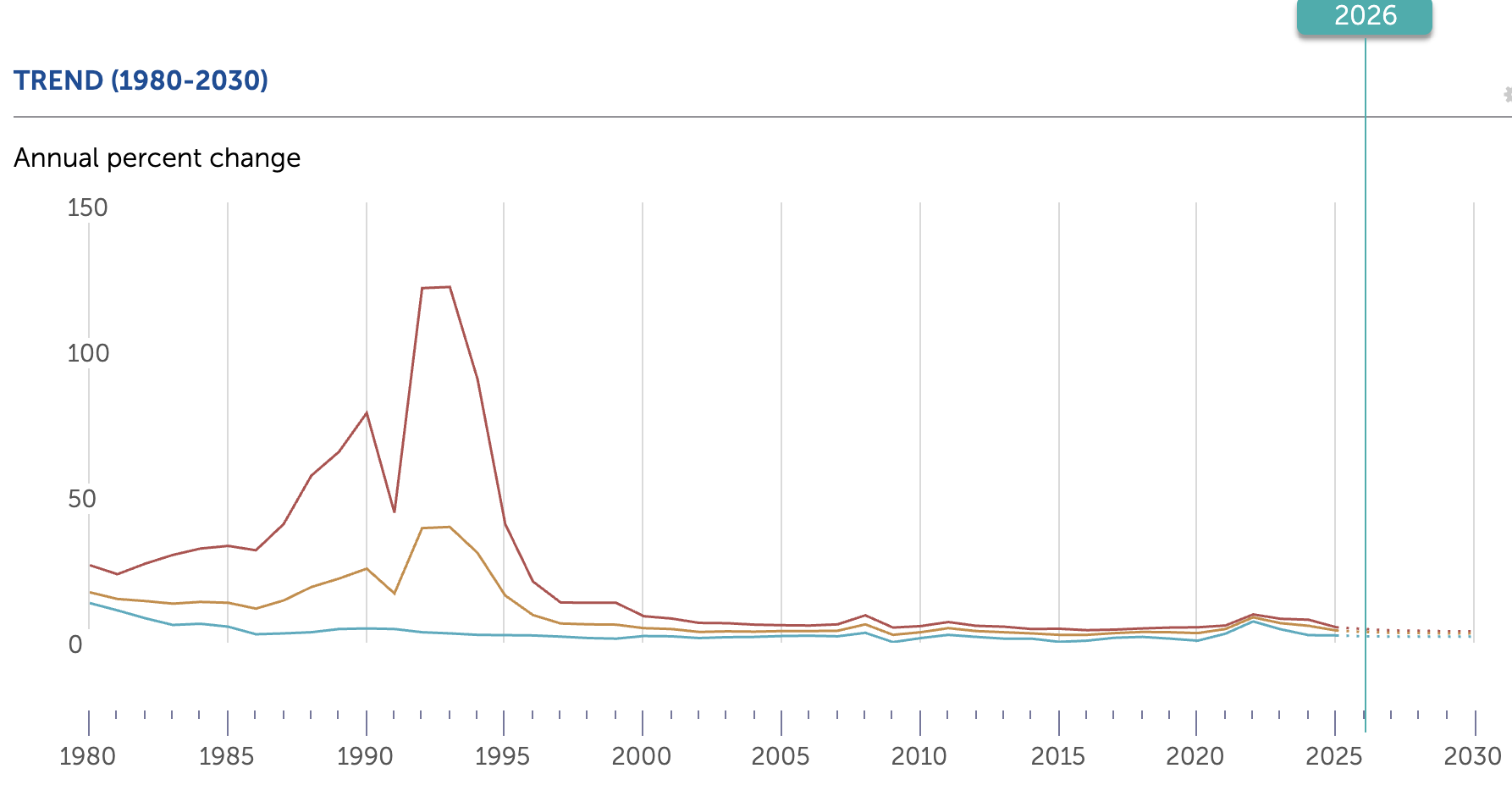

In recent inflation cycles, markets have often moved in ways that seem confusing. Stocks can rise on strong inflation data, while bonds sell off even as headline inflation cools. These moves are not mistakes. They reflect how investors separate market temporary price swings from the persistent inflation pressures.

