1. Recent Price Action of AUD/USD

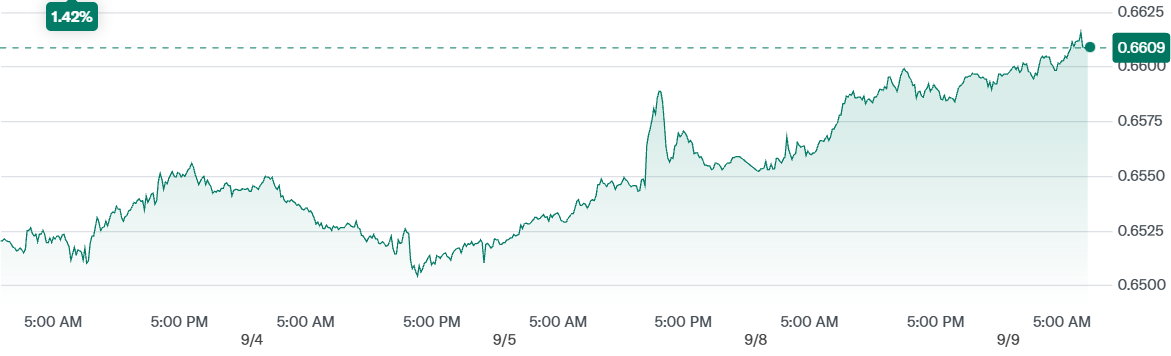

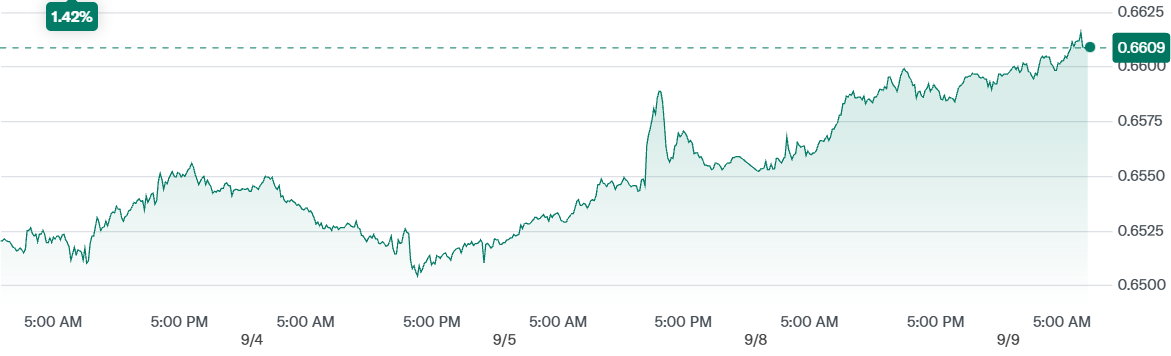

The Australian dollar has been climbing against the US dollar, with AUD/USD edging towards the 0.6600 mark.

This is the highest level in several weeks, reflecting a steady recovery from the mid-0.64 zone seen earlier in the summer.

The move began late last week, when weaker US employment data pressured the dollar. The momentum carried into this week, as traders extended bets against the greenback.

Key AUD/USD Levels

| Level |

Importance |

Impact if Broken |

| 0.67 |

Upper target |

Signals strong bullish continuation |

| 0.6650–70 |

Resistance zone |

Could trigger profit-taking |

| 0.66 |

Key hurdle |

Daily close above = bullish bias |

| 0.6550–30 |

Support area |

First cushion against pullbacks |

| 0.65 |

Major support |

Loss of momentum if broken |

2. Key Market Drivers Behind AUD/USD

1) United States dynamics:

Concerns about the American labour market, combined with expectations of possible downward revisions to non-farm payroll figures, have driven investors to price in deeper interest-rate cuts by the Federal Reserve. This has weighed heavily on the dollar, providing a natural lift to the Australian currency.

2) Australian sentiment:

Locally, data showed that consumer confidence fell by 3.1% month-on-month to 95.4 in September. Normally, such a decline might pressure the currency, yet the Aussie has remained firm as global factors – particularly dollar weakness – overshadowed domestic softness.

3) Global risk appetite:

The Australian dollar is often seen as a barometer of global risk sentiment. Hopes of stabilisation in China's economic data have supported demand for risk-sensitive currencies like the AUD, keeping it resilient even in the face of mixed domestic indicators.

Factors Driving AUD/USD

| Factor |

Current Impact |

Bias for AUD/USD |

| US jobs data |

Weak, raising Fed cut expectations |

Bullish |

| Fed rate outlook |

Market pricing deeper cuts |

Bullish |

| Australian confidence |

Fell to 95.4 in Sept |

Bearish |

| Chinese data |

Stabilisation hopes support sentiment |

Bullish |

| Risk appetite |

Firm, favouring high-beta currencies |

Bullish |

3. Where the Market Stands Regarding AUD/USD

At the time of writing, AUD/USD trades close to 0.6700.

Over the past year, the pair has ranged widely between 0.59 and 0.69. The current level positions it in the upper half of this range, a sign of resilience

.

This rebound highlights just how strongly external factors, especially US dollar weakness, are driving the currency.

4. Technical Outlook of AUD/USD

From a technical standpoint, the picture has turned positive:

Resistance: The key hurdle is at 0.6600. A clean daily close above it could open the way to 0.6650–0.6670. followed by 0.6700.

Support: Immediate support rests around 0.6550–0.6530. Below that, the round figure of 0.6500 becomes more critical.

Bias: The bias remains constructive while price holds above the mid-0.65s.

5. Event Risks to Watch

The coming days bring several important catalysts:

1) United States:

Revisions to non-farm payroll data could reshape labour-market expectations. Confirmation of weakness would strengthen the case for rate cuts and weigh further on the dollar.

2) Australia:

Local data and central bank commentary may influence expectations. If the Reserve Bank of Australia signals reluctance to ease, the Aussie could find additional support.

3) China:

Trade and growth updates remain central to the Aussie's outlook. Stronger data would boost sentiment, while disappointments could undermine the rally.

6. Trading Scenarios Regarding AUD/USD

Three possible paths stand out:

Bullish: A break above 0.6600 could extend gains to 0.6650–0.6670. and even to 0.6700 if dollar weakness persists.

Bearish: A rejection at 0.6600 could push the pair back to 0.6550/0.6530. with 0.6500 acting as a deeper support.

Base case: Sideways consolidation between 0.6530 and 0.6600 until new data provides clearer direction.

7. Trading Considerations

Market conditions are catalyst-driven, making flexibility essential.

Position sizing should reflect the potential volatility around US employment revisions. A confirmed daily close above 0.6600 would support a bullish outlook. Conversely, a failure to hold gains could encourage profit-taking.

Stop-loss discipline and patience for confirmation signals remain critical in this environment.

Conclusion

The Australian dollar's rise towards 0.6600 reflects a mix of global and local factors.

US dollar weakness, driven by expectations of Fed easing, has been the main driver. Domestic data has softened, but risk sentiment and Chinese expectations have kept the Aussie firm.

The 0.6600 level is now the battleground. Whether the pair breaks higher or consolidates will likely depend on the next wave of US and Chinese data.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.