Investing in VNQ can suit those seeking diversified U.S. real estate exposure and regular dividends, but consider interest rate risks and economic cycles before buying.

Real estate is a key component of many investment portfolios, offering potential income and growth. Direct property ownership, however, can be expensive, complex, and illiquid.

The Vanguard Real Estate ETF (VNQ) provides an alternative, giving investors access to a diversified portfolio of U.S. REITs and property-related companies in a single, easily traded fund.

This article provides a detailed overview of the Vanguard Real Estate ETF (VNQ). It explains how the fund works, its portfolio composition, dividend income, costs, and sector exposure.

Highlights

VNQ provides diversified exposure to the U.S. real estate market through more than 160 REITs, covering sectors such as industrial, healthcare, retail, residential, and specialised properties.

The fund is cost-efficient, with an expense ratio of 0.13%, and manages over $65 billion in assets, making it one of the largest and most liquid real estate ETFs.

VNQ delivers a consistent dividend income, with a YTD yield around 6.3% and a 3-year return around 2.88%, offering an attractive option for investors seeking regular income.

Its portfolio structure allows for broad market coverage and risk diversification, though top holdings and sector-specific factors can influence returns.

While the fund has shown solid long-term performance, it remains sensitive to interest rate changes and economic cycles, which can affect both valuations and dividend payouts.

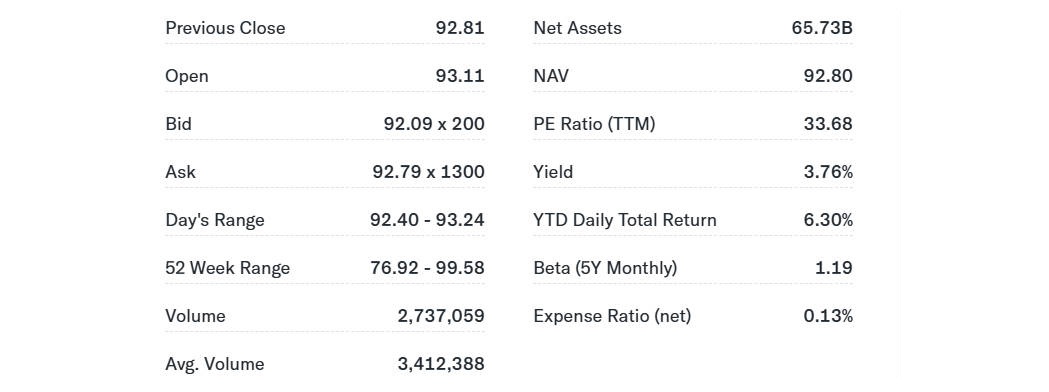

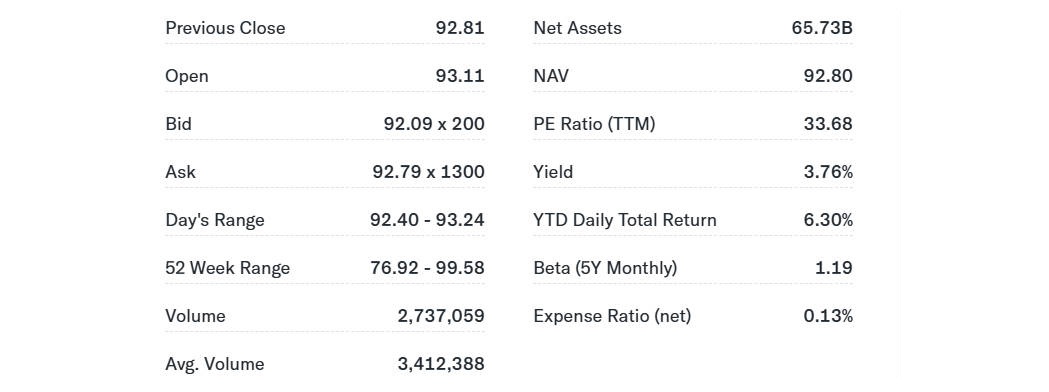

The Numbers Behind VNQ ETF: Cost, Size, and Yield

One of VNQ's key attractions is its scale and efficiency. The fund manages tens of billions of dollars in assets, making it one of the largest real estate ETFs globally.

Its expense ratio remains low compared to actively managed real estate funds, which is consistent with Vanguard's focus on keeping costs down for investors.

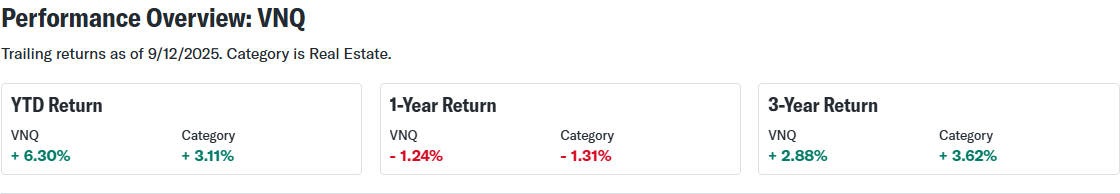

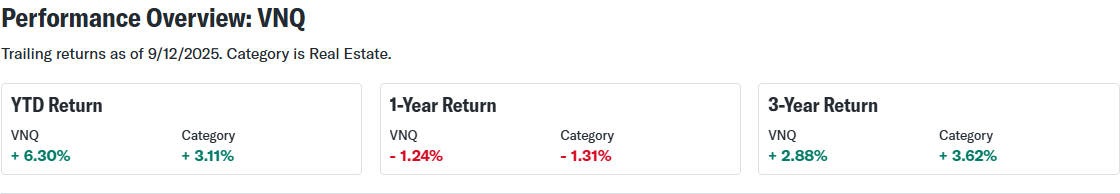

Dividend income is a major reason why investors hold VNQ. VNQ has shown mixed results compared with its category peers:

Year-to-date, it has delivered a strong return of +6.30%, outperforming the category average of +3.11%.