Headlines CPI reflects immediate price changes driven largely by energy and food. Core CPI strips those out to reveal inflation drivers that tend to persist, especially shelter and services. Markets pay closer attention to core inflation because it shapes expectations for interest rates and policy over time.

As a result, the same CPI report can send mixed signals. Falling energy prices may ease headline inflation and improve sentiment, while stubborn shelter inflation keeps core CPI elevated and financial conditions tight. Markets react differently because they are not trading today’s inflation number. They are trading inflation expectations and how durable price pressures really are.

Core CPI vs Headline CPI: What Markets Are Really Pricing

Markets do not treat headline CPI and core CPI as competing indicators. They assign them different roles in the inflation narrative.

Headline CPI influences sentiment, short-term positioning, and inflation psychology. Core CPI determines whether monetary policy stays restrictive, eases cautiously, or tightens further. When these two measures diverge, markets side with core inflation almost every time.

Recent cycles have illustrated this clearly. Periods of sharp disinflation driven by falling energy prices have repeatedly failed to produce sustained rallies in bonds or durable easing expectations.

Meanwhile, modest upside surprises in core CPI, particularly in services and shelter, have triggered disproportionate market repricing. This is because core inflation shapes the expected path of interest rates, real yields, and liquidity conditions.

Comparison Table

| Feature |

Headline CPI |

Core CPI |

| Includes food & energy |

Yes |

No |

| Main purpose |

Measures overall cost of living |

Measures underlying inflation pressure |

| Volatility |

High |

Low |

| Key drivers |

Energy, food, commodities |

Shelter, services, wages |

| Sensitivity to shocks |

Very sensitive |

Limited |

| Policy relevance |

Indirect |

Direct |

| Market focus |

Short-term sentiment |

Long-term pricing |

| Reliability for trends |

Low |

High |

What Headline CPI Signals and Why It Misleads

Headline CPI includes all consumer price components, notably food and energy. It captures the full cost-of-living pressure experienced by households and plays an outsized role in public perception of inflation.

However, from a market perspective, headline CPI is a noisy indicator. Energy prices can swing sharply from one month to the next due to supply dynamics, geopolitical developments, or seasonal effects. Food prices respond to weather patterns, logistics disruptions, and global commodity cycles. These movements can dominate the headline figure without altering the underlying inflation trajectory.

However, from a market perspective, headline CPI is a noisy indicator. Energy prices can swing sharply from one month to the next due to supply dynamics, geopolitical developments, or seasonal effects. Food prices respond to weather patterns, logistics disruptions, and global commodity cycles. These movements can dominate the headline figure without altering the underlying inflation trajectory.

This creates the illusion of rapid disinflation. A sharp fall in gasoline prices can drag headline CPI lower even as service-sector inflation remains firm. Markets may initially respond positively, but that reaction often fades once participants assess the composition of the data.

Headline CPI matters, but mostly as a transmission mechanism. Its influence lies in how it shapes inflation expectations, not in how it defines policy reality.

