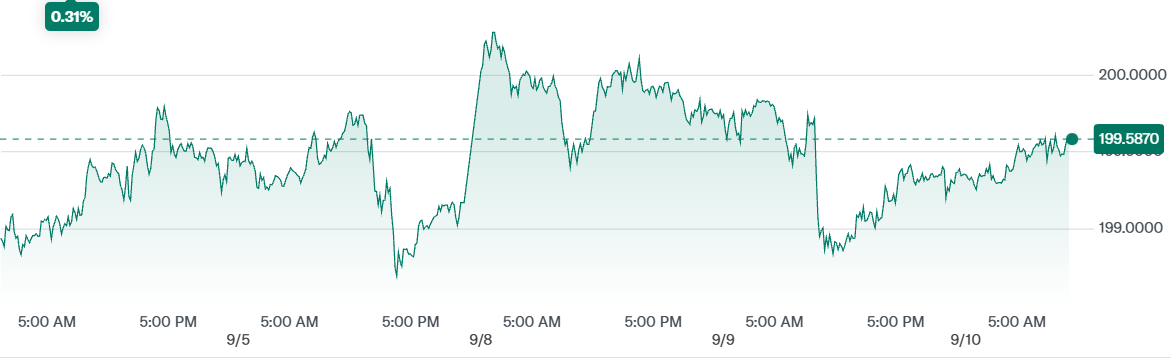

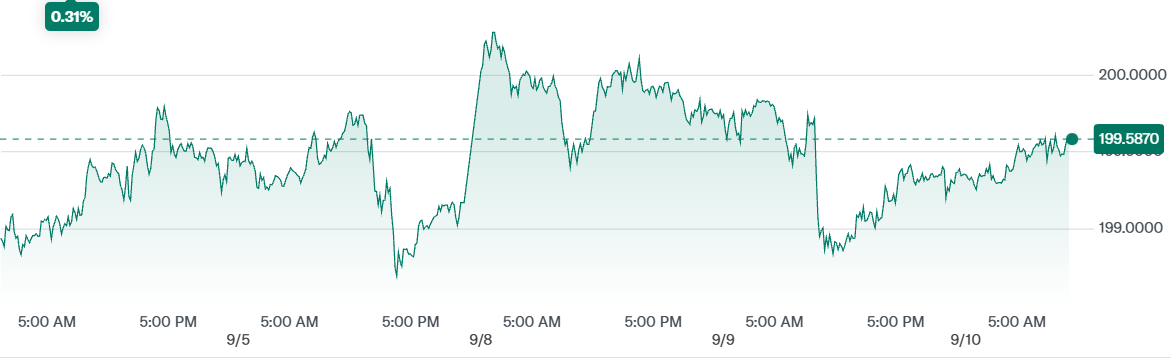

Sterling's strength and firm risk appetite keep GBP/JPY supported near 199. but the 200 mark remains a stubborn barrier. A decisive break depends on UK data and BoJ signals.

Sterling-Yen Tug of War

The pound–yen cross has entered a period of heightened volatility.

After climbing to a fourteen-month peak near 200.35. GBP/JPY has since eased lower, only to rebound back above the 199.00 threshold. This price action underscores the push and pull between sterling resilience and yen support, leaving traders to question whether the 200 level will ultimately give way.

The cross remains sensitive to shifts in monetary policy expectations, economic data, and market risk sentiment. As such, the next decisive move is likely to depend on both central bank rhetoric and broader macroeconomic signals.

BoE Steadfast, BoJ Hesitant

At the heart of the sterling's strength lies the perception that the Bank of England (BoE) will tread cautiously on rate cuts.

While UK growth has slowed, inflation remains stubbornly above target, reducing the likelihood of an aggressive policy pivot. This has helped anchor sterling, keeping downside pressure at bay and offering support to GBP/JPY.

By contrast, the Bank of Japan (BoJ) faces a very different landscape. Political uncertainty and fragile domestic conditions have made the BoJ hesitant to fully normalise policy.

Although speculation about rate adjustments lingers, the central bank's cautious stance has prevented the yen from mounting a sustained recovery. This divergence in policy paths is a key driver of the current sterling-yen dynamics.

Risk Appetite vs Global Headwinds

Risk sentiment has been another important factor in shaping GBP/JPY. When global equities and risk assets rally, the yen often weakens as investors reduce demand for safe havens. This tendency has given sterling an additional lift, especially during periods of improved market confidence.

Yet, the environment is far from one-sided. Concerns over global trade, geopolitical flashpoints, and fragile supply chains continue to temper optimism. These lingering risks mean sterling's rallies are capped, as the market remains wary of potential shocks that could drive flows back into the yen.

The Chart Speaks: Key Levels in Play

From a technical perspective, GBP/JPY is trading within a well-defined range. Immediate support lies between 198.50 and 198.70. with a deeper safety net around 197.50. These levels are likely to attract dip-buying interest if the pair weakens.

On the topside, 200.35 represents the key resistance level. A clean break above this point could pave the way for further gains, with targets at 200.50 and potentially the 201.00 mark. However, repeated failures to breach this resistance may encourage profit-taking and reinforce the risk of consolidation.

For now, traders appear to be waiting for fresh catalysts before committing to a sustained directional move.

Key Technical Levels: GBP/JPY

| Level |

Significance |

Notes |

| 197.5 |

Major support |

Break lower could trigger deeper losses |

| 198.50–198.70 |

Near-term support zone |

Buyers expected to defend |

| 199 |

Psychological handle |

Current pivot area |

| 200.35 |

Immediate resistance |

Repeated rejection seen here |

| 200.50–201.00 |

Next resistance band |

Breakout targets if 200.35 is cleared |

What Could Tip the Scales?

Several upcoming events could dictate whether sterling breaks free of its current range.

1) UK Data Releases:

Indicators on growth, inflation, and the labour market will be closely monitored. Stronger figures may support the pound by reducing expectations of imminent rate cuts.

2) BoJ Policy Signals:

Any shift in tone from the BoJ could prove pivotal. Even subtle hints towards firmer policy normalisation may strengthen the yen and weigh on GBP/JPY.

3) Global Risk Sentiment:

Renewed geopolitical or trade-related tensions could prompt a safe-haven rush into the yen, while a calmer backdrop would allow sterling to extend its momentum.

Market Drivers Behind GBP/JPY at a Glance

| Factor |

Effect on GBP/JPY |

Current Outlook |

| UK Data (GDP, CPI, Jobs) |

Strong figures support sterling |

Mixed, but inflation remains sticky |

| BoJ Policy Guidance |

Hawkish signals strengthen the yen |

Cautious and hesitant |

| Risk Sentiment |

Improved sentiment lifts GBP/JPY |

Supported but fragile |

| Geopolitical Tensions |

Heightened risks favour yen safe haven |

Ongoing concerns persist |

Outlook: Balancing on the 200 Line

The sterling–yen cross finds itself finely balanced. Sterling's relative strength and supportive risk appetite continue to provide upward pressure, but yen resilience and policy caution at the BoJ are preventing a decisive breakout.

The 200 mark has become both a psychological barrier and a technical hurdle. Should sterling manage to sustain gains above this level, the pair may enter a new phase of bullish momentum. Conversely, failure to clear resistance could see GBP/JPY retreat back towards support, with range-bound trading persisting.

For now, traders are watching closely. The question is not only whether sterling can break free, but also what conditions are required for it to do so. The answer may lie in the balance between domestic data, central bank policies, and the ever-present influence of global risk sentiment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.