While old age, sickness, and death are the four unavoidable realities of life, in today's society, pharmaceutical companies, which rely on sickness for profit, are in the ascendant. Walking down the street, the number of pharmacies is increasing. And in the stock market, pharmaceutical stocks are showing the same boom. Next, let's provide a clear investment perspective by evaluating in-depth the current status and long-term prospects of pharmaceutical stocks.

What are pharmaceutical stocks?

What are pharmaceutical stocks?

It refers to stocks traded in the stock market that are related to the pharmaceutical industry. These stocks represent companies engaged in the fields of pharmaceuticals, medical devices, medical services, and biotechnology. These pharmaceutical stocks reflect the broad coverage of the pharmaceutical industry and showcase the growth potential and investment opportunities in different segments of the industry.

Within the pharmaceutical industry, there are two main categories: API manufacturers and formulation producers. API manufacturers specialize in the production of basic raw materials for drugs, which are supplied to formulation companies for use in making the final drug. Representative companies include China's Huahai Pharmaceuticals and the U.S.'s Pfizer, which play a crucial role in the drug production chain.

Formulation manufacturers are responsible for processing the raw materials into finished drugs, such as tablets and capsules, which ultimately reach the consumer. Well-known formulation manufacturers include Hengrui Pharmaceuticals, WuXi AppTec, and Gilead Sciences. Each of these two types of companies has its own role in the pharmaceutical supply chain, and together they drive the pharmaceutical industry and ensure the complete flow of drugs from raw materials to finished products.

Biotechnology companies fall into two main categories: biopharmaceuticals and gene editing and therapeutics. Biopharmaceutical companies specialize in the development and production of medicines using biotechnology, and these companies are committed to developing innovative biopharmaceuticals to meet a variety of medical needs. Representative companies include Conocino and AstraZeneca.

On the other hand, gene editing and therapeutic companies focus on genomics and cell therapy research, aiming to break through the limitations of traditional treatments. For example, Addix Medical in the US is engaged in research on gene editing technology to develop therapeutic solutions for genetic diseases. These companies push the frontiers of biotechnology and offer new possibilities for the future of medicine.

Medical device and equipment companies fall into two main categories: diagnostic devices and therapeutic devices. Diagnostic device companies specialize in the production and sale of medical imaging equipment and in vitro diagnostic devices, which are used for early detection and accurate diagnosis of diseases. Representative companies include Myriad Medical and Medtronic.

Therapeutic device companies, on the other hand, are involved in the production and sale of surgical instruments and rehabilitation equipment, which play a key role in the medical process and help patients recover and regain their health. Well-known therapeutic equipment companies include A-share company Lepu Medical and U.S.-based Boston Scientific.

Medical service companies include two main categories: hospitals and clinics and health management. Hospitals and clinics are responsible for operating medical institutions and providing a variety of medical services, with representative companies such as Meinian Health. Health management companies focus on providing health checkups and disease prevention services, aiming to improve overall health. Examples include Aier Eye and United Health Group.

It should be noted that the pharmaceutical industry is a high-investment, high-risk field. The cost of developing a new drug usually exceeds US$2 billion, and the cycle from R&D to market is as long as 10 to 15 years. This process not only requires huge capital but also involves a complex approval process with high costs and market risks.

In addition, high returns in the pharmaceutical industry are dependent on successful FDA approval of drugs. Approved and marketed drugs not only provide significant financial returns but also enhance a company's market position and investment attractiveness. However, unapproved drugs can lead to financial losses and reputational damage.

Therefore, investors investing in pharmaceutical stocks should fully understand the complexity of the FDA approval process in order to accurately assess the associated investment risks and identify potential R&D opportunities. And by thoroughly analyzing the FDA's approval dynamics, a company's R&D pipeline, and its market positioning, investors can make smarter and more forward-thinking investment decisions to achieve more robust investment returns in the pharmaceutical sector.

Why are pharmaceutical stocks plummeting?