Core CPI and the Persistence Problem

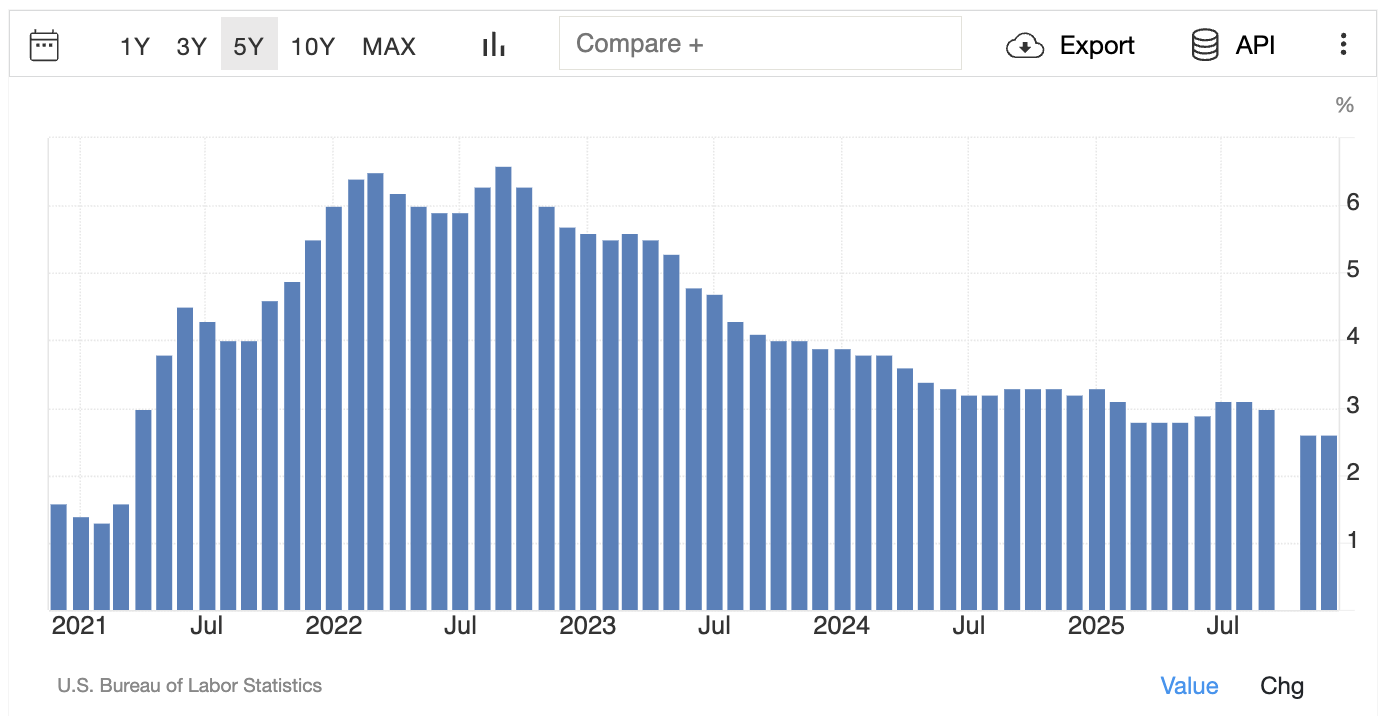

Core CPI excludes food and energy to strip out short-term volatility and expose structural inflation pressure. This makes it the primary inflation gauge for central banks, including the Federal Reserve.

Core inflation reflects forces that monetary policy can influence only gradually. Labor costs, service pricing, housing rents, and expectations-driven behavior adjust slowly. Once elevated, they tend to remain sticky even as growth cools.

Markets focus on core CPI because it answers a single critical question: Is inflation receding on its own, or does it require prolonged policy restraint?

Markets focus on core CPI because it answers a single critical question: Is inflation receding on its own, or does it require prolonged policy restraint?

When core CPI remains elevated, markets infer that interest rates must stay higher for longer. That assumption feeds directly into higher bond yields, tighter financial conditions, and lower equity valuations, regardless of what headline inflation is doing.

Shelter Inflation: The Gravity Well of Core CPI

No component has influenced core CPI more persistently than shelter. Rents and owners’ equivalent rent together account for more than one-third of the CPI basket and an even larger share of core inflation dynamics.

Shelter inflation lags real-time housing market changes because it is based on lease agreements and survey data that reflect past rent levels. This backward-looking nature means reported shelter costs often rise even after new rental prices and home sales have already slowed.

