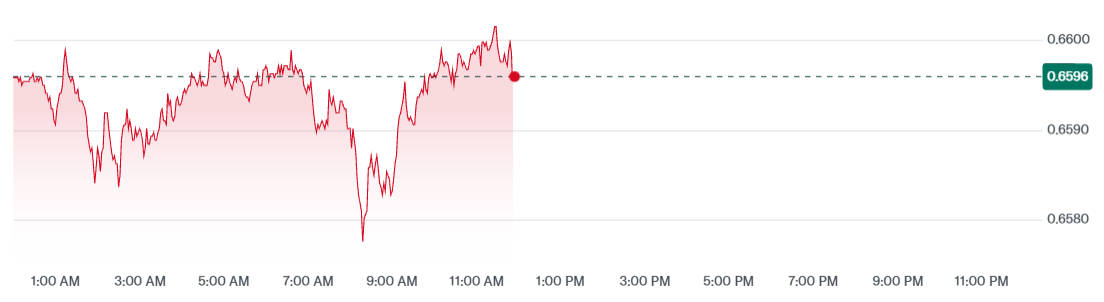

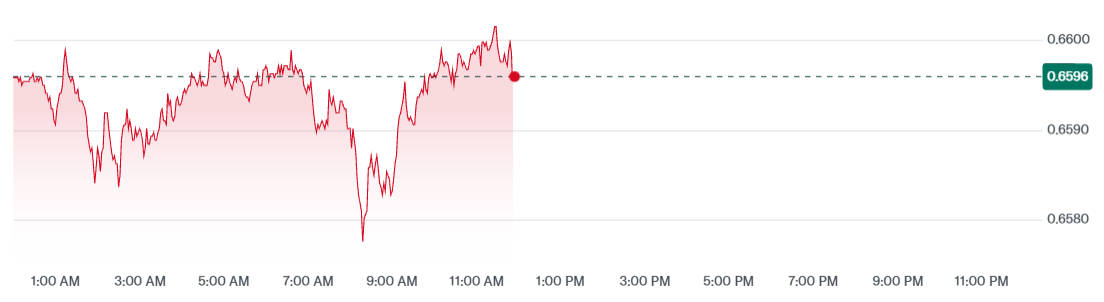

The Australian Dollar (AUD) against the US Dollar (USD) has experienced fluctuations, recently retreating from an 11-month high of 0.6706 to 0.6592. This movement underscores the delicate balance between domestic economic indicators and global monetary policies.

Economic Indicators and Central Bank Policies

1) Australian Economic Landscape

Australia's economy remains resilient, with a steady unemployment rate of 4.2% and a robust labour market.

However, recent data indicates a slight dip in employment, with a loss of 5.400 jobs in August, primarily due to a significant decrease in full-time positions. Despite this, the participation rate remains strong at 66.8%.

Inflation has shown signs of moderation, with the annual CPI for August expected around 2.8%. This aligns with the Reserve Bank of Australia's (RBA) target range of 2–3%, suggesting that previous rate cuts are beginning to take effect.

2) RBA's Monetary Policy Stance

RBA Governor Michele Bullock has indicated that the central bank's current cash rate of 3.6% may be appropriate, with further easing contingent on economic developments.

The RBA has already implemented rate cuts in February, May, and August 2025. and markets anticipate a potential cut in November if inflation remains subdued.

Global Factors Influencing AUD/USD

1) US Federal Reserve's Approach

The Federal Reserve's cautious stance on rate cuts has provided support to the USD. Chair Jerome Powell described the recent rate cut as a "risk management cut," emphasizing that future decisions will depend on incoming data.

This approach has tempered expectations of aggressive rate cuts, bolstering the USD's position.

2) Commodity Prices and Trade Relations

Australia's economy is closely tied to commodity exports, particularly to China. Recent developments, including extended tariff truce negotiations between the US and China, have reduced immediate trade tensions, providing a stabilizing effect on the AUD.

Technical Analysis and Market Sentiment

The AUD/USD pair is currently trading within a range, with support around 0.6570 and resistance near 0.6700. Market sentiment is cautious, with traders awaiting the upcoming CPI data and US non-farm payrolls report for clearer direction.

Scenarios and Possible Market Moves

| Scenario |

Trigger |

Likely AUD/USD Response |

| High CPI / Dovish Fed |

Inflation exceeds expectations, US data soft |

AUD/USD may rally toward 0.6700–0.6710, supported by rate-cut moderation and weaker USD |

| Weak CPI / Strong US Data |

Inflation below expectations, US inflation strong |

AUD/USD likely drifts toward 0.6500, facing downside risk |

| Mixed Signals |

Inflation moderate, Fed ambiguous |

AUD/USD remains range-bound between 0.6570–0.6700, limited conviction |

Outlook and Strategy Considerations

Traders should monitor:

Australia's CPI release and its deviation from forecasts

Fed communications and US inflation indicators

Technical levels and market sentiment shifts

Commodity price trends impacting the AUD

The CPI report is expected to be the primary catalyst in the near term. A surprise in either direction could trigger a significant move in AUD/USD, while muted data may result in consolidation.

Conclusion

The AUD/USD pair is at a pivotal juncture, influenced by domestic economic indicators and global monetary policies. The upcoming CPI release will be crucial in determining the pair's near-term trajectory.

Traders and investors should remain vigilant to these developments, as they will play a significant role in shaping market dynamics in the coming weeks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.