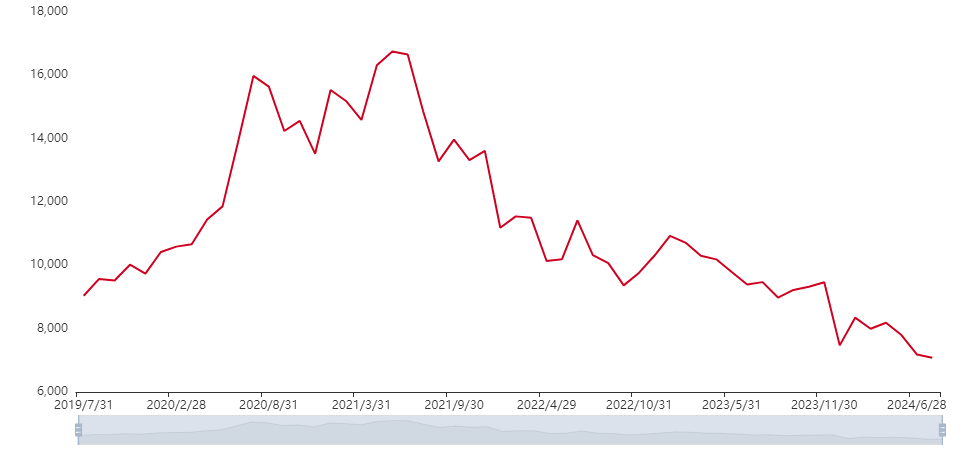

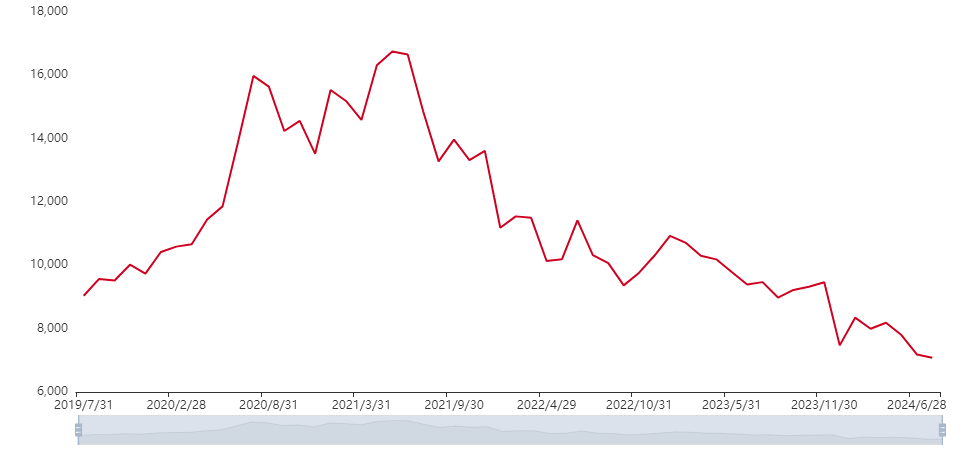

According to current market data, many pharmaceutical stocks may have been overshooting in recent years. In China's A-share market, the CSI Pharmaceuticals Index has fallen to historic lows, with price-to-earnings ratios and price-to-book ratios at low levels. The main reasons for this include the impact of China's anti-corruption efforts on the supply side of the pharmaceutical industry, as well as the government's policy adjustments to the pharmaceutical industry, such as centralized purchasing of medicines (pooled purchasing) and price controls.

The implementation of the collective purchasing policy has led to a sharp drop in drug prices, directly compressing companies' profit margins and leading to a significant drop in the profitability and market valuation of pharmaceutical companies. Such policy changes not only weakened the revenue streams of pharmaceutical companies but also caused greater uncertainty and pressure on the industry as a whole, which drove pharmaceutical stocks down significantly.

New drug regulatory regulations, changes in the approval process, or increased regulation of already existing drugs may create additional costs and sales hurdles for pharmaceutical companies. These policy adjustments may require companies to invest more resources in compliance, thereby increasing operating costs. In addition, increased regulatory stringency may result in a longer time to market for drugs, affecting the company's market competitiveness and profitability. These changes not only increase a company's operational risk but may also negatively impact its market performance, leading to a decline in pharmaceutical stocks.

Moreover, failure of clinical trials or blockage of approval of key drugs can significantly affect a company's share price. Drug development is not only lengthy and expensive; it involves multiple trials and approval stages. If a key drug fails clinical trials or FDA approval, it will have a direct impact on a company's future revenue expectations and market confidence. As these drugs are usually an important source of revenue for the company, failure could lead to huge financial losses and erode investor confidence in the company's future development, resulting in a sharp drop in the share price.

At the same time, increased competition or the entry of new competitors may significantly erode an incumbent company's market share. New competitors bringing in more competitive products or services may reduce industry profit margins and force the incumbent company to engage in price wars or increase marketing investment to maintain market share. This could raise doubts about the incumbent's future profitability and market position, leading to a decline in the share price.