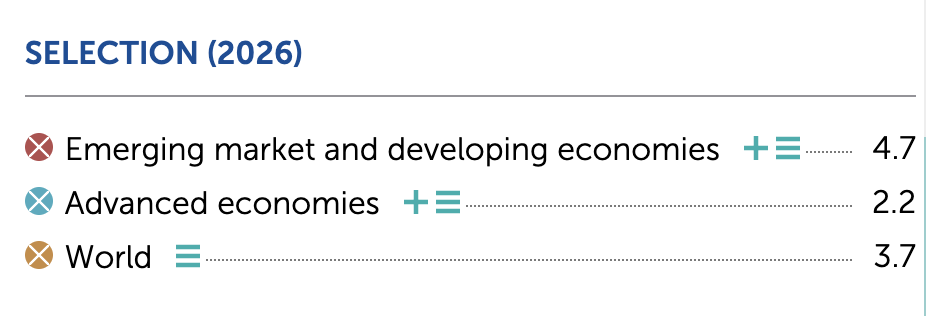

This lag causes market confusion because, even as home prices flatten and new lease growth cools, reported shelter inflation stays high. Markets react to the persistence of shelter inflation, which takes time to reflect real-time declines. [1]

For policymakers and investors alike, shelter inflation is a signal of inertia. As long as it fails to decelerate convincingly, core CPI remains a binding constraint on monetary easing.

