior have reignited a market-wide question: how much of bookkeeping, tax preparation, and customer workflow can be automated outside incumbent platforms. One high-profile example is the launch of a desktop agent research preview positioned around agentic capabilities.

Even if Intuit ultimately benefits from AI, the market can still derate the stock short-term because AI changes the pricing conversation: investors start asking whether software vendors retain value, or whether it migrates to the AI layer and connectors.

A distinctive aspect of Intuit’s competitive advantage lies not only in its product features but also in its regulated workflows, distribution channels, and proprietary data. However, concerns regarding AI-driven disruption tend to impact software companies broadly before a thorough assessment of fundamentals occurs. This dynamic can result in abrupt declines in high-quality stocks, even when underlying business fundamentals remain strong.

3) Pre-Earnings De-Risking Is Rational When Expectations Are High

Intuit printed a strong Q1 (fiscal quarter ended October 31, 2025) and reiterated full-year guidance. Q1 net revenue was $3.885B (+18% y/y), with Global Business Solutions up 18% and Consumer up 21%, driven heavily by Credit Karma's strength.

This strong performance increases expectations for the second quarter. For investors holding positions in anticipation of favorable tax season results, reducing exposure prior to earnings is a common institutional risk-management strategy, particularly when broader market sentiment is shifting toward risk reduction.

The Highest-Value Fundamental Reasons INTU Is Under Pressure Into Feb 26

1) Tax Season Execution Risk Is Concentrated In One Quarter

Intuit reports Q2 results on February 26, and the quarter ends January 31. That means the reEven if overall tax demand remains stable, the composition of product mix significantly affects earnings quality.

Variations between do-it-yourself and assisted offerings, the adoption of 'Live' services, and the timing of promotional activities can influence profit margins more than anticipated.

Given that the stock is valued as a predictable compounder, any signs of volatility in early-season unit economics may result in disproportionate compression of valuation multiples.ility in early-season unit economics can drive disproportionate multiple compression.

2) Intuit’s “FinTech Balance Sheet” Is Bigger Than Many Investors' Models

A genuinely underappreciated factor is how much seasonal financing now sits near the consumer platform.

Intuit disclosed a $5.8B short-term revolving credit facility maturing March 31, 2026, dedicated to its early tax refund offering (up to five days before IRS settlement, after confirmation and initiation).

The company also replaced its prior revolver with a $2.2B facility expiring January 9, 2031, with the ability to expand commitments up to $4B, and it explicitly references potential use connected to early refund processing.

This matters for two reasons:

Rate sensitivity: The $5.8B facility references SOFR-based borrowing with a 0.875% margin. With SOFR around 3.69% (latest available), that is a roughly 4.57% base cost before any other economics, and it floats with rates.

Perception shift: In risk-off regimes, equity markets penalize anything that looks even partially like a lender or funding-dependent fintech, even if the credit risk is operationally managed.

This factor provides a clear rationale for INTU’s underperformance ahead of earnings: from a macro investor perspective, the company is no longer viewed solely as a software-as-a-service (SaaS) provider.

3) Credit Karma’s Growth Was Strong, Which Creates A Tougher Narrative Test

In Q1, Credit Karma revenue was $651M (+27% y/y), with strength cited in personal loans, credit cards, and auto insurance.

Credit Karma’s revenue stream is inherently cyclical. Should consumer credit underwriting standards tighten or marketing budgets be reallocated, the economics of lead generation may shift rapidly. As Credit Karma has served as a primary growth driver, any slowdown in its performance could overshadow the earnings narrative, even if the core QuickBooks business remains robust.

4) Margin Expansion Is Competing With Investment Needs

In Q1, Intuit quantified cost pressures within Global Business Solutions, including higher staffing and marketing costs, and notably higher QuickBooks Capital cost of revenue due to increased loan volume.

Simultaneously, Intuit is allocating resources to enhance platform capabilities, including the development of AI-enabled features. In risk-averse market environments, investors typically favor capital preservation over further investment, and may penalize even prudent expenditures if they introduce uncertainty regarding operating leverage.

5) Segment Reporting Changes Can Increase The Risk Discount

Effective August 1, 2025, Intuit combined Consumer, Credit Karma, and ProTax into a single Consumer segment, and it moved certain expenses into corporate items.

Reduced segment-level transparency may prompt investors to apply a higher discount rate to future earnings, as it becomes more challenging to discern which business components are accelerating or decelerating. This is particularly relevant in quarters where tax season dynamics and Credit Karma performance may diverge.

6) Capital Return Is A Support, But It Does Not Stop A Multiple Reset

Intuit reported about $3.7B in cash and investments and $6.1B in debt as of October 31, 2025, and repurchased $851M of stock in Q1, with $4.4B remaining on the authorization.

Share repurchase programs can provide some downside protection over time; however, they are generally insufficient to prevent significant repricing when investors are reducing exposure ahead of a major event.