Market concerns are often raised when a company's earnings report shows declining revenues, weakening profitability, or rising costs. Declining revenues may indicate a lack of market demand or weak business development; weakening profitability reflects cost control issues or a failed profit model; and rising costs can erode profit margins. The combination of these factors affects a company's financial health and reduces the market's confidence in its prospects, leading to a decline in pharmaceutical Stock Prices.

In addition, company executive turnover, internal scandals, or strategic failures may seriously affect investor confidence. Executive turnover may bring about changes in management style and strategic direction, increasing uncertainty about a company's short- and long-term performance. Internal scandals may damage a company's reputation, affecting business operations and market image. And strategic failures may lead to misallocation of the company's resources, affecting its core competitiveness and profitability. All of these factors may trigger investor concerns, leading to a drop in share price.

Although the pharmaceutical industry is generally regarded as a relatively stable sector, it can still be significantly affected by specific economic cycles or market conditions. For example, an economic downturn may reduce overall market demand, while changes in market expectations for the pharmaceutical industry may also lead to share price volatility. Despite the strong anti-cyclical nature of the pharmaceutical industry, its performance may still be affected by macroeconomic conditions and investor sentiment, which may lead to an overall decline in pharmaceutical stocks.

When the overall economic situation is poor or market sentiment is low, it may be a drag on the pharmaceutical industry. Uncertainties in the global economy, such as a dollar tightening cycle or global liquidity tightening, often lead to higher financing costs and compressed industry valuations. This economic environment may make it more difficult for the pharmaceutical industry to raise capital while compressing companies' profit margins, which in turn affects the market performance of pharmaceutical stocks. When investors are pessimistic about the outlook of the market, they may reduce their investments in them, which may lead to a decline in the prices of these stocks.

And when the market is pessimistic about the outlook of the pharmaceutical industry or overreacts to policy changes, it may lead to significant volatility in the prices of pharmaceutical stocks. If investors are concerned about the industry's growth potential or the uncertainty of the policy environment, they may sell their shares, further exacerbating share price volatility. Conversely, positive market expectations and optimism about the industry's prospects may drive stock prices higher.

Overall, a selloff in pharma stocks is usually the result of a combination of factors, including policy adjustments, economic cycles, industry characteristics, and changes in market sentiment. However, despite the current selloff, they still offer investment value in the long run.

Pharmaceutical stocks can continue to hold?

Pharmaceutical stocks can continue to hold?

Despite the current downward pressure on pharma stocks, there are still investment opportunities in the sector in the long run. Especially in the context of the strong performance of technology stocks, the market has a clear expectation of the Fed's interest rate cut, and the pharmaceutical sector is still attractive. The current market sentiment towards the pharmaceutical industry is more pessimistic, which provides investors with the opportunity to deal with the emotional impact.

Pharmaceutical stocks, as defensive stocks, have shown great stability in China's A-share market. It has remained resilient and stable despite multiple rounds of bull and bear transitions. This characteristic reflects the pharmaceutical industry's resilience to economic fluctuations and provides a solid investment rationale for long-term investors.

Although it may face market volatility and policy adjustments in the short term, these factors actually provide long-term investors with opportunities to add to their positions. Policy adjustments are usually phased, and the industry is expected to gradually return to growth after a short-term drop in stock prices. Therefore, the current low point may be a good opportunity to increase positions.

When market sentiment is pessimistic, a contrarian investment strategy can often deliver better returns. Low valuations provide placement opportunities for long-term investors, especially for pharma companies with strong fundamentals. Although they may be affected by negative sentiment in the short term, the long-term growth potential of these companies remains. Investors should focus on high-quality companies at the bottom of the market, which usually have stronger viability and growth potential after the industry consolidation and are preferable for long-term investment.

In the midst of market turmoil, some stocks have shown strong resistance, indicating potential investment opportunities. These overshooting stocks may signal the potential for a future rebound. Although they may be affected by market sentiment in the short term, their stable performance indicates that the fundamentals remain solid. Once market sentiment improves, these stocks may see a strong rebound. Therefore, focusing on these stable-performing stocks may bring investors excellent long-term returns.