Energy Prices and the False Comfort of Disinflation

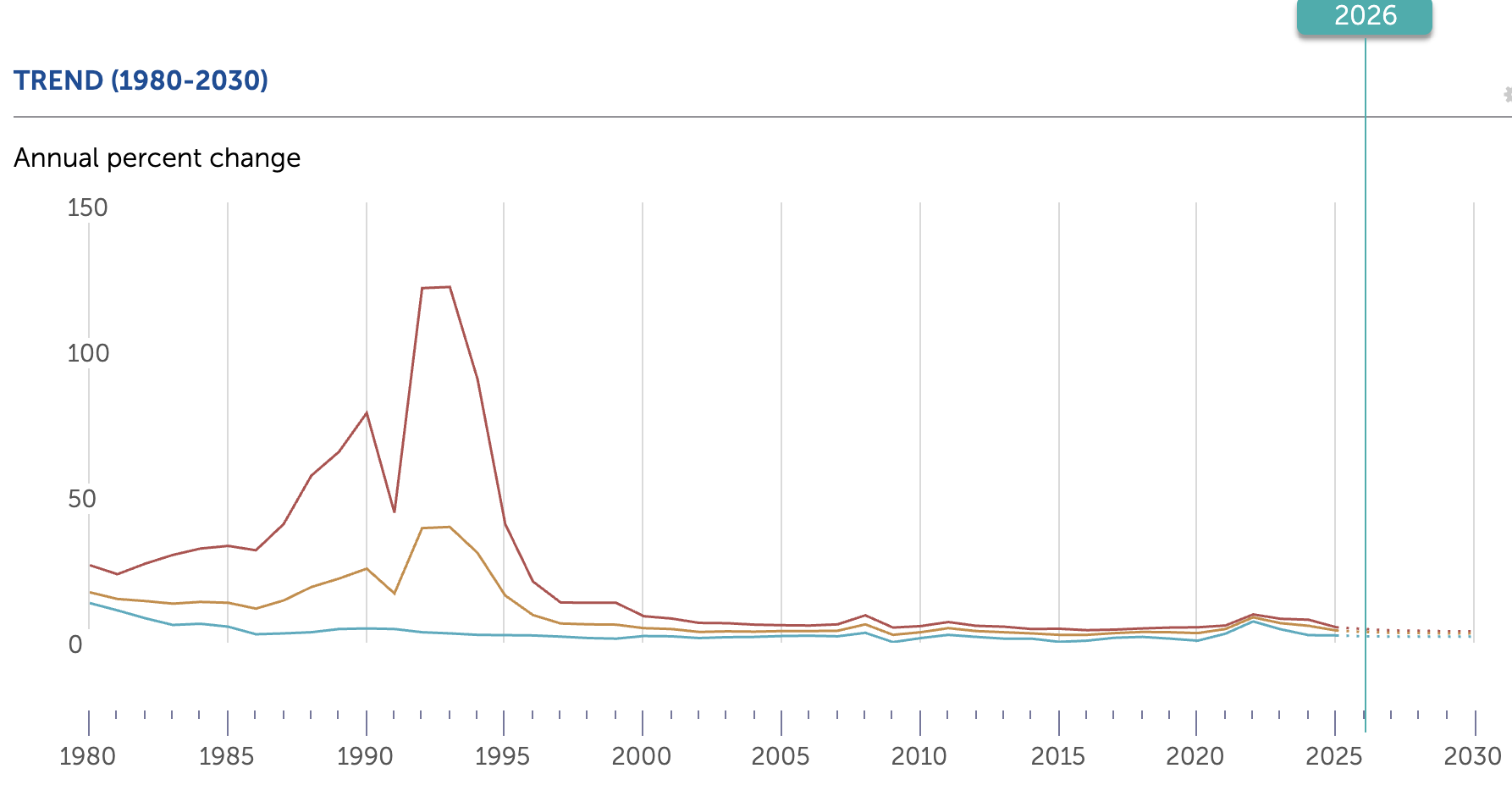

Energy prices are the dominant swing factor in headline CPI. Oil, gasoline, and utilities can move the headline number dramatically within a single release. [2]

Markets have learned to treat energy-driven disinflation with caution. Energy prices are cyclical, geopolitically sensitive, and prone to reversal. They are not reliably influenced by interest rates and do not reflect domestic demand conditions.

When headline CPI falls because energy prices retreat, markets initially respond with optimism. But if core services inflation remains firm, that optimism rarely survives. Bond markets reprice, rate expectations adjust, and risk assets struggle to build momentum.

Energy can change the optics of inflation. It rarely changes its trajectory.

Inflation Expectations and Market Psychology

The interaction between headline and core CPI plays out most clearly through inflation expectations. Consumers react to headline inflation because it reflects visible prices. Policymakers worry about whether those reactions become embedded in wage demands and pricing behavior.

If headline inflation remains high for extended periods, expectations rise. Once expectations become unanchored, they feed directly into core inflation through labor markets and service pricing.

Markets monitor this transmission channel closely. They assess not just inflation prints, but whether those prints are altering behavior. When core CPI remains elevated, markets assume expectations are not yet fully contained, even if headline inflation temporarily improves.

This is why market reactions often feel asymmetric. Upside surprises in core CPI trigger sharp repricing. Downside surprises in headline CPI trigger skepticism.

Why Markets React “Wrong” to CPI Data

Two CPI reports with identical headline readings can produce opposite market reactions depending on what is happening beneath the surface.

If headline CPI rises due to energy while core services inflation cools, markets may rally. If headline CPI falls due to energy while shelter and services remain firm, markets may sell off. These reactions are not contradictory. They reflect an assessment of future policy, not present inflation. Markets trade the path, not the print.

If headline CPI rises due to energy while core services inflation cools, markets may rally. If headline CPI falls due to energy while shelter and services remain firm, markets may sell off. These reactions are not contradictory. They reflect an assessment of future policy, not present inflation. Markets trade the path, not the print.

For example, a CPI report may show headline inflation falling because gasoline prices dropped, yet markets still sell bonds if shelter and services inflation remain firm. In that case, investors assume interest rates will stay higher, even though the headline number looks better.

Understanding this distinction is essential for interpreting moves in yields, equities, and currencies around inflation data. Those who focus solely on the headline number often misread both the message and the response.

Implications Across Asset Classes

Interest rate markets are anchored almost entirely to core CPI trends. Persistent core inflation keeps real yields elevated and limits the scope for rate cuts. Equity markets respond indirectly, through discount rates and earnings sensitivity to financial conditions. Currency markets track relative inflation persistence, which feeds into yield differentials.

Commodities, by contrast, are more sensitive to headline inflation drivers, particularly energy. This divergence explains why commodity markets and financial assets can move in opposite directions following the same CPI release.

You need to remember that the CPI report is not a single signal. It is a layered dataset that different markets read in different ways.