Technical Damage And Forced Selling Amplified The Decline

The February leg down was not subtle. INTU closed at $434.09 on Feb. 3, down 10.9% on the day, with volume near 7.48 million shares, far above the typical pace implied by recent averages.

That kind of tape often reflects mechanical selling:

risk-parity and volatility-controlled exposure reductions,

systematic trend signals flipping negative,

stop-loss clusters breaking under widely watched levels.

By the evening of Feb. 3, daily technical indicators showed extreme “capitulation,” with RSI(14) near 13 and broad sell signals across the moving averages.

INTU technical snapshot (daily)

| Indicator |

Reading |

Implication |

| RSI (14) |

13.0 |

Deeply oversold, but can stay oversold in a downtrend |

| MACD (12,26) |

-24.56 |

Bearish momentum remains dominant |

| MA20 (simple) |

475.66 |

Price far below short-term trend |

| MA50 (simple) |

512.73 |

Intermediate trend broken |

| MA200 (simple) |

592.80 |

Long-term trend decisively broken |

| Nearby pivots |

Pivot ~430.83; S1 ~428.86; R1 ~434.19 |

Market is trading around key support-resistance bands |

An oversold condition does not necessarily indicate undervaluation. Rather, it suggests that market movements have outpaced historical norms, increasing the likelihood of sharp rebounds while also confirming a shift toward defensive institutional positioning.

What To Watch Closely In The Feb 26 Earnings Report

Core Numbers The Market Will Trade

Q2 guidance already on the table: revenue $4.519B to $4.549B, non-GAAP EPS $3.63 to $3.68. The trade is whether Intuit lands cleanly inside these ranges and, more importantly, whether it reaffirms the full-year outlook.

Full-year fiscal 2026 guidance: revenue $20.997B to $21.186B, non-GAAP EPS $22.98 to $23.18.

Business Metrics That Could Explain The Stock Move

TurboTax early-season mix: paid vs free, DIY vs assisted, and refund-related product attach.

Credit Karma monetization: volume and take-rates across loan and card verticals.

Online Ecosystem durability: in Q1, Online Ecosystem revenue was $2.351B (+21%), with QuickBooks Online Accounting $1.206B (+25%). Any hint that pricing, customer growth, or mix-shift is cooling will hit the narrative.

Financing and payments exposure: anything that changes the market’s view of Intuit’s “fintech” risk profile.

Frequently Asked Questions (FAQ)

1) Why Is INTU Stock Dropping In Early February?

The stock suffered a steep one-day decline on Feb. 3 and extended earlier losses, reflecting a mix of software-sector risk-off sentiment, elevated volatility, and company-specific expectation risk heading into tax season.

2) When Is Intuit’s Next Earnings Report?

Intuit is scheduled to report second-quarter fiscal 2026 results on Feb. 26, after market close. The quarter ended Jan. 31, and the conference call is set for 1:30 p.m. Pacific time, the same day.

3) What Is Intuit Guiding For In Fiscal 2026?

Intuit’s latest guidance calls for fiscal 2026 revenue of $20.997B to $21.186B and non-GAAP EPS of $22.98 to $23.18. The market will focus on whether management reaffirms these ranges on February 26.

4) Is this drop mainly about TurboTax?

TurboTax is the focal point because tax season is starting, and investors want early signals. But the move also reflects broader valuation compression in software and uncertainty around multi-segment execution, including small business and consumer-credit adjacent monetization.

5) What guidance has Intuit already provided for the quarter being reported?

For Q2 FY2026, Intuit guided revenue to $4.519–$4.549 billion and non-GAAP EPS to $3.63–$3.68, along with revenue growth of roughly 14% to 15%.

6) Does the early tax refund offering increase risk?

It can increase perceived risk because it involves large seasonal credit facilities, including a disclosed $5.8B short-term revolver tied to early refunds. Even if operationally controlled, it introduces funding-rate sensitivity and can make INTU trade more like fintech during risk-off periods.

7) How does AI affect intuit’s outlook?

AI is both an opportunity and a valuation risk. New agent-style tools are pushing investors to reassess how much workflow software can charge when more automation sits at the AI layer. Even if Intuit benefits, the market may temporarily compress multiples until the earnings narrative proves durable.

8) Do the options market expect a large move after earnings?

Yes. Implied moves around the earnings window are priced in the low-to-mid teens, consistent with elevated uncertainty and encouraging investors to reduce exposure before the report.

Conclusion

INTU’s selloff looks like a classic pre-earnings multiple reset amplified by two specific pressures: elevated discount rates and a renewed market debate about AI-driven software value capture. The overlooked angle is seasonal financing. Intuit’s early refund and other money-movement features create a funding and rate-sensitivity overlay that can change how macro investors price the stock. February 26 is the catalyst that could either re-anchor confidence through clean execution and reaffirmed guidance or validate the market’s new risk premium.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(Intuit Inc.)(IRS)(FRED)(Intuit Inc.)(Intuit Inc.)(Intuit Inc.)(Intuit Inc.)