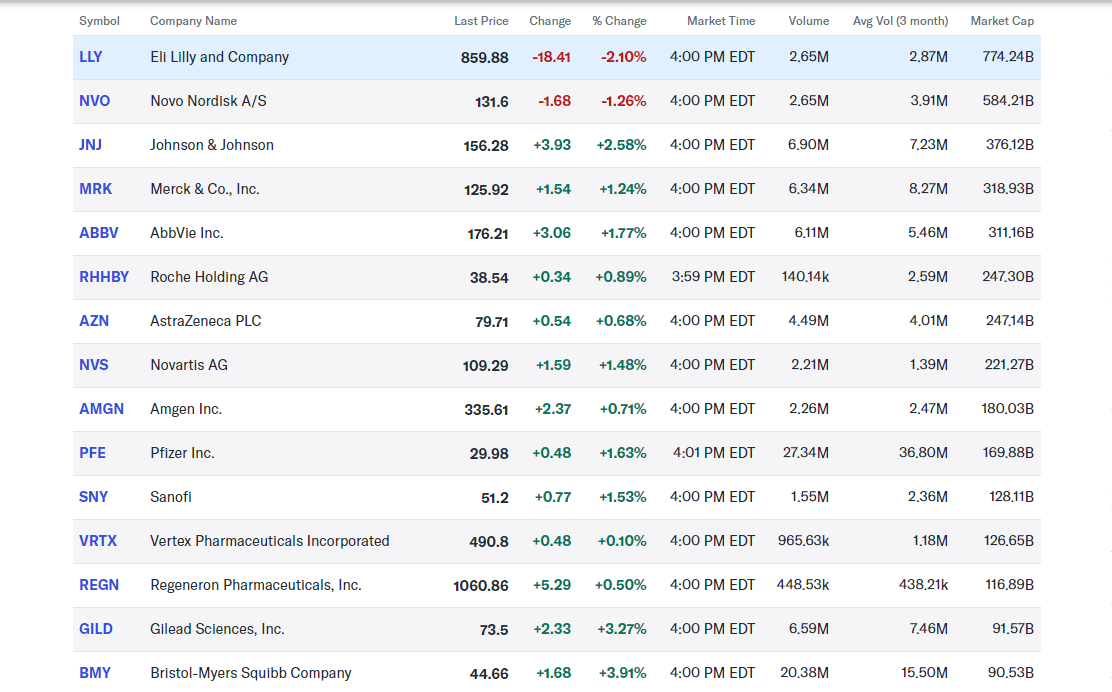

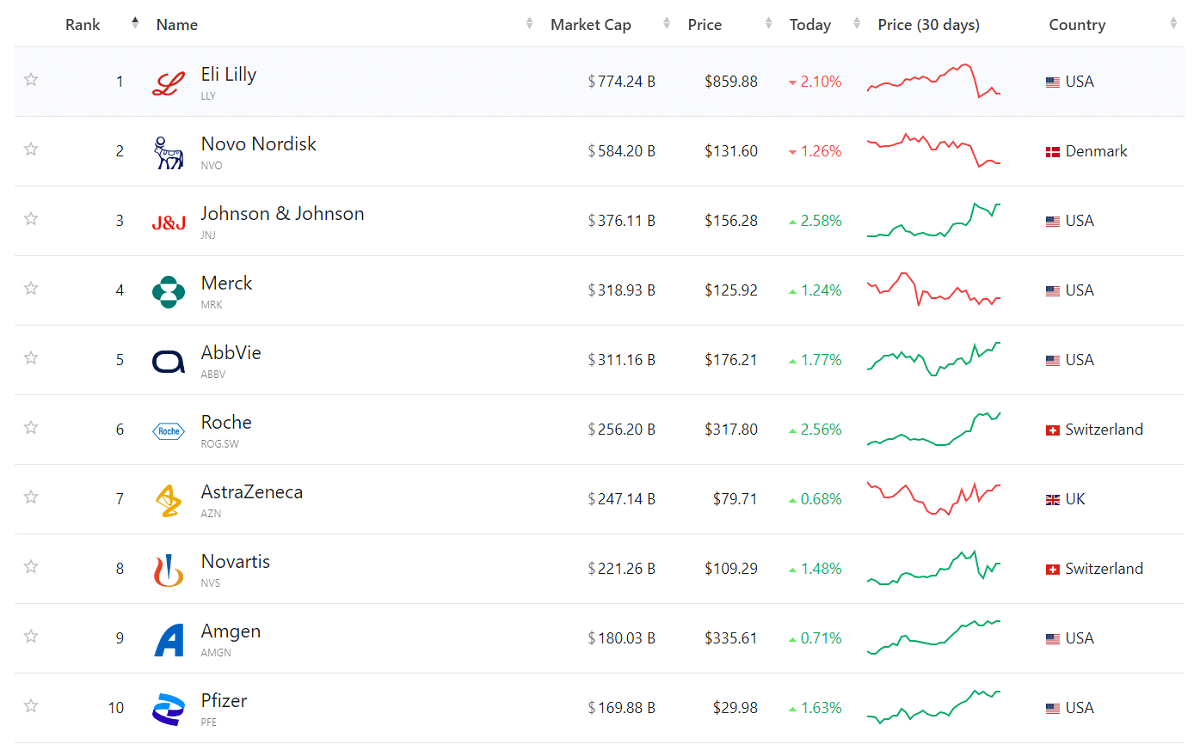

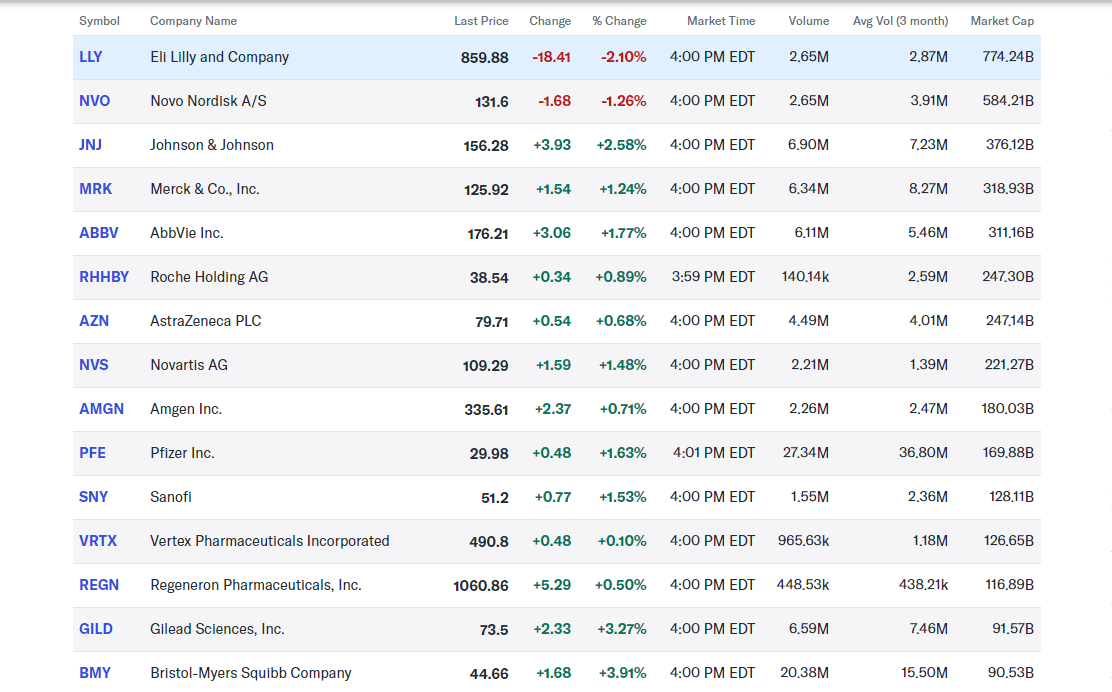

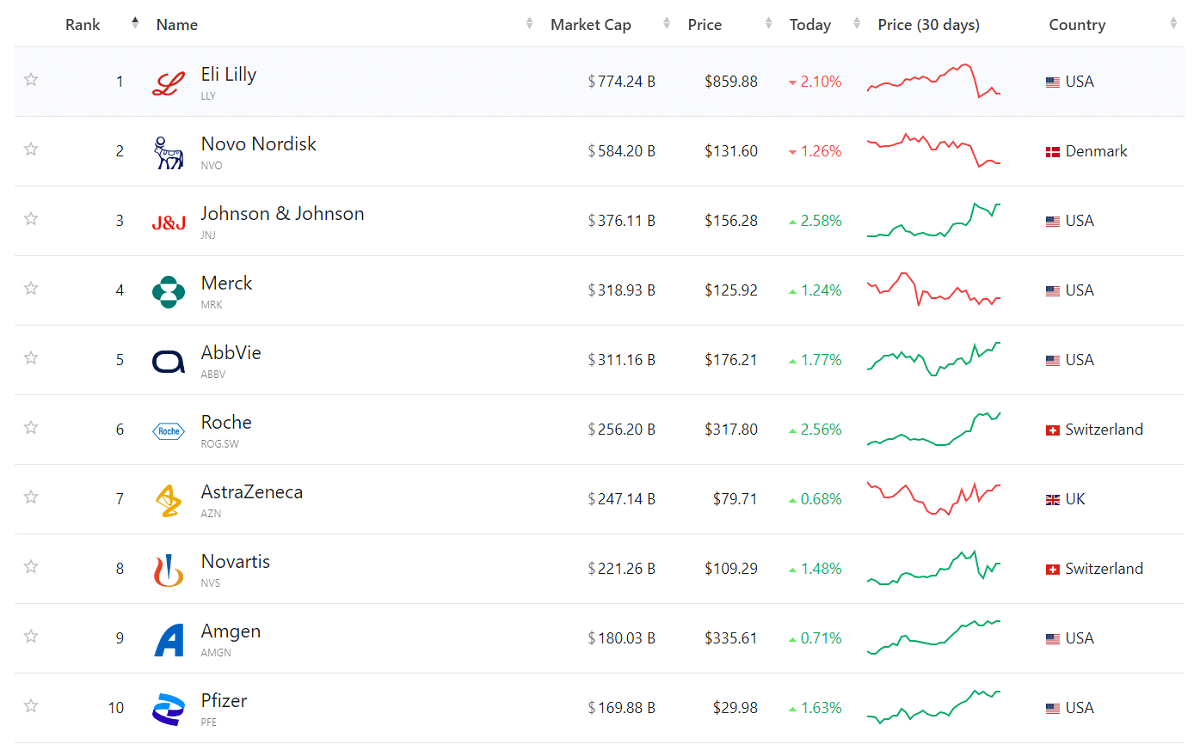

For example, star stocks in pharmaceuticals, such as Novo Nordisk and Eli Lilly, hold leadership positions in the diet drug market. These companies have driven innovation and sales of weight-loss drugs with their strong research and development capabilities and market presence. Although these two stocks have experienced significant gains, they still have room for further upside in the future due to their sustained earnings growth and broad market potential. Investors are bullish on these companies' leading position in the industry and long-term growth prospects, believing that they are expected to continue to deliver lucrative returns.

Stable, slow-moving bulls such as UNH, MRK, and REGN have outperformed as long-term investments, albeit at higher prices. These companies usually have solid fundamentals and solid growth prospects, and their stock prices, while not cheap, offer good buying opportunities during market pullbacks. These stocks are suitable for long-term holding due to their solid growth and stable financial performance and can provide investors with sustainable returns.