Frequently Asked Questions (FAQ)

1. Why do markets focus more on core CPI than headline CPI?

Markets prioritize core CPI because it reflects persistent inflation driven by wages, shelter, and services. These components shape central bank policy paths, real interest rates, and liquidity conditions, which ultimately determine bond yields, equity valuations, and currency pricing.

2. Why do stocks sometimes fall when headline inflation is lower?

Stocks can fall after lower headline inflation if core CPI remains sticky. Markets interpret persistent core inflation as a signal that interest rates will stay higher for longer, tightening financial conditions and increasing discount rates applied to future earnings.

3. How does shelter inflation affect core CPI so much?

Shelter inflation carries a large weight in core CPI and adjusts slowly because it reflects existing leases rather than real-time rents. This lag keeps core inflation elevated even when housing markets cool, delaying any meaningful policy relief.

4. Why does falling energy inflation not reassure markets?

Falling energy prices often lower headline CPI, but do not address service-sector or wage inflation. Because energy prices are volatile and reversible, markets discount their impact unless core inflation also shows sustained and broad-based moderation.

5. Which CPI number does the Federal Reserve care about most?

The Federal Reserve focuses primarily on core CPI because it filters out volatile components and captures inflation persistence. Persistent core inflation signals ongoing demand pressures that monetary policy must restrain, even if headline inflation temporarily improves.

6. Can headline CPI still move markets in the short term?

Yes. Headline CPI can drive short-term market moves by influencing inflation expectations, commodities, and consumer sentiment. However, these reactions usually fade if core CPI trends do not confirm a durable shift in underlying inflation dynamics.

Conclusion

The difference between headline CPI and core CPI is simple but important. Headline CPI shows how inflation feels right now, largely shaped by energy and food prices. Core CPI shows where inflation is coming from and whether it is likely to last, driven by shelter, services, and wage-related costs.

This is why markets often react cautiously when headline inflation falls. If core inflation stays firm, especially in housing and services, expectations for interest rates and financial conditions do not change much. What may look like a strange market reaction is usually a logical one. Markets are not focused on short-term relief. They are focused on whether inflation pressure is truly easing beneath the surface.

Disclaimer: This material is for general information purposes only and is not intended as, and should not be considered to be, financial, investment, or other advice on which reliance should be placed. No opinion given constitutes a recommendation by EBC or the author that any investment, security, transaction, or strategy is suitable for any specific person.

Sources

[1] https://www.bls.gov/news.release/cpi.nr0.htm

[2] https://www.oecd.org/content/dam/oecd/en/data/insights/statistical-releases/2026/1/consumer-prices-oecd-01-2026.pdf

However, from a market perspective, headline CPI is a noisy indicator. Energy prices can swing sharply from one month to the next due to supply dynamics, geopolitical developments, or seasonal effects. Food prices respond to weather patterns, logistics disruptions, and global commodity cycles. These movements can dominate the headline figure without altering the underlying inflation trajectory.

However, from a market perspective, headline CPI is a noisy indicator. Energy prices can swing sharply from one month to the next due to supply dynamics, geopolitical developments, or seasonal effects. Food prices respond to weather patterns, logistics disruptions, and global commodity cycles. These movements can dominate the headline figure without altering the underlying inflation trajectory. Markets focus on core CPI because it answers a single critical question: Is inflation receding on its own, or does it require prolonged policy restraint?

Markets focus on core CPI because it answers a single critical question: Is inflation receding on its own, or does it require prolonged policy restraint?

If headline CPI rises due to energy while core services inflation cools, markets may rally. If headline CPI falls due to energy while shelter and services remain firm, markets may sell off. These reactions are not contradictory. They reflect an assessment of future policy, not present inflation. Markets trade the path, not the print.

If headline CPI rises due to energy while core services inflation cools, markets may rally. If headline CPI falls due to energy while shelter and services remain firm, markets may sell off. These reactions are not contradictory. They reflect an assessment of future policy, not present inflation. Markets trade the path, not the print.