Forex technical analysis mainly refers to making certain judgments on the future direction and degree of changes in a certain forex market or a specific currency price based on historical market data. In practical applications, charts with various technical indicators are usually used and combined with certain rules to predict the trend of exchange rates, so they are often vividly referred to as chart analysis methods.

The chart analysis method uses charts that record prices to study the market and determine the future direction of prices. So for investors who are not familiar with the technical analysis of forex, the first thing is to understand what types of charts are commonly used.

1、 Types of Forex Technical Indicator Charts

1. Bar chart

A bar chart, also known as a bar chart, bar chart, bar chart, bar chart, or bar chart, is a statistical chart that uses the length of a rectangle as a variable. A bar chart is used to compare two or more values (at different times or under different conditions), with only one variable, and is usually used for analysis on smaller datasets. A bar chart can also be arranged horizontally or expressed in a multidimensional manner.

It is the most basic chart that reflects price behavior. Each column represents a period of time - at least 1 minute and at most several years. Over time, the bar chart reflects different price patterns.

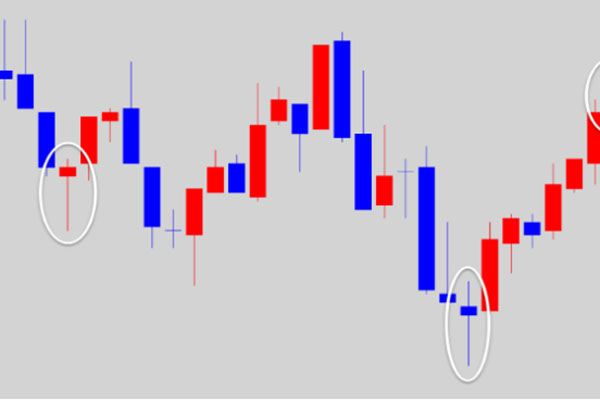

2. Candle chart (K-line chart)

Candle chart generally refers to the K-line chart. The drawing of the K-line chart in the stock and futures markets includes four data, namely opening price, highest price, lowest price, and closing price. All K-lines are unfolded around these four data, reflecting the overall situation and price information. If you put the daily K-line chart on a piece of paper, you can get a daily K-line chart, and you can also draw weekly and monthly K-line charts.

Unlike a simple bar chart, each candlestick represents the highest, lowest, opening, and closing prices for a period of time. Provide investors with stronger visual information.

3. Dot line diagram

A dot and line chart is similar to a bar chart, except that multiple X and O are used to indicate changes in price trends. The dot and line chart is independent of time and only emphasizes price changes.

2、 Characteristics of Forex Technical Analysis

1. Essentially, it is a record of price fluctuations

Whether it is the K-line or the Moving Average, indicators are derived statistics of prices, so the core is still price fluctuations.

2. It is impossible to guarantee the absolute accuracy of the analysis results

Technical analysis often uses statistical analysis as a means, and the analysis result is actually a probability event, not an absolute event. That is to say, market analysis results are only a type of prediction, which may or may not be correct. These prediction results can only be used as the basis for formulating investment plans, but preparations must be made in the plan to deal with the errors in the prediction results. And stop loss is a necessary measure to prevent errors in the analysis results.

3. Not applicable to all markets

Each technical analysis method has its advantages and disadvantages, and each is suitable for a certain market environment.

Forex technology analysis is more commonly used by experienced traders, and investors who have just started can combine their own needs and learn some simple theories and methods to start the path of forex technology analysis.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.