Over the past year, VNQ posted a slight loss of -1.24%, slightly better than the category's -1.31%.

Looking at a longer horizon, its three-year return of +2.88% trails the category average of +3.62%, reflecting moderate growth in the broader real estate sector.

Performance has varied over time. During periods of stable or declining interest rates, VNQ has often delivered strong returns.

Conversely, in rising rate environments, the fund has tended to lag broader equity markets due to the higher financing costs faced by property companies.

What's Hiding in the Portfolio: From Office Towers to Data Centres

VNQ is far more than just office buildings and shopping centres. Its portfolio includes a wide variety of REITs, ranging from traditional commercial property to specialised sectors.

The largest weightings often include industrial and logistics companies that benefit from e-commerce growth, as well as data centre REITs that house the digital infrastructure powering cloud computing.

Healthcare properties, retail outlets, and residential housing are also represented. This mix provides diversification across the real estate landscape, helping to balance risks in individual segments.

However, like most ETFs, VNQ has a concentration of exposure in its top holdings, meaning that the performance of a handful of large REITs can significantly influence returns.

Why Investors Love VNQ: Income, Diversification, and Liquidity

Investors are drawn to VNQ for three principal reasons.

1) Income:

REITs are legally required to distribute most of their taxable income to shareholders, making them reliable sources of dividends. VNQ aggregates this income across dozens of REITs, delivering a steady stream to investors.

2) Diversification:

Direct property investment usually involves significant capital, high transaction costs, and concentrated risk in one or two assets. VNQ solves this by offering exposure to hundreds of properties and multiple sectors in a single trade.

3) Liquidity:

Unlike property transactions, which can take months to complete, VNQ can be bought or sold on the stock exchange instantly. This flexibility is a major advantage for investors who want real estate exposure without long-term commitments.

The Cracks in the Foundation: Risks You Can't Ignore

Although VNQ has many strengths, investors should be mindful of the risks.

Interest rate sensitivity is the most significant. When borrowing costs rise, REITs face higher debt expenses and reduced profitability. At the same time, bonds become more attractive compared to REIT dividends, which can depress valuations.

Sector-specific challenges also matter. Office properties, for example, face pressure from remote working trends, while retail REITs continue to adapt to the shift towards online shopping. These structural changes can weaken certain parts of VNQ's portfolio.

Finally, investors must avoid assuming that REITs are inherently safe. Although they provide regular income, they remain equity investments subject to market cycles and economic downturns.

During recessions, property values and rental income can decline, affecting distributions and share prices.

Is VNQ Built for You? Matching the ETF to Investor Profiles

VNQ is not suitable for every type of investor, but it fits well in certain portfolios. Those seeking consistent income often appreciate its dividend yield, while long-term holders value its role in providing diversification alongside shares and bonds.

It can also be a useful tool for those who wish to gain exposure to U.S. real estate but lack the means or desire to manage properties directly. However, investors with very short time horizons, or those highly sensitive to interest rate risk, may prefer other assets.

How VNQ Competes: Rivals in the Real Estate ETF Space

VNQ is often compared with other real estate ETFs, such as those from iShares or Schwab. While competitors may offer similar exposure, VNQ stands out for its size, liquidity, and low cost.

Smaller or more specialised funds may provide targeted exposure to areas such as global property or niche REIT sectors, but they typically come with higher fees or less diversification.

For most broad-based real estate exposure, VNQ remains the dominant choice, though investors should still evaluate alternatives based on their specific objectives.

Reading the Real Estate Compass: Where VNQ Might Be Headed

Looking forward, VNQ's performance will hinge on a few critical factors.

Interest rates are at the centre of the outlook. If rates stabilise or decline, REIT valuations may recover, and income streams could become more attractive relative to bonds. Inflation trends are also vital, as property values often move in line with broader price levels.

Within the portfolio, certain sectors appear stronger than others. Logistics facilities and data centres are benefiting from secular growth in e-commerce and technology, while healthcare REITs may profit from demographic shifts. Conversely, office and retail properties remain under pressure.

Overall, VNQ's trajectory will be shaped by how these sectoral forces balance out against the broader economic backdrop.

Final Thoughts: A Solid Structure or a Shaky Investment?

VNQ is a well-established way to access the U.S. property market, offering a balance of income, diversification, and efficiency.

It is not risk-free and is particularly vulnerable to interest rate movements, but for long-term investors willing to ride through property cycles, it can be a valuable component of a balanced portfolio.

Like any investment, VNQ works best when its role is clearly defined. For those seeking exposure to real estate without the complications of direct ownership, it remains one of the most practical and cost-effective options available.

Frequently Asked Questions

1. What kind of yield does VNQ offer?

VNQ typically yields around 3% to 4% annually, paid through dividends from its underlying REITs. The exact figure varies with property sector performance and interest rates.

2. How do rising rates affect VNQ?

Higher rates increase borrowing costs for REITs and reduce the relative appeal of their dividends. This often leads to weaker returns for VNQ in rising-rate environments.

3. Is VNQ better than buying property directly?

VNQ offers diversification, liquidity, and lower costs than direct property ownership. However, it does not provide the same control, leverage, or potential tax advantages that property investors may enjoy.

4. Is now a good time to invest in VNQ?

The answer depends on investment goals. Long-term investors may find the current dividend yield attractive, but short-term risks remain due to uncertainty around interest rates and economic growth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.