Undervalued varieties of pharmaceutical stocks, such as Pfizer and Schweppes, are currently trading at relatively depressed share prices, but these companies have greater potential to rebound in the long term. Although they may face challenges in the short term, their fundamentals and market potential provide a good opportunity for a future share price rebound. These stocks are suitable for investment during market downturns with a view to realizing larger gains in the future.

If you are certain that you want to invest in the pharmaceutical industry, then you need to first assess your own risk tolerance and investment objectives in the face of its significant volatility. If one can accept short-term market volatility and is optimistic about the long-term outlook, it may be feasible to continue to hold these stocks. At the same time, it is important to consider the proportion of pharmaceutical stocks in the overall portfolio. If the proportion is too large, diversification should be considered to reduce risk.

It is of course important to note that while the pharmaceutical sector has the potential for high returns, it also comes with high risks. Investors should therefore pay attention to FDA approval developments, a company's R&D pipeline, and financial statements when evaluating pharmaceutical stocks. Regularly track the status of clinical trials and approvals of drugs, study the progress of drugs in development, and prepare and prepare company financial reports. It is also important to understand industry market trends, policy changes, and competition. Combining these factors will help make more informed investment decisions.

In summary, investors are advised to adjust their perspective and shift their focus from short-term market volatility to long-term fundamentals and growth potential. Despite the current pessimistic market sentiment and the potential for short-term volatility, pharmaceutical stocks have the dual attributes of consumption and technology, providing them with stable growth potential. In the long run, stable demand and technological innovation will continue to drive the pharmaceutical industry, so patient holding and strategic investment will likely deliver strong returns.

Pharma stocks current state and long-term outlook

| Investment Status |

Long-term Prospects |

| Govt. collection policy cuts profits, stocks fall. |

Short-term impact, long-term standardization. |

| Current market volatility. |

Industry may profit during recovery. |

| R&D failures and approval issues hurt investment. |

Gene editing drives future growth. |

| New competitors erode market share. |

Leading companies may maintain a leading position. |

| Low valuations offer investment opportunities. |

High-quality stocks may rise postconsolidation. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What are pharmaceutical stocks?

What are pharmaceutical stocks?

Pharmaceutical stocks can continue to hold?

Pharmaceutical stocks can continue